Bitcoin (BTC) starts a brand new week looking lower an outrageous macro atmosphere after sealing its cheapest weekly near the coast nearly 2 yrs.

As risk assets over the global economy have a hammering and also the U.S. dollar surges, the biggest cryptocurrency is on the limp footing.

September, getting began on bulls’ side, has become living as much as its informal crypto market nickname — “Septembear” — and BTC/USD is presently lower 6.2% since the beginning of the month.

Unhealthy news keeps coming for hodlers, who’re clinging to dormant coins in growing figures because the dollar runs rampant and mainstream appetite to diversify into riskier plays is constantly on the evaporate.

With macro set to stay the important thing focus for everybody now, Cointelegraph analyzes what could lie available for BTC cost action.

In economic problems that rival any major duration of historic upheaval seen previously century or even more, here are a few factors to take into consideration when assessing where Bitcoin could mind next.

Weekly close transmits BTC/USD to November 2020

Whilst not matching the prior week’s losses (3.1% versus 11%), yesteryear 7 days nevertheless were able to spark Bitcoin’s cheapest weekly close since November 2020, data from Cointelegraph Markets Pro and TradingView shows.

Because the downside keeps coming, Bitcoin has thus switched back the time to prior to the breakout, which required it beyond its prior halving cycle’s all-time high.

A feeling of deja vu is unwelcome towards the average hodler — the great majority buying and cold storing in the last 2 yrs has become underwater.

“$BTC just made the cheapest weekly near the coast this zone,” popular Twitter analyst Senate bill Investments summarized following the close.

“Looks bearish with stocks searching to interrupt support too. But on the other hand this is exactly what everybody expects.”

If the markets could pull a surprise “max pain” proceed to the upside, liquidating short bias, is really a key alternative argument for Bitcoiners. For popular trader Omz, the weekly close cost of $18,800 even represents a convincing local bottom.

The RSI divergence hasn’t gone undetected elsewhere, with trader JACKIS flagging its arrival a week ago.

“We only got two touches from the oversold territory previously & they’ve always marked the precise bottom too,” he tweeted at that time.

Fellow buying and selling account IncomeSharks also maintained that the reversal could accompany the U.S. midterm elections at the begining of November, but stopped lacking stating that the underside is at.

“Elevator lower, stairs up,” it commented around the 4-hour chart at the time.

“Keep on building double bottoms and new supports, Midterm Rally remains up for grabs. Break this structure, remove these targets, and get a new bottom.”

Dollar wrecking ball costs stocks, fiat

Monday has barely began and also the turmoil that supported a week ago has already been back having a vengeance on macro markets.

An unstoppable U.S. dollar is lounging waste to key buying and selling partner currencies, using the Bitcoin pound sterling making the news at the time because it plunges 5% in the future inside a couple of percentage points of USD parity — its cheapest levels from the greenback ever.

GBP/USD would stick to the euro becoming worth under $1, as the misery forced Japanese government bodies to support the yen exchange rate artificially a week ago.

EUR/USD briefly fell below $.96 before a modest rebound, while USD/JPY remains near its greatest because the 1990s despite Japan’s intervention.

Simultaneously, alarm bells are sounding for global bonds, that have fallen to 2020 levels. Markets commentator Holger Zschaepitz cautioned alongside Bloomberg data:

“Looks such as the bond market bubble has burst. The need for global bonds has stepped by another $1.2tn now, getting the entire loss from ATH to $12.2tn.”

Stocks are going to fare no better, with futures lower at the time before the Wall Street open. Brent oil fell below $85 per barrel the very first time since the beginning of 2022.

“Global bonds are collapsing within their fiat currencies, that are collapsing from the dollar, that is fast losing purchasing power,” Saifedean Ammous, author from the popular books, “The Bitcoin Standard” and “The Fiat Standard,” reacted.

“It is going to be several weeks & years prior to the average fiat user realizes simply how much they are getting destroyed financially. The ‘new normal’ is poverty.”

With crypto still highly correlated with stocks and inversely correlated against dollar strength, the outlook for Bitcoin is thus under positive because the established order looks set to stay.

