The bull market excitement that transported prices to new highs throughout 2021 has provided method to bear market doldrums for just about any Bitcoin (BTC) buyer who designed a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers “are actually underwater” and also the marketplace is preparing for any final capitulation event.

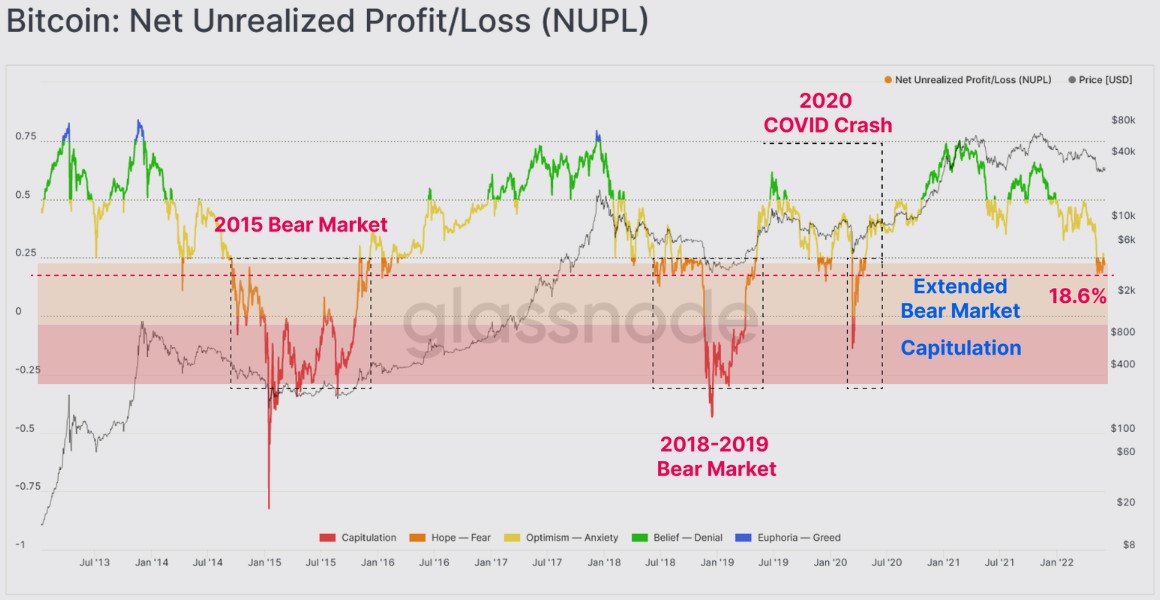

As observed in the graphic above, the NUPL, a metric tha is really a way of measuring the general unrealized profit and lack of the network like a proportion from the market cap, signifies that “less than 25% from the market cap takes place in profit,” which “resembles an industry structure equal to pre-capitulation phases in the past bear markets.”

According to previous capitulation occasions, if your similar move would occur in the current levels, the cost of Bitcoin could drop right into a cost selection of $20,560 to $25,700 inside a “full-scale capitulation scenario.”

The marketplace is looking for the underside

Using the crypto market clearly buying and selling in bear market territory, the issue on everyone’s thoughts are “where may be the bottom?”

