Bitcoin (BTC) miner Core Scientific’s stock has soared nearly 200% previously four days, following a positive reception for any 12 ,. 14 financing proposal from the current creditor that’s wishing the firm can avoid personal bankruptcy.

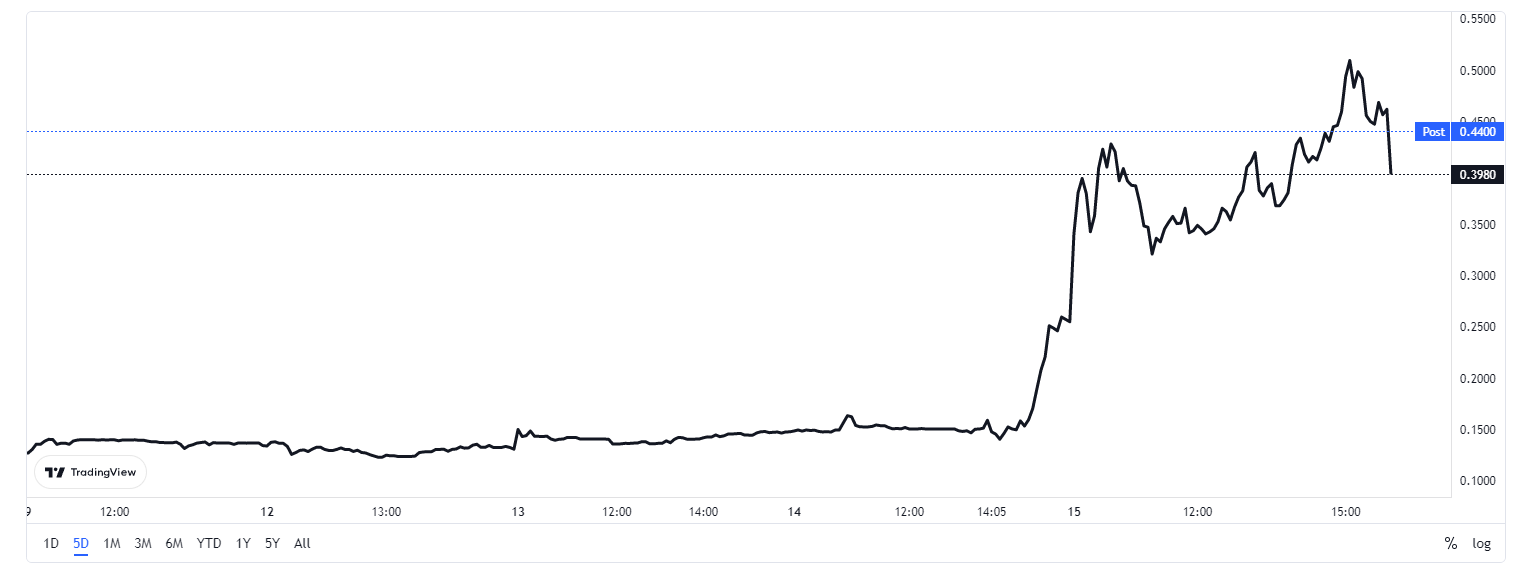

Shares for that embattled miner were sitting approximately 13 cents on 12 ,. 12, before climbing to almost 40 cents because the market closed on 12 ,. 15 — an increase of 198%.

Based on financial media firm Marketbeat, traders acquired 6,572 call choices on 12 ,. 15, 136% greater than the typical amount of 2,780, indicating that lots of are bullish around the stock and therefore are betting the cost continues rising.

Some people from the Bitcoin community were also obtaining shares, wishing for any huge return when the financing plan experiences and also the firm can survive the bear market.

Purchased a slug of $CORZ in the close. When the financing experiences plus they can survive the bear market, this trade turn into a complete MONSTER. DYOR. For the reference: pic.twitter.com/eHF4NXjcvH

— CR (@CashRocket) December 14, 2022

The rally may be the oncoming of a turnaround, or simply a defunct cat bounce. Core Scientific was hit having a run of not so good news throughout 2022 and despite recent gains the cost continues to be 95% less than it had been at the beginning of the entire year.

On 12 ,. 14 financial services platform B. Riley authored a letter to Core’s shareholders and lenders, outlining a $72 million financing plan it believes will avoid the miner from having to apply for Chapter 11 personal bankruptcy.

If the deal be recognized, the very first $40 million could be funded “immediately, with zero contingencies,” while all of those other funds could be issued if Core concurs to suspend payments to equipment lenders before the cost of Bitcoin has returned above $18,500 — a cost the key cryptocurrency continues to be below since November. 9.

B. Riley suggests the financial lending will give you Core with 2 yrs of operating cash, and notes their analyst forecasts the miner can generate annual earnings of roughly $165 million in a Bitcoin cost of $18,000, by having an extra $20 million for every $1,000 cost increase.

Related: How hard has this bear market been for Bitcoin mining? Watch Market Talks on Cointelegraph

Core was hit hard through the broader market downturn and filed a study on March. 26 citing a minimal BTC cost, high electricity rates along with a refusal from bankrupt crypto loan provider Celsius to pay back a $2.a million loan as explanations why it could default on a number of its financial obligations.

Unhealthy news ongoing on November. 22, once the miner accepted inside a questionnaire that it is cash reserves might be depleted through the finish of 2022 and it didn’t accept is as true could raise funds through financing or capital markets because of the market conditions.