Bitcoin (BTC) continues to be not able to interrupt in the 26-day-lengthy climbing down funnel. Investors are uncomfortable holding volatile assets following the U . s . States Fed promised to lessen its $9 trillion balance sheet.

While inflation continues to be surging worldwide, the very first indications of a fiscal downturn demonstrated because the U . s . Kingdom’s retail sales fell 1.4% in March. Furthermore, Japan’s industrial production dropped 1.7% in March. Lastly, the U.S. gdp fell 1.4% within the first quarter of 2022.

This bearish macroeconomic scenario can partly explain why Bitcoin continues to be on the downtrend since early April. Still, one should evaluate how professional traders position themselves, and derivatives markets tprovide some excellent indicators.

The Bitcoin futures fees are muted

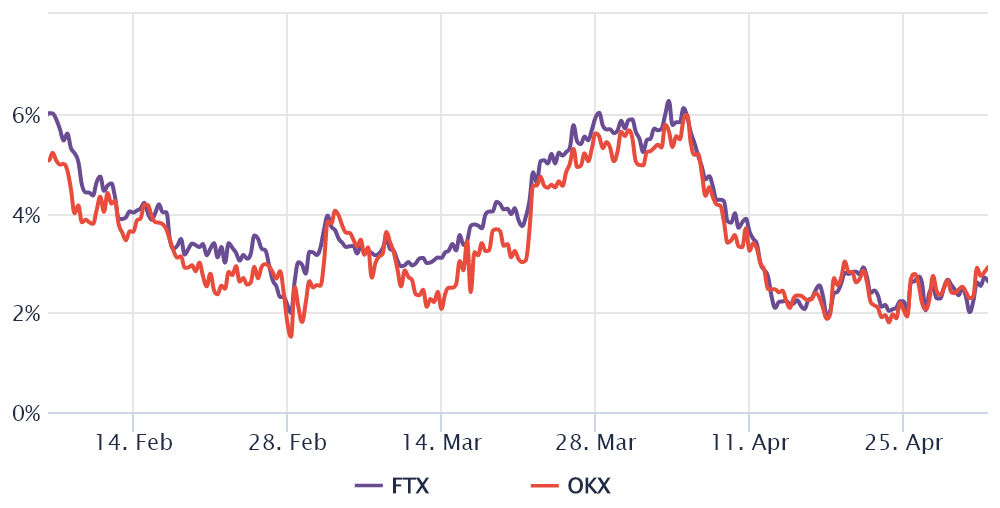

To know if the current bearish trend reflects top traders’ sentiment, you ought to evaluate Bitcoin’s futures contracts premium, also is referred to as a “basis.”

Unlike a continuous contract, these fixed-calendar futures don’t have a funding rate, so their cost will differ vastly from regular place exchanges. A bearish market sentiment causes the 3-month futures contract to trade in a 5% or lower annualized premium (basis).

However, an unbiased market should present a 5% to 12% basis, reflecting market participants’ unwillingness to secure Bitcoin for affordable before the trade settles.

The above mentioned chart implies that Bitcoin’s futures premium continues to be below 5% since April 6, indicating that futures market participants are unwilling to open leverage lengthy (buy) positions.

