South Korean experts have predicted the crypto market’s capital will rise from around $800 billion with a $1.5 trillion the coming year. Plus they declare that “stabilizing” inflation figures “during the very first 1 / 2 of next year” will whet investors’ appetites for Bitcoin (BTC) along with other tokens.

The claims were created inside a study named “2023 Cryptoasset Market Prospect Report” through the research wing from the South Korean crypto exchange Korbit and as reported by Edaily.

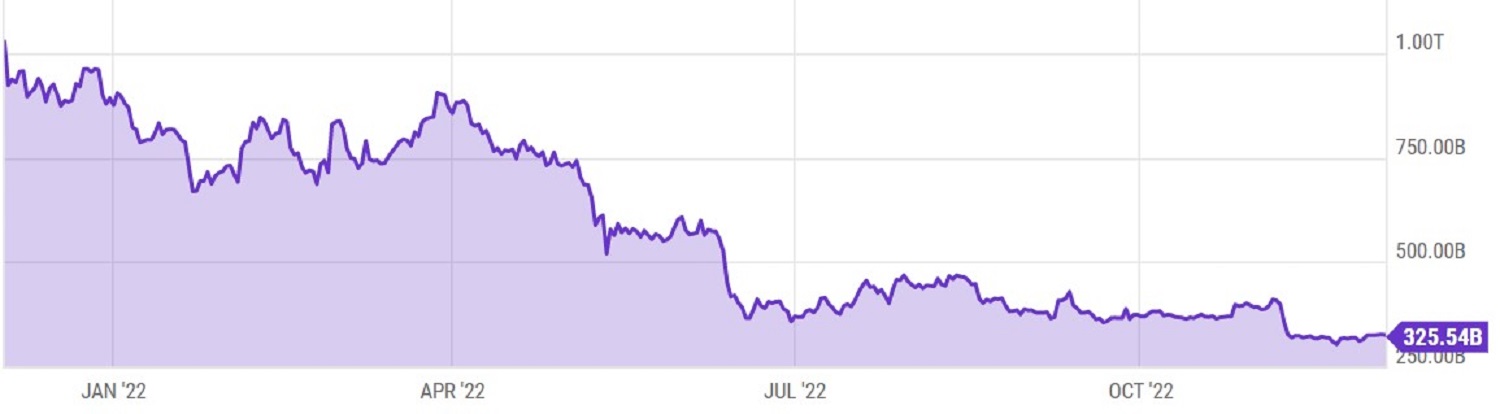

The bitcoin market cap is presently lower over 65% from last year, however, many appear hopeful of the recovery.

The Korbit researchers claimed that although central banks such as the U . s . States’ Fed have “strengthened risk asset avoidance,” you will find signs the Given will retreat from 2022 policies the coming year – sparking a “recovery” within the “demand for greater-risk assets” for example crypto.

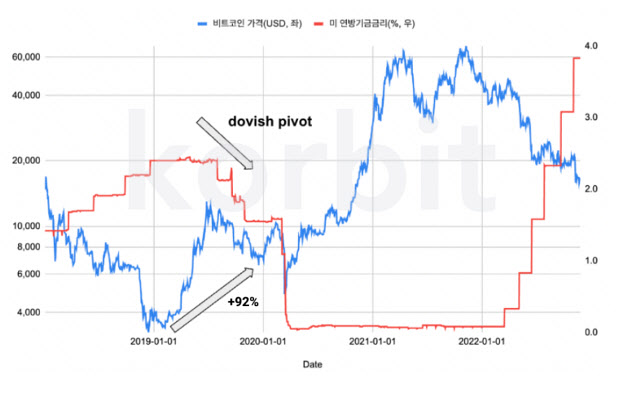

They added they expected 2023 “to be much like 2019” – an occasion when crypto started to create a gradual recovery following a icy crypto winter of 2018.

One of the main researchers within the study mentioned:

“The public frequently thinks the 2018 crypto crash ongoing in 2019. However, the bitcoin cost recovery in 2019 arrived at 92%.”

The Korbit researchers mentioned that Given policies at the begining of 2019 saw the central bank halt a number of rate of interest hikes. This brought to some “dovish pivot” in bitcoin prices in September of the identical year. An identical event will probably occur the coming year – provided the Given truly does avoid raising rates of interest.

They also made the next predictions for 2023:

- Adoption will rise – and mainstream firms will start searching at not just BTC options, but additionally Ethereum (ETH) adoption proposals

- The synergy between stablecoins, the DeFi sector, and traditional banking institutions increases

- Tether (USDT), USD Gold coin (USDC), and BUSD will “fiercely compete for supremacy” as stablecoins race to get “the next dollar”

Possible “market volatility” inducing occasions the coming year range from the following:

- New rules introduced globally within the wake from the FTX collapse

- Fresh concerns over centralized exchanges, again because of the fall of FTX and also the fallout

- The decision from the legal struggle between your US Registration and Ripple

- the failure or success of yankee progressive crypto regulation spearheaded by the kind of Wyoming Senator Cynthia Lummis