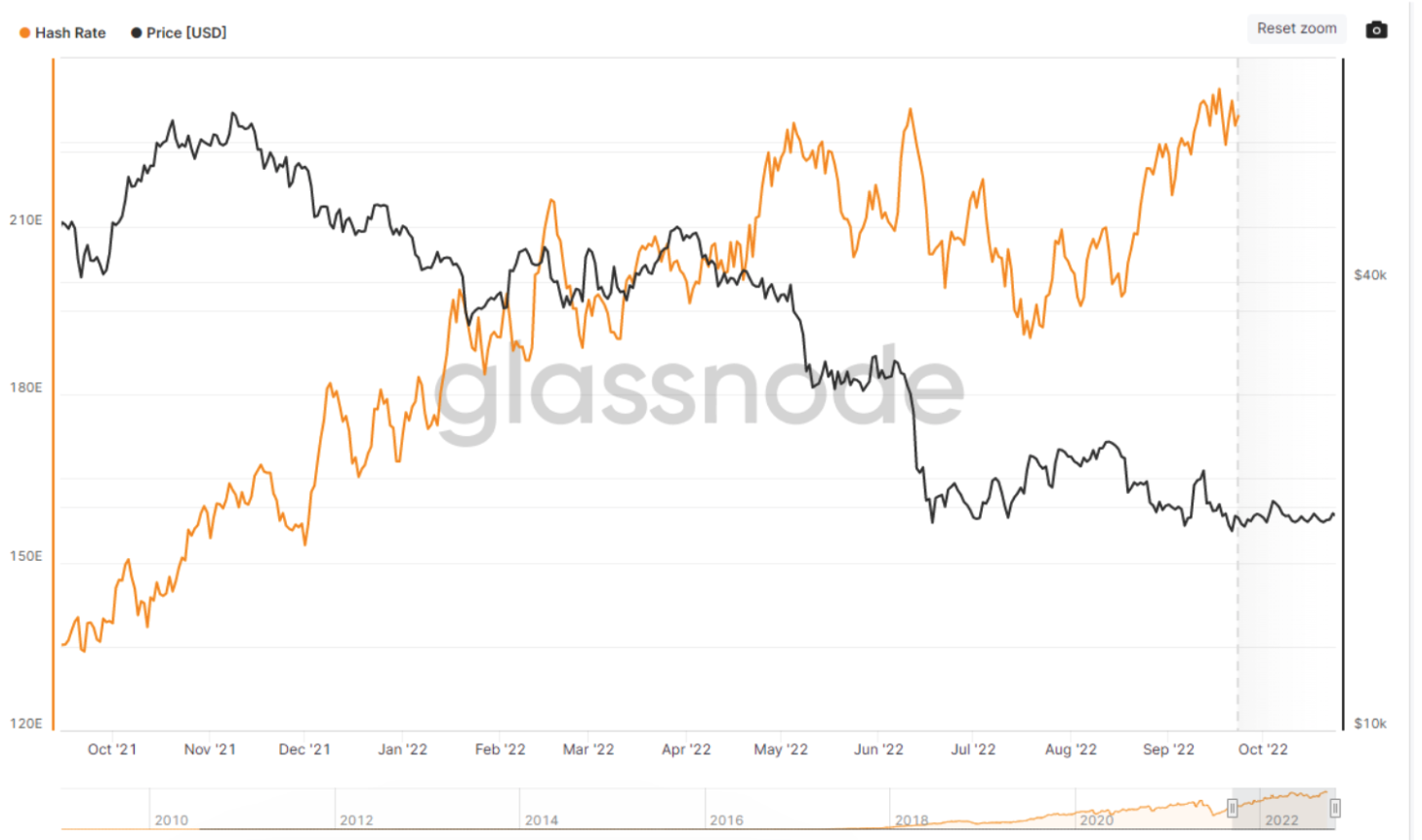

October observed an outburst in Bitcoin’s hash rate, that is pushing the metric to a different a lot of 245 exahashes per second. These changes brought to some sharp reduction in the hashprice, producing a stop by the net income margins for Bitcoin (BTC) miners and reaching a minimal of $66.8 per petahash on March. 24.

Based on Luxor Technologies, “hashprice” may be the revenue BTC miners earn per unit of hash rate, the total computational power deployed by miners processing transactions on the proof-of-work network.

