Previously, it had been frequently stated that Bitcoin (BTC) moves the whole crypto and blockchain industry. Is that this still the situation?

Yesteryear couple of several weeks have experienced Bitcoin hitting high-water marks including all-time high lengthy-term holder rates and local highs in hash rate difficulty adjustment — yet Bitcoin continues to be in bearish conditions once we mind into Q4 of 2022.

Not every regions of the blockchain industry can boast such signals of strength, for example investment capital (VC), which introduced in $840,000 in October, lower 48.6% in the previous month. Likewise, there’s been a ongoing stop by GameFi nonfungible token sales, despite 10% more active gamers in October compared to September.

Even while, regulation remains a looming threat from entities such as the U . s . States Registration, that is now searching in to the possibility that Ether (ETH) is really a security considering that 46.65% of Ethereum nodes have been in the U . s . States.

Download and buy this set of the Cointelegraph Research Terminal.

Each month, Cointelegraph Research releases a trader Insights are convinced that analyzes key indicators from various sectors from the blockchain industry, for example regulation, crypto mining, security tokens, Bitcoin and Ether derivatives, and VC activities.

Another positive Bitcoin signal

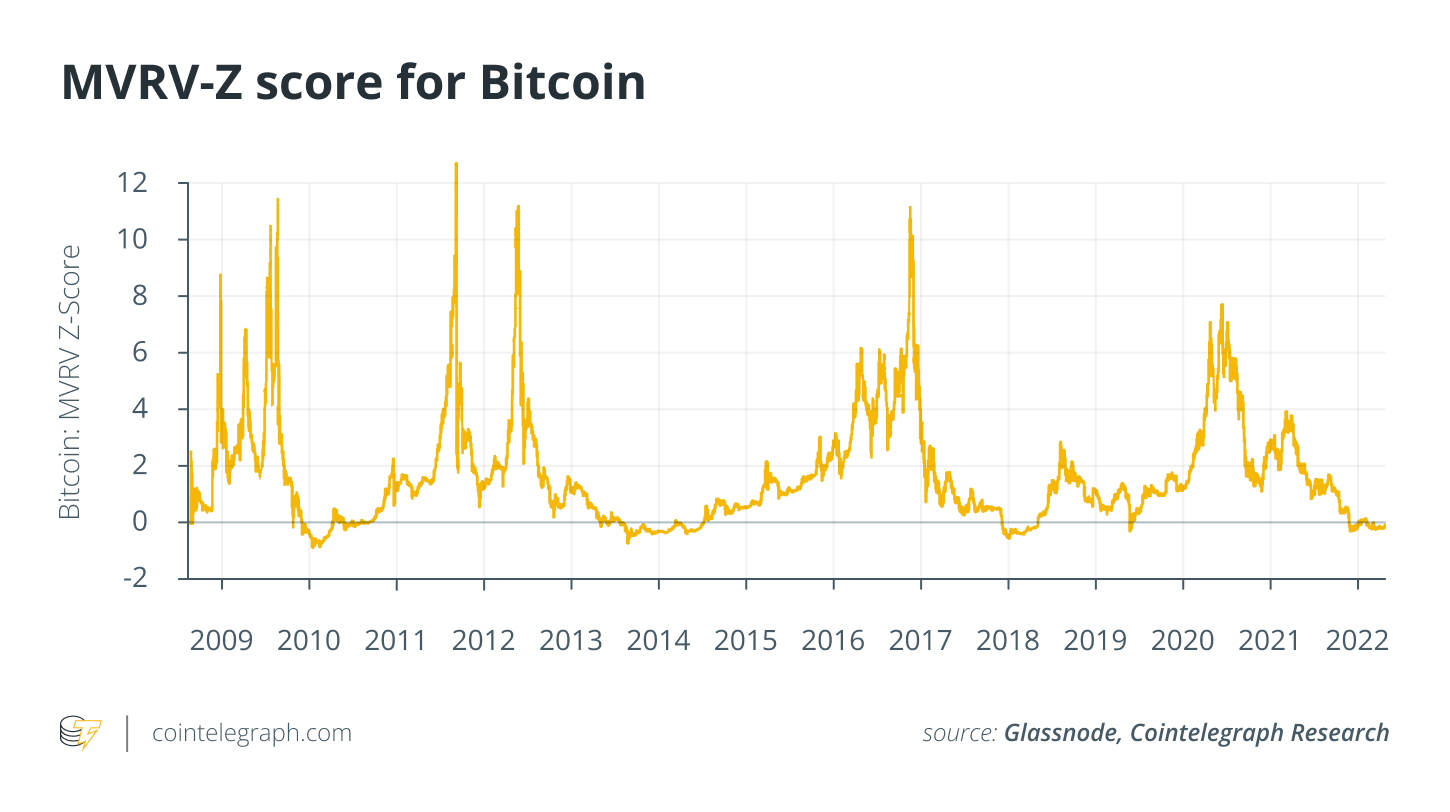

Bitcoin is buying and selling above its 50-day moving average (MA), using the 100-day MA serving as resistance and also the moving average convergence/divergence (MACD) histogram signaling a bullish trend. On-chain data and in the past accurate metrics advise a bottom might be near. In addition, the MVRV-Z score has developed in the eco-friendly zone since late June, suggesting Bitcoin is bottoming out.

Publish-Federal Open Market Committee (FOMC) volatility was brief on November. 2, using the buying and selling range consolidating round the $20,000 level. In addition to the FOMC, volatility could are available in the wake from the U.S. midterm elections and Q3 earnings from crypto behemoths MicroStrategy, Coinbase, Block and Robinhood, which exist in November.

Bitcoin’s fundamentals continue to be strong, and also the asset that began everything for crypto will probably help to keep the ultimately on target through all of those other bear market, though it may face some volatility on the way. But thankfully, 1 BTC is constantly on the equal 1 BTC.

The Cointelegraph Research team

Cointelegraph’s Research department comprises the best talents within the blockchain industry. Getting together academic rigor and filtered through practical and difficult-won experience, they around the team are dedicated to getting probably the most accurate and insightful content in the marketplace.

Demelza Hays, Ph.D., may be the director of research at Cointelegraph. Hays has compiled a group of subject material experts from over the fields of finance, financial aspects and technology to create towards the market the premier source for industry reports and insightful analysis. They utilizes APIs from a number of sources to be able to provide accurate and helpful information and analyses.

With decades of combined experience of traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to place its combined talents to proper use using the Investor Insights Report.

The opinions expressed in the following paragraphs are suitable for general informational purposes only and aren’t meant to provide specific advice or recommendations for anyone or on any sort of security or investment product.