Bitcoin (BTC) has been around a rut, and BTC’s cost will probably remain in its current downtrend. But like I pointed out a week ago, when nobody is speaking about Bitcoin, that’s usually the optimum time to become buying Bitcoin.

Within the last week, the cost required another tumble, shedding below $19,000 on Sept. 6 and presently, BTC bulls are battling to switch $19,000–$20,000 to support. This week, Fed Chairman Jerome Powell reiterated the Fed’s persistence for doing literally whatever needs doing to combat inflation “until the task is performed,” and market analysts have elevated their rate of interest hike predictions from .50 basis suggests .75.

Essentially, rate of interest hikes and quantitative tightening should crush consumer demand, which, eventually results in a reduction in the price of products or services, but we’re not there yet. Additional rate hikes plus QT will probably push equities markets lower and given their high correlation to Bitcoin cost, a further downside for BTC is easily the most likely outcome.

So, yeah, there is not a powerful investment thesis for Bitcoin at this time in the outlook during cost action and short-term gains. What about individuals who’ve an extended investment horizon?

Let’s rapidly review 3 charts that suggest investors ought to be buying Bitcoin.

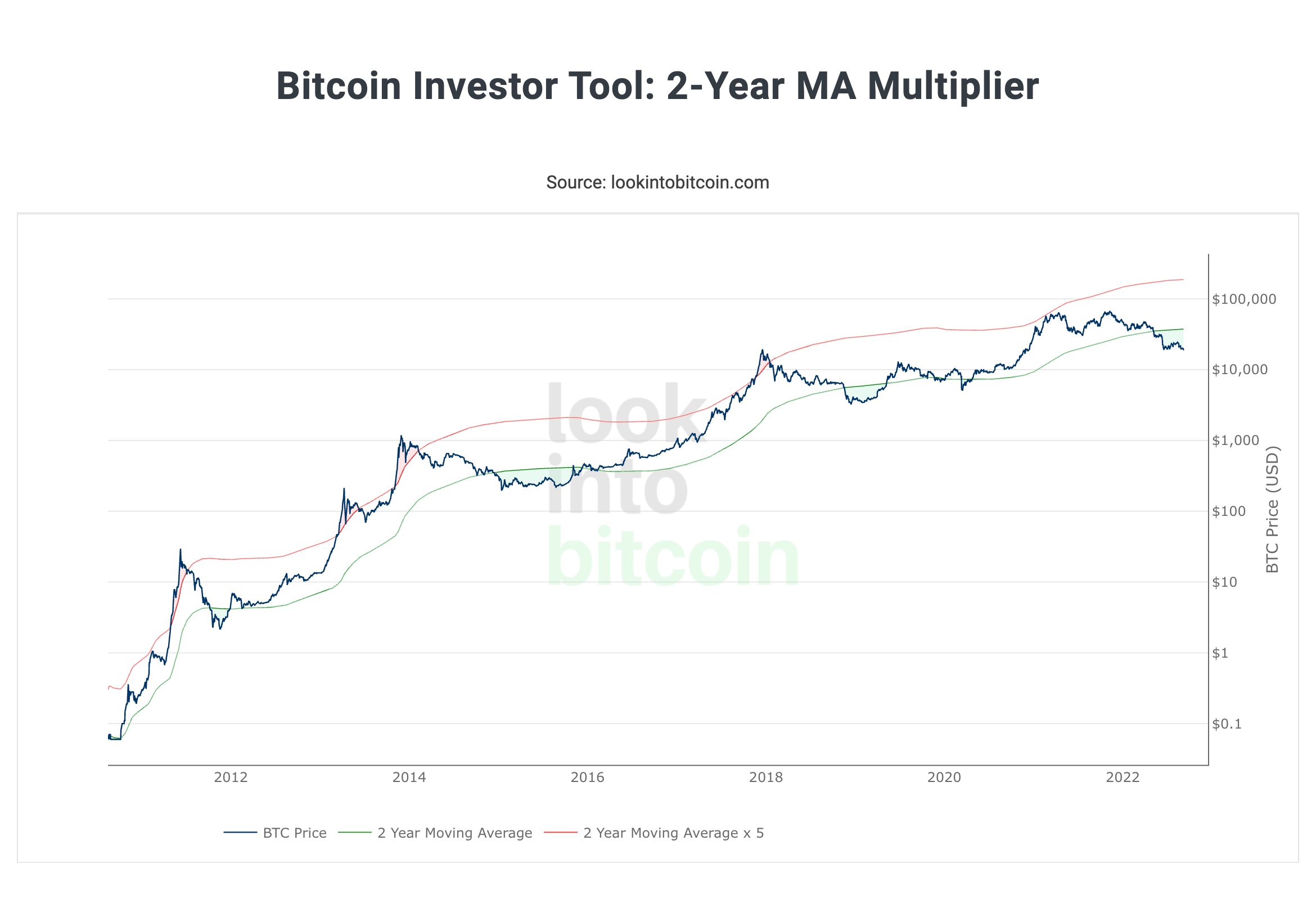

Bitcoin investor tool: 2-year MA multiplier

Bitcoin’s cost is presently 72% lower from the all-time high at $69,000. In the last bear markets, BTC’s cost saw a 55% correction (This summer 21), a 71% visit March 2020 as well as an 84% correction in December 2018. While brutal to pass through, the present 72% correction isn’t outdoors from the norm in comparison with previous drawdowns all-time highs.

Evaluating this drawdown data from the 2-year MA multiplier, you will observe that the cost dropped underneath the 2-year moving average, created out a trough after which consolidated for multiple several weeks before resuming the 12-year-lengthy upward trend.

These areas would be the “shaded” zones underneath the eco-friendly 2-year moving average. Zooming in around the right side from the chart, we are able to observe that cost is again underneath the 2-year moving average, even though there’s no manifestation of a “trough” being dug, if historicals should be relied upon, the cost is presently with what is a consolidation zone.