Euro Area Consumer Cost Index (CPI) arrives now, likely to show inflation still growing, as the U.S. Personal Consumption Expenses Cost Index (PCE) print should on the other hand continue the U.S. downtrend which started in This summer.

The U.S. dollar index (DXY) meanwhile shows no manifestation of reversing, now at its greatest since May 2002.

Hodlers in classic bear market mode

Among such mayhem, it comes down as no real surprise that Bitcoin hodlers’ conviction is growing and lengthy-term investors won’t sell.

Persistent hodling is really a hallmark of Bitcoin bear markets, and also the latest data implies that that mindset is firmly back this season.

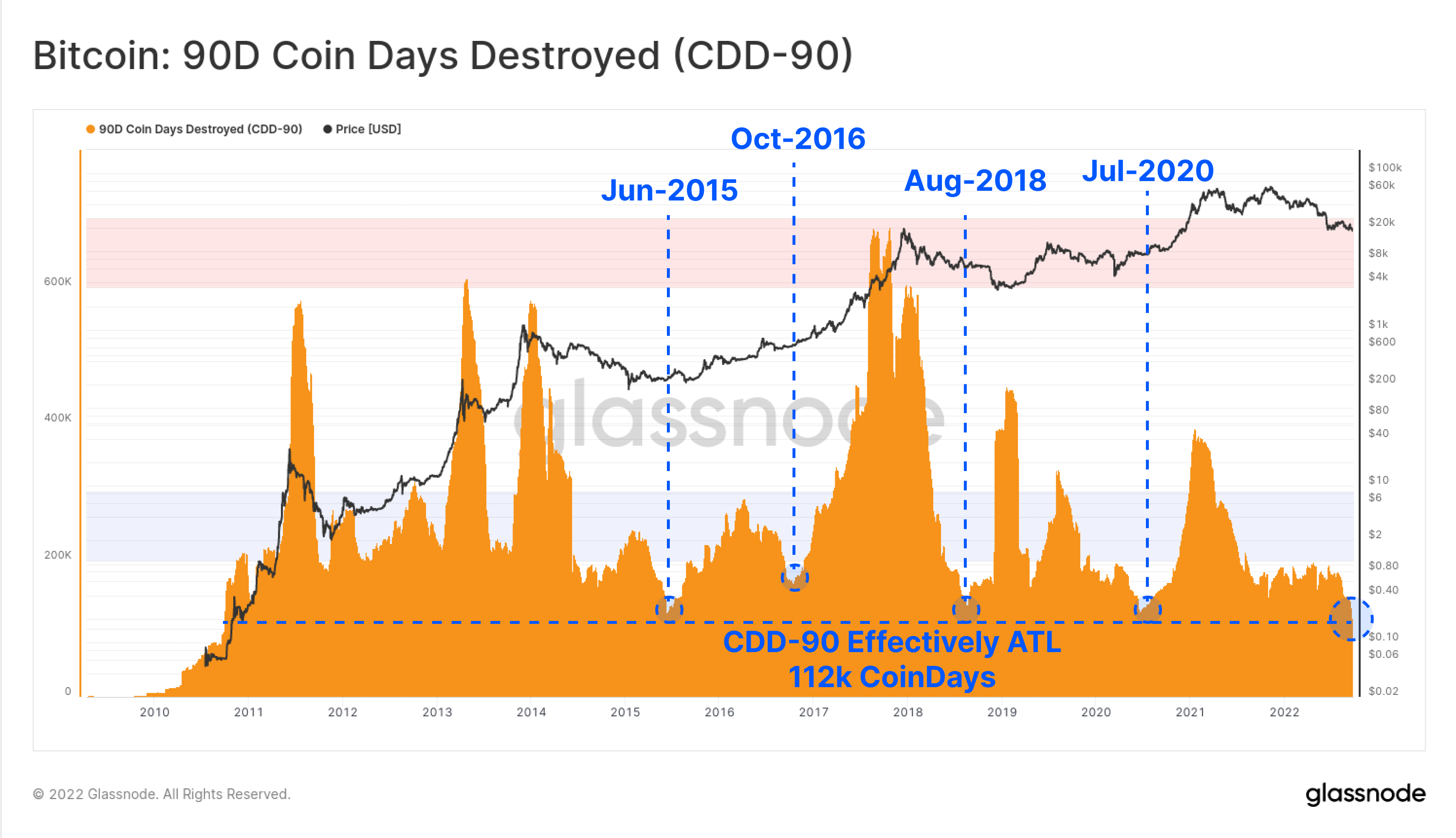

Based on on-chain analytics firm Glassnode, Bitcoin’s so-known as Gold coin Days Destroyed (CDD) metric is setting new lows.