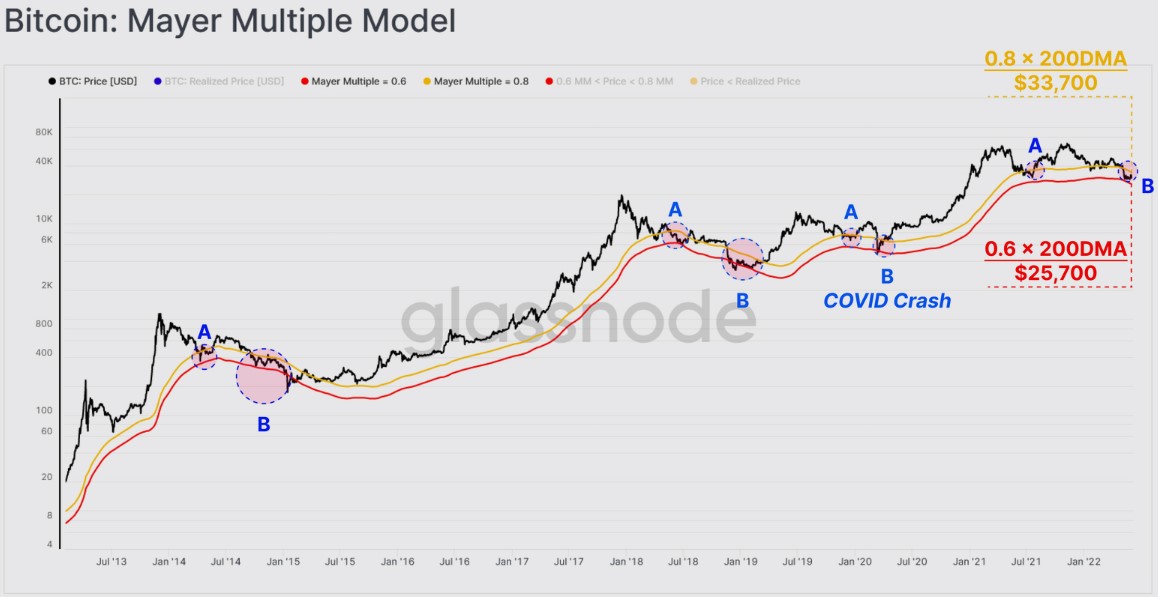

One metric that will help provide some possible guidance may be the Mayer Multiple, an oscillator that tracks the ratio between cost and also the 200-day moving average.

In the past bear markets, “oversold or undervalued conditions have coincided using the Mayer Multiple falling in the plethora of .6–0.8,” based on Glassnode and that’s exactly the range where Bitcoin now finds itself.

In line with the cost action from previous bear markets, the current buying and selling selection of Bitcoin between $25,200 and $33,700 lines track of the B phase from the previous bear market cycles and may mark the reduced of BTC in the present cycle.

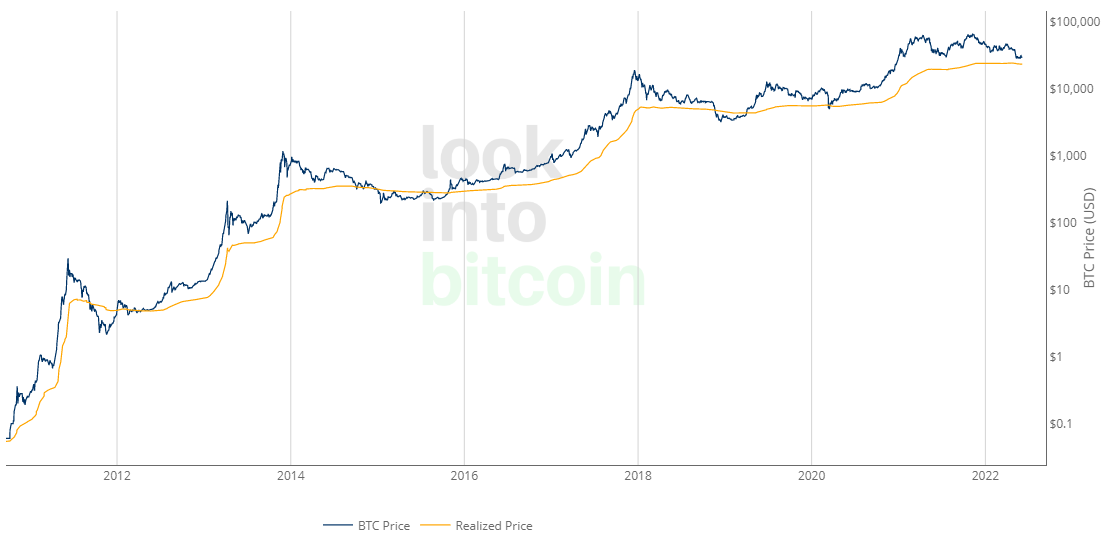

The Bitcoin recognized cost model also provides understanding of exactly what a potential cost bottom for Bitcoin might be, using the current studying supplied by the Bitcoin data provider LookIntoBitcoin suggesting the recognized cost for BTC is $23,601 by June 5.

