Bitcoin (BTC) starts another week inside a precarious position near $20,000 in front of fresh macro upheaval.

After admittedly sealing its best week’s gains since March, the biggest cryptocurrency is battling to carry onto its lately-reclaimed levels.

Major resistance zones remain overhead, with inflation data due for release later within the week, the approaching days can be unnerving for risk-assets everywhere.

Simultaneously, crypto market sentiment is showing indications of recovery, as well as on-chain metrics still underscore what ought to be Bitcoin’s latest macro cost bottom.

With conflicting data everywhere, Cointelegraph requires a much deeper take a look at potential market moving factors for that week ahead.

200-week moving average causes headaches

Around $20,850, the June 10 weekly close was almost nothing special for BTC/USD, however the pair still managed its best seven days’ development in several several weeks.

Ending Sunday a complete $1,600 greater than its position at the beginning of a few days, Bitcoin thus sealed progress not seen since March.

The success didn’t last, however, because the hrs following a weekly close switched negative. During the time of writing, BTC/USD was targeting $20,400, data from Cointelegraph Markets Pro and TradingView showed.

Bitcoin’s capability to hold current levels might be type in deciding the atmosphere this Summer time, as relief on global equities provides an chance for crypto to erase a number of its losses from recent several weeks.

Commentators including buying and selling suite Decentrader thus eyed the weekly chart with interest.

Weekly check out $BTC futures. Current candle is placed to shut on the bullish engulfing bar over the Moonraker and weekly vwap. Momentum is popping as well. If stocks still show up and also have a summer time rally $BTC and crypto should likely follow. https://t.co/tlkrnTsG33

— Decentrader (@decentrader) This summer 10, 2022

Others were less passionate, noting that BTC/USD had still performed another close underneath the essential 200-week moving average (WMA) around $22,500.

In the past bear markets, the 200 WMA acted like a general support level, with Bitcoin wicking below it briefly to set up macro bottoms. This time around, however, seems to become different, as $22,500 continues to be absent in the chart for any month.

#BTC weekly candle has rallied +15% but continues to be holding resistance underneath the 200MA for several days.

Lower periods are a little more bullish, indicators are cool down but markets remain fearful.

Will #Bitcoin break back over the weekly 200MA prior to the weekly close? pic.twitter.com/NZXbxK8Oi2

— Steve Courtney ~ Crypto Crew College (@CryptoCrewU) This summer 8, 2022

Zooming out, meanwhile, popular trader TechDev recommended a far more positive outlook throughout 2022.

Through the finish of the season, he contended in the weekend, a reclaim of further important WMAs should lead to Bitcoin ending its “reaccumulation phase” altogether.

“BTC flipping 32-35K likely confirms finish of reaccumulation which year+ correction,” TechDev told Twitter supporters.

“Most probable to happen imo once both 100W and 50W EMAs have been in this range. 100W presently at 34.8K and 50W at 37.2K.”

Elsewhere, ongoing asset liquidation from embattled crypto lending platform Celsius put into selling pressure.

Celsius is constantly on the send its remaining cryptoassets to exchanges. Couple of hrs ago, 2,000 wBTC was transferred in the primary wallet, after a number of hops eventually hit Coinbase and Binance.

Remaining key assets:

410k stETH ($479mm)

16k wBTC ($342mm) pic.twitter.com/ae6viYL1Jk— light (@lightcrypto) This summer 10, 2022

Relentless dollar has returned as Asia markets dip

Asian stocks trended lower on This summer 11 because the begin to the macro week was clouded by news of social unrest in China.

As protesters required the discharge of frozen funds among a scandal involving both banking officials and native government bodies charged with mistreating COVID-19 tracking apps, markets felt the stress.

During the time of writing, the Shanghai Composite Index traded lower 1.5%, while Hong Kong’s Hang Seng was 3.1% lower.

Europe fared somewhat better with modest growth for that FTSE 100 and Germany’s DAX, using the U . s . States still to spread out.

Just before Wall Street coming back, however, the U.S. dollar index (DXY) had been making fresh strides greater, cancelling out a retracement which in fact had provided a cooler finish to a week ago.

DXY what food was in 107.4 on This summer 11, just .4 points off twenty-year highs seen days prior.

Analyzing the problem, one analyst at buying and selling firm The Rock described DXY as “about as extreme because it gets” when it comes to year-to-date growth.

“Based around the extreme rally to date this season, the DXY has become up 16% every year,” he authored.

“This is all about as extreme because it will get in the past speaking and, regrettably, it typically coincides with major financial pressure in markets, an economic depression, or both.”

Bitcoin were able to buck its traditional inverse correlation to DXY a week ago, climbing together using the index.

Inflation tipped to supply “untidy week”

In the event that weren’t enough, age-old subject of inflation is apt to supply a further test of market resilience now.

The U.S. Consumer Cost Index (CPI) readout for June arrives This summer 13, and expectations are suitable for the monthly figure to become even greater year-on-year.

The greater inflation, and also the more it diverges from individuals already high expectations, the greater risk assets have a tendency to react awaiting a reaction from policymakers.