CDD describes the number of dormant days are erased when BTC leaves its host wallet following a given period. When CDD is high, it shows that more lengthy-term stored coins are actually on the go.

“The total amount of Bitcoin gold coin-days destroyed within the last 90-days has, effectively, arrived at an exciting-time-low,” Glassnode commented.

“This signifies that coins that have been HODLed for many several weeks to years would be the most dormant they’ve have you been.”

This news follows days of numerous hodl-focused metrics showing dedication to help keep the BTC supply under locksmith for much better days.

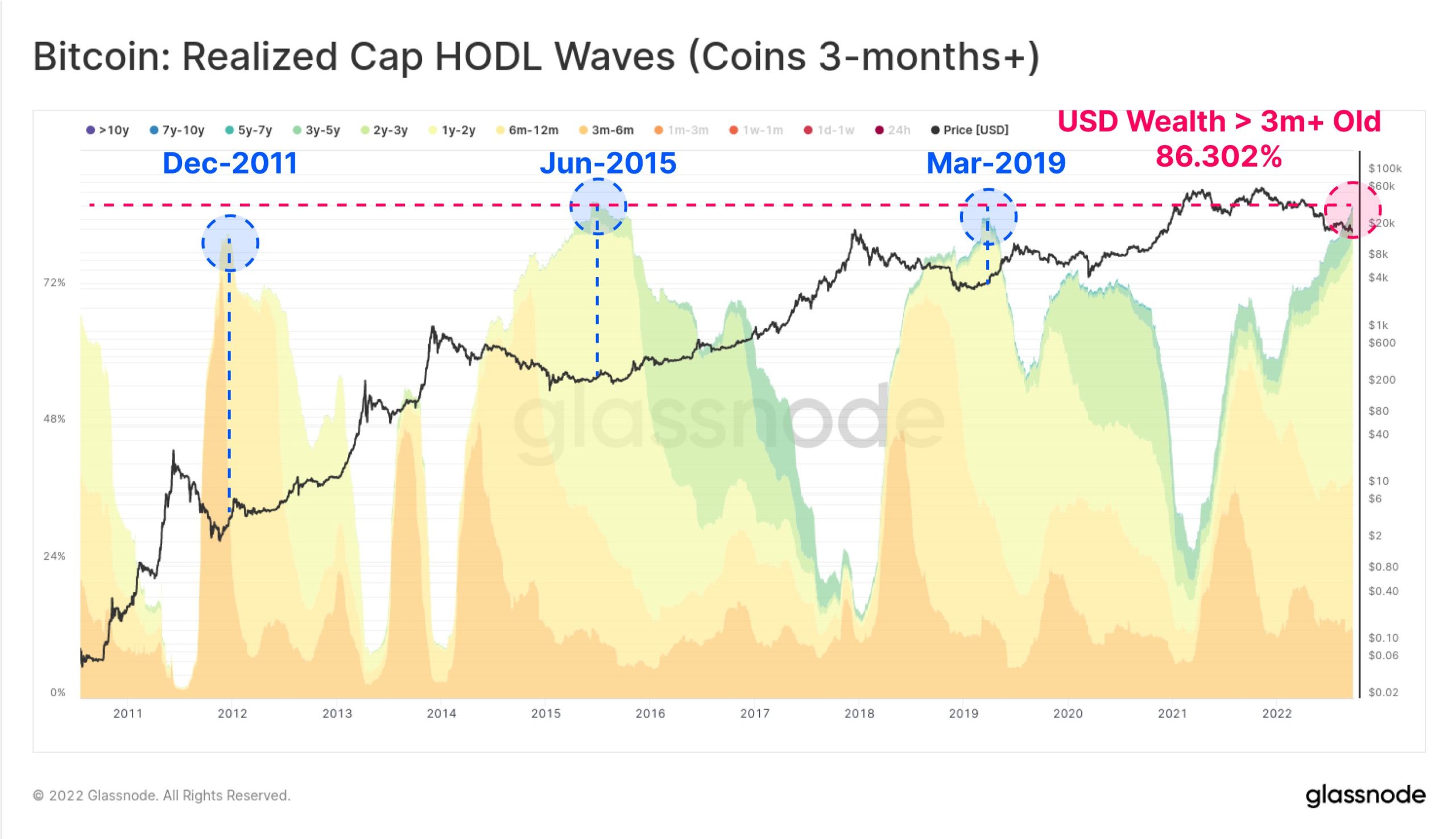

Glassnode meanwhile furthermore noted the growing prevalence of coins hodled not less than three several weeks like a proportion from the USD worth of the BTC supply.

“Bitcoin HODLers seem to be steadfast and unwavering within their conviction,” it agreed.

An associated chart demonstrated Bitcoin’s HODL Waves metric — a depiction from the supply damaged lower by gold coin dormancy.

