The entire cryptocurrency market capital acquired 2% previously 7 days, reaching $850 billion. Despite the positive movement and also the climbing funnel which was initiated on November. 20, the general sentiment remains bearish and year-to-date losses add up to 63.5%.

Bitcoin (BTC) cost also acquired only 2% around the week, but investors haven’t much to celebrate because the current $16,800 level represents a 64% drop year-to-date.

Bankrupt exchange FTX continued to be in the centerpiece from the newsflow following the exchange hacker ongoing to maneuver servings of the stolen $477 million in stolen assets in an attempt to launder the cash. On November. 29, analysts alleged that part of the stolen funds were used in OKX.

The FTX saga makes politicians shout louder within their requires regulation. On November. 28, the ecu Central Bank (ECB) president Christine Lagarde known as regulation and supervision of crypto an “absolute necessity.” The U . s . States House Financial Services Committee Chair Maxine Waters announced that lawmakers would explore the collapse of FTX inside a 12 ,. 13 inquiry.

On November. 28, Kraken, a U.S.-based cryptocurrency exchange, decided to pay greater than $362,000 included in an offer “to stay its potential civil liability” associated with violating sanctions against Iran. Based on the U . s . States Treasury Department’s Office of Foreign Assets Control, Kraken exported services to users who made an appearance to stay in Iran once they involved in virtual currency transactions.

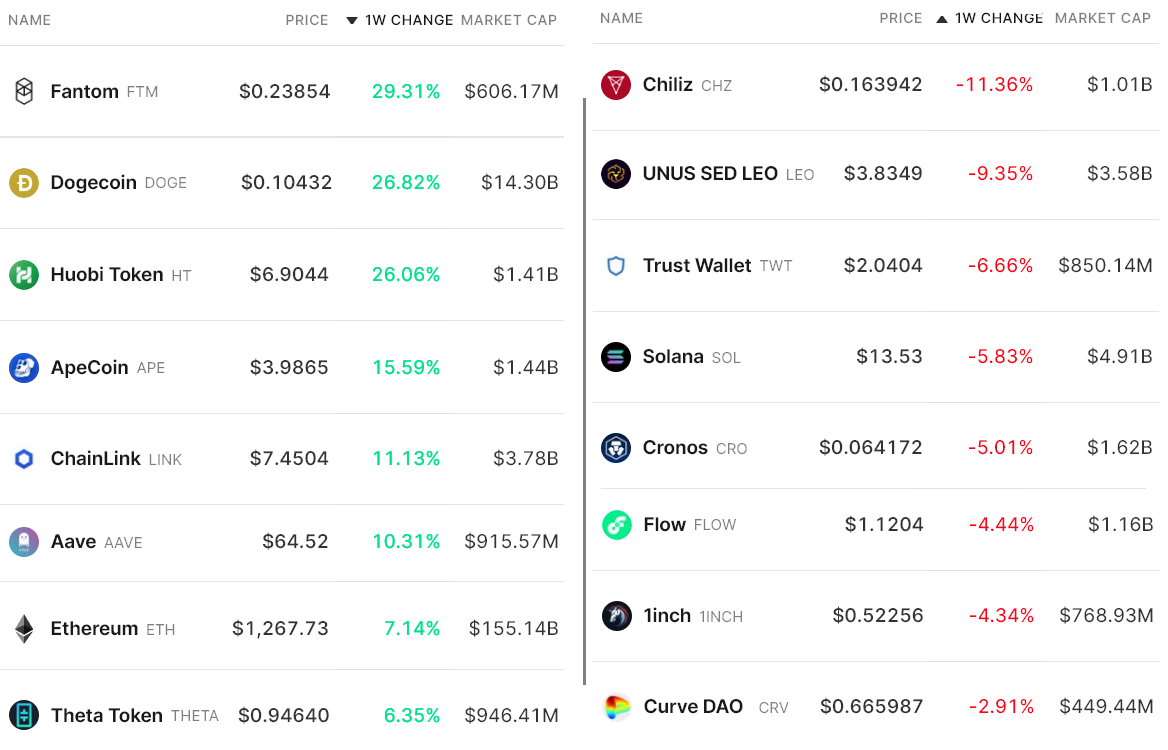

The TwoPercent weekly grow in total market capital was impacted largely by Ether’s (ETH) 7% positive cost move. The bullish sentiment also considerably impacted altcoins, with 6 from the top 80 coins rallying 10% or even more at that time.

Fantom (FTM) acquired 29.3% among reports the Fantom Foundation generates consistent profits and it has 3 decades of runway without selling any FTM tokens.

Dogecoin (DOGE) rallied 26.8% as investors elevated expectations that Elon Musk’s vision for Twitter 2. includes some type of DOGE integration.

ApeCoin (APE) acquired 15.6% following the community-brought DAO comprised of ApeCoin holders launched its very own marketplace to purchase and sell NFTs in the Yuga Labs ecosystem.

Chainlink (LINK) rallied 11.1% in front of its staking services beta-version launch on 12 ,. 6, boosting holders’ reward-earning possibilities.

Leverage demand is balanced between bulls and bears

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

The 7-day funding rate was near zero for Bitcoin, Ether and XRP, therefore the data suggests a well-balanced demand between leverage longs (buyers) and shorts (sellers).

The only real exception was BNB, which presented single.3% weekly funding rate for individuals holding leverage shorts. Although it isn’t troublesome to sellers, it reflects investors’ unease about buying BNB in the current cost levels.

Traders also needs to evaluate the choices markets to know whether whales and arbitrage desks have placed greater bets on bullish or bearish strategies.

The choices put/call ratio shows moderate bullishness

Traders can gauge the market’s overall sentiment by calculating whether more activity goes through call (buy) options or put (sell) options. In most cases, call options can be used for bullish strategies, whereas put choices are for bearish ones.

A .70 put-to-call ratio signifies that put options open interest lag the greater bullish calls by 30% and it is therefore bullish. In comparison, single.20 indicator favors put options by 20%, which may be considered bearish.

Despite the fact that Bitcoin’s cost unsuccessful to interrupt the $17,000 resistance on November. 30, there wasn’t any excessive interest in downside protection using options. Consequently, the put-to-call ratio continued to be steady near .53. The Bitcoin options market remains more strongly populated by neutral-to-bearish strategies, because the current level favoring buy options (calls) signifies.

Regardless of the weekly cost rally on select altcoins as well as the 7.1% grow in Ether cost, there has been no indications of sentiment improvement based on derivatives metrics.

There’s balanced interest in leverage using futures contracts, and also the BTC options risk assessment metric didn’t improve even while Bitcoin’s cost tested the $17,000 level.

Presently, the chances favor individuals betting the $870 billion market capital resistance displays strength however a 5% negative move toward the $810 billion support isn’t enough to invalidate the climbing funnel, that could give bulls balance-needed room to eradicate the contagion risks brought on by FTX’s insolvency.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.