Bitcoin (BTC) could still visit a major cost capitulation, but more whales have to start selling first, data suggests.

In a single of their daily QuickTake market updates on May 27, on-chain analytics platform CryptoQuant highlighted more and more bearish whale behavior.

Small whale selling should spark “absolute capitulation”

Among prevalent consensus that BTC/USD should include a lower low than its May 12 pivot cost of $23,800, a number of Bitcoin’s largest holders are showing indications of eagerness.

Searching at unspent transaction outputs (UTXOs) from various “bands” of whale wallets, CryptoQuant contributor Binh Dang flagged selling in the top cohort growing since April.

Individuals entities with $a million or even more, referred to as “giant” whales, have upped their distribution of coins, while smaller sized whales — individuals with under $a million — happen to be slower to shift their position.

“Following the dip what food was in the finish of The month of january, we still saw the buildup because all the leading value bands increased, but in the 21st of April to now, giant whales (range over 1M$ – USD) happen to be disbursing and don’t have any signals to amass now,” Dang described.

“If minor whales and retailers quit, I believe we will have the complete capitulation and bottom also. Otherwise, I’ll keep close track of positive movements in the plethora of $1M to think about a reversal.”

An associated graphic demonstrated recognized supply from giant whales decreasing dramatically, with $100,000-$a million whales but now starting to follow.

By comparison, the $10,000-$100,000 and $1,000-$10,000 bands demonstrated no indications of capitulation.

“Giant whales carry on around the distribution. Minor ones and retailers keep your defensive condition,” CryptoQuant add-chain analyst Julio Moreno put in private comments to Cointelegraph.

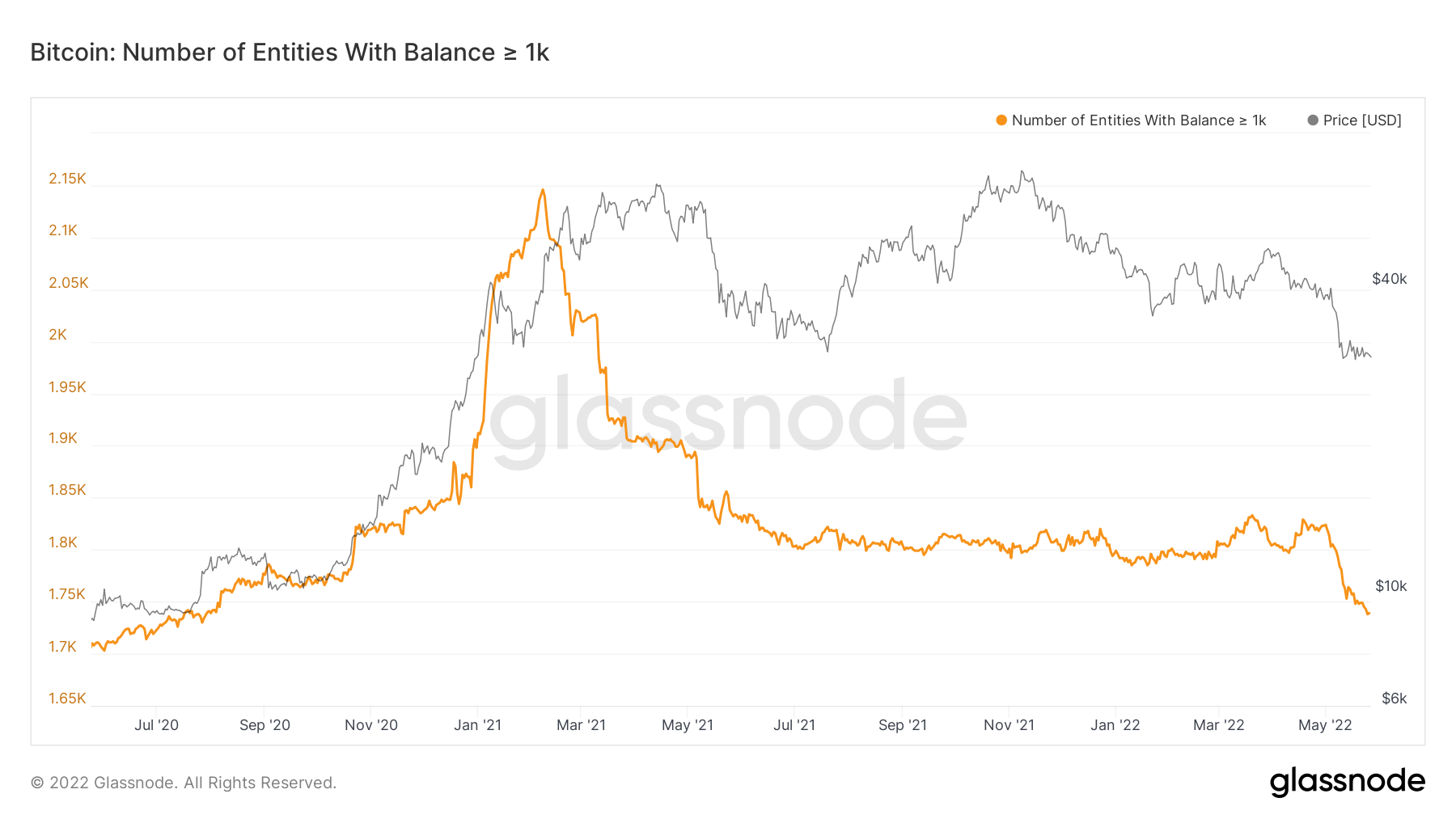

Data from fellow on-chain analytics firm Glassnode meanwhile confirmed a general reduction in the amount of entities qualifying as whales.

