The “Bitcoin-is-dead” gang has returned and also at it again. Nov the FTX cryptocurrency exchange has resurrected these infamous critics which are once more blaming a robbery around the money which was stolen, and never the thief.

“We want regulation! Why did the federal government allow this to occur?” they scream.

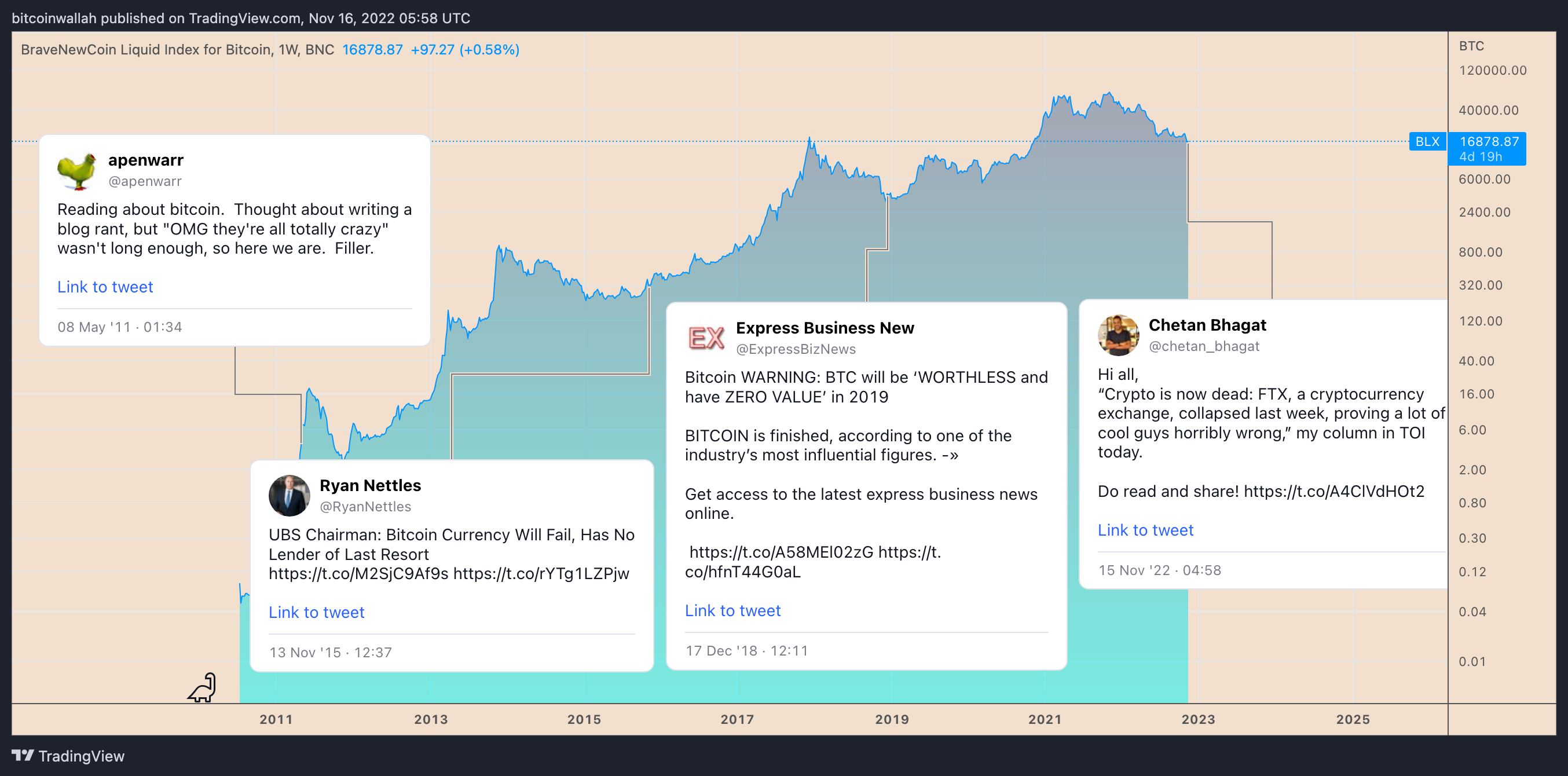

For example, Chetan Bhagat, a famous author from India, authored an in depth “crypto” obituary, evaluating the cryptocurrency sector to communism that guaranteed decentralization but were left with authoritarianism.