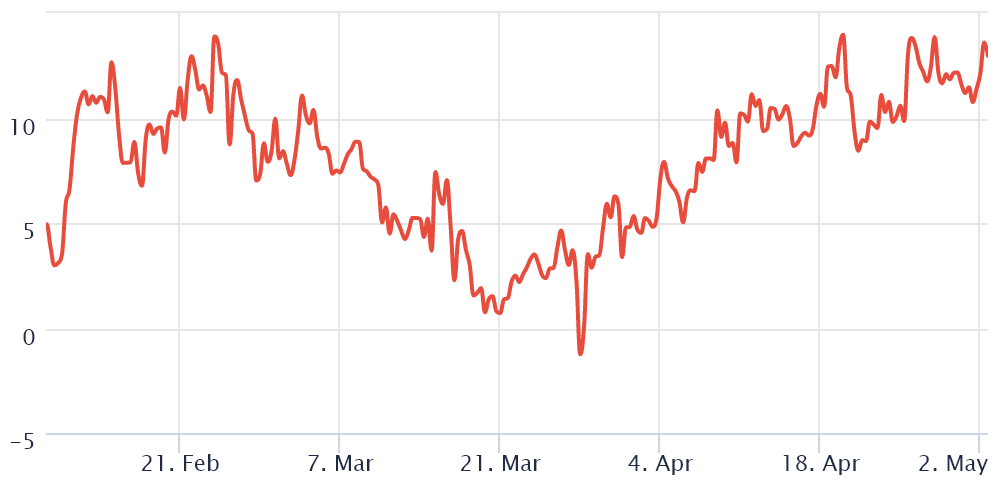

Options traders stay in the “fear” zone

To exclude externalities specific towards the futures instrument, traders also needs to evaluate the choices markets. The 25% delta skew compares equivalent call (buy) and set (sell) options. The indicator will turn positive when “fear” is prevalent since the protective put options fees are greater compared to call options.

The alternative holds when market makers are bullish, resulting in the 25% delta skew to shift towards the negative area. Readings between negative 8% and positive 8% are often considered neutral.

The above mentioned chart implies that Bitcoin option traders happen to be signaling “fear” since April 8, just like BTC broke below $42,500 carrying out a 10% stop by four days. Obviously, this type of metric might be reflecting the 16% negative BTC cost performance in the last month, so not quite an unexpected.

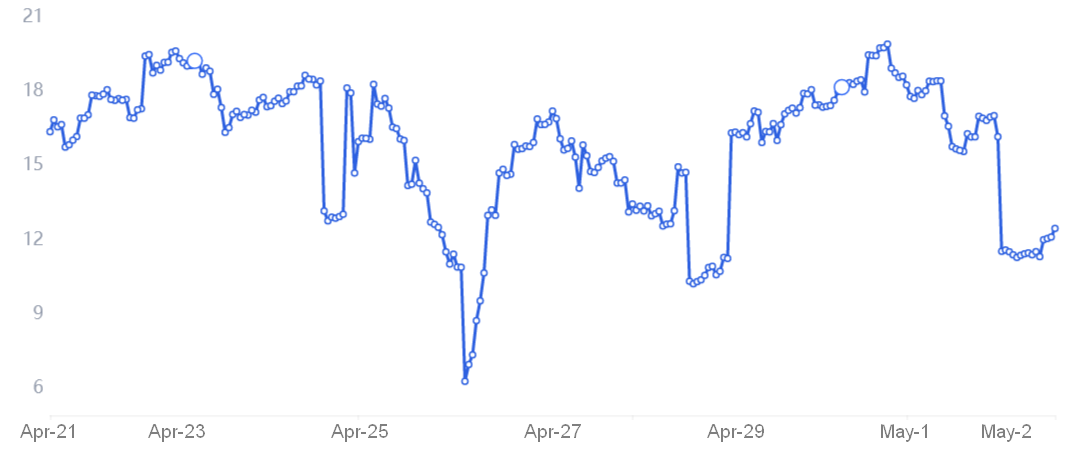

Margin markets sustain its optimism

Margin buying and selling enables investors to gain access to cryptocurrency and leverage their buying and selling position, thus potentially growing returns. For instance, an investor can purchase cryptocurrencies by borrowing Tether (USDT) to improve their exposure.

However, Bitcoin borrowers are only able to short the cryptocurrency because they bet on its cost decline. Unlike futures contracts, the total amount between margin longs and shorts is not always matched.

The above mentioned chart implies that traders happen to be borrowing more Bitcoin lately, because the ratio decreased from 20 on April 30 to the present 12.5. The greater the indicator, the greater confident professional traders are with Bitcoin’s cost.

Despite extra Bitcoin borrowing activity targeted at betting around the cost downturn, margin traders remain mostly positive, based on the USDT/BTC lending ratio.

Bitcoin traders fear further correction as macroeconomic indicators deteriorate because investors expect a possible crisis effect on riskier markets. However, there aren’t any indications of leverage short (negative) bets using margin or futures, meaning sellers lack conviction at $38,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.