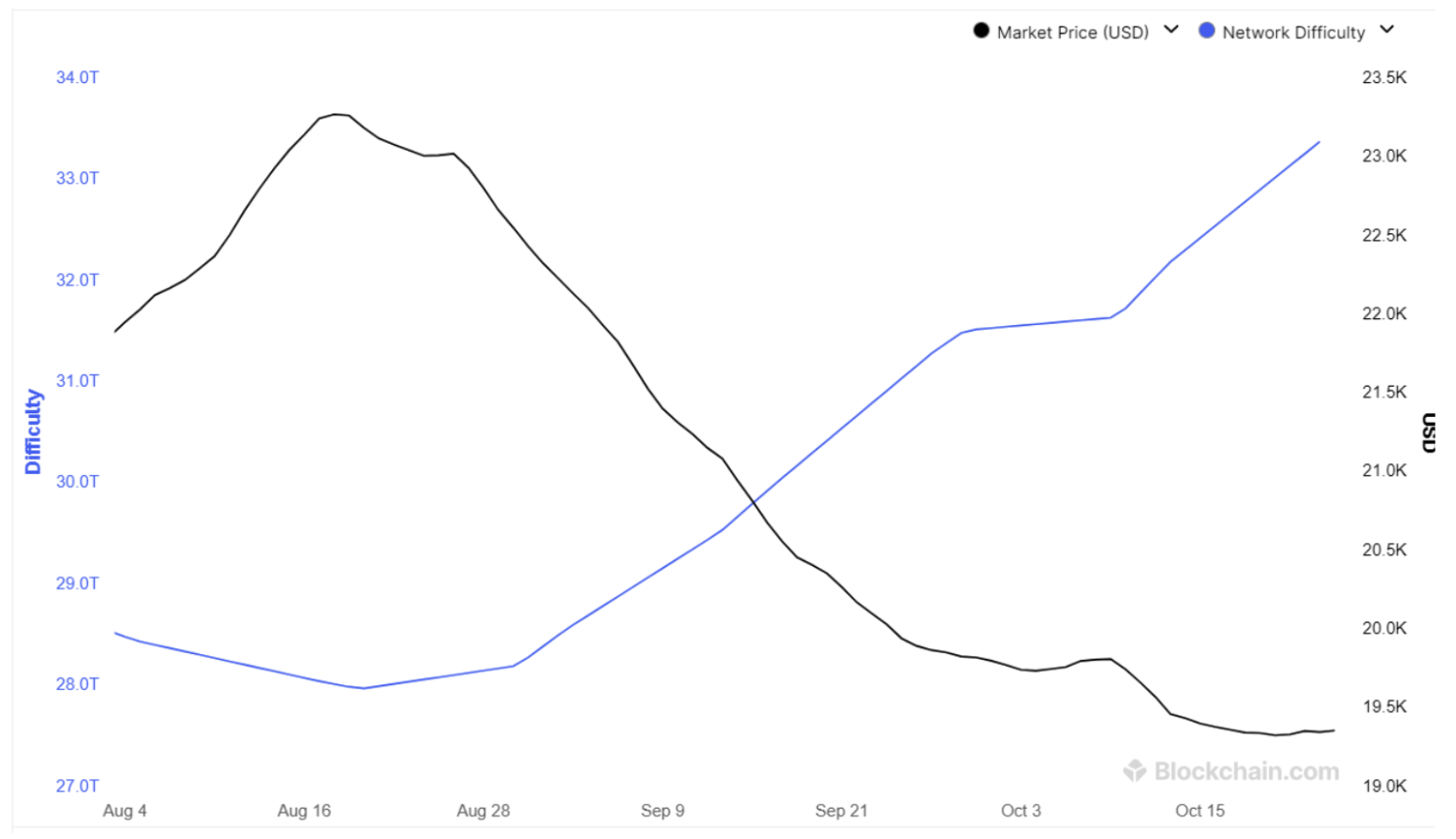

Not just has volume been sporadic, however the Bitcoin hash rate elevated a week ago to typically 269 EH/s. Which means that the network’s difficulty continues to be rising since This summer 2022.

The development of mining operations, which creates miner competitiveness the elevated utilization of ASIC miners, for efficient than their alternatives and also the Ethereum Merge have brought some Ethereum mining firms to fill empty rack space from non-operating Ether (ETH) GPU miners with BTC-specific ASIC miners.

Consequently, the boost in the hash rate led to a spinal manipulation from the Bitcoin difficulty at any given time when BTC’s cost was shedding. Not surprisingly, following the hash rate spike and hard increase, the hashprice plummeted to $.0657 per terahash each day, therefore reducing the amount of profit.