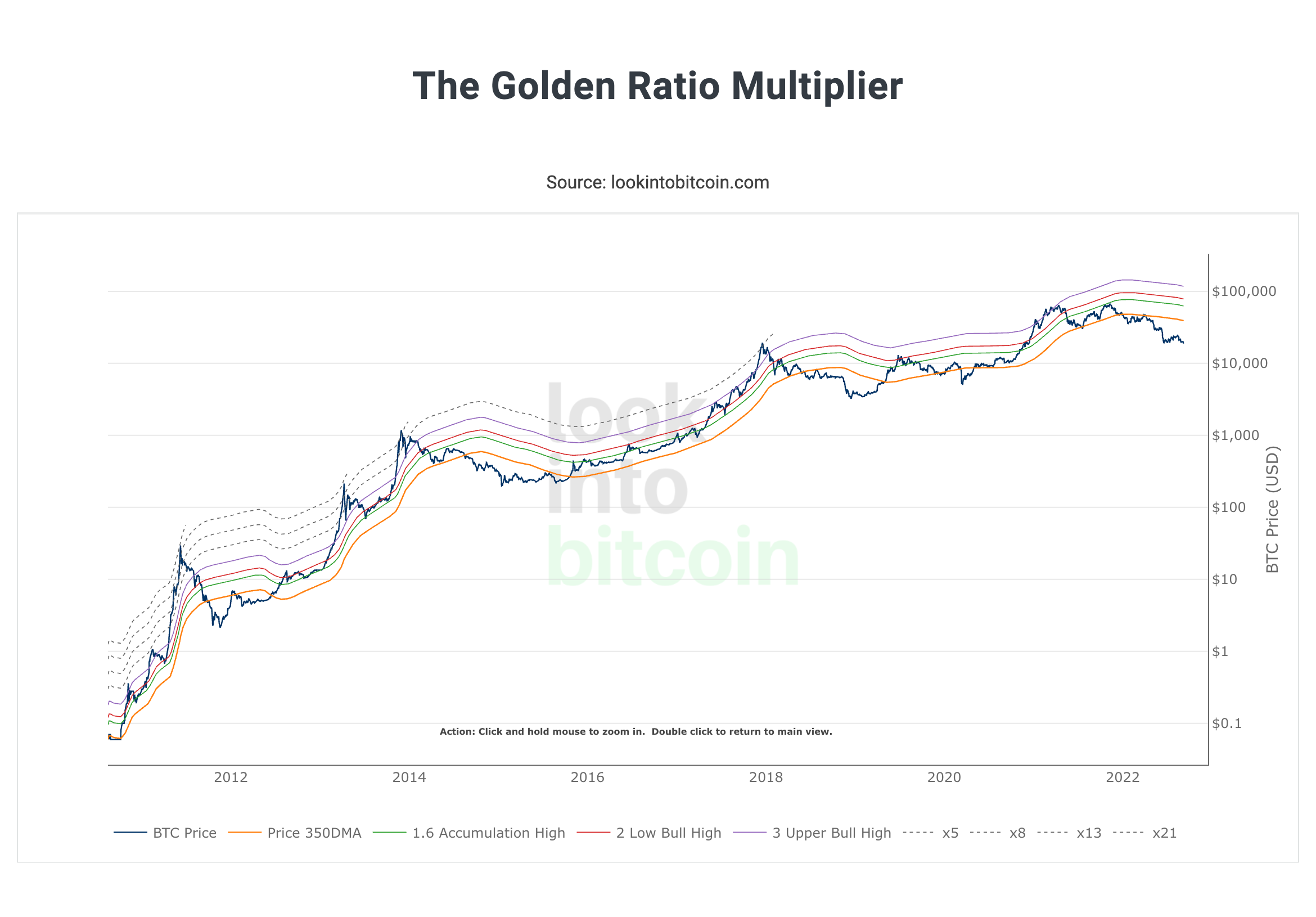

The golden ratio multiplier

Another interesting moving average and Fibonacci sequence-based indicator that implies Bitcoin’s cost is undervalued may be the golden ratio multiplier.

Based on LookIntoBitcoin creator Philip Quick:

“The chart explores Bitcoin’s adoption curve and market cycles to know how cost may behave on medium to lengthy term periods. To get this done, it uses multiples from the 350 day moving average (350DMA) of Bitcoin’s cost to recognize regions of potential potential to deal with cost movements.”

Quick further described that “specific multiplications from the 350DMA happen to be extremely effective with time at choosing intracycle highs for Bitcoin cost as well as the major market cycle highs.” Basically, the indicator is:

“An effective tool because with the ability to demonstrate once the marketplace is likely overstretched inside the context of Bitcoin’s adoption curve growth and market cycles.”

Presently, BTC’s cost is underneath the 350DMA and like the 2-year MA multiplier. Dollar-cost-averaging into extreme lows has shown to be a sensible way of creating a Bitcoin position.

