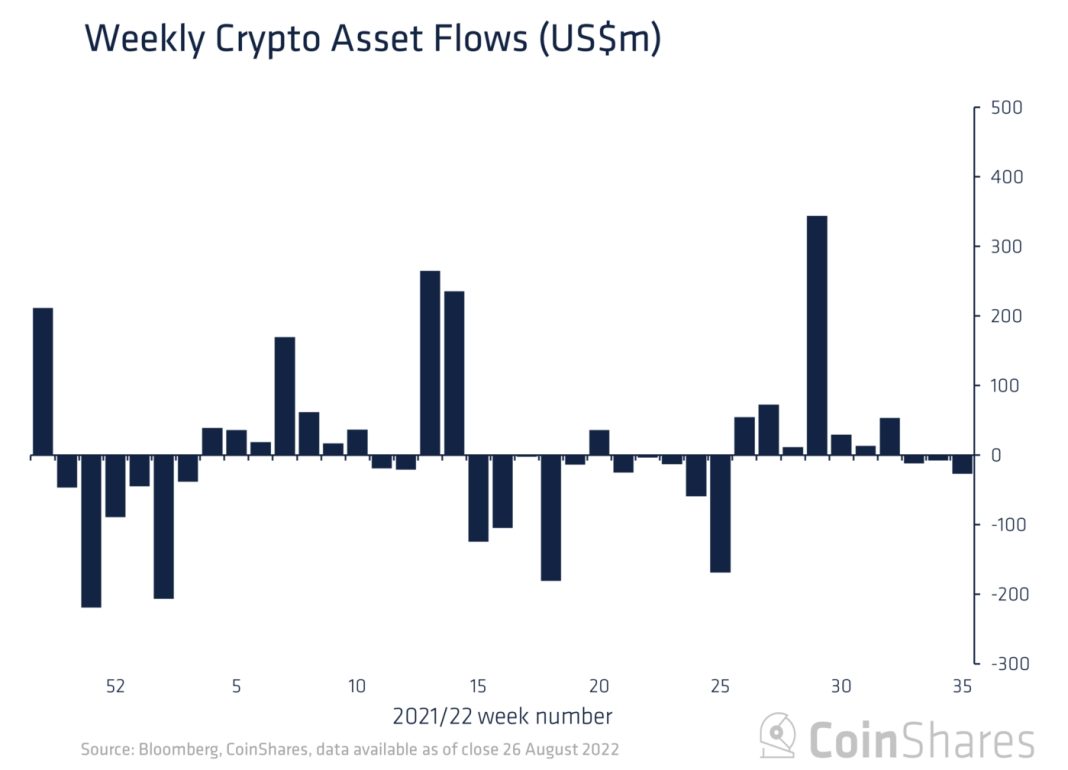

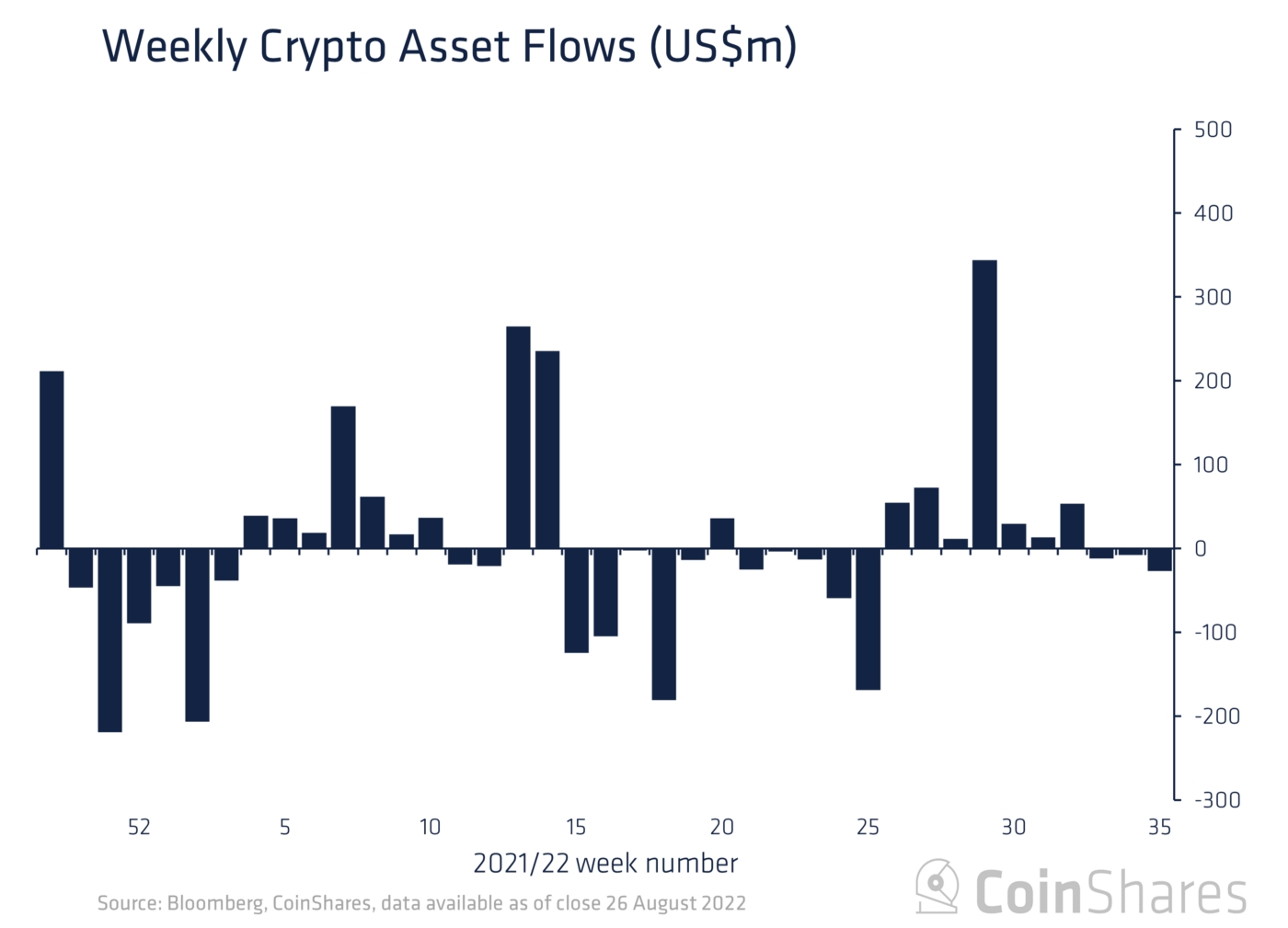

Capital is flowing into short bitcoin (BTC) funds in a record rate, while regular lengthy bitcoin funds still see outflows, new data in the crypto research and investment firm CoinShares shows.

Based on CoinShares’ latest digital asset fund flows report, short bitcoin investment funds – funds that increase in value when bitcoin’s cost falls – saw inflows of USD 18m a week ago, the biggest weekly inflow ever recorded for that category. The inflows introduced the entire assets under management (AUM) in a nutshell bitcoin funds to USD 158m.

Simultaneously, conventional bitcoin funds that increase in value because the bitcoin cost increases saw outflows of USD 11m, the information demonstrated. The outflows represent someth consecutive week of outflows for bitcoin funds, CoinShares stated.

Meanwhile, ethereum (ETH)-backed funds saw the 2nd-largest outflows a week ago, with USD 2.1m departing the funds. Among other altcoin-backed funds, solana (SOL) and avalanche (AVAX) each saw inflows of USD .5m.

Overall, crypto investment funds – both lengthy and short – recorded inflows of USD 9.2m for that week, with short bitcoin funds comprising most the flows.

The general inflows a week ago mark a noticable difference from two days ago, once the sector saw outflows of USD 27m. In those days, short BTC funds also recorded inflows, while lengthy BTC and ETH funds saw outflows.

Commenting around the large flows into short bitcoin products within the latest report, CoinShares stated the result is a “much more hawkish view” expressed by US Fed (Given) chairman Jerome Powell throughout the Fed’s recent meeting in Jackson Hole. The hawkish tone seems to possess been “unexpected by a few investors,” the report added.