The U . s . States Ftc has labeled social networking and crypto a “combustible combination for fraud,” with up to 50 % of crypto-related scams via social networking platforms in 2021.

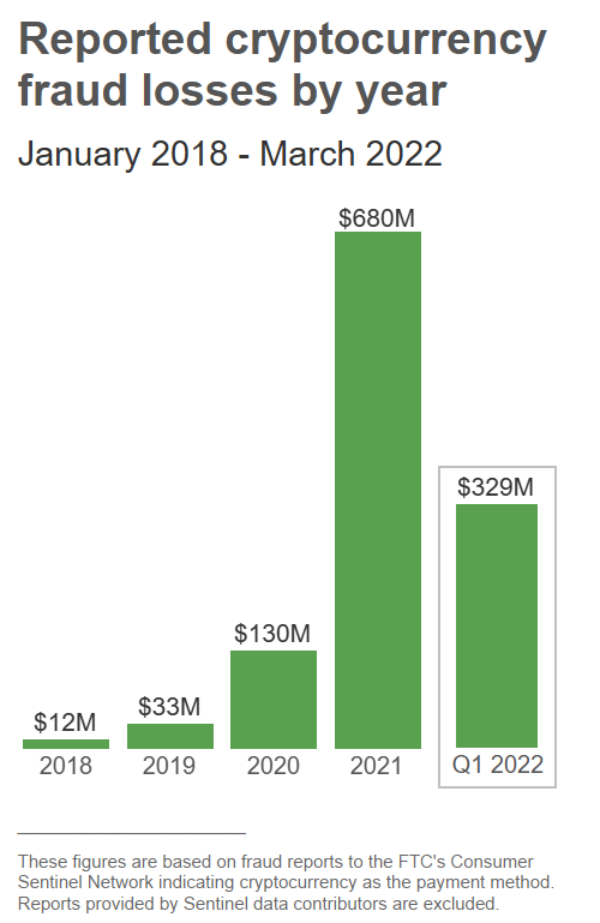

Printed on Friday, the report discovered that around $1 billion in crypto is lost to scammers all year round, that was greater than a five-fold increase from 2020, and nearly 60 occasions up from 2018.

New analysis finds consumers reported losing greater than $1 billion in #cryptocurrency to scams since 2021. The majority of the losses consumers reported would bogus cryptocurrency investment scams: https://t.co/MYGTcaw1aS #DataSpotlight /1

— Federal trade commission (@Federal trade commission) June 3, 2022

By March 31, the quantity of crypto lost had been approaching 1 / 2 of the 2021 figure, showing that momentum doesn’t seem to be slowing.

The Federal trade commission discovered that Instagram (32%), Facebook (26%), WhatsApp (9%) and Telegram (7%) were the very best platforms employed for crypto scams.

Interestingly, Twitter, the social networking platform broadly adopted through the crypto-community, wasn’t pointed out despite being full of junk e-mail and scam bots touting fake crypto giveaways.

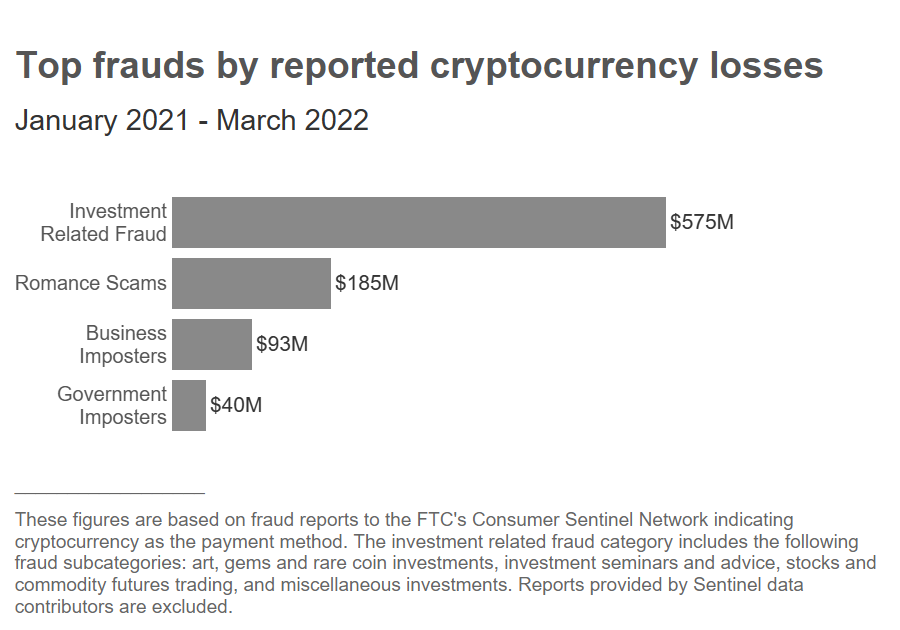

According to fraud reports to FTC’s Consumer Sentinel Network, the most typical kind of crypto scam was Investment Related Fraud, creating $575 million from the total $1-billion figure.

“These scams frequently falsely promise potential investors that they’ll earn huge returns by investing within their cryptocurrency schemes, but people report losing the money they ‘invest.’”

Based on the Federal trade commission, common investment scams include cases where a so-known as “investment manager” contacts someone, promising to develop their cash — as long as the customer buys cryptocurrency and transfers it to their internet account.

Other methods include impersonating a high profile who are able to multiply any cryptocurrency that the consumer transmits them or promises free cash or cryptocurrency.

The Federal trade commission also lists scams which involve purchase of fake art, gems and rare coins, bogus investment workshops and advice, along with other miscellaneous investment scams included in this group.

The following largest crypto-scam-related losses originated from Romance Scams at $185 million, where a love interest attempts to lure someone into investing inside a crypto scam.

Business and Government Impersonation Scams arrived third at as many as $133 million, by which scammers target consumers, claiming their cash is in danger because of fraud or perhaps a government analysis.

“These scams can begin having a text in regards to a supposedly unauthorized Amazon . com purchase, or perhaps an alarming online pop-up made to resemble a security alert from Microsoft. After that, individuals are apparently told the fraud is extensive as well as their cash is in danger.”

The scammers will pretend to become a associated with the financial institution to secure the person’s crypto.

In some cases, scammers have impersonated border patrol agents apparently telling people their fiat accounts are frozen included in a medication trafficking analysis. These scammers tell people the only method to safeguard their cash would be to place it in crypto. They’re directed to get cash and feed it right into a crypto ATM and therefore are tricked into delivering it towards the scammers’ wallet address rather.

The report discovered that people aged 20–49 were probably to get rid of crypto to some fraudster, with individuals within their 30s the toughest hit, creating 35% of total reported fraud losses.

Related: A existence after crime: What goes on to crypto grabbed in criminal investigations?

The quantity of crypto lost increases up based on age bracket, using the median individual reported cryptocurrency losses for individuals within their 70s reaching as much as $11,708, when compared with just $1,000 for 18- and 19-year-olds.

Articles around the FTC’s Consumer Advice website details various ways to prevent cryptocurrency scams:

- Only scammers demand payment in cryptocurrency. No legitimate business will demand you signal cryptocurrency ahead of time — to not purchase something and never to safeguard your hard earned money. That’s always a gimmick.

- Only scammers guarantees profits or big returns. Don’t trust individuals who promise you are able to rapidly and simply earn money within the crypto markets.

- Never mix internet dating and investment recommendations. Should you meet someone on the dating site or application, and they would like to demonstrate the way to invest in crypto or request you to send them crypto, that’s a gimmick.