Mixing both of these metrics shows that the reduced for BTC could exist in the $23,600 to $25,200 range.

Related: Among crypto bear market, institutional investors scoop up Bitcoin: CoinShares

Temporary holder and miner capitulation

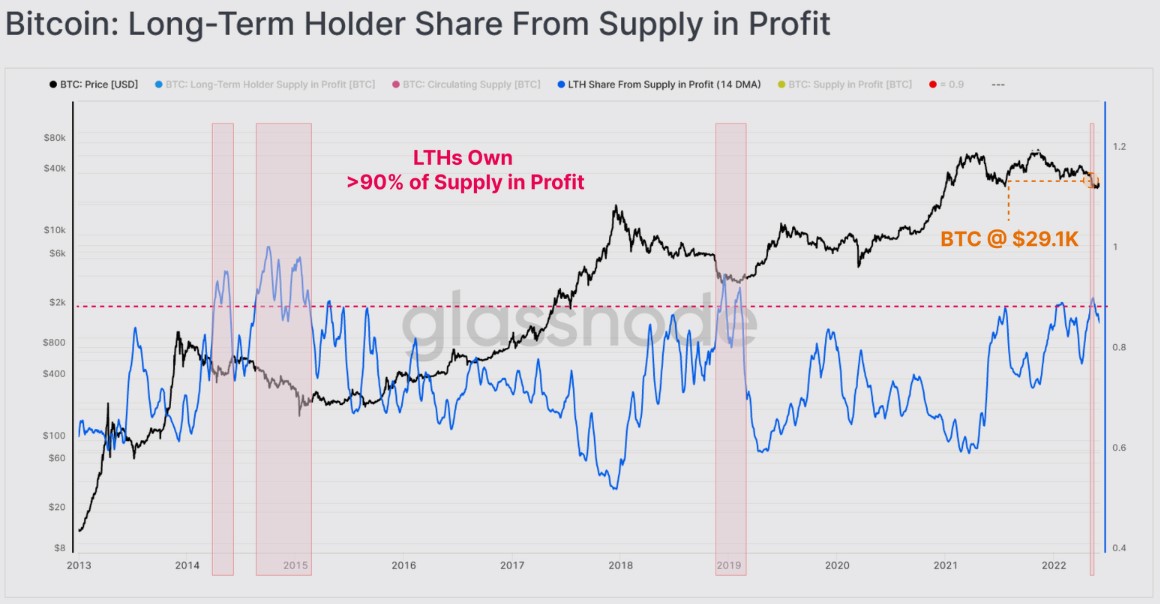

Selling in the present market conditions has largely been covered with short-term hodlers, like the behavior which was seen throughout the two previous extended bear markets where lengthy-term holders held greater than 90% from the profit on the market.

The current drop below $30,000 for Bitcoin saw the proportion of supply in profit spike above 90% for that lengthy-term holder cohort, suggesting short-term holders have “essentially arrived at an almost-peak discomfort threshold.”

