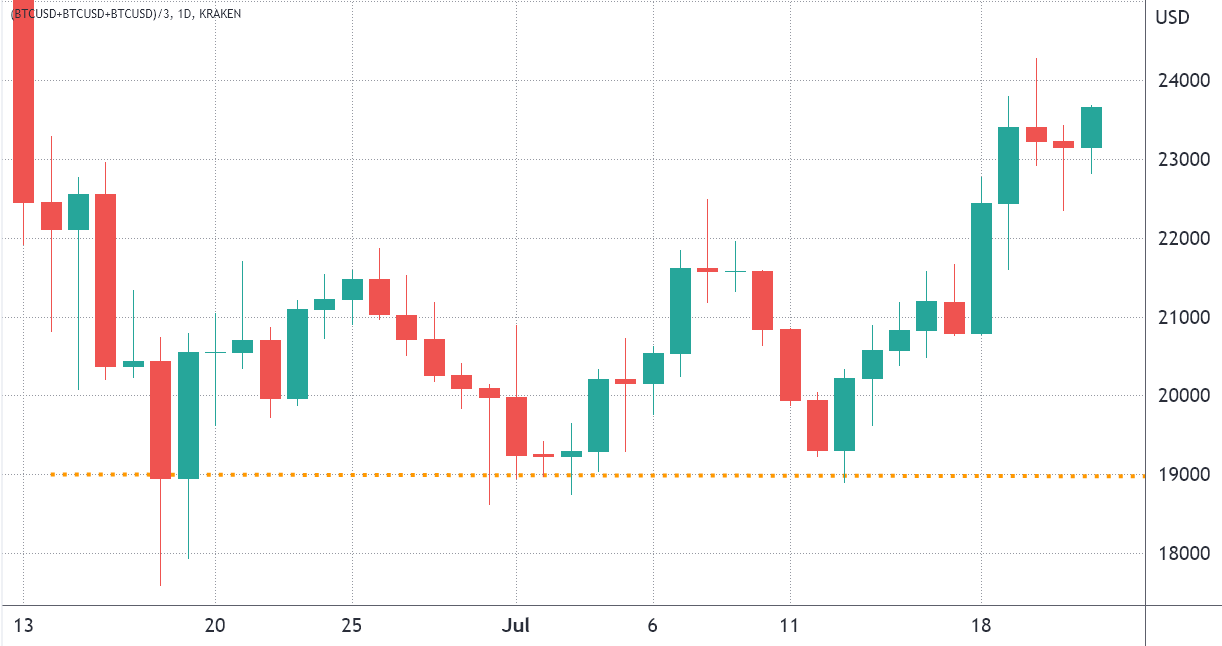

The prior $19,000 Bitcoin (BTC) support level gets to be more distant following the 22.5% grow in nine days. However, little optimism continues to be instilled because the impact from the Three Arrows Capital (3AC), Voyager, Babel Finance and Celsius crises remain uncertain. Furthermore, the contagion claimed another victim after Thai crypto exchange Zipmex stopped withdrawals on This summer 20.

Bulls’ hopes rely on the $23,000 support strengthening over the years, but derivatives metrics show professional traders continue to be highly skeptical of continuous recovery.

Macroeconomic headwinds favor scarce assets

Some analysts attribute the crypto market strength to China’s lower-than-expected gdp data, causing investors to anticipate further expansionary measures by policymakers. China’s economy expanded .4% within the second quarter versus the year before, because the country ongoing to have a problem with self-enforced limitations to curb another outbreak of COVID-19 infections, according to CNBC.

The U . s . Kingdom’s 9.4% inflation in June marked a 40-year high, and also to supposedly aid the populace, Chancellor from the Exchequer Nadhim Zahawi announced a $44.5 billion (GBP 37 billion) assistance package for vulnerable families.

Under these conditions, Bitcoin reversed its downtrend as policymakers scrambled to resolve the apparently impossible problem of slowing economies among ever-growing government debt.