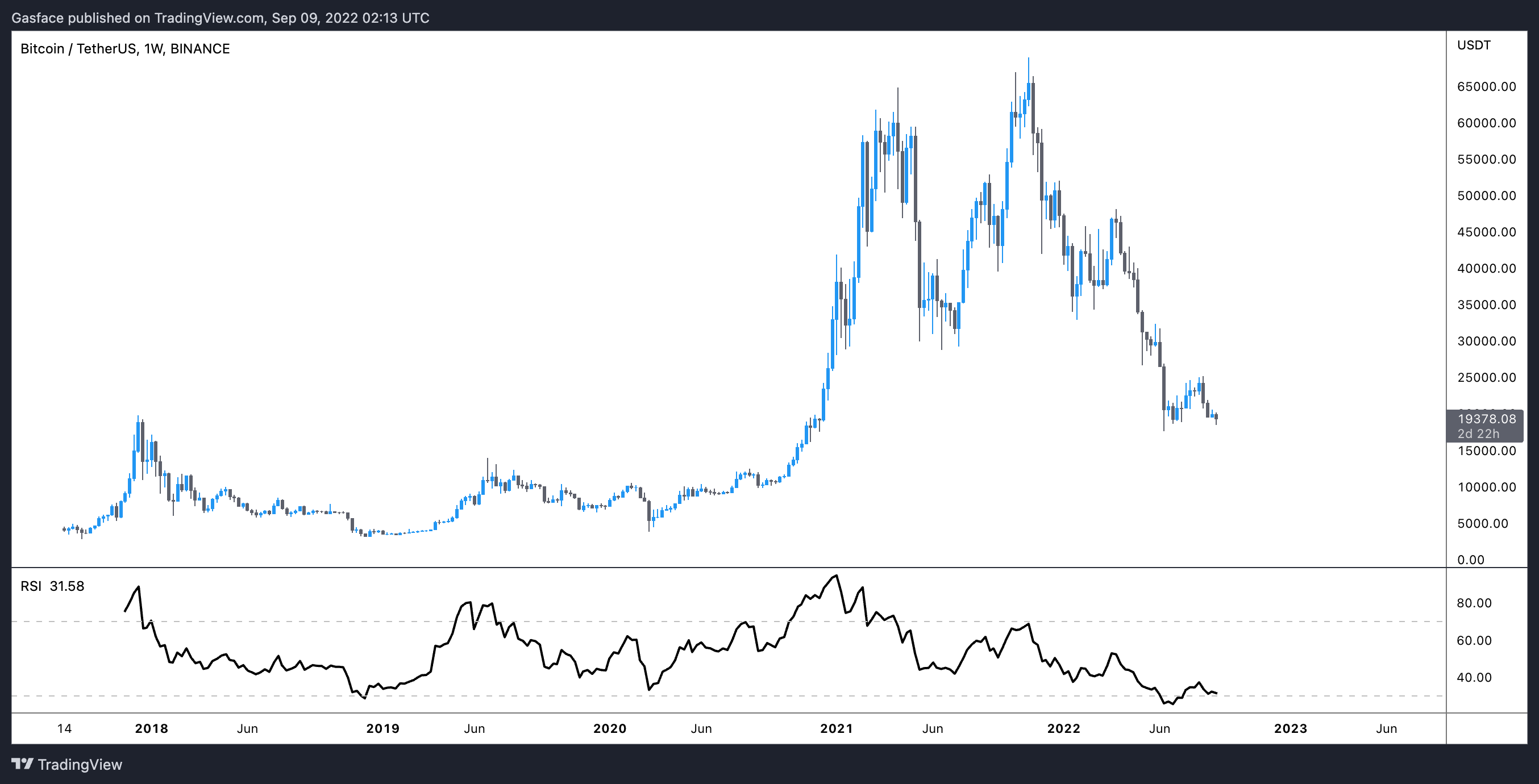

Considering Bitcoin’s one-week relative strength index (RSI) also implies that the asset is almost oversold. When evaluating the weekly RSI to BTC’s candlepower unit chart, it’s obvious that accumulation during oversold periods is another lucrative tactic.

