The versatility behind running Bitcoin (BTC) mining operations could be fundamental to solving the actual-world issues that stand when it comes to the power industry, suggests Arcane research.

Among the greatest concerns government bodies raise with regards to Bitcoin’s mainstream adoption is its energy needs. While innovations in chipset manufacturing have helped reduce operational costs associated with Bitcoin mining, a report from Arcane reveals the market’s possibility to transform the power industry.

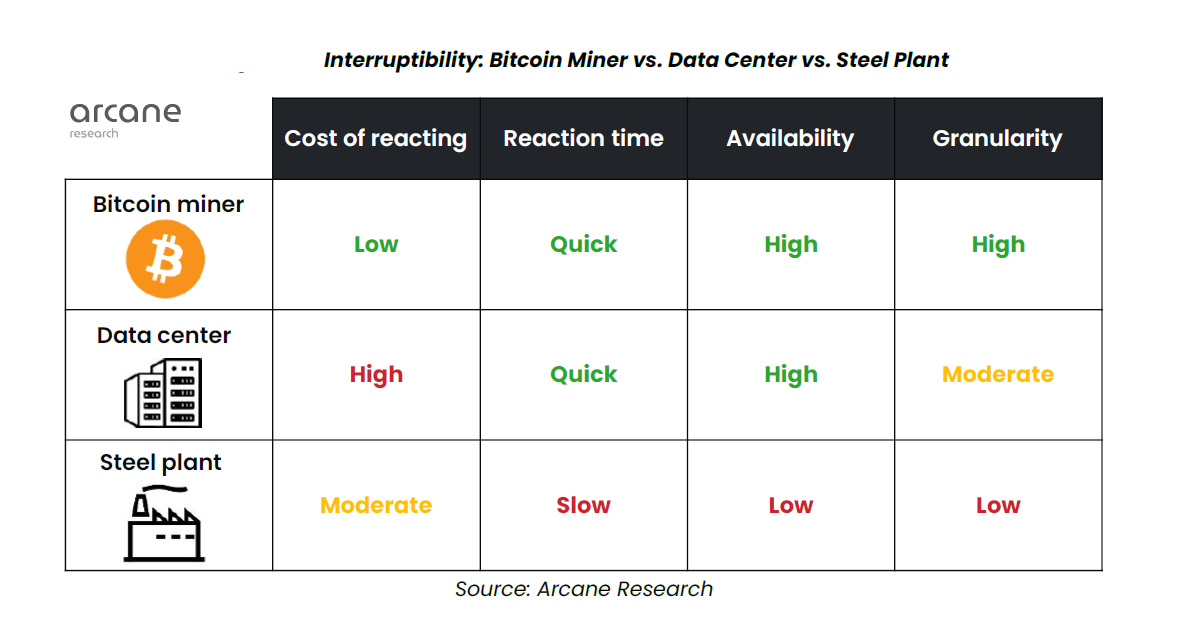

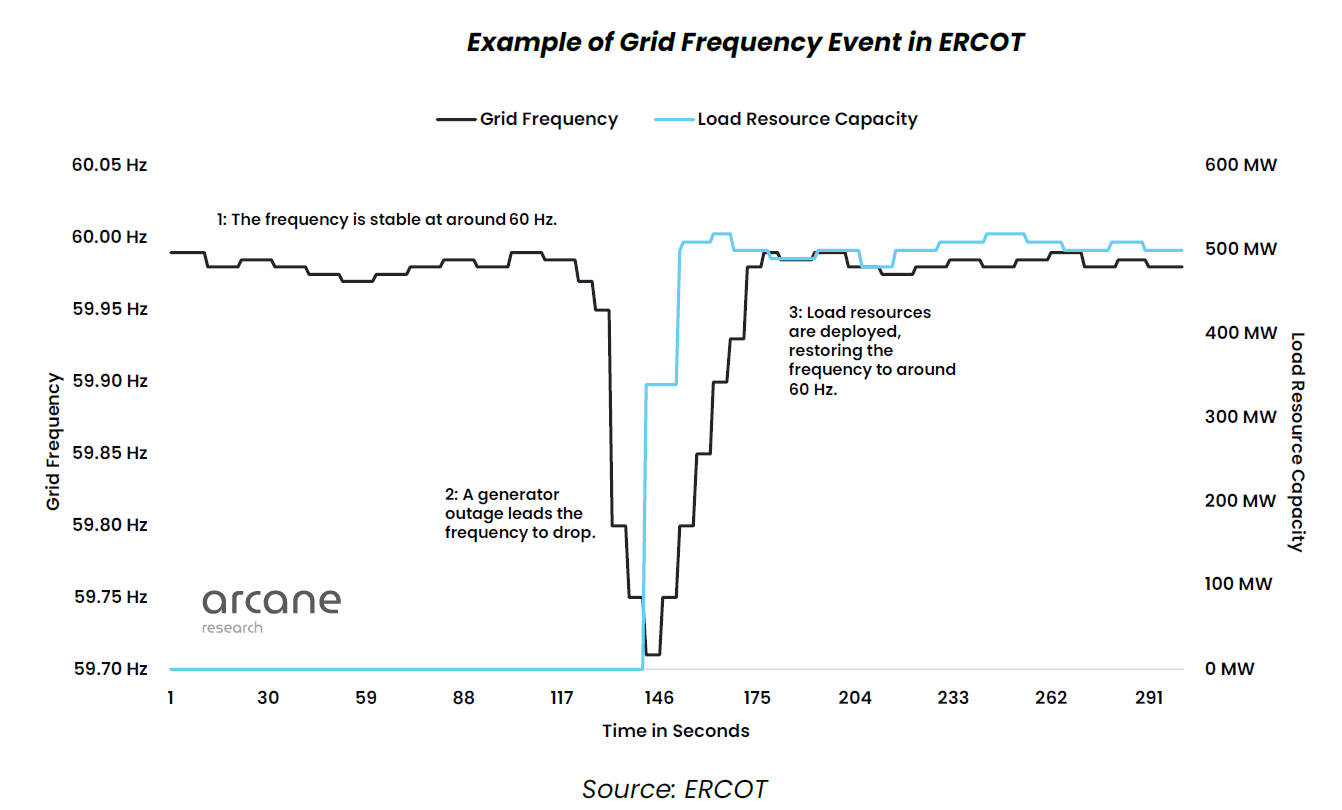