Possibly unsurprisingly, his column easily used a melting Bitcoin (BTC) emblem since it’s featured image.

Hi all,

“Crypto has become dead: FTX, a cryptocurrency exchange, collapsed a week ago, showing lots of awesome guys horribly wrong,” my column in TOI today.Do read and share! pic.twitter.com/A4ClVdHOt2

— Chetan Bhagat (@chetan_bhagat) November 15, 2022

Bhagat must have selected a far more accurate image for his op-erectile dysfunction (melting FTX (FTT) Token?), particularly after searching at Bitcoin’s decade-plus history which has seen it surviving even nationwide bans. This includes 465 466 obituaries since its debut in ’09 if this traded for any couple of cents.

The FTX/Alameda’s collapse is comparable to previous bearish trigger occasions like Mt. Gox in 2014. Therefore, this failure of centralization will once more underline why is Bitcoin special, and why FTX may be the complete opposite of Bitcoin and decentralization.

Furthermore, the incident also needs to boost progression of in, non-custodial exchanges for Bitcoin that can help reduce reliance upon trust.

FTX might have had zero Bitcoin in child custody

Traders taken care of immediately FTX’s shocking collapse by pulling their BTC from custodial exchanges. Particularly, the quantity of Bitcoin held by all exchanges dropped to two.07 million BTC on November. 17 from 2.29 million BTC at the outset of the month.

U . s . States-based exchanges saw the greatest outflows, particularly, with users withdrawing over $1.5 billion in BTC previously week alone.

On November. 9, FTX stopped withdrawals of cryptocurrencies, including Bitcoin, raising accusations the exchange was without sufficient reserves to satisfy the demand.

Which was further apparent in a leaked FTX balance sheet that demonstrated the exchange getting zero Bitcoin against its $1.4 billion liabilities in BTC. Quite simply, FTX enabled fractional-reserve Bitcoin buying and selling.

“This really is, around the one hands, not a good idea because you will only determine whether they’ve been swimming naked when the exchange implodes, supported on your part losing all of your funds,” Jan Wüstenfeld, writes independent market analyst. He adds:

“However, this artificially boosts the bitcoin supply within the short-run, suppressing the cost and stopping actual cost discovery […] Yes, I understand these aren’t real bitcoin, but because lengthy because the exchanges issuing fake paper, Bitcoin remains operational, the result can there be.”

Thus, FTX’s little-to-minimal contact with Bitcoin potentially reduces Its probability of selling any remaining funds to boost liquidity.

The incident can also be likely to make a new cohort of Bitcoin hodlers by forcing individuals to not maintain their funds on dangerous exchanges and exercise self-child custody. While a decreasing quantity of BTC on exchanges means less coins open to sell.

Mike Bankman-Fried was anti-Bitcoin

FTX founder Mike Bankman-Fried (SBF) was the Democrats’ second greatest donor after States for that midterm elections, giving nearly $45 million to lobby for crypto rules that will allegedly benefit his firm.

Related: US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in a single week

But speculations are large that SBF tried to tarnish Bitcoin’s growth with the U.S. lawmakers, in addition to news articles, where he downplayed Bitcoin being an efficient payment system.

MSM lionized this shady character. For instance, listed here are 2 from the 219 articles about him on @Foot. @SBF_FTX‘s anti-Bitcoin, pro-centralisation and pro-heavy-handed regulation values certainly aligned with their own.

Was he the poster boy to have an orchestrated propaganda campaign? https://t.co/urJcu6mqB6 pic.twitter.com/PTIn1JudXG

— Bitcoms (@bitcoms) November 15, 2022

Other commentators also have stated an association between SBF and anti-crypto U.S. Senator Elizabeth Warren, noting the former’s father, Frederick Bankman, helped the politician draft tax legislation in 2016.