Whales still dictate support and resistance

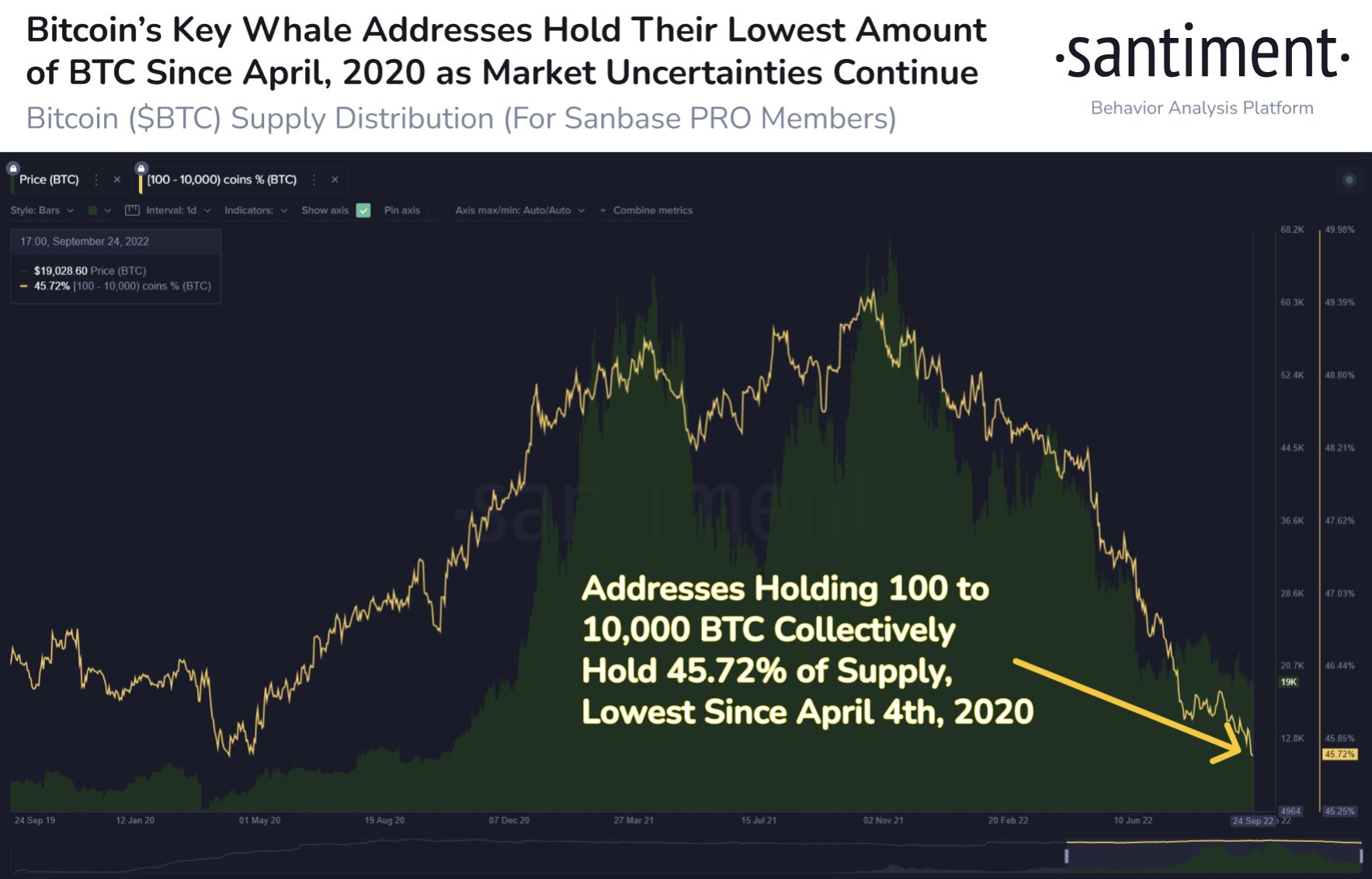

While old hands leave behind the “sell” button, Bitcoin’s largest-volume investors take presctiption the radar of analysts with regards to place cost moves.

The present buying and selling range represents a zone of great interest because of the extent of buying and selling activity involving whale money previously.

Large buys lend excess weight to some specific support cost while this is also true of resistance levels, and based on on-chain monitoring resource Whalemap, BTC/USD is presently stuck backward and forward.

“Holding 19k-18k is essential for $BTC,” the Whalemap team summarized late a week ago.

An associated chart demonstrated whale resistance levels capping relief for Bitcoin and restricting it to inside the $20,000 zone.