Because of inexpensive of reacting, Bitcoin mining complements the development of solar and wind power grids, which frequently produce unstable and non-controllable energy. Arcane research highlights the Electric Reliability Council of Texas, up to now, only has permitted bitcoin miners to have fun playing the innovative demand response programs.

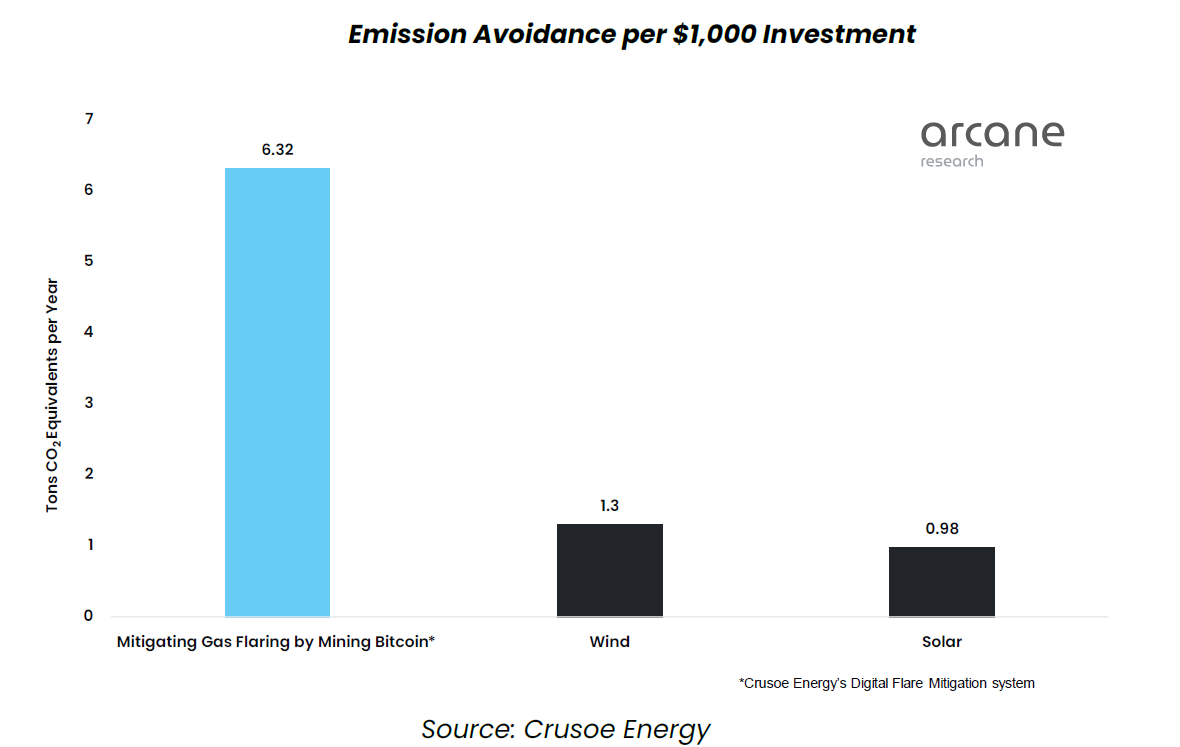

Additionally to being flexible to grid demands, Bitcoin mining will also help solve the process of gas flaring — the entire process of burning gas connected with oil extraction.