Once more, an acceleration since April pointed to whale distribution, so that as of May 27, overall whale figures were in their cheapest since This summer 2020.

Eyes on volume triggers

Earlier in May, whale buy levels created key support targets below $27,000.

Related: Bitcoin ‘good to visit up’ after BTC cost hits cheapest since Terra crash

For on-chain monitoring resource Whalemap, they were of great interest as a direct consequence from the initial May 12 dip.

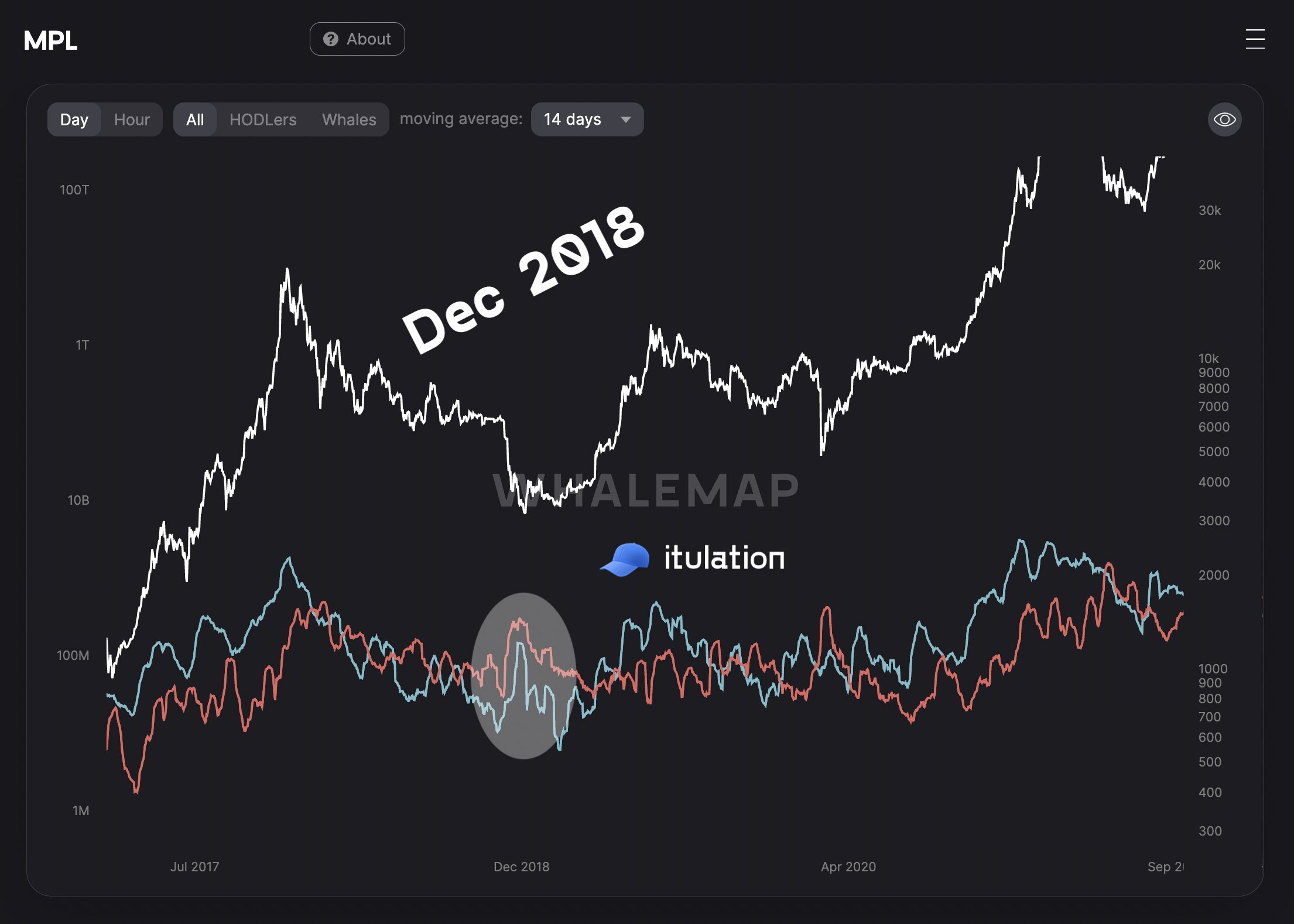

In subsequent analysis, researchers demonstrated that capitulatory occasions from the kind forecast for BTC/USD needed coins moving at both an income along with a reduction in elevated amounts.

“On May twelfth both profits AND losses were greater than normal,” a part of an explanatory tweet mentioned, alongside a chart of moving profit/ loss (MPL) data.

“Among capitulation is at 12 , 2018 when similar MPL activity was present (but in a much bigger scale).”

Now, on-chain transaction volume saw an obvious increase, Cointelegraph reported.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.