This really is crazy:

Elizabeth Warren is renowned for to be the anti-crypto Senator

Who helped her draft her tax legislation in 2016?

The one and only Frederick (Joe) Bankman, the daddy of SBFhttps://t.co/QMYkC2gpE9

— Ryan Shea (@ryaneshea) November 15, 2022

SBF’s influence among U.S. lawmakers has become gone with him facing potential criminal charges for unlawfully using customer funds for FTX trades.

Press “F” to flush

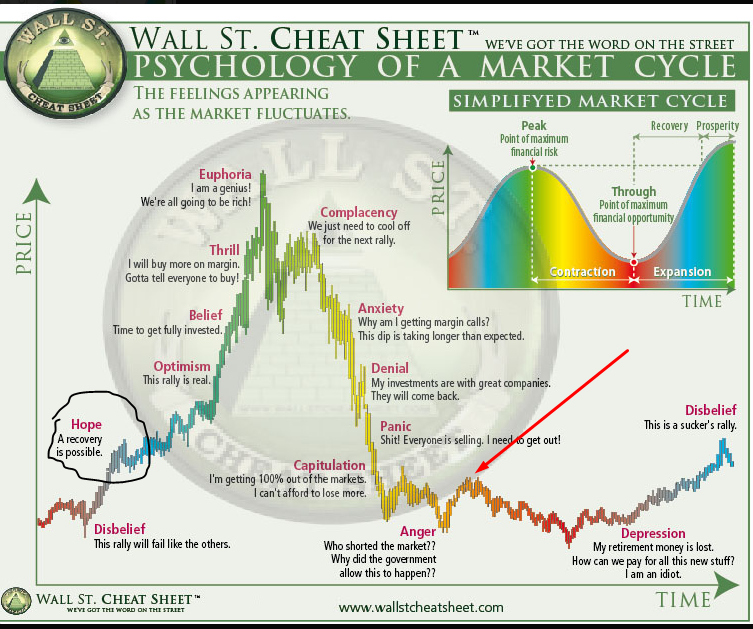

Past cryptocurrency market downturns have roots within the failure of centralized players in addition to “altcoins” that ultimately became a cash-grab.

FTX’s token FTT is just the latest example. Other unsuccessful projects that triggered an industry downturn this year range from the Defi lending platform Celsius Network (CEL) and Terra (LUNA).

FTX may be the complete opposite of #Bitcoin #Bitcoin ’s protocol was produced specifically prevent Ponzi schemes, bank runs, Enron’s, WorldCom’s, Bernie Madoff’s, Mike Bankman-Fried’s…

…bailouts and wealth reassignments.

Some comprehend it, some not.

We’re still early.

/21m

— Nayib Bukele (@nayibbukele) November 14, 2022

Produced and run by centralized entities, the availability of those tokens, and for that reason cost, becomes susceptible to manipulation: undisclosed pre-mine allocations, insider VC deals, small float versus. total supply, take your pick.

It’s contact with such (crap) tokens, particularly by means of collateral, that ultimately drove crypto hedge funds Three Arrow Capital, FTX’s sister firm Alameda Research, and many more down.

“In our opinion, the bubble in crypto that sprang this season is at the climate of tokens being produced only for speculative purposes,” noted BOOX Research, adding:

“Basically we can debate which cryptos are ‘bad money driving the good’, FTT and LUNA are simply two examples everybody can agree shouldn’t have existed.”

