It’s becoming more and more difficult to support a bullish short-term view for cryptocurrencies because the total crypto market capital continues to be below $1.4 trillion within the last 146 days. In addition, a climbing down funnel initiated at the end of This summer has limited the upside after two strong rejections.

The FirPercent weekly negative performance in cryptocurrency markets was supported by stagnation within the S&P 500 stock exchange index, which continued to be essentially flat at 3,650. Uncertainty is constantly on the limit the eventual recovery as worsening global economic conditions have caused trans-Off-shore shipping rates to plunge 75% versus the year before, forcing sea carriers to cancel a large number of sailings.

Conflicting macroeconomic signals limit risk market upside

In one side, the worldwide macroeconomic scenario improved following the U . s . Kingdom’s government reverted intends to cut earnings taxes on March. 3. However, investors’ fear elevated as global investment bank Credit Suisse’s credit default swaps arrived at their greatest level on March. 3. Such instruments allow investors to safeguard against default, as well as their cost surpassed levels seen in the height from the 2008 economic crisis.

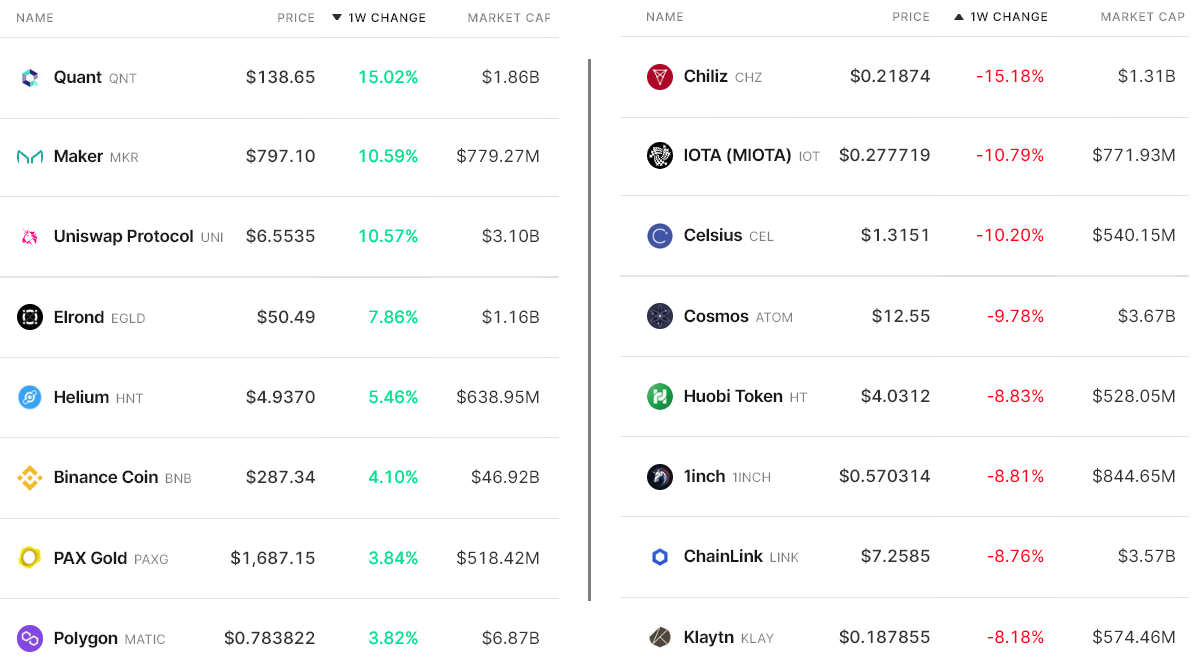

Here is a listing of the winners and losers from the crypto market capitalization’s 1% loss to $935 billion. Bitcoin (BTC) was by helping cover their singlePercent gain, which brought its dominance rate hitting 41.5%, the greatest since August. 5.

Quant (QNT) leaped 15% on speculation that it is interoperable blockchain protocol would find adoption across governmental and regulatory physiques.

Maker (MKR) acquired 10.6% after MakerDAO launched an offer to lower the stability fee for that Curve protocol staked Ether (ETH) pool.

UniSwap Protocol (UNI) acquired 10.6% after UniSwap Labs, a startup adding towards the protocol, apparently elevated over $100 million from vc’s.

Still, just one week of negative performance isn’t enough to interpret how professional traders are situated. Individuals thinking about tracking whales and market markers should evaluate derivatives markets.

Derivatives markets indicate further downside

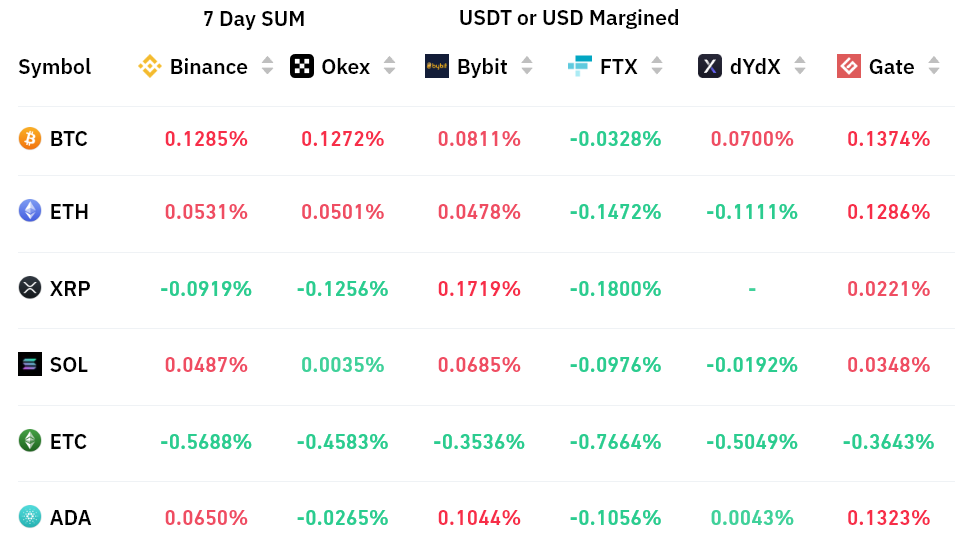

For example, perpetual futures, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflected neutral sentiment because the accrued funding rate was relatively flat generally in the last 7 days. The only real exception was Ether Classic (ETC), although a .50% weekly cost to keep a brief (bear) position shouldn’t be considered relevant.

Since Sept. 26, the yields around the U.S. Treasury’s 5-year notes declined from 4.2% to three.83%, indicating investors are demanding less returns to carry very safe assets. The flight-to-quality movement shows how risk-averse traders are as mixed sentiment emerges from lackluster economic indicators and company earnings.

Because of this, bears think that the current longer-term climbing down formation continues within the approaching days. Additionally, professional traders’ insufficient curiosity about leveraging cryptocurrency longs (buys) is apparent within the neutral futures funding rate. Consequently, the present $980 billion market capital resistance should remain strong.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.