Nevertheless, separate figures from research firm Santiment make sure whales’ BTC exposure overall has fallen to 2-year lows.

“Extreme fear” enters second week

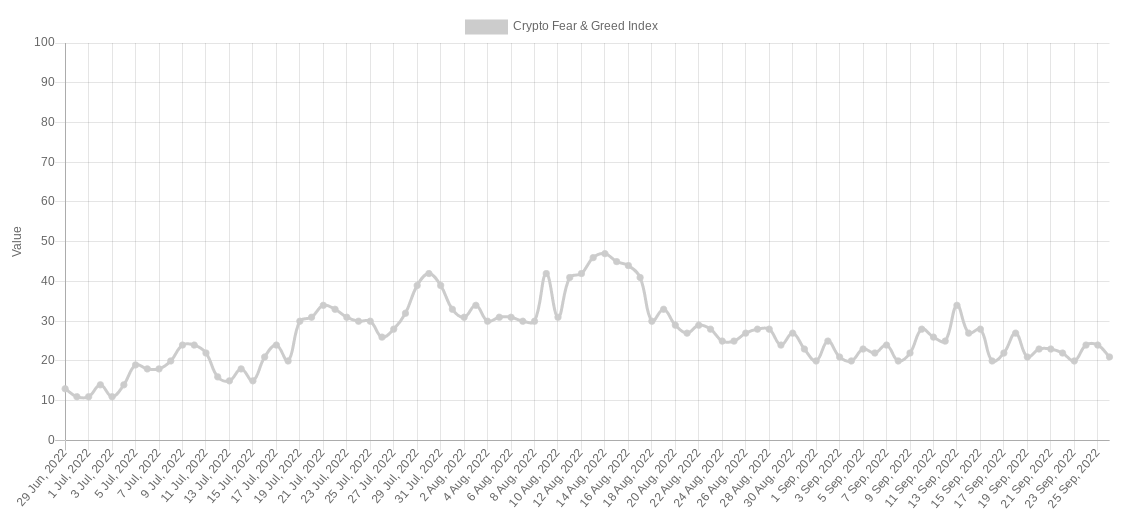

Inside a familiar go back to 2022 norms, crypto market sentiment has experienced “extreme fear” mode for over a week.

Related: 5 altcoins that may turn bullish if Bitcoin cost stabilizes

As reported by the Crypto Fear & Avarice Index, which measures aggregate crypto market sentiment, the typical investor couldn’t feel a lot more uneasy concerning the outlook.

By Sep. 26, Fear & Avarice recorded a score of 21/100, with 25/100 the boundary for “extreme fear.

Cold ft is certainly not a new comer to the marketplace this season, which saw its longest-ever stint in “extreme fear” in excess of two several weeks.

