Bitcoin (BTC) dipping below $36,000 “smells like capitulation,” one trader states as suspicion mounts over U . s . States stock markets.

Inside a tweet on May 6, Cointelegraph contributor Michaël van de Poppe recommended the BTC cost what food was in least giving “serious signals.”

Analyst: Stocks saw “forced liquidation”

After plunging to 10-week lows in line with equities around the May 5 Wall Street buying and selling session, Bitcoin bounced at levels last observed in Feb.

The downturn both in crypto and stocks, which adopted a preliminary bounce your day prior on the rear of expected rate hikes through the Fed, made an appearance to become greater than traders expected.

The S&P 500 finished your day lower 3.5%, as the Nasdaq 100 ended lower 5%. Outdoors stocks, U.S. 10-year Treasury futures shed 1%, an uncommon combination that gave some market participants pause for thought.

Jason Goepfert, founding father of Sundial Capital Research, noted that this type of chain of occasions had only happened two times previously quarter-century — throughout the 2008 Global Financial Trouble and also the March 2020 COVID-19 crash.

“Someone is growing, which is forced liquidation,” he told his Twitter supporters.

There has been a couple of days previously twenty five years when S&P 500 futures were lower 3% and 10-year Treasury futures lower 1%:

October 9, 2008

March 18, 2020Someone is growing, which is forced liquidation.

— Jason Goepfert (@jasongoepfert) May 5, 2022

As a result, the squence of events roping in Bitcoin might have been the capitulation event that lots of had formerly stated was necessary because of altering U.S. economic conditions.

“That has the aroma of capitulation in my experience or at best some serious signals overall,” Van de Poppe commented.

He noted the dip had also created the greatest-volume 4-hour candle since early December on BTC/USD. As Cointelegraph recently reported, volume would be a key aspect that required to return to be able to create a more convincing capitulation event.

Data from Cointelegraph Markets Pro and TradingView, meanwhile, demonstrated relative calm coming back to Bitcoin markets overnight.

BTC lengthy liquidations near The month of january highs

Assessing the outcome from the dip on hodlers, however, it made an appearance that the full market reset hadn’t resulted in the day’s losses.

Related: $27K ‘max pain’ Bitcoin cost is ultimate buy-the-dip chance, states research

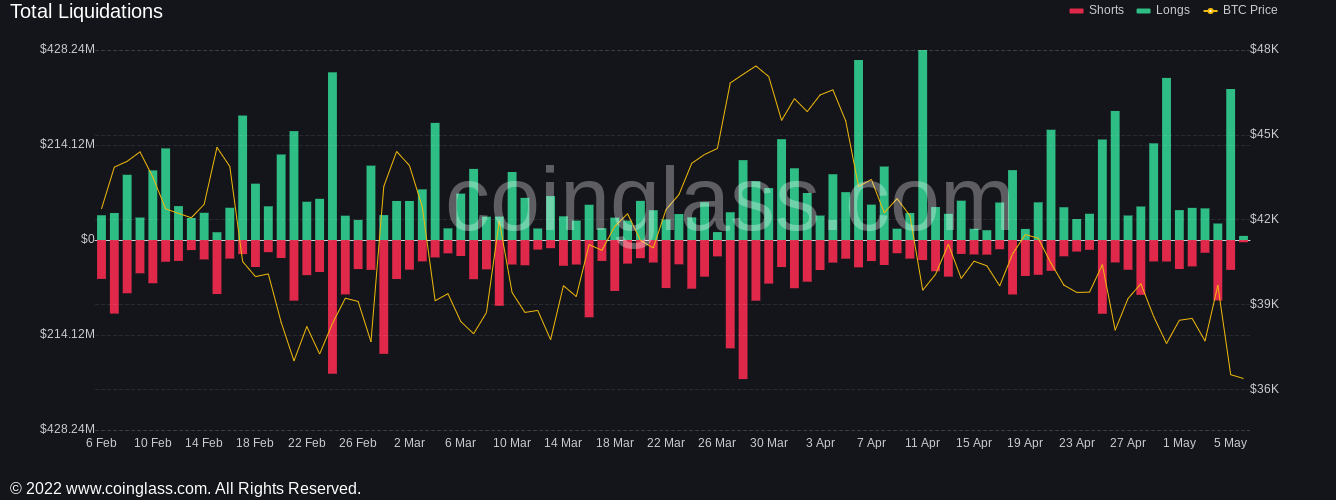

Liquidations continued to be fairly tame across cryptocurrencies, BTC comprising $190 million within the 24 hrs during the time of writing. It was the greatest daily tally for many several weeks but didn’t exceed January’s cascade to $32,000.

The rest of the $200 million originated from altcoin pairs, data from on-chain monitoring resource Coinglass demonstrated.

“Regardless of the items I ever say within the short-term, macro remains lower,” popular trader Crypto Chase summarized concerning the outlook:

“There is going to be bounces, pops, squeezes, short-term excitement, take your pick.. however i don’t believe we have seen macro reversal before major capitulation OR Given backtracking stance on rate hikes/QT/balance reduction.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.