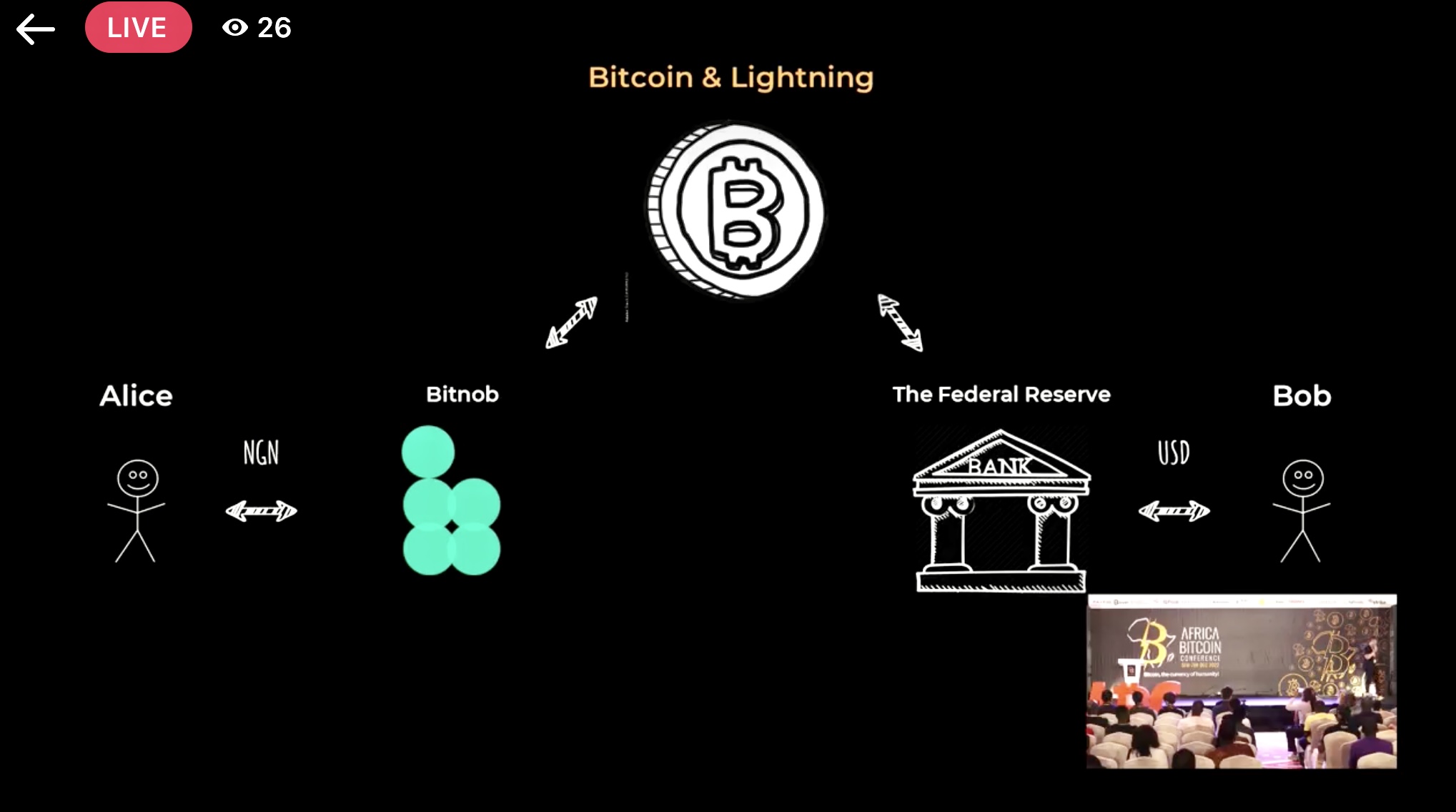

The Lightning Network has struck Ghana, Kenya and Nigeria. Throughout a conference in Ghana, Strike Chief executive officer Jack Mallers announced that the Bitcoin (BTC) payments company has partnered using the mobile application Bitnob to facilitate payments into Africa.

Mallers made the announcement on stage at AfroBitcoin, a Bitcoin conference in Ghana’s capital of Accra. He was alongside Bernard Farah, the Nigerian Chief executive officer of Bitnob, carrying out a short presentation on how it operates.

Money transfers into Africa make use of the Lightning Network, the layer-2 payments network built atop Bitcoin. The feature is known as “Send Globally,” also it enables instant, low-cost payments to Africa.

The feature doesn’t need individuals to use Bitcoin themselves, Bitnob Chief executive officer Bernard Parah described on stage. No-transaction-fee feature is presently available to Africans in Nigeria, Ghana and Kenya. In comparison, remittance services for example Wise have a small commission, while Western Union may charge up to 10% for the money transfers.

Dollar payments are instantly changed into naira, cedi or shillings (currencies in Nigeria, Ghana and Kenya, correspondingly) and therefore are deposited straight to recipients’ banks, mobile money, or Bitnob accounts.

Solving mix-border payments into Africa using Bitcoin will be a major boost to local economies. In Nigeria alone, $17.2 billion was submitted remittances towards the country in 2020. However, based on the World Bank, “for each $200 submitted 2020, it cost the sender $17.8 (8.nine percent).” That means roughly $1.5 billion lost in charges, or roughly the GDP of Samoa.

If Nigeria would eliminate remittance charges by utilizing Bitcoin payment rails, Nigerians across the nation would benefit financially. In Kenya and Ghana, everything is similar. A large number of Ghanaians and Kenyans reside in the U . s . States and frequently send money overseas. Crypto in Africa has surged recently, remittance is among the a lot of reasons why.

Related: Subway accepts Bitcoin, so users could possibly get a sandwich around the Lightning Network

Mallers compared the general experience to PayPal’s Venmo application because it’s an immediate peer-to-peer payment. Venmo is really a mobile application that enables instant and frictionless payments between U . s . States customers. Mallers stated the Lightning Network has “just achieved dollars to Naira, Naira to dollars.”

The advancement is presently only accessible to Americans delivering money to individuals residing in Ghana, Kenya and Nigeria–English-speaking countries in Africa, even though the rollout is placed to carry on across Africa.

This story is developing and will also be updated with new info.