Rise in mining costs means compressed profits

A adding step to the depressed profit level may be the general increase in BTC mining costs. For instance, there’s been a clear, crisp rise in the cost of electricity within the U . s . States. From This summer 2021 to This summer 2022 alone, the cost of electricity elevated by 25%, from $75.20 to $94.30 per megawatt hour. Energy prices also have a tendency to rise in winter, as individuals need to heat their houses. The Bitcoin mining market is already seeing a boost in mining in Kazakhstan because of affordable energy.

Bitcoin miners face other rising costs, for example hosting charges, obtaining miners and installing or upgrading cooling systems. Throughout the 2020–2021 crypto bull market, Bitcoin mining companies required out loans when BTC and equipment prices were much greater, meaning the eye on existing financial obligations themselves could hurt newer and overleveraged mining firms.

It’s obvious that the rise in hash rate and Bitcoin difficulty, along with the reduction in hashprice, is resulting in compressed income. The next graph shows home loan business profits inside a landscape in which the hash rate, difficulty and the price of electricity still rise.

When the hash rate is constantly on the increase among a falling hashprice, the profit continuously decrease, possibly leading some mining firms to shut up shop permanently.

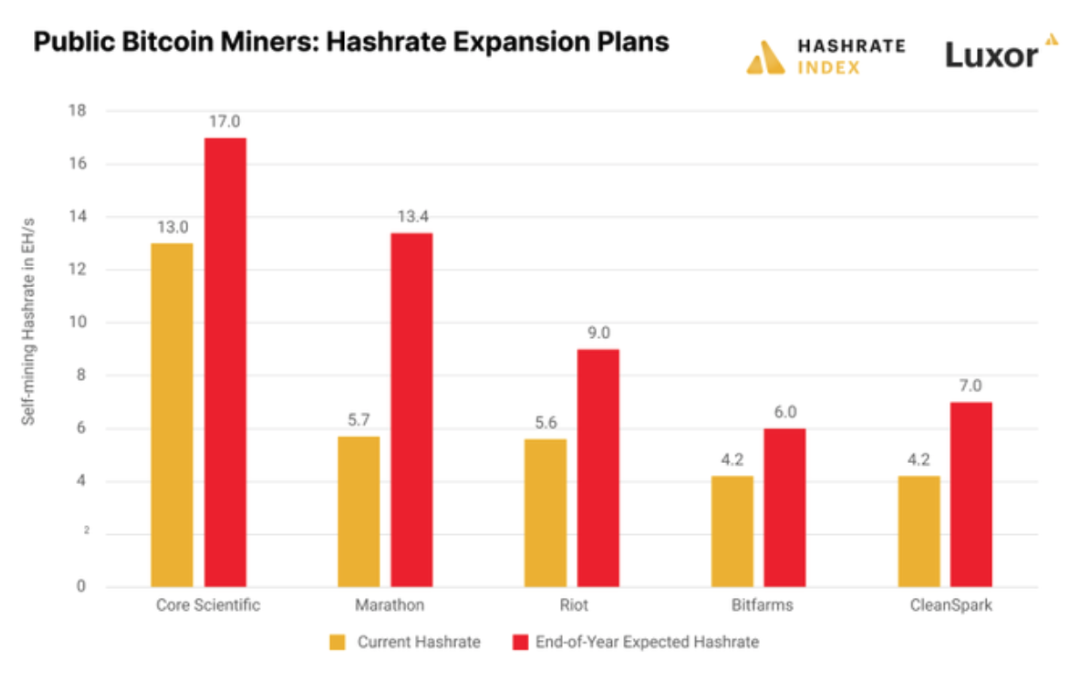

One possible result’s that lean (cooler balance sheets) mining firms like Marathon might be able to purchase liquidated equipment and rack space from bloated mining firms that fail.

Mining businesses that are remaining lean while trying to scale may prove victorious. Mining companies for example Core Scientific, Marathon, Riot, Bitfarm and CleanSpark are get yourself ready for expansion even while many miners have found profitability difficult.

Related: Public Bitcoin miners’ hash rates are booming — But could it be really bearish for BTC cost?

Is sustainability the solution?

Cellular the down sides discussed, BTC mining firms should adopt sustainable BTC mining models for profitability potential and also to ease regulators. This will include using alternative energy, growing production capacity and installing advanced cooling systems.

Mining firms can boost their operations by utilizing alternative energy from wind power, solar energy and hydroelectricity, which concurrently reduces costs as well as their carbon footprint. This method can result in more consistency and sustainability in Bitcoin mining energy costs. Norwegian has were able to capture 1% of Bitcoin mining via a 100% alternative energy approach.

The depressed Bitcoin cost, high hash rate and Bitcoin difficulty, in addition to low hashprice, lead to small income, which can lead to sustainable, decentralized mining practices over the industry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.