Crypto and equities financial markets are lower and besides the positive news of Celsius repaying all their debt and staying away from an enormous liquidation, you will find couple of around the place reasons which are prompting investors to purchase Bitcoin and altcoins.

The collapse of numerous decentralized finance (DeFi) protocols, crypto investment funds and BTC buying and selling 60% below its all-time high still weigh on sentiment however a couple of positive tidbits of information might be a sign the market is able to enter a consolidation phase.

expect individuals will shift from the comatose condition of fear towards the realization that many vast amounts of $ in forced place selling (LFG, 3AC, lenders, miners) were a capitulation/risk transfer rivaled only through the Covid crash https://t.co/vAj7HfTKxf

— light (@lightcrypto) This summer 7, 2022

Crypto investors HODL

Based on a current survey conducted by Appinio, regardless of the collapse in crypto prices and start of bear market, “more than half (55%) of crypto investors held their investments as a result of the current crypto-asset market sell-served by just 8% selling their investments.”

This means the an investment conviction of most crypto investors remains strong. The research also discovered that “33% of yankee investors are committed to crypto-assets,” an “40% of investors believe Bitcoin is definitely the best investment chance within the next three several weeks.”

American investors show resiliency

With regards to how American investors taken care of immediately the broad pullback across markets, Appinio discovered that 65% of respondents held their investments and turn into positive about their choices.

When requested to pinpoint their most pressing short-term concerns, 66% of respondents reported rising inflation, 39% highlighted the condition from the global economy and 34% identified worldwide conflict.

Based on Callie Cox, U.S. investment analyst at eToro, these concerns coupled with ongoing uncertainty “and a general rise in living costs and housing costs” have created “a perfect storm of setbacks” for investors.

Cox stated,

“Despite these 4 elements, investors across generations are demonstrating an amount of maturity and understanding and aren’t letting feelings dictate important money decisions.”

Related: Bitcoin traders expect a ‘generational bottom,’ but BTC derivatives data doesn’t agree

Bitcoin enters oversold territory

Additionally towards the resiliency displayed by crypto investors, several on-chain metrics also claim that the marketplace might have hit oversold territory and it is primed for consolidation.

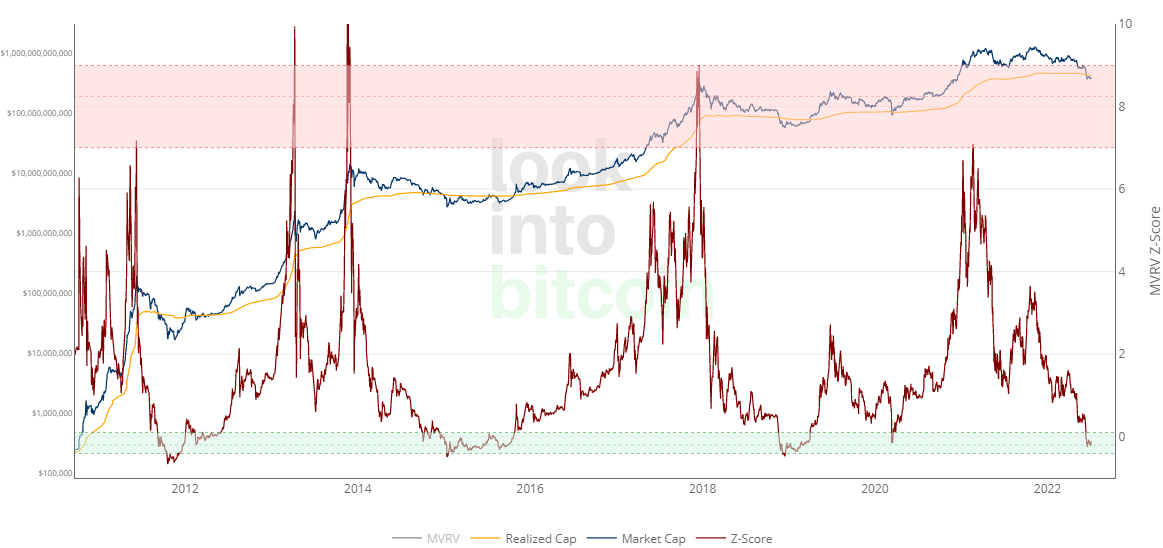

The MVRV Z-score, which utilizes a mix of Bitcoin’s market price, recognized value and z-score, is a reliable tool to assist identify when BTC is “extremely over or undervalued in accordance with its fair value” according to LookIntoBitcoin.

As proven around the chart above, periods in which the red z-score has joined the low eco-friendly band have symbolized good buying possibilities for BTC, as have occasions once the market cost dropped underneath the recognized cost, an element proven through the blue and yellow lines towards the top of the chart.

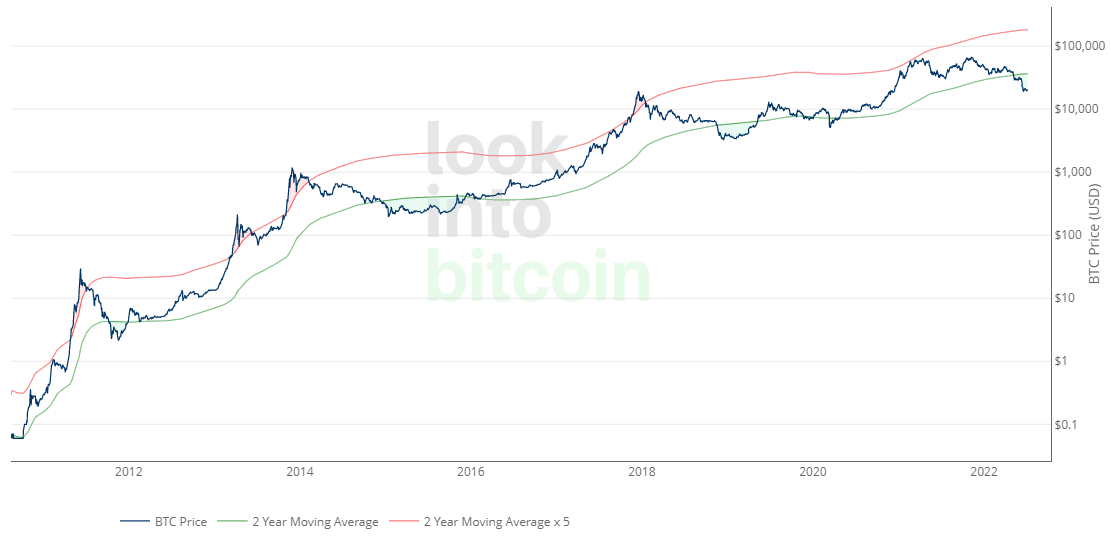

The Bitcoin Investor Tool provided by LookIntoBitcoin likewise offers insight when selling or buying Bitcoin can establish outsized returns.

The eco-friendly shaded areas around the chart represent amounts of time in which the cost of Bitcoin reaches an amount that’s considered in the past low and could represent a great chance to purchase.

It ought to be noted by using the Bitcoin investor oral appliance the MVRV Z-Score, time put in bear market conditions varies and can embark upon to have an longer timeframe, so it might be wise for investors not to exclusively base their investment thesis on any particular metric or indicator in isolation.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.