The blockchain space is seeing some regions of strength regardless of the perceived downturn on the market. The perpetual futures funding rates for Bitcoin (BTC) and Ether (ETH) have flipped to positive on major exchanges, which shows bullish sentiment among derivatives traders. Additionally, Bitcoin began buying and selling below your buck basis, that has marked previous regions of market bottoms. In comparison, June saw decentralized finance (DeFi) notice a 33% reduction in total value locked and crypto stocks give a -42.7% average month-over-month return.

There’s a continuing fight between bullish and bearish sentiments in various regions of the marketplace. To assist cryptocurrency traders maneuver with the battlefield, Cointelegraph Research lately launched its monthly “Investor Insights Report.” Within the report, the study team breaks lower yesteryear month’s top market-moving occasions and also the most important data over the various sectors of the profession. They provide expert analysis and insights that may benefit serious blockchain market participants.

Derivatives may give a key indicator of altering sentiments

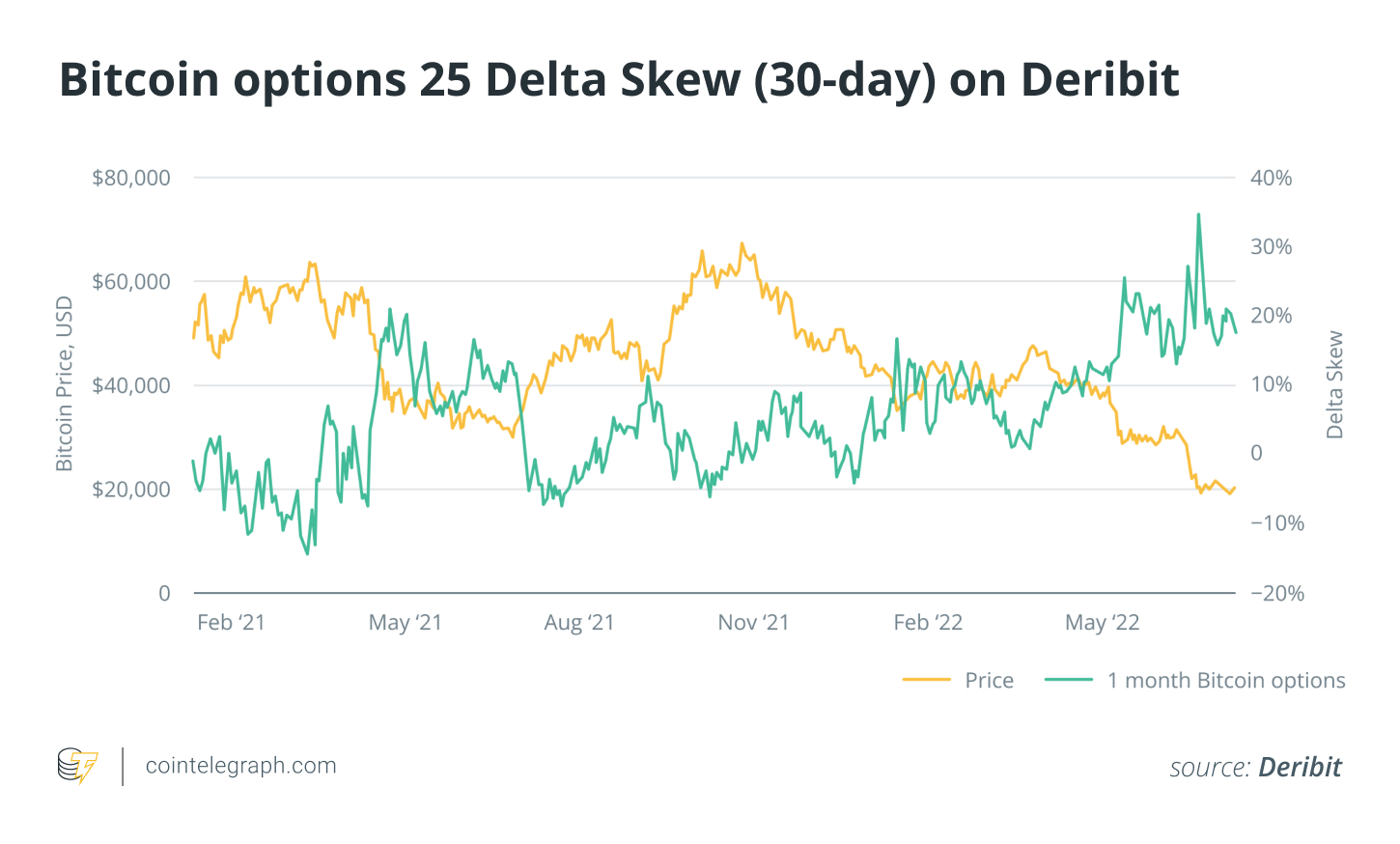

Prior to June, there was a powerful bearish sentiment on the market. One indicator of bearish and bullish sentiment may be the volatility skew of the market. The bigger the skew range, the greater volatile, while tighter ranges suggest less volatility — which means more confidence on the market. On June 18, the Bitcoin options 25-delta skew peaked at 36%, the greatest ever on record. Since that time, some optimism has came back, delivering the skew lower to 17%. This signals a powerful thought that the crypto market will rebound within the next couple of several weeks.

Premiums on lengthy calls on Bitcoin and Ether indicate that traders are positive concerning the finish of the season. However, solvency issues and the chance of contagion continue to be present on the market and also the minds of investors and regulators.

In sideways markets, traders may use strangles to create returns if Bitcoin stays range-bound. Strangles involve selling puts and calls at different strike prices. The thought of a strangle is much like it would seem: putting a put (a choice to market) along with a call (a choice to purchase) below and over the current place cost. For instance, if Bitcoin reaches $20,000, first sell a put at $15,000 around the downside along with a call at $30,000 around the upside. When they expire following a month, the premiums increase the risk for gains without the transaction charges.

Download and buy reports around the Cointelegraph Research Terminal.

Presently, the choices skew includes a steep slope, by having an implied volatility differential as high as 10% between your $17,000–$24,000 strike prices on Deribit and also the Chicago Mercantile Exchange. This signifies a great setup for any risk reversal involving a brief put at $17,000 along with a lengthy call at $24,000.

Is bullish sentiment beginning to push bears back?

