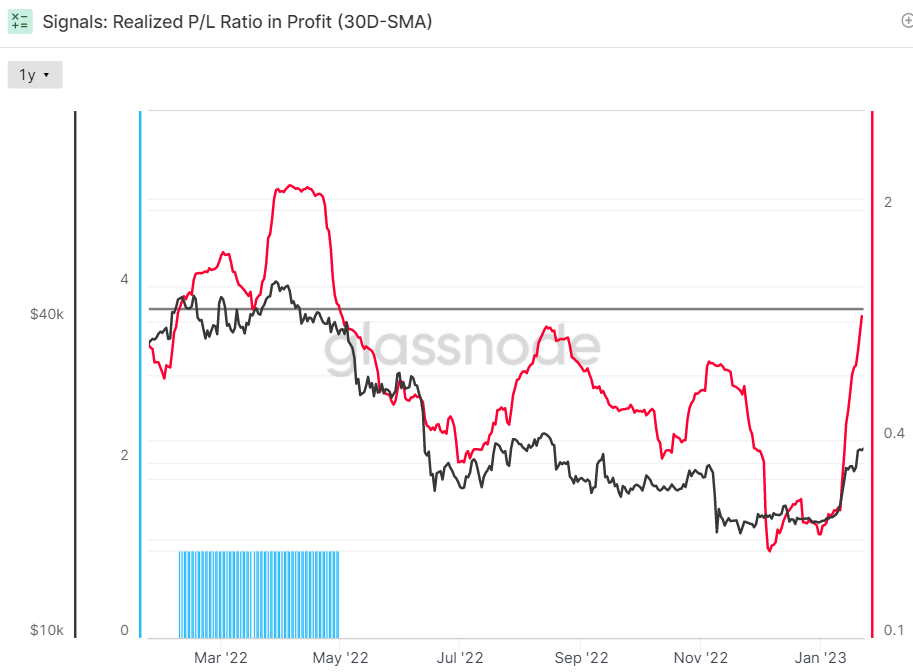

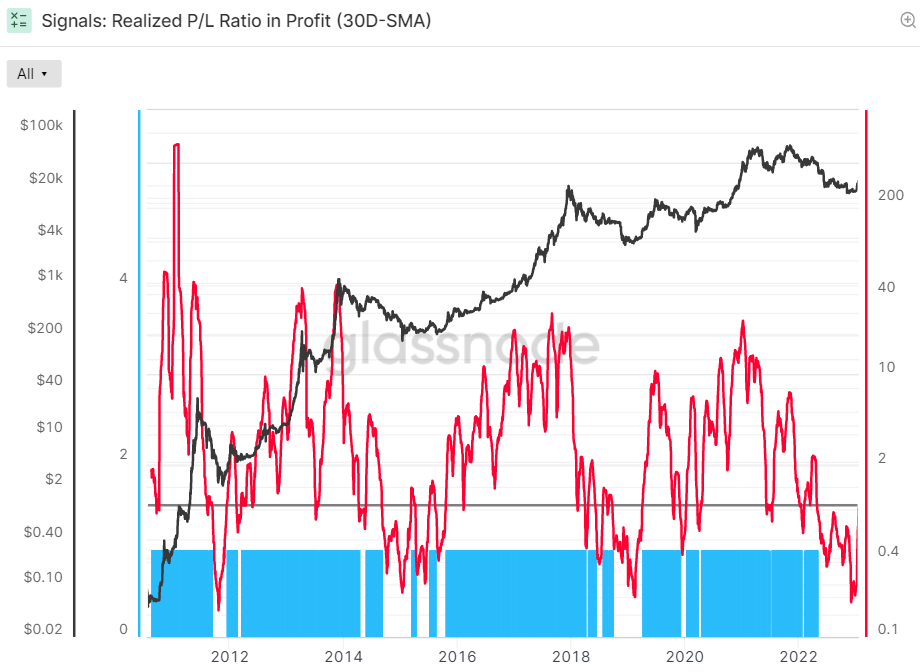

The 30-Day Simple Moving Average (SMA) of Glassnode’s Bitcoin Recognized Profit-Loss Ratio (RPLR) indicator is going to move above one the very first time last April. Which will imply that the Bitcoin market will quickly be realizing a larger proportion of profits (denominated in USD) than losses. Based on Glassnode, “this generally ensures that sellers with unrealized losses happen to be exhausted, along with a healthier inflow of demand exists to soak up profit taking”.

In the past, a rest back above one out of the 30-Day SMA from the Recognized Profit-Loss Ratio carrying out a prolonged spell below zero (as a result of bear market) has coincided with Bitcoin market bottoms. Once the RPLR bottomed in 2015 at .23 (and also the Bitcoin cost only agreed to be under $200), Bitcoin then continued to publish an almost 90x rally within the next just below 3 years.

Similarly, once the RPLR bottomed around .2 in 2019 and Bitcoin’s cost had fallen close to $3,600, the cryptocurrency then continued to rally around 19x to when it hit record highs at the end of 2021 just below 3 years later. The RPLR lately bottomed around .18, its cheapest since 2011 when Bitcoin was buying and selling within the $16,000s.

Bulls is going to be wishing for history to once more rhyme, which the world’s largest cryptocurrency by market cap can publish another exponential rally from lows within the next three approximately years. A 10x rally from recent lows would see Bitcoin hitting around $160,000.

