The Lightning Network (LN) got a little faster, because the suitably named Secure Card now enables Bitcoin (BTC) enthusiasts to cover products or services using contactless technology.

An information analyst at the organization behind the credit card, CoinCorner, required the Secure card on the trial operate on the Isle of individual, an english Crown dependency within the Irish Ocean. “MSW” — because he is famous — drawn on to pay for at greater than eight point-of-purchase (PoS) devices throughout his lunchtime analysis.

It labored such as this: For just about any PoS device showing a Lightning invoice, MSW simply hovered the NFC-enabled Secure Card nearby. In total, MSW 20 compensated for 25 breakfasts, lunches, drinks and snacks while using LN before the Secure Card’s release:

⚡️#LightningLunch – Day 16⚡️

Prawn noodles, mango lassi

Street KitchenCost: 44,634 丰 (£11.50)

Notes: Magnificent of course, but pretty spicy

Pro-tip: Bring your lunch time early in order to save sats !Total spent: 413,107 丰 / £123.30

Current value: £110.06 pic.twitter.com/EA8Dgx6qoI— CoinCornerMSW (@CoinCornerMSW) May 9, 2022

MSW told Cointelegraph that while using Secure Card “felt completely natural and labored just understandably:”

“For me, it’s a huge step-up when it comes to consumer experience in comparison with checking QR codes. An added bonus for me personally was understanding a few of the local companies round the Isle of individual and watching the way they have accepted the Secure Card.”

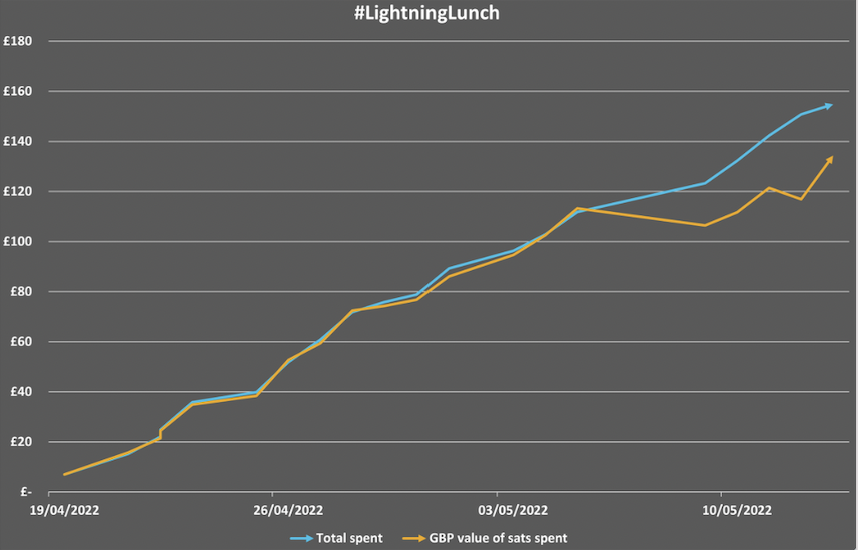

An information analyst towards the core, MSW also documented the comparative price of parting with Satoshis, (the tiniest denomination of the Bitcoin), versus having to pay for refreshments with pounds sterling, the Isle of Man’s currency. Considering the recent bear market cost action, the pound value is marginally greater.

A layer-two technology built on Bitcoin, the LN is fantastic for instant payments and micropayments. However, before the Secure Card, shoppers from El Salvador to the Isle of individual would pay within the LN by checking a QR code.

For Danny Scott, Chief executive officer of CoinCorner, this really is “not as efficient and user-friendly once we need so that it is for any mass audience.” Payment with QR codes is extended and awkward:

“It still involves unlocking a telephone, opening an application, checking a QR code after which making the transaction. This can be a backwards step with regards to consumer experience compared to what we’re accustomed to today for in-person payments.”

In true Bitcoiner style, the Secure Card is interoperable with industry protocols including Lightning and LNURL. Scott emphasizes they “will explore other concepts around steps to make The Secure Card, and also the consumer experience for those Lightning use cases, better.”

In most, the Lightning Network keeps growing, from large payment integrations such as Cash Application, lower to grassroots movements and individuals making micropayments.

Related: Rising global adoption positions crypto perfectly to be used in retail

The Secure Card is yet another Bitcoin payment innovation “real products for that real life,” states Scott. Ultimately, it furthers the road toward “hyperbitcoinization.”

The progress in payments flies when confronted with FTX Chief executive officer Mike Bankman-Fried’s recent comments, who experienced warm water for suggesting he sees “no future” in Bitcoin payments.