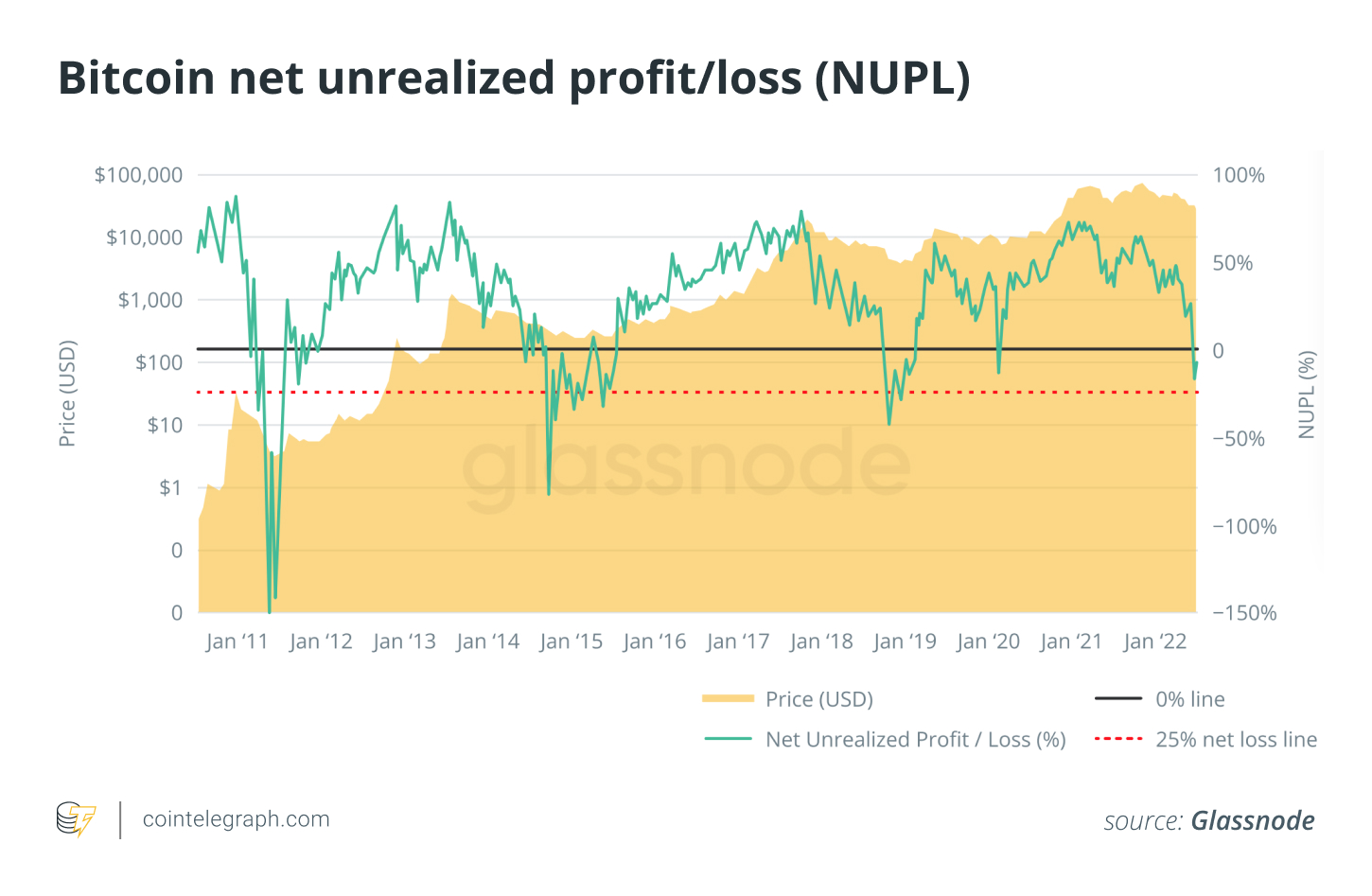

Bitcoin’s internet unrealized loss has hit a 3-year low, highlighting that it is market value is almost 17% lower compared to its aggregate cost basis. In the past, global bottoms have created when losses hit over 25%. The downsloping moving averages and also the relative strength index within the oversold zone indicate that bears have been in control.

However, the very first time since March 2020, Bitcoin traded below its mining cost basis, an amount which has in the past marked global capitulations and bottoms within the cost of Bitcoin. The internet unrealized profit/loss indicator is much more evidence the bulls might be overtaking the bears.

From derivatives towards the NFT sector

The Investor Insights Report covers many other topics for example security tokens, DeFi, blockchain gaming, cryptocurrency mining, blockchain-related stocks, regulation and investment capital investments. The topic experts stay awake-to-date on all of the latest news and trends to chop with the weeds and supply essential insights in to the blockchain industry.

Each portion of the report covers important components impacting the subject. Subject material experts cover the most crucial happenings that have a significant impact, and the details are presented inside a digestible format that serious participants within the crypto marketplace may use to obtain an overview, highlights along with a forecast for which might be coming. The e-newsletter has become readily available for subscription featuring complete charts and detailed analyses.

The Cointelegraph Research team

Cointelegraph’s Research department comprises the best talents within the blockchain industry. Getting together academic rigor and filtered through practical, hard-won experience, they around the team are dedicated to getting probably the most accurate, insightful content in the marketplace.

Demelza Hays, Ph.D., may be the director of research at Cointelegraph. Hays has compiled a group of subject material experts from over the fields of finance, financial aspects and technology to create towards the market the premier source for industry reports and insightful analysis. They utilizes APIs from a number of sources to be able to provide accurate, helpful information and analysis.

With decades of combined experience of traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to place their combined talents to proper use using the Investor Insights Report.

Disclaimer: The opinions expressed within the article are suitable for general informational purposes only and therefore are not meant to provide specific advice or recommendations for anyone or on any sort of security or investment product.