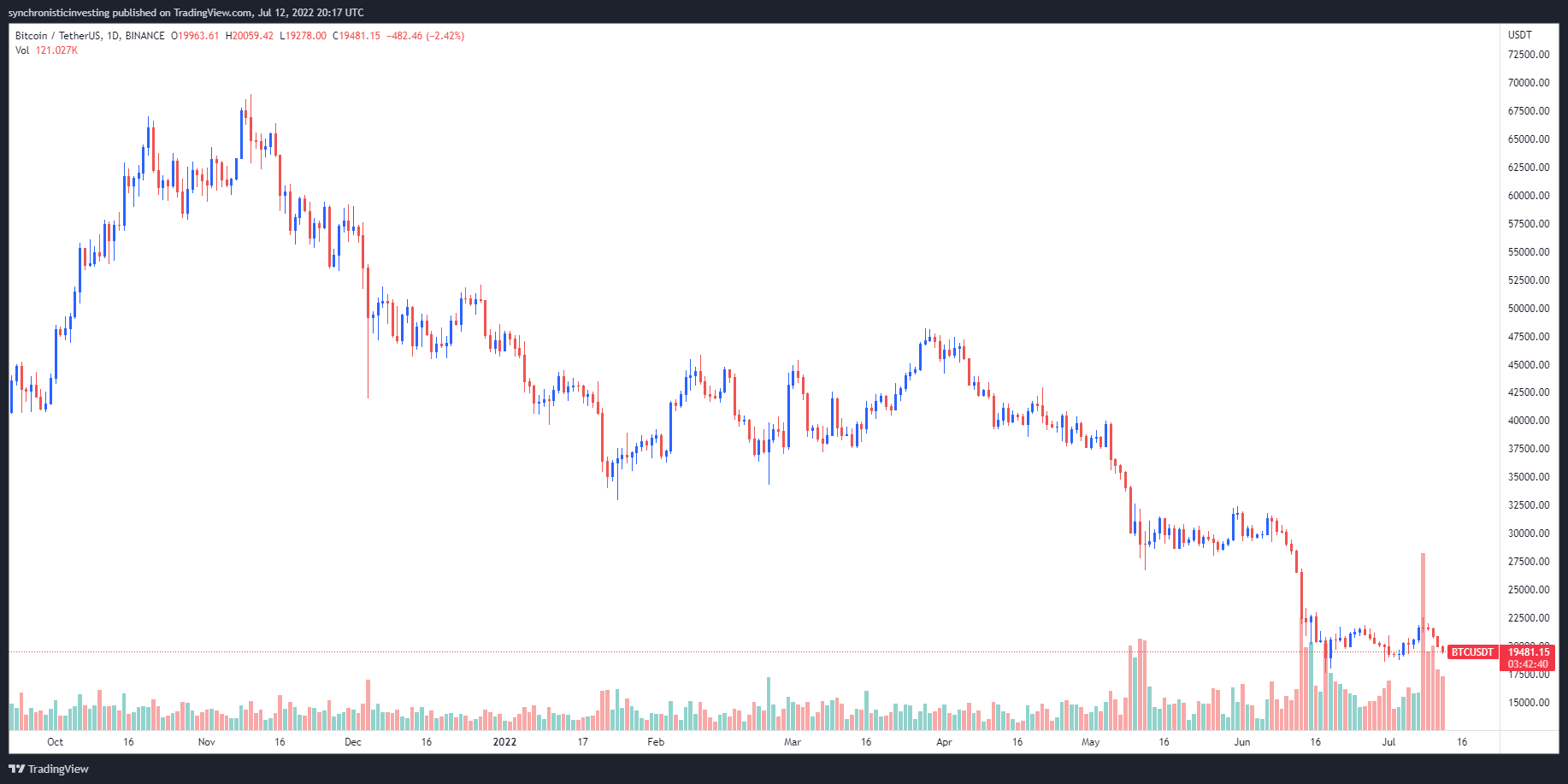

The positive gains recorded within the first 10 days of This summer have basically disappeared on This summer 13 as Bitcoin (BTC) and also the wider market slid back toward new yearly lows.

Subdued action on the market could be tracked to a number of factors varying today’s record-high Consumer Cost Index print along with a raging US dollar that lately hit its greatest level since October 2002.

Data from Cointelegraph Markets Pro and TradingView implies that This summer 13 marked the 5th consecutive day’s a declining BTC cost, which hit an intra-day low at $18,910, following a declines over the major stock exchange indices.

Because the world awaits a catalyst that literally brings positive momentum back to global markets, here’s what several analysts are saying about what’s next for Bitcoin.

Was Bitcoin’s latest surge caused by wash buying and selling?