However, the cryptocurrency sector faces its very own issues, including regulatory uncertainties. For example, on This summer 21, the U . s . States Registration (SEC) labeled nine tokens as “crypto asset securities,” thus not just falling underneath the regulatory body’s purview but responsible for getting unsuccessful to join up by using it.

Specifically, the SEC known Powerledger (POWR), Kromatika (KROM), DFX Finance (DFX), Amp (AMP), Rally (RLY), Rari Governance Token (RGT), DerivaDAO (DDX), LCX, and XYO. The regulator introduced charges against an old Coinbase product manager for “insider buying and selling” once they allegedly used non-public information for private benefit.

Presently, Bitcoin investors face an excessive amount of uncertainty regardless of the apparently useful macroeconomic backdrop, that ought to favor scarce assets for example BTC. Because of this, an analysis of derivatives information is useful for understanding whether investors are prices greater likelihood of a downturn.

Pro traders remain skeptical of cost recovery

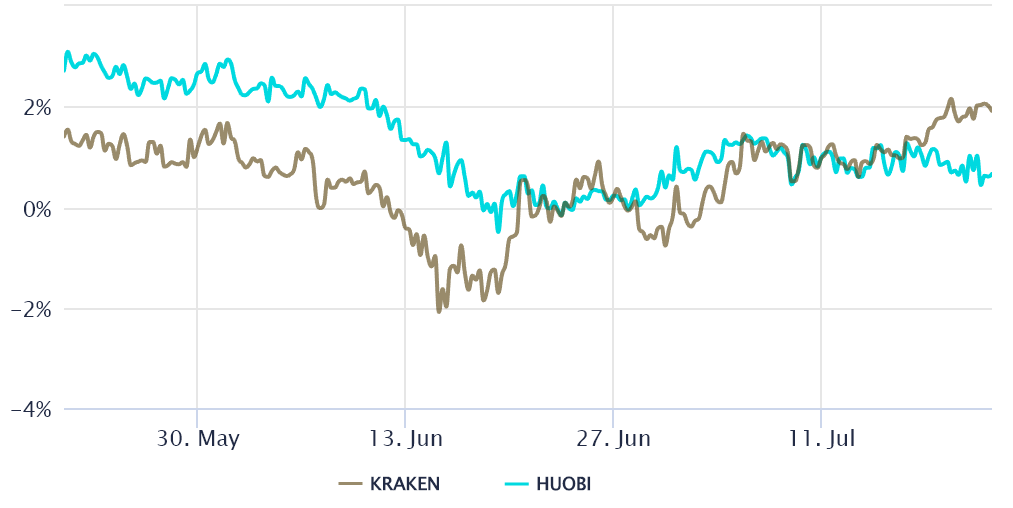

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, they’re professional traders’ preferred instruments simply because they avoid the perpetual fluctuation of contracts’ funding rates.

These fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. However this scenario is not only at crypto markets, so futures should trade in a 4% to 10% annualized premium in healthy markets.

The Bitcoin’s futures premium flirted using the negative area in mid-June, something is usually seen during very bearish periods. The mere 1% basis rate, or annualized premium, reflects professional traders’ unwillingness to produce leverage lengthy (bull) positions. Investors remain skeptical from the cost recovery regardless of the inexpensive of opening a bullish trade.

You have to also evaluate the Bitcoin options markets to exclude externalities specific towards the futures instrument. For instance, the 25% delta skew is really a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 12%, as the opposite is true during bullish markets.

The 30-day delta skew peaked at 21% on This summer 14 as Bitcoin battled to interrupt the $20,000 resistance. The greater the indicator, the less inclined options traders will be to offer downside protection.

More lately, the indicator moved underneath the 12% threshold, entering an unbiased area, with no longer sitting in the levels reflecting extreme aversion. Consequently, options markets presently display a well-balanced risk assessment from a bull run and the other re-test from the $20,000 area.

Some metrics claim that the Bitcoin cycle bottom is behind us, but until traders possess a better look at the regulatory outlook and centralized crypto service providers’ liquidity because the Three Arrows Capital crisis unfolds, the chances of breaking above $24,000 remain uncertain.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.