Bitcoin (BTC) remained rangebound in the March. 6 Wall Street open with traders already arranging a “violent” breakout.

Bitcoin whale activity highlights the significance of $19,000

Data from Cointelegraph Markets Pro and TradingView adopted BTC/USD because it increased and lower by only dependent on a couple of $ 100 at the time.

The quantity of $20,000 created an emphasis for that pair, which meandered in line with consolidating U.S. equities and dollar strength.

Without any place catalyst around the corner on short timeframes, on-chain analytics resource Whalemap switched to largescale purchase and sell suggests sketch out likely support and resistance.

Towards the downside, $19,174 marked the website of whale buy-ins, suggesting its ongoing strength like a line within the sand.

Bullish progress, meanwhile, would need to deal with a cloud of resistance at $21,500.

“Don’t be depressed by the noise,” the Whalemap team commented alongside a chart showing the important thing levels overnight.

As Cointelegraph reported, $19,000 had been around the radar, reflecting the broader aggregate cost offered for that BTC supply — Bitcoin’s so-known as “investor cost basis.”

Elsewhere, others targeted $21,000 like a likely level should a spate of bullishness start working.

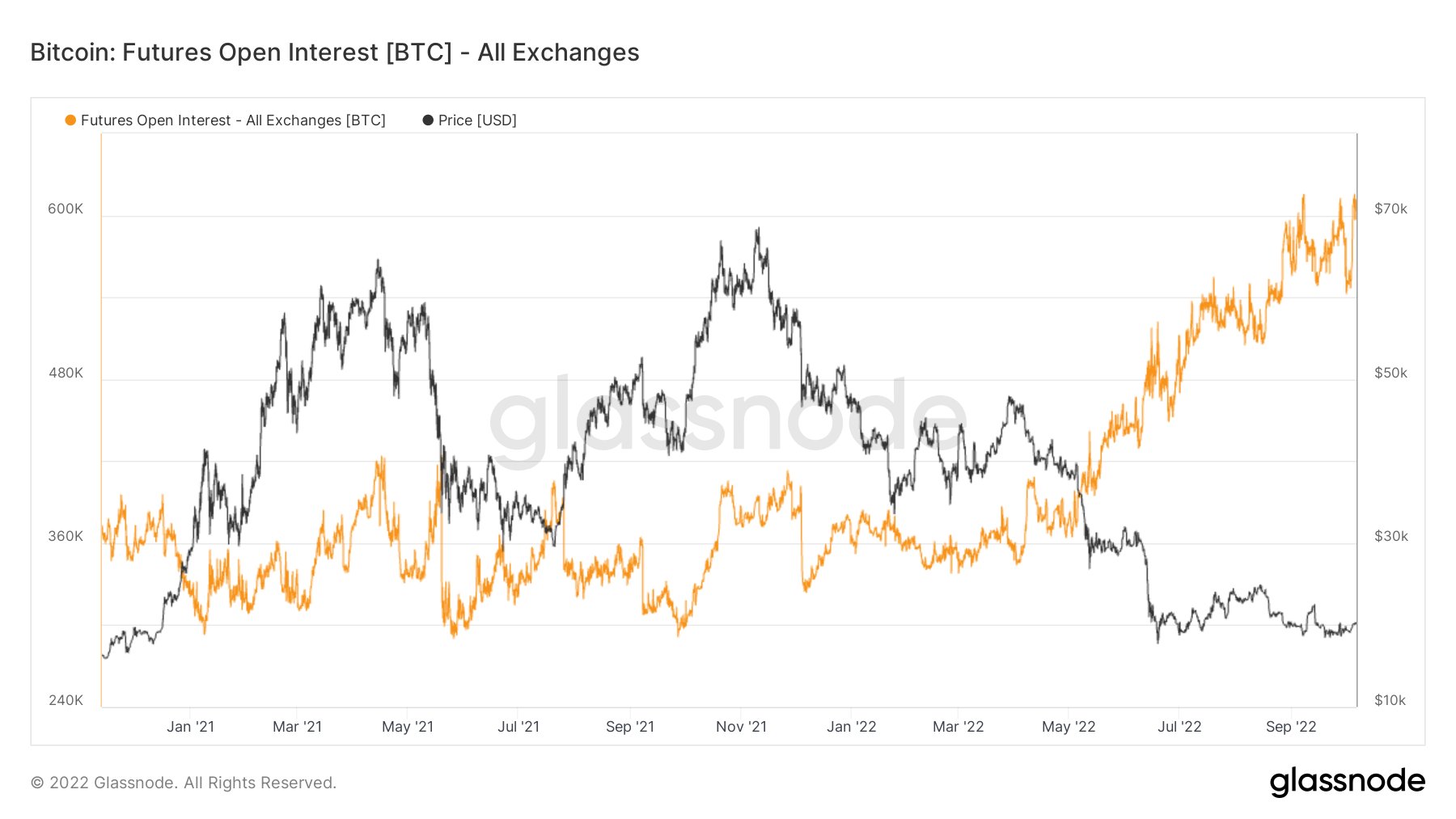

Futures open interest approaches an archive 604,000 BTC

On longer timeframes, meanwhile, popular buying and selling account Daan Crypto Trades flagged an impending triangular breakout for BTC/USD after days of comparative sideways buying and selling.

Related: BTC cost still away from ‘max pain’ — 5 items to know in Bitcoin now

“$BTC The only real two lines you demand for in a few days,” he summarized.

On derivatives markets, traders were continuously adding dry powder, that could fuel a “violent” finish towards the established order.

“As bitcoin consolidates around $20,000, BTC denominated futures open interest sits just beneath in history highs at 604k BTC,” Dylan LeClair, senior analyst at UTXO Management authored inside a dedicated thread at the time.

“Whether up or lower, when bitcoin breaks from its current range, it’ll be a violent move.”

LeClair noted the all-time full of open interest was mainly collateralized by stablecoins, marking a definite vary from the heavy upside volatility observed in April 2021, when BTC/USD hit $58,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.