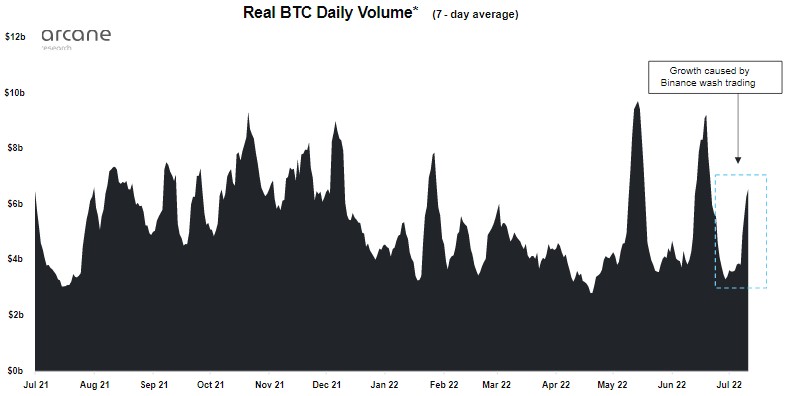

Bitcoin’s gains in the last week had sparked a brand new wave of optimism for many traders, however that optimism will probably fade soon. Data from Arcane Studies have shown that the majority of the momentum originated from removing buying and selling charges for several Bitcoin pairs on Binance cryptocurrency exchange.

Based on Arcane Research, following the fee was removed, buying and selling volumes around the exchange surged also it can be probably related to “wash buying and selling from traders trying to exploit the charge removal to achieve greater fee tiers.”

When searching in the crypto exchange ecosystem in general, however, activity remains subdued that is suggestive of reduced curiosity about buying cryptos nowadays.

Arcane Research stated,

“All other exchanges saw muted buying and selling volume a week ago, using the seven-day average buying and selling volume sitting near 1-year lows, illustrating the organic buying and selling activity on the market is extremely muted right now.”

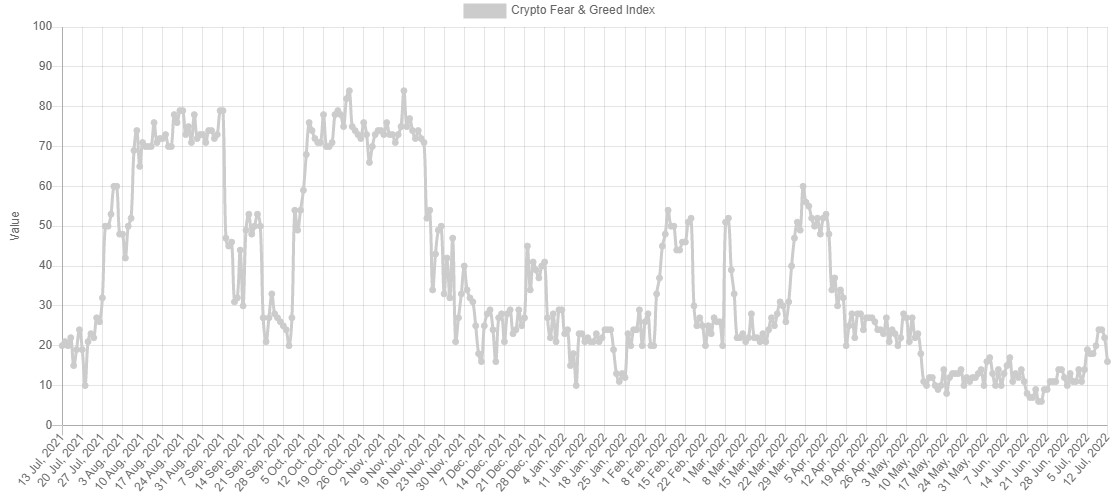

Extreme fear persists

Further evidence highlighting the possible lack of curiosity about buying Bitcoin are available in the Crypto Fear and Avarice Index, that is presently experiencing a “record-lengthy 68-day streak” within the very fearfully territory.

As noted by Arcane Research, the spike to some score of 24 on This summer 10 was largely affected by Binance’s decision to get rid of buying and selling charges, which “led the metric to overstate the present market sentiment fearfulness.”

Following the novelty of fee-less Bitcoin buying and selling on top exchange subsided and volumes came back to normalcy, the worry and Avarice index has descended into the extreme fear zone.

Exchange outflows provide further proof of the condition from the market. Following a liquidation of Three Arrows Capital and also the freezing of funds at platforms like Celsius, the speed that users happen to be pulling BTC off exchanges hit its greatest level ever on June 26.

Since the beginning of 2020, BTC outflows from exchanges have far outpaced BTC inflows, having a sharp increase between June & This summer 2022.

On June 26th, we had the biggest output of BTC, with 153k BTC (worth roughly $3.2 billion) scurrying to have an exit from centralized exchanges. pic.twitter.com/FQp2E2YkSw

— Delphi Digital (@Delphi_Digital) This summer 12, 2022

Related: 3 key metrics suggest Bitcoin and also the wider crypto market have further to fall

Leveraged liquidity increases above $25,000

Your final little bit of understanding of the standards keeping Bitcoin in the current buying and selling range was provided by researchers at Jarvis Labs, who provided the next chart showing the dark bands of liquidity which exist below $18,000 and above $25,000.

Based on Jarvis Labs, the look of highly leveraged liquidity signaled the chance that BTC might make a run for $25,000 barring any unforeseen negative developments.

Jarvis Labs stated,

“The caveat here’s that for cost to threaten that much cla, forget about skeletons could possibly get uncovered inside the cryptocurrency market, otherwise more forced selling could be triggered.”

Although it remains seen which way the cost of BTC will move, the main one factor that traders should prepare themselves for is the opportunity of elevated volatility within the several weeks ahead as rising global tensions, surging inflation and prevalent pessimism claim that the crypto market and world in particular might be set for a long bear market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.