Bitcoin continues to be pumping since the beginning of 2023. The world’s first and largest cryptocurrency by market capital was last altering hands near to $21,000, up a sensational 27% to date around the month. Which means Bitcoin is on target because of its best monthly gain since October 2021, regardless of the month still getting 15 days to visit.

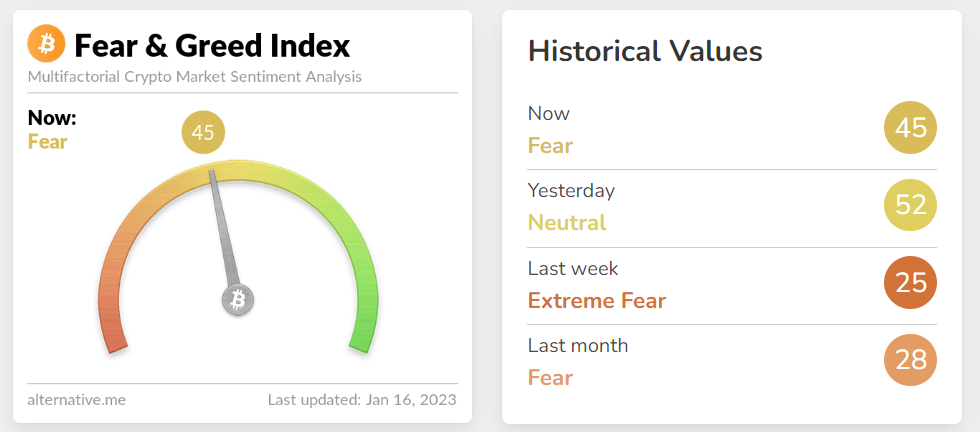

Considering the current surge, Alternative.me’s popular Bitcoin fear and avarice index moved from “fear” the very first time since April 2022 over the past weekend, hitting 52 before shedding to 45 on Monday.

The most recent rally has attracted the typical foreseeable scepticism from bears on social networking, a lot of whom happen to be dismissing Bitcoin’s newest recovery like a “bull trap”. To be fair, selling rallies was the playbook for 2022.

This Rally Might Be Different

But 2023 will probably be a vastly different year to 2022. 2022 would be a year characterised by 1) big upside inflation surprises in key global markets such as the US and Europe and a pair of) aggressive subsequent rate hikes from the kind of the united states Fed and European Central Bank. The current transfer of economic data, especially in the US, shows that 2023 is a lot more apt to be annually of downside inflation surprises and easing expectations for Given tightening.

Consequently, this latest Bitcoin rally feels different. One carefully adopted options market indicator implies that investors have grown to be probably the most positive on Bitcoin’s six-month performance outlook since the beginning of 2022.

Bitcoin’s 180-day call-put skew retrieved into positive territory on Monday the very first time each year, based on crypto derivatives data analytics firm Amberdata. Which means bullish cash options expiring in six several weeks now are more expensive than bearish put options of the identical expiry.

“We begin to see the current rally in digital assets like a market reversal and never a bear market rally,” stated 3iQ’s mind of research Mark Connors inside a recent email to clients. Connors noted that recent less hawkish commentary from Given policymakers shows that the sharp decrease in money way to obtain 2022 might be ending.

These Indicators Suggest Crypto Winter Embracing Spring

Other broadly adopted technical indicators will also be supportive of the concept that the crypto winter might finally be visiting an finish. First of all, Bitcoin has damaged convincingly to northern its 200-Day Moving Average the very first time since December 2021.

Just like April 2021’s unsuccessful make an effort to return over the 200DMA wound up like a key market level (Bitcoin would will continue to fall an additional 67% in 2022), the Bitcoin bulls are wishing that January’s bullish 200DMA break could signal the beginning of a brand new bull market.

Based on Glassnode, “since the 200-day SMA is really broadly observed by market analysts, it has a tendency to carry significant weight on investor psychology when it’s damaged convincingly… It’s frequently considered the absolute minimum macro bull/bear threshold level”.

Meanwhile, Bitcoin’s latest rally has additionally sent it to northern its Recognized Cost the very first time since early November, which based on Glassnode, was last around $19,700. Which means the typical Bitcoin holder has become holding an unrealized profit and it is “under a smaller sized amount of acute financial stress”.

Based on Glassnode data, Bitcoin has returned to northern both its 200DMA and Recognized Cost the very first time since December 2021.