Stablecoin issuers like Tether (USDT) and Circle have accrued a substantial be part of the U . s . States Treasury market, outperforming major traditional finance players.

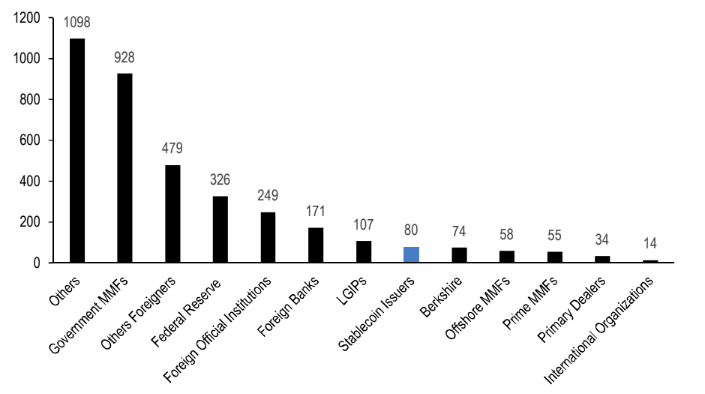

Various stablecoin providers with each other held $80 billion price of short-term U.S. government debt by May 2022, based on research through the investment bank JPMorgan released on August. 16.

Tether, Circle along with other stablecoin firms taken into account 2% from the total marketplace for the U.S. Treasury bills, holding a larger share of T-bills than totally of Warren Buffett’s investment giant Berkshire Hathaway.

Stablecoin issuers also have outperformed offshore money market funds (MMF) and prime market MMFs when it comes to their Treasury-bill investment proportion, based on the data.

Regarded as low-risk assets, Treasury bills are debt instruments which are generally utilized by companies like a cash equivalent on corporate balance sheets. Tether and Circle — issuers from the world’s greatest asset-backed stablecoins, Tether and USD Gold coin (USDC), — have promised to purchase U.S. Treasury bills while cutting reliance upon commercial paper captured.

The move came among uncertainty surrounding algorithmic stablecoins sparked by TerraUSD (formerly UST) losing its U.S. dollar peg in May 2022.

As opposed to algorithmic stablecoins, which depend on algorithms and smart contracts to aid their U.S. dollar backing, asset-backed stablecoins like USDT and USDC are made to ensure the 1:1 peg by holding cash and customary cash equivalents. During the time of writing, USDT’s market capital comes down to $67.6 billion, while USDC’s market price is $52.4 billion, based on data from CoinGecko.

Related: Tether reserve attestations to become conducted by major European accounting firm

As formerly reported, USDC has witnessed notable development in market cap, while Tether’s market dominance continues to be shedding since May. “Market confidence in Tether like a stablecoin continues to be progressively eroding, using the occasions in the last couple of several weeks speeding up that dynamic,” JPMorgan stated. Based on the bank, one of the greatest motorists behind the shift continues to be the “superior transparency and asset quality of USD Coin’s reserve assets.”