For macro analyst Alex Krueger, the likely trajectory with this week is thus obvious.

“Going to become untidy,” he summarized on Twitter.

Styles now

#1 CPI Inflation. Consensus is greater: 8.8% yoy, 1.1% mother. My view: is available in even greater, large dip will get bought.

#2 Earnings. Mostly financials now. Ought to be OK.

#3 European gas crisis. Exerts downwards pressure on risk and also the euro.

Likely to be untidy. https://t.co/LCmt2GRcHl

— Alex Krüger (@krugermacro) This summer 10, 2022

CPI, while stripping out most of the leading inflation indicators, even caught the interest of mainstream commentators over the past weekend inside a harsh hint this week’s figures could place the cat one of the pigeons.

“As next week’s US CPI inflation print could get not far from 9%, many will stop wasting time to indicate this is through backward-searching,” economist Mohamed El-Erian reacted.

“Yes…however it Captures the discomfort that lots of feel, specially the less fortunate segments of society and Influences inflation expectations.”

Any knee-jerk reaction meanwhile could for sure spook Bitcoin markets consistent with other risk assets, or at best spark major volatility, as seen during previous CPI occasions.

MACD shows cost bottom happening

With multiple Bitcoin cost metrics either flashing “bottom” or perhaps hitting all-time lows, the area isn’t lacking signals suggesting a BTC investment at current prices includes a in the past unrivaled risk/reward ratio.

Now, the most recent metric to participate the herd may be the moving average convergence/divergence (MACD) around the weekly chart.

MACD effectively tracks a chart trend already happening. It involving subtracting the 26-period exponential moving average (EMA) in the 12-period EMA.

Once the resulting value is below zero, Bitcoin is commonly inside a bottoming scenario, and therefore the current visit to $17,600 might be also should historic norms repeat.

A #Bitcoin capitulation of cost, once the weekly MACD is underneath the zero-line, has always marked the underside. pic.twitter.com/5U1Q13Ybju

— dave the wave (@davthewave) This summer 10, 2022

Commentator Matthew Hyland meanwhile noted an identical MACD structure still happening around the 3-day chart.

“3-Day MACD continues to be on the bullish mix,” market analyst Kevin Svenson added.

“Despite the pullback, I remain bullish for the medium term.”

As Cointelegraph reported, Bitcoin’s relative strength index (RSI) has already been at its most “oversold” levels ever.

A week ago, meanwhile, one trader known as This summer 15 because the key date through which another chart feature will call the underside, that one made up of two separate MAs.

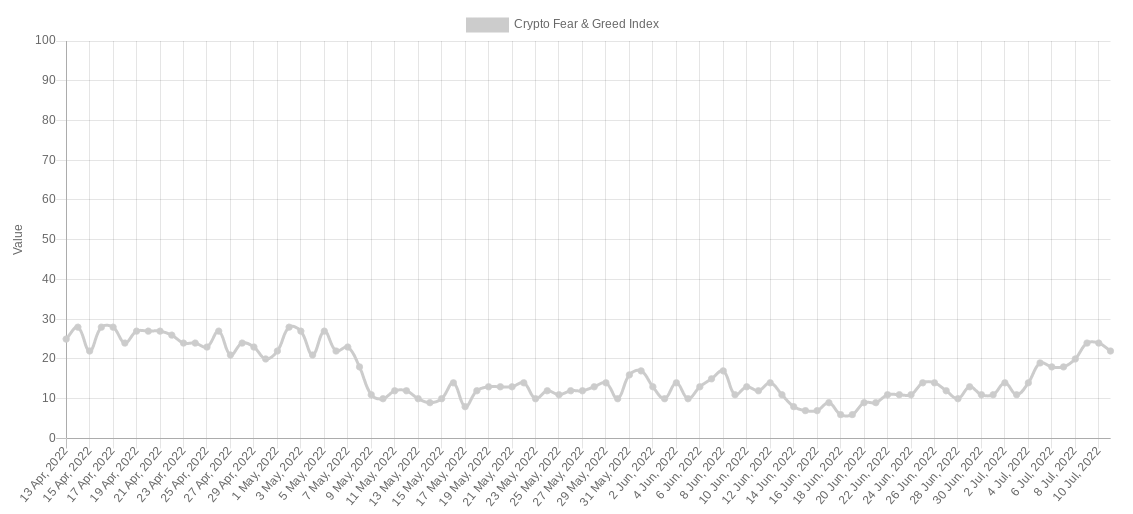

2-month highs for Crypto Fear & Avarice Index

Like a modest silver lining, the typical crypto investor is gradually getting their confidence back, the most recent data suggests.

Related: 5 Best cryptocurrencies to look at now: BTC, UNI, ICP, AAVE, QNT

Building on previous strength, crypto market sentiment hit its greatest levels since early May over the past weekend, and it is now at 22/100.

While still in “extreme fear” territory, the Crypto Fear & Avarice Index’s renaissance supplies a obvious contrast towards the occasions of history two several weeks, where it dipped as little as 8/100 — below even some previous bear market bottoms.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.