Arcane highlights that by leveraging the agnosticism, modularity, and portability of Bitcoin rigs, miners can setup operations alongside oil wells, reasoning that “Per $1,000 investment, a bitcoin mining system reduces emissions of 6.32 a lot of CO2 equivalents each year, when compared with 1.3 for wind and .98 for solar.”

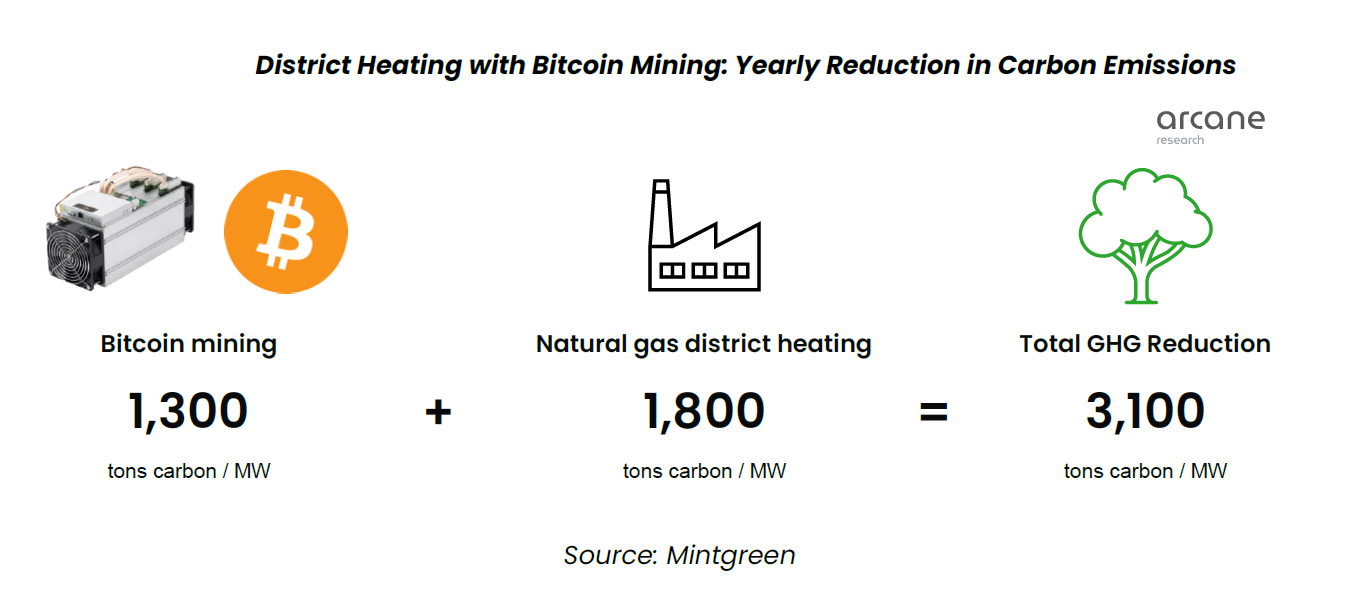

Bitcoin mining can further assist the energy industry by repurposing its consequence — heat — to warm up homes, industries, along with other applications throughout the coming winter. You should observe that heating makes up about roughly 40% from the world’s CO2 emissions.

Repurposing heat from Bitcoin mining provides several advantages, including operational subsidies minimizing heating costs.

Related: US lawmakers appeal straight to 4 mining firms, requesting information on energy consumption

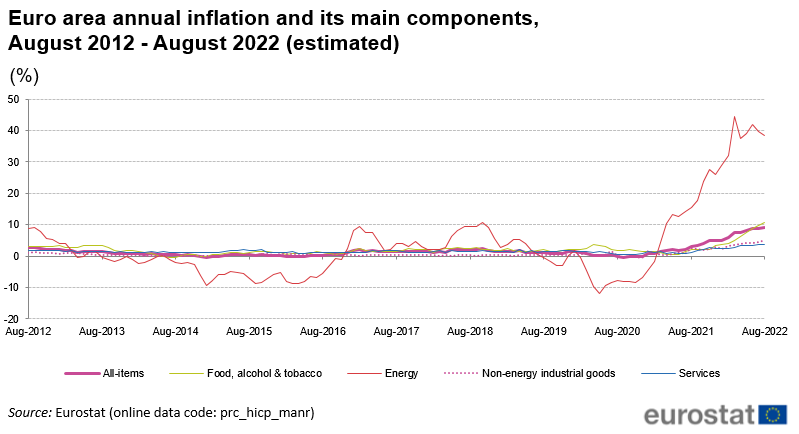

The significance of the above mentioned research comes at any given time when Eurozone hit record inflation of 9.1% among gas and crisis.

As Cointelegraph reported, energy prices composed the biggest cost push, up by a yearly rate of 38.3% in the last month.