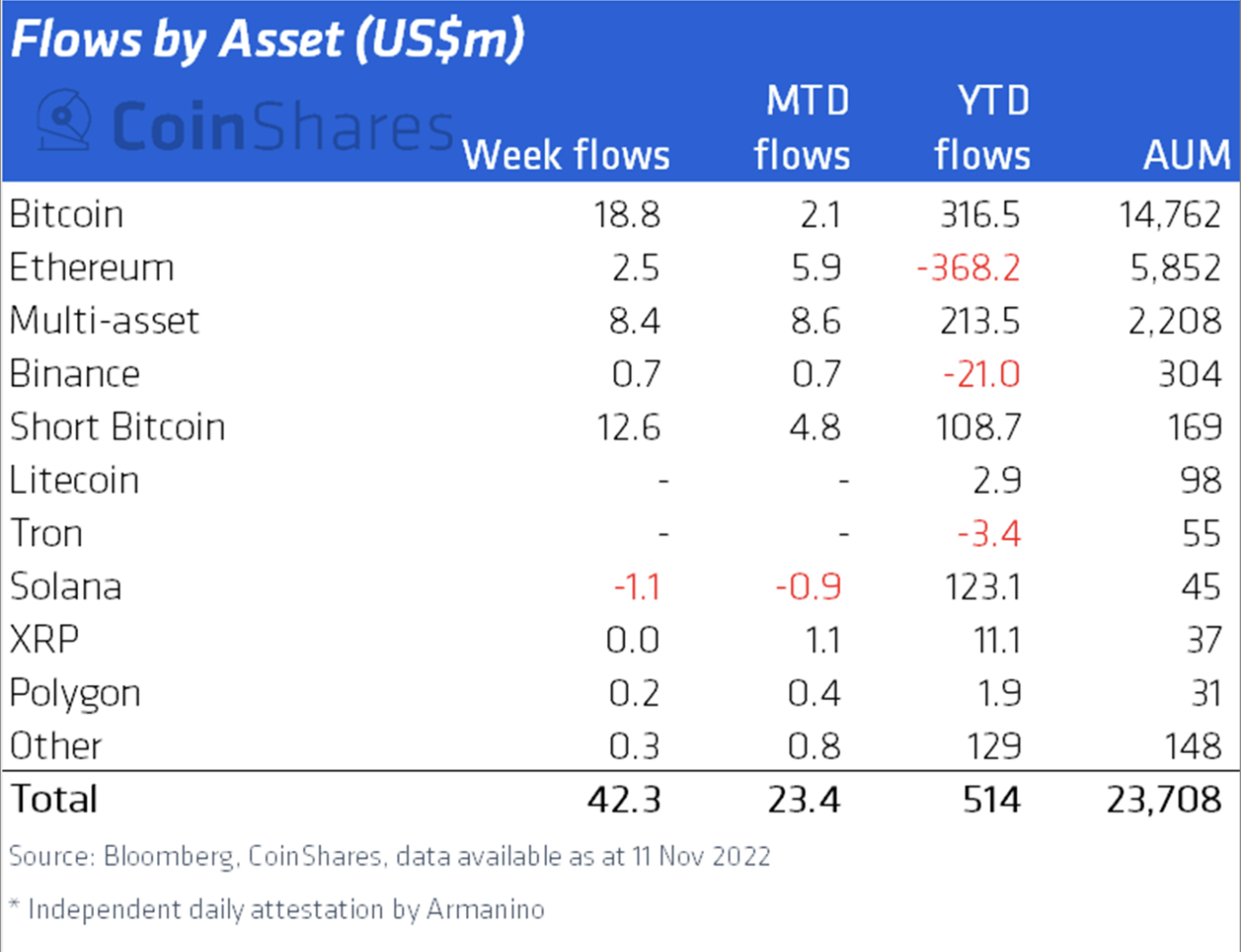

Therefore, an industry flush of altcoins which should not have access to ever existed, FTT incorporated, may further strengthen investors’ rely upon Bitcoin. Early information is showing exactly the same, with CoinShares reporting an inflow uptick into Bitcoin-based investment funds.

Particularly, Bitcoin-based investment vehicles attracted $18.8 million for their coffers within the week ending November. 11, getting its year-to-date inflows to $316.50 million.

“The inflows started later within the week on the rear of extreme cost weakness motivated through the FTX/Alameda collapse,” noted James Butterfill, mind of research at CoinShares, adding:

“It shows that investors check this out cost weakness being an chance, differentiating between ‘trusted’ organizations as well as an inherently trustless system.”