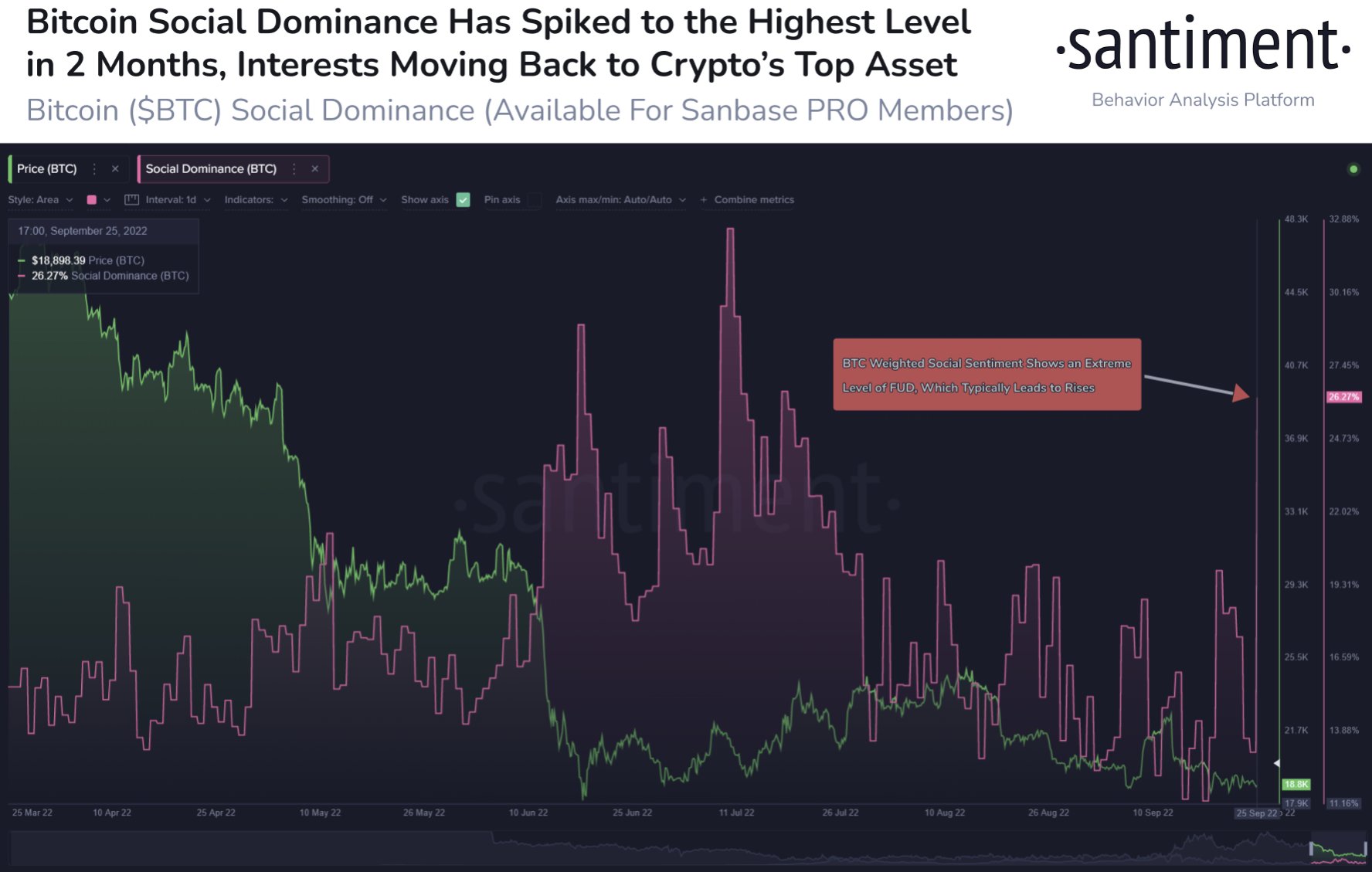

A possible silver lining could lie in social networking interest, which saw a rebound over the past weekend, Santiment noted.

“Among crypto’s best players assets, $BTC may be the subject in 26%+ of discussions the very first time since mid-This summer,” it revealed partly of Twitter comments now.

“Our backtesting shows 20%+ focused on Bitcoin is really a positive for that sector.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.