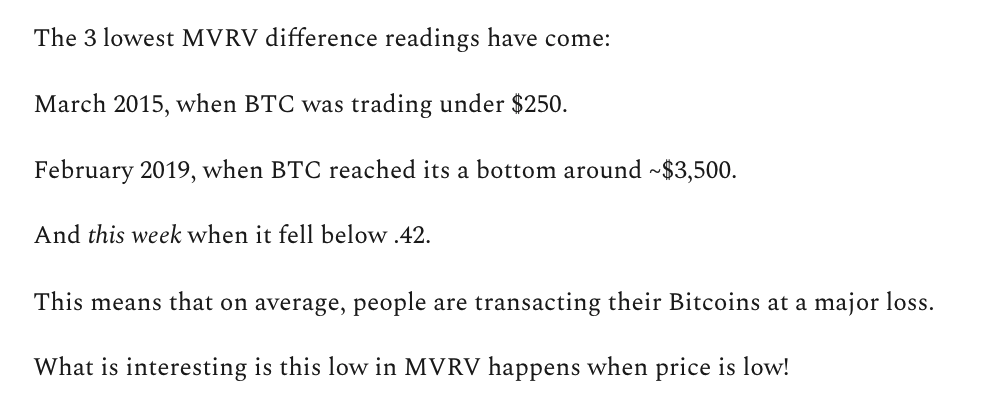

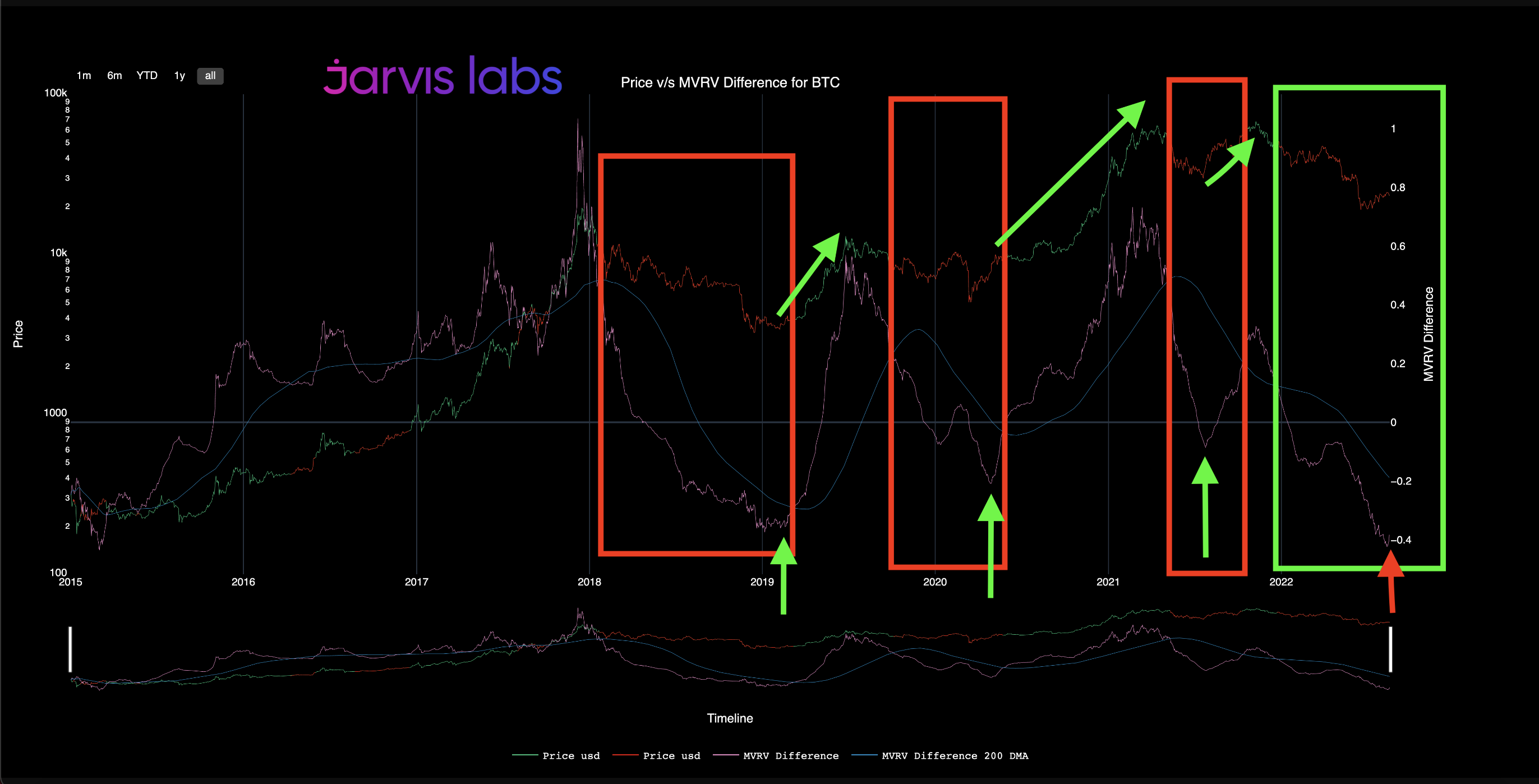

Bitcoin’s MVRV Z-score

An on-chain indicator known as the MVRV lately hit its cheapest score since 2015. The metric is basically a ratio of BTC’s market capital against its recognized capital, or perhaps in simpler terms, the quantity people compensated for BTC when compared to asset’s value now.

Based on Jarvis Labs analyst “JJ,” Bitcoin’s MVRV (market capital versus recognized capital) indicator is printing a studying that’s very low. The analyst elaborated:

The MVRV Z-score provides understanding of when Bitcoin is undervalued and overvalued in accordance with its fair cost. Based on analytics firm Glassnode, “when market price is considerably greater than recognized value, it’s in the past indicated an industry top (red zone), as the opposite has indicated market bottoms (eco-friendly zone).”

Searching in the chart, compared against BTC’s cost, the present -.16 MVRV score is incorporated in the same range as previous multi-year and cycle bottoms for Bitcoin’s cost. A pure interpretation from the data indicate that Bitcoin is in the middle of a bottoming process and perhaps entering the first stages of accumulation.

Obviously, its cost could drop much further, and also the bearish factors which are battering equities markets will probably also still impact crypto prices, so no indicators pointed out above ought to be trusted because the solitary rationale for investing.

The crypto marketplace is in bad shape, which appears unlikely to alter for the short term, but timing market bottoms can also be impossible for many traders. So, what investors need to look for is confluence among a number of metrics and indicators that align with one’s thesis.

Right now, the majority of Bitcoin’s on-chain metrics and technical analysis indicators suggest sensible dollar-cost-averaging right into a manageable position. The bottom line is risk management. Don’t invest greater than you really can afford to get rid of, and also you won’t need to bother about losing your shirt.

This e-newsletter was written by Big Smokey, the writer from the Humble Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

Disclaimer. Cointelegraph doesn’t endorse any content of product in this article. Basically we are designed for supplying all of you information that people could obtain, readers must do their very own research when considering actions associated with the organization and bear full responsibility for his or her decisions, nor this short article can be viewed as being an investment recommendations.