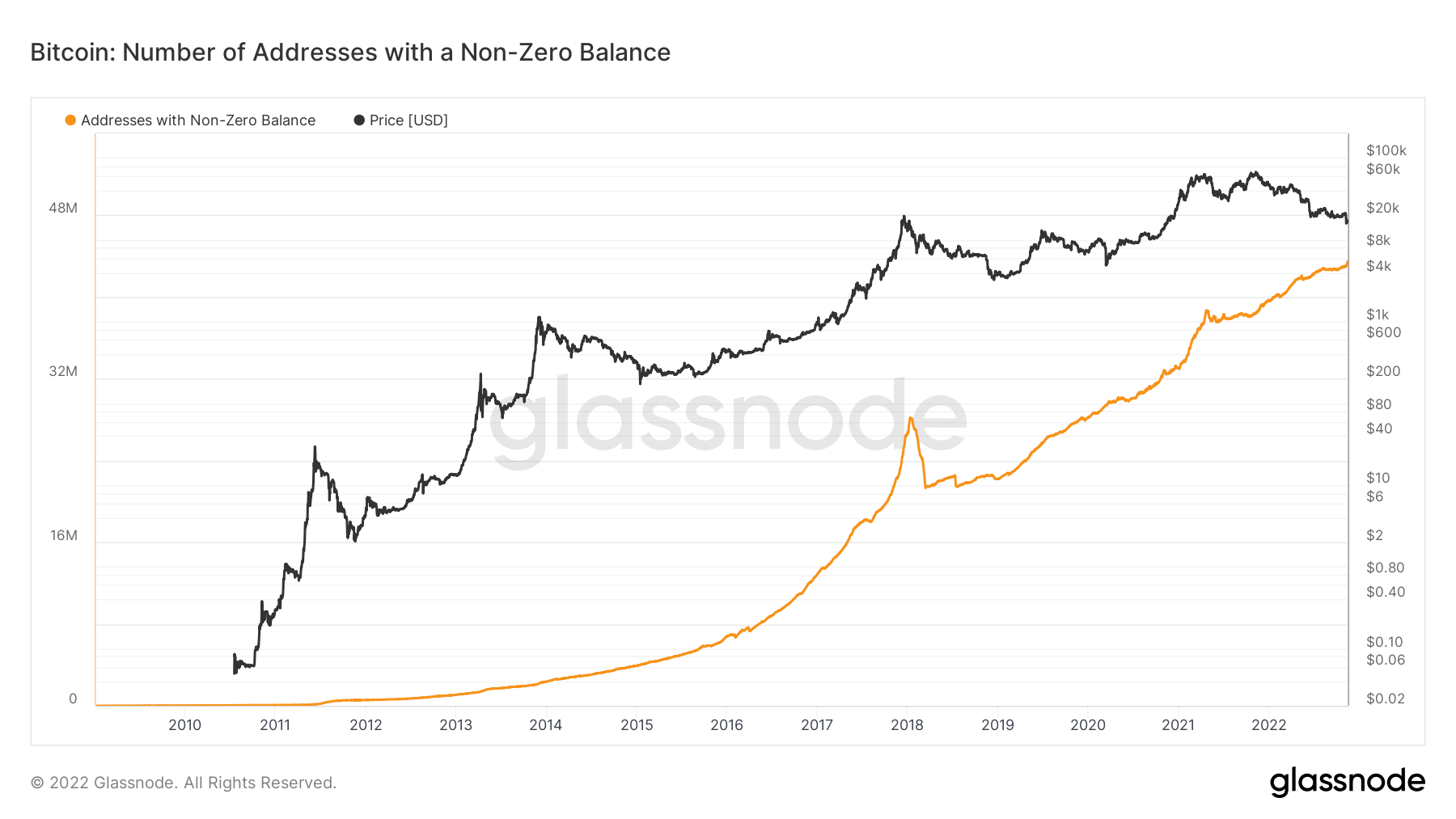

Meanwhile, Bitcoin isn’t witnessing a collapse sought after in the present bear market when compared with 2018, on-chain data reveals.

The amount of non-zero Bitcoin addresses has ongoing to climb regardless of the cost downtrend, hitting an archive a lot of 43.14 million by November. 16.

Compared, the 2018 bear market saw a considerable stop by the amount of non-zero Bitcoin addresses, suggesting traders have grown to be relatively well informed in regards to a cost recovery, especially because the FTX domino effect clears the dead wood.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.