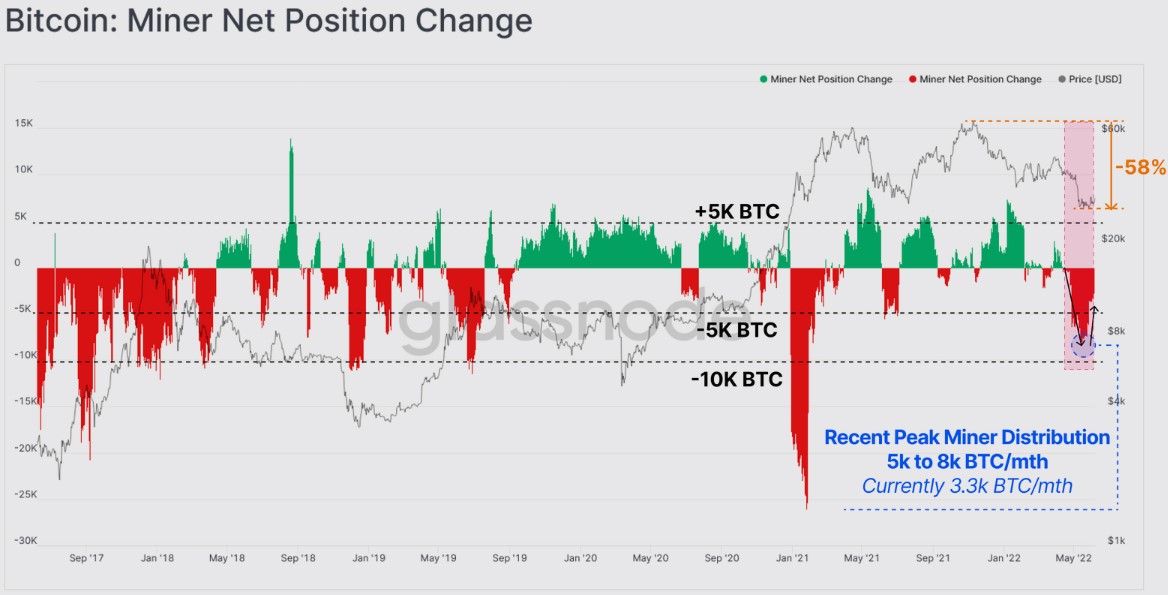

Based on Glassnode, miners are also internet sellers in recent several weeks because the loss of BTC has hampered the profitability for miners leading to “an aggregate miner balance decrease in between 5K and 8K BTC monthly.”

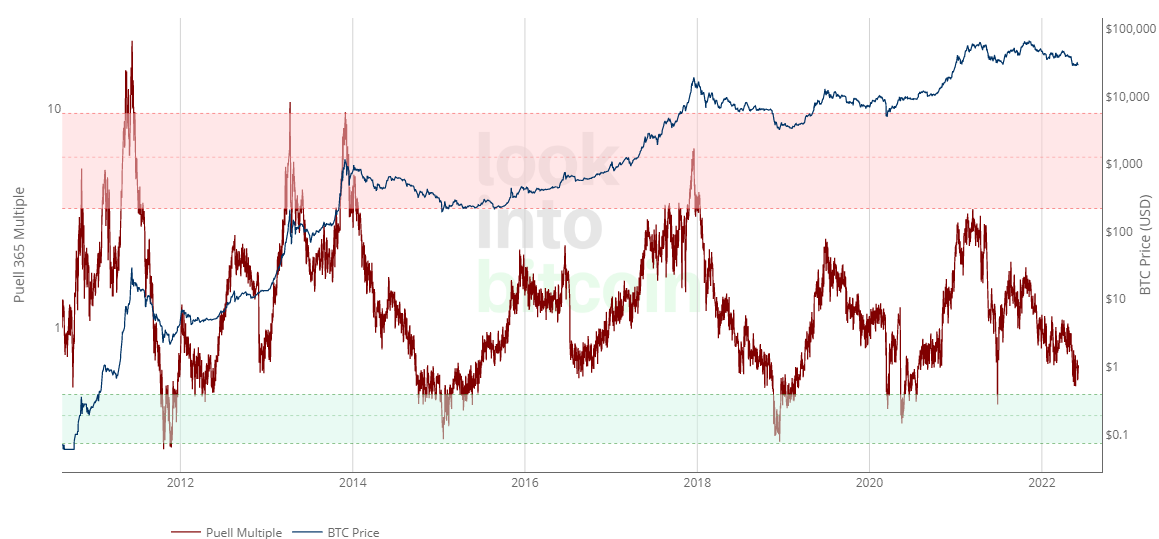

If the cost of BTC still decline came from here, the opportunity of a rise in miner capitulation isn’t unthinkable, as shown previously through the Puell Multiple, the ratio from the daily issuance worth of bitcoin towards the 365-day moving average of the value.

Historic data implies that the metric has declined in to the sub-.5 zone throughout the late stages of previous bear markets, that has yet to happen throughout the current cycle. In line with the market conditions, a BTC cost decline of the additional 10% can lead to your final miner capitulation event that will resemble the cost decline and selling seen in the hight of previous bear markets.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.