Bitcoin’s (BTC) cost may climb by greater than 50% in September, per month otherwise considered ominous for that cryptocurrency because of its poor historic returns.

BTC cost double-bottom after which to $30K?

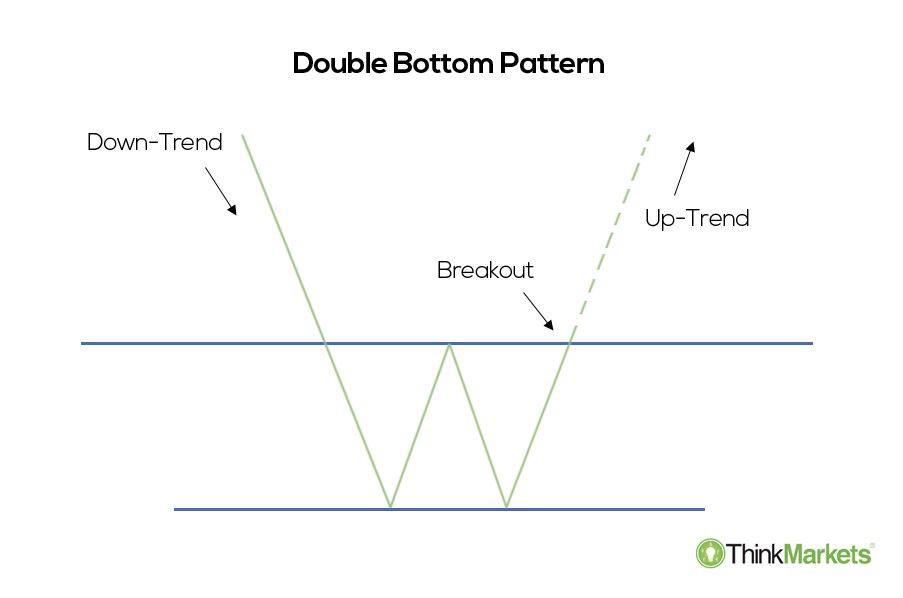

The conflicting upside signal develops from a potential double-bottom pattern on Bitcoin’s longer-time-frame charts from the U . s . States dollar. Double-bottoms are bullish reversal patterns that resemble the letter W because of two lows and a general change in direction from disadvantage to upside.

Bitcoin’s decline below $20,000 in This summer, adopted with a sharp recovery toward $25,000 along with a subsequent go back to the $20,000 level in August, partly confirms the double-bottom scenario. The cryptocurrency would complete the pattern after rebounding toward $25,000.

A W-formed cost move in a perfect scenario might be adopted by another sharp move greater — a dual-bottom breakout.

Meanwhile, a dual-bottom’s upside target is located after calculating the space between your pattern’s peak (neckline) and cheapest levels and adding the end result towards the breakout point, as highlighted below. Quite simply, a possible 50% cost rally.

As some caution, double-bottom setups have a small amount of failure risks, about 21.45%, according to Samurai Buying and selling Academy’s study of popular charting patterns.

Market slips back to “extreme fear“

Bitcoins bullish reversal scenario occurs among general cost depreciation over the risk-on markets.

Initially, BTC’s descent to $20,000 began after Fed Chair Jerome Powell reasserted his hawkish stance on inflation at Jackson Hole a week ago. It further motivated the Bitcoin market sentiment to fall under the “extreme fear” category, based on the popular Fear and Avarice index, or F&G.

The marketplace isn’t enjoying $BTC hanging out $20k. Back to Extreme Fear today.

Live chart: https://t.co/Jr5151zN7I pic.twitter.com/UnztrZP7FP

— Philip Quick (@PositiveCrypto) August 31, 2022

But, to Philip Quick, creator of Bitcoin databases LookIntoBitcoin, the marketplace sentiment isn’t as fearful because it is at June as a result of “huge quantity of forced selling” at now-defunct crypto hedge fund Three Arrows Capital and also the stablecoin project Terra.

“The F&G score is nowhere close to intensely fearful because it was when the score dropped to as little as 6 it’s presently at 23,” Quick described, adding:

“There was blind panic in those days, whereas we’re presently a duration of indifference where individuals have finished the bear market and care more about their summer time holidays and/or living costs crisis.”

The statement aligns with Bitcoin investors selling their holdings in a $220 million daily average loss, based on data tracked by Glassnode.

“Investor psychology seems to become one that’s keen to merely ‘get my money-back,’ having a great amount of spending happening at and around their cost basis,” the on-chain analytics firm mentioned in the latest weekly report, adding the Bitcoin bulls are fighting a constant fight.

Related: UBS raises US recession odds to 60%, what performs this mean for crypto prices?

Which includes whales, entities that hold between 1,000 and 10,000 BTC. They’ve been accumulating Bitcoin recently because the cost wobbles around $20,000, based on data resource Ecoinometrics.

The whales addresses controlling 1k to 10k BTC are beginning to amass coins on-chain again.

Without a doubt that will not cancel the bear market but apparently many people love #Bitcoin at $20k. pic.twitter.com/7oQmAZ4T5K

— ecoinometrics (@ecoinometrics) August 29, 2022

“In this bear market, you need to either dollar cost average ready or upright purchase the dip and wait,” authored Nick, an analyst at Ecoinometrics.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.