Bitcoin (BTC) retrieved modestly on August. 20 but continued to be on target to log its worst weekly performance within the last two several weeks.

Bitcoin hash ribbons flash bottom signal

Around the daily chart, BTC’s cost rose 2.58% to $21,372 per token but was still being lower by nearly 14.5% week-to-date, its worst weekly returns since mid August. Nevertheless, some on-chain indicators claim that Bitcoin’s correction phase might be visiting an finish.

Which includes Hash Ribbons, a metric that tracks Bitcoin’s hash rate to find out whether miners have been in accumulation or capitulation mode. By August. 20, the metric is showing the miners’ capitulation has ended the very first time since August 2021, which could cause the cost momentum switching from negative to positive.

Nevertheless, Bitcoin continues to be not able to shrug off a flurry of prevailing negative indicators, varying from negative technical setups to the ongoing contact with macro risks. Therefore, despite positive on-chain metrics, a bearish continuation can’t be eliminated.

Listed here are three good reasons why Bitcoin’s market bottom might not be in yet.

BTC cost rising wedge breaks lower

Bitcoin’s cost decline now has triggered a rising wedge breakdown, suggesting more losses for that crypto within the coming days.

Rising wedges are bearish reversal patterns that form following the cost increases in the contracting, climbing funnel but resolve following the cost breaks from it towards the downside, which could cause a drop to as little as the utmost wedge’s height.

Using the technical concepts around the BTC chart above presents $17,600 because the rising wedge breakdown target. Quite simply, the Bitcoin cost could fall by roughly 25% by September.

Bitcoin bulls are misjudging the Given

Bitcoin had surged by roughly 45% during its rising wedge formation, after bottoming out in your area around $17,500 in June.

Interestingly, the time of Bitcoin’s upside moves coincided with investors’ growing expectations that inflation has peaked—and the Fed would start cutting rates of interest when March 2023.

The expectations emerged in the Given Chairman Jerome Powell’s FOMC statement from This summer 27.

Powell:

“Because the stance of financial policy tightens further, it in all probability will end up appropriate to slow the interest rate of increases basically we assess how our cumulative policy adjustments are affecting the economy and inflation.”

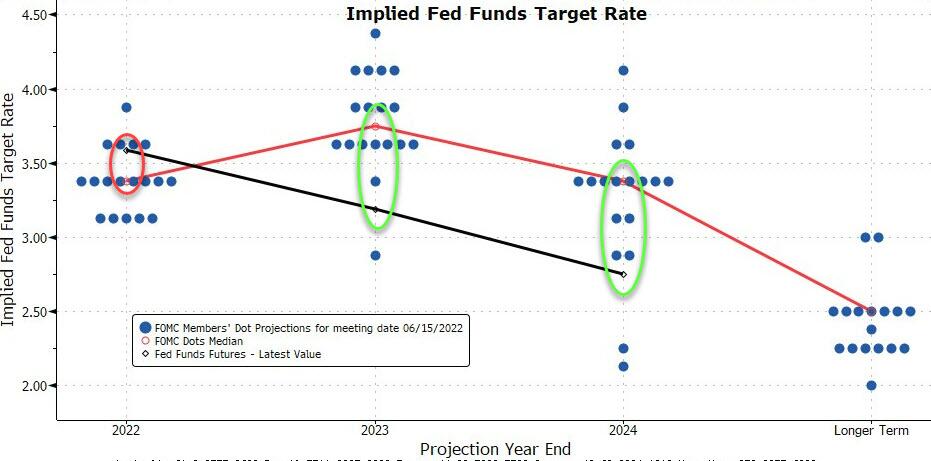

Nevertheless, the newest Given us dot plot implies that most officials anticipate the rates to achieve 3.75% through the finish of 2023 before sliding back lower to three.4% in 2024. Therefore, the prospects of rate cuts remain speculative.

St Louis Given president James Bullard also noted he would support another consecutive 75 basis point raise in the central bank’s policy meeting in September. The statement falls using the Fed’s dedication to bring inflation lower to twoPercent from the current 8.5% level.

Related: Options data shows Bitcoin’s short-term upward trend reaches risk if BTC falls below $23K

Quite simply, Bitcoin along with other risk-on assets, which fell right into a bear market territory once the Given started a hostile tightening cycle in March, should remain pressurized for the following couple of years.

If history is any indicator…

The continuing Bitcoin cost recovery risks turning out to be an incorrect bullish signal because of the asset’s similar rebounds during previous bear markets.

BTC’s cost rebounded by nearly 100%—from around $6,000 to in excess of $11,500—during the 2018 bear market cycle, simply to wipe-from the gains entirely and drop toward $3,200. Particularly, similar rebounds and corrections also required devote 2019 and 2022.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.