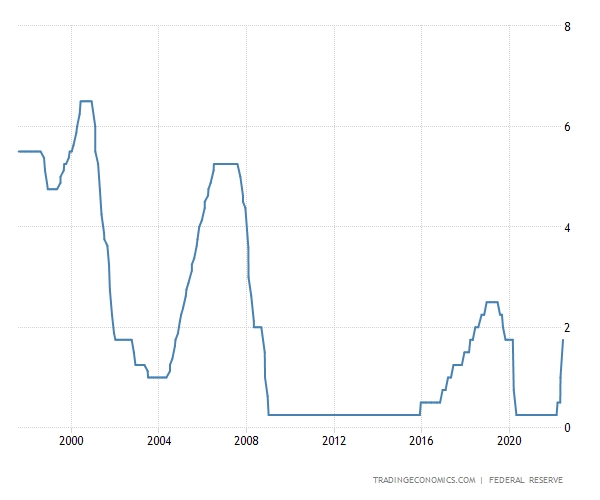

The US Fed (Given) is placed to announce another critical rate of interest hike on Wednesday now, and crypto market participants are watching carefully for just about any clues about how exactly strongly the Given will move.

Knowing in the derivative exchange CME’s FedWatch Tool, traders are usually expecting the Given to boost rates by 75 basis points, having a 77.5% possibility of this outcome. However, which implies that the marketplace prices inside a 22.5% probability the Given will raise rates by 100 basis points – a hike described by Bloomberg because the “largest increase from the modern Given era.”

The potential of one hundred-basis point hike originates into focus lately, because of the more and more hot inflation figures in america. Earlier this year, data demonstrated that inflation arrived at 9.1% in June, greater than analysts had expected or more from 8.6% per month earlier.

Still, the most recent inflation report did result in a relief rally of sorts for that crypto market, with bitcoin (BTC) getting risen by near to 14% because the latest inflation report arrived on the scene on This summer 13.

BTC cost because the June US inflation report:

Based on the Singapore-based crypto buying and selling firm QCP Capital, one hundred-basis point hike through the Given is not likely to occur considering that inflation “is showing indications of peaking.” The firm also stated that the small-rally should be expected because the broader market realizes this.

“Since our prime [inflation] print, the marketplace continues to be decisively prices out the prospect of one hundred bps hike within the This summer [Given meeting]. Presently, a 20% possibility of 100 bps continues to be priced in but our view is the fact that 75 bps is easily the most the Given is going to do. So expect another boost as 100 bps will get completely priced out,” the firm authored within an update on Telegram prior to the weekend.

Meanwhile, the Wall Street Journal on Monday reported that so-known as overnight index swaps now indicate an expectation on the market the Given will raise rates strongly before the finish of the season, before turning around the coming year and beginning to chop them by June.

Exactly the same data also established that the Given will raise rates by 75 basis points at its meeting now, using the Federal Funds rate likely to attend around 3.3% through the finish of the season.

The predicted turn-around in Given policy has “marveled” even investors themselves, the report stated. “From an expectation perspective it isn’t been in an extreme such as this,” the report reported Jim Caron, a senior portfolio manager at investment bank Morgan Stanley, as saying.

At 12:18 UTC on Monday, BTC traded at USD 22,928, lower 3.7% per day or more 5.3% per week.

____

Find out more:

– We Currently Know How Little We Know About Inflation – Fed’s Powell

– US Given the reason for Downturn, Large Crypto Players Have Responsibility Toward Ecosystem – FTX Chief executive officer

– Inflation Is 2022’s Boogeyman

– Bitcoin and difficult Assets Will Win as Inflation Increases, Novogratz States and Sees BTC at USD 500K

– Crypto Winter Will Finish Before 2022 Has Gone Out – Korbit

– The Approaching Recession will Hit Crypto, although not as Hard while you Think