Alternative Bitcoin Market Cycle Indicator Also Flashing Eco-friendly

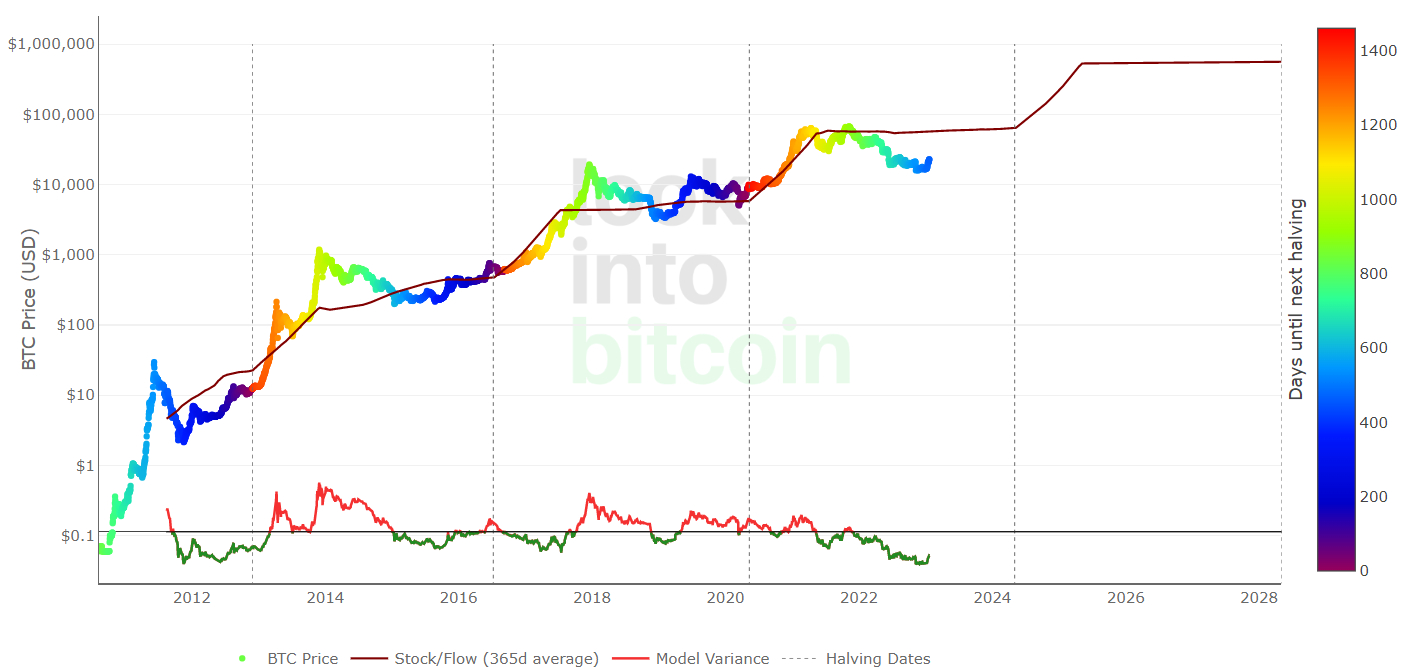

The RPLR is delivering a obvious signal that Bitcoin may be in early stages of the new bull market. Alternative Bitcoin market cycle indicators are delivering an identical message. Based on Bitcoin’s stock-to-flow valuation model, a large rally might be approaching within the year’s ahead.

As are visible in the above mentioned chart thanks to consider bitcoin, Bitcoin’s cost follows a foreseeable market cycle in between each so-known as “halving” (once the mining reward is decline in half). Soon after the halving, there’s typically an exponential boost in Bitcoin’s cost, adopted with a bear market that normally bottoms about midway to another Bitcoin halving. This cycle continues to be adopted pretty much to date throughout the current cycle.

Similar chart analysis published by pseudonymous crypto-focused Twitter account @CryptoHornHairs demonstrated that Bitcoin is nearly exactly carrying out a near four-year market cycle where prices rally for 1064 days after each 364-day bear market. Based on @CryptoHornHair’s analysis, Bitcoin’s cost has adopted this cycle almost towards the letter of history eight years.

Other Indicators Pointing to some Bitcoin Bottom

At current levels within the upper $22,000s, Bitcoin is buying and selling greater by around 37.5% this month, its best monthly gain since October 2021. The rally has unsurprisingly generated lots of excitement and heated debate over the possibilities of 2022’s bear market potentially ending.

Indeed, the broader macro picture is searching better of computer is at 2023 – the majority of the Fed’s rate hikes have the symptoms of already happened around inflation falling quickly to the central bank’s 2.% target with US growth slowing considerably. Indeed, macro traders are more and more betting on the better rate of interest backdrop at the end of 2023/into 2024.

Quite simply, the primary driver of 2022’s bear market (a far more hawkish than expected Given) appears like it’s not likely to be (because ) an issue in 2023. Simultaneously, multiple other technical as well as on-chain indicators will also be pointing towards the Bitcoin bottom possibly getting been printed.

First of all, Bitcoin lately surged above its 200-Day SMA and Recognized Cost. Both are thought to be highly significant levels, having a sustained break towards the south or north of either frequently considered suggestive of a transfer of Bitcoin’s cost momentum. Glassnode’s New Addresses Momentum and RHODL Multiple Indicators are also trending greater. Elsewhere, Alternative.me’s Bitcoin Fear and Avarice Index lately recovery to neutral (above 50). Whether it are now able to hold above 50 on the sustained basis, it has in the past been usual for a bear market ending.