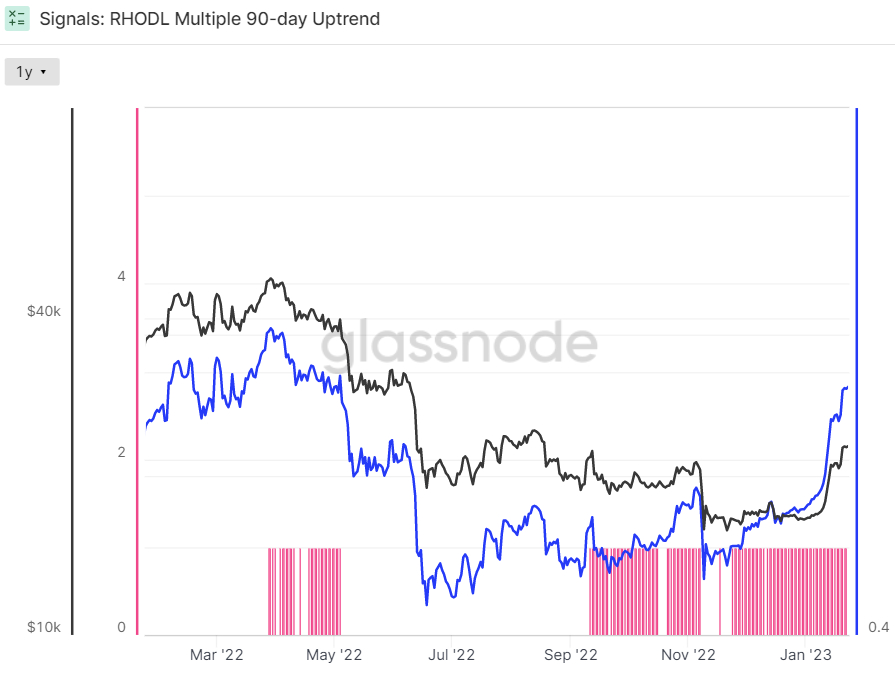

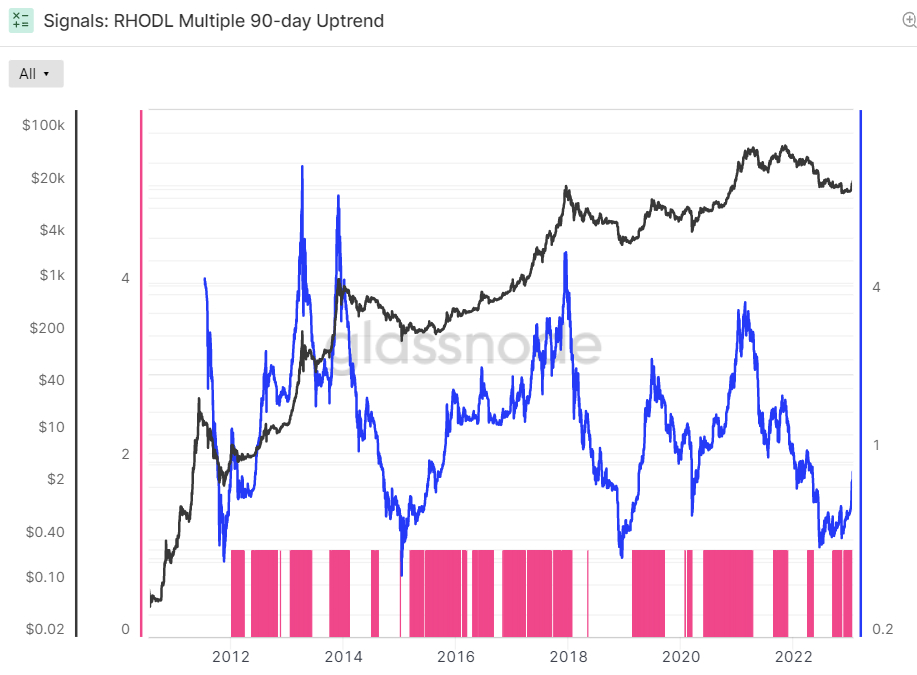

Based on data from crypto analytics firm Glassnode, the 90-Day Bitcoin’s Recognized HODL Multiple has risen to the greatest level since May 2022, when Bitcoin’s cost was around $30,000, instead of current levels within the upper $22,000s. The Realize HODL Ratio (RHODL) is really a ratio of the amount of Bitcoins that moved under 1 week ago versus the amount of coins that moved one or two years back.

Glassnode states that greater values indicate a dominance in 1-week-old coins while lower values indicate a dominance in 1y-2y old coins. The Recognized HODL Multiple is definitely an oscillator that’s calculated by dividing the present RHODL with a simple moving average (SMA) from the RHODL in the last one year.

The crypto analytics firm claims that “when the RHODL Multiple transitions into an upward trend more than a 90-day window, it signifies that USD-denominated wealth is beginning to shift back towards new demand inflows”. It “indicates earnings are being taken, the marketplace is capable of doing absorbing them… (and) that longer-term holders are beginning to invest coins” Glassnode condition.

The RHODL Multiple was last around .85, getting been bottomed under .5 in June 2022. In the past, once the RHODL Multiple recovers from the drop under .5, this is a good indicator of the approaching Bitcoin bull market.

What This Signifies for BTC?

The increase in the RHODL Multiple is available in wake of Bitcoin’s cost getting rallied nearly 40% to date this month, using the world’s largest cryptocurrency by market capital on target because of its best monthly performance since October 2021. BTC/USD was last altering hands within the upper $22,000s, as traders, analysts and investors consider if the latest rally is the beginning of an extended-term push greater, or perhaps a so-known as “bear market trap”.

And also the recent positive transfer of Glassnode’s RHODL metric comes at any given time when other indicators will also be pointing to some potential bottom. Bitcoin lately surged above its 200-Day SMA and Recognized Cost. Both are thought to be highly significant levels, having a sustained break towards the south or north of either frequently considered suggestive of a transfer of Bitcoin’s cost momentum.

Meanwhile, Glassnode’s New Addresses Momentum and Recognized Bitcoin P&L Ratio has additionally been trending greater. Multiple Indicators are also trending greater. Elsewhere, the Bitcoin Fear and Avarice Index by Alternative.me lately retrieved to neutral. Whether it are now able to hold above 50 on the sustained basis, it has in the past been usual for a bear market ending.

Macro Tailwinds in 2023?

More broadly, the macro picture is searching better of computer is at 2023 – the majority of the Fed’s rate hikes have the symptoms of already happened around inflation falling quickly to the central bank’s 2.% target with US growth slowing considerably. Indeed, macro traders are more and more betting on the better rate of interest backdrop at the end of 2023/into 2024.

Quite simply, the primary driver of 2022’s bear market (a far more hawkish than expected Given) appears like it’s not likely to be (because) an issue in 2023. While there’s no be certain that Bitcoin keeps recent gains and pushes further towards the north in 2023, particularly if the approaching expected US recession proves worse than anticipated and triggers downside in US equities, Bitcoin’s downside risks appear reduced in contrast to this time around this past year.

Within the short-term, if Bitcoin can muster a push above $23/23,000 resistance, the doorway is available to a retest recently-summer time highs within the $25,500 area included in a wider pushback for the $30,000 area.