Voyager Digital Holdings, the owner of the crypto platform, announced today they joined right into a multi-million line of credit agreement with Alameda Ventures, but additionally that they’re going to issue a notice of default to major crypto hedge fund Three Arrows Capital (3AC) to fail to pay back its loan.

Alameda Ventures is really a investment capital arm of Alameda Research, a quantitative buying and selling firm and also the parent company from the FTX exchange, the Chief executive officer which, Mike Bankman-Fried continues to be making news in the last a few days because of his opinion the large crypto firms possess a responsibility propose within the duration of the crypto market crisis.

Per Voyager’s announcement,

The organization “entered right into a definitive agreement with Alameda for any USD 200 million cash and USDC revolver along with a BTC 15,000 (USD 304m) revolver.”

This confirms the offer reported today. It comes down additionally to FTX supplying the crypto lender BlockFi, that could be struggling with issues all around the 3AC and its likely insolvency, a “USD 250 million revolving credit facility” package. Typically, revolving credit facility plans involve a trader supplying funds that may be attracted upon if they are essential.

Voyager mentioned that, as formerly disclosed, the organization promises to make use of the proceeds from the credit facility “to safeguard customer assets considering market volatility and just if such me is needed,” adding:

“In accessory for this facility, by June 20, 2022, Voyager has roughly USD 152 million cash and owned crypto assets on hands, in addition to roughly USD 20 million of money that’s restricted for purchasing USDC.”

Alameda presently not directly holds an 11.56% stake in Voyager.

It is not all Voyager needed to share, because they mentioned the operating subsidiary, Voyager Digital, LLC, may issue a notice of default to 3AC to fail to pay back its loan. The business’s contact with 3AC includes BTC 15,250 and USDC 350m.

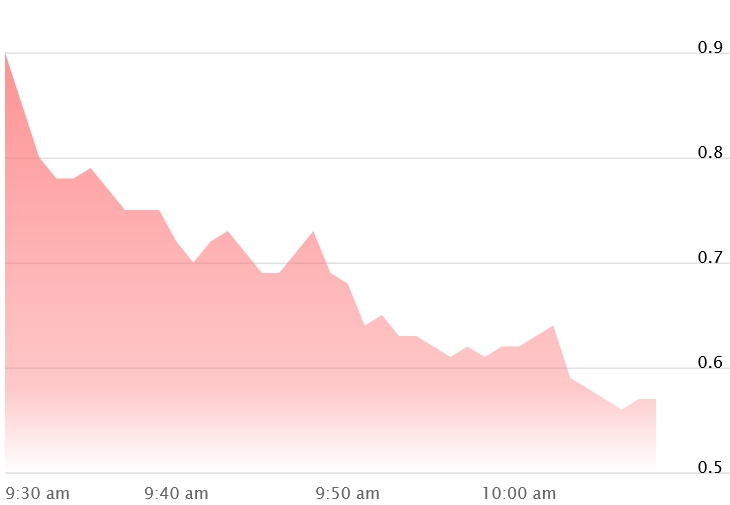

Voyager Digital shares tanked following a news:

Based on Voyager, they provided a preliminary request repayment of USDC 25m by June 24, after which subsequently requested for repayment from the entire balance of USDC and BTC by June 27 – neither which has to date been paid back, they stated. Failure by 3AC to pay back these amounts by specified dates will “constitute a celebration of default,” stated the organization, adding:

“Voyager promises to pursue recovery from 3AC and it is in discussions using the Company’s advisors concerning the legal remedies available. The Organization is not able to evaluate at this time the quantity it can get over 3AC.”

Cryptonews.com has arrived at to 3AC for comment.

____

Find out more:

– BlockFi, Crypto.com, yet others Come Forward as Three Arrows Hires Advisors, Babel Finance Pauses Withdrawals

– Three Arrows Capital ‘Ghosted Us’ After USD 1M Went Missing, Buying and selling Firm Claims

– BlockFi Safeguards USD 250M Line Of Credit from Bankman-Fried’s FTX

– SEC’s Peirce States Crypto’s Insufficient ‘Bailout Mechanism’ Is really a Strength FTX Chief executive officer like a ‘White Knight’

– US Given the reason for Downturn, Large Crypto Players Have Responsibility Toward Ecosystem – FTX Chief executive officer

– Insufficient Liquidity for Celsius to market Staked Ethereum in Open Market – Analyst

____

(Updated at 14:33 UTC: a chart with Voyager Digital stock cost was added.)