Time waits without one and finance industry is the same. Mainly in the uncharted territory of cryptocurrency buying and selling, checking up on the short-paced alterations in prices is way to succeed. An array of cryptocurrencies, a couple of viable buying and selling strategies and various tools available to first time traders may all cause confusion.

Fortunately, technology makes it easy to automate several buying and selling processes, including market analysis, predicting trends and order execution. This releases additional time for proper planning and creating a good foundation for lengthy-term cryptocurrency buying and selling success.

What’s automated crypto buying and selling?

Automated crypto buying and selling, sometimes known as automated cryptocurrency buying and selling, is the concept of using software (crypto buying and selling bots) to purchase and sell digital currencies on one’s account. These computer programs usually are meant to respond to market changes to trade in the optimum moment. In addition, automatic crypto buying and selling removes the component of uncertainty and emotion from by hand exchanging cryptocurrencies.

Even though some newer crypto bots utilize smart contracts and operate on the blockchain, most automated crypto buying and selling platforms continue to be APIs. The word API describes a credit card applicatoin programming interface that enables your bank account to talk with a cryptocurrency exchange therefore it can open and shut positions around the user’s account based on certain predetermined conditions.

Automated cryptocurrency buying and selling has numerous advantages over manual buying and selling, including the truth that bots could work continuously without rest. They’re also impartial by emotion, so that they will invariably stick to their strategy and follow any new market trend or event soon after it takes place.

Several kinds of crypto buying and selling bots can be found, each differing when it comes to features, functionalities and cost. Typically the most popular ones are usually arbitrage or grid buying and selling bots. Arbitrage bots make use of the cost variations on several exchanges, while grid buying and selling is centered on the “buy low, sell high” strategy.

Some automated crypto platforms have different characteristics, like the hodl function on 3Commas. This doesn’t just trade additionally, it enables users to buy and hold crypto instantly by purchasing at affordable prices. It can be the consumer to find the cryptocurrencies they need along with a bot to enable them to in performing just that.

Generally, automated crypto buying and selling experiences four steps: data analysis, signal generation, risk allocation and execution:

- Data analysis: Inside a technology-oriented world, data is a vital component for achievement, for this reason a crypto buying and selling bot needs data analysis. Machine learning-enabled software are capable of doing data mining tasks more quickly than the usual human. Signal generation: When the data analysis is performed, a bot performs the trader’s work by predicting market trends and identifying possible trades according to market data and technical analysis indicators.

- Risk allocation: The danger allocation function is how the bot determines how you can distribute risk among different investments according to predetermined parameters established through the trader. These rules usually define how and what number of capital is going to be invested when buying and selling.

- Execution: The procedure by which cryptocurrencies are ordered and offered as a result of the signals generated through the pre-activated buying and selling system is called an execution. Only at that period, the signals will generate purchase or sell orders which are forwarded to the exchange via its API.

Is crypto bot buying and selling lucrative?

Though one may think otherwise, manual buying and selling is less popular. Actually, algorithmic buying and selling bots took over the loan industry to this kind of extent that algorithms now drive the majority of the activity on Wall Street. It is not only crypto that’s being traded by bots, just about everything including equities, bonds and foreign currency has become being bought and offered through algorithms.

The primary reason behind this shift is straightforward: Bots could make decisions quicker than humans. They’re also not biased by feelings, to allow them to stay with their buying and selling strategy even if your financial markets are volatile.

Bear in mind that crypto buying and selling bots aren’t perfect plus they can’t eliminate all risks. However, they are able to automate buying and selling procedures to assist both new and experienced traders earn profits. To correctly configure a bot, it’s crucial to possess a fundamental knowledge of the marketplace along with the rules and tools connected with buying and selling.

Just how much will a crypto buying and selling bot cost? The treatment depends on which features and functionalities a person is searching for. Some crypto buying and selling bots have the freedom, while some may cost a couple of $ 100 monthly.

Is crypto automation legal?

There’s nothing illegal about employing a buying and selling bot in almost any jurisdiction where cryptocurrency buying and selling is allowed. Within the traditional financial market, using bots is very common and well-controlled. Machines now execute a lot of stock trades, and this is also true for cryptocurrency buying and selling. A bot is only a method to trade that does not require someone to execute the trades by hand — it’s not breaking any laws and regulations.

However, there are many limitations for this. Some crypto bots are outright frauds, while some utilize shady tactics that may be considered dishonest or illegal. Pump-and-dumps and directing customers to unregulated brokers who might take your hard earned money without delivering any service are types of this. These bots operate potentially outdoors the bounds of legality.

Do automated buying and selling bots work? The issue isn’t whether or not they work it’s how good they operate. Their impact can also be based on a number of factors, such as the platform and bot used, along with the degree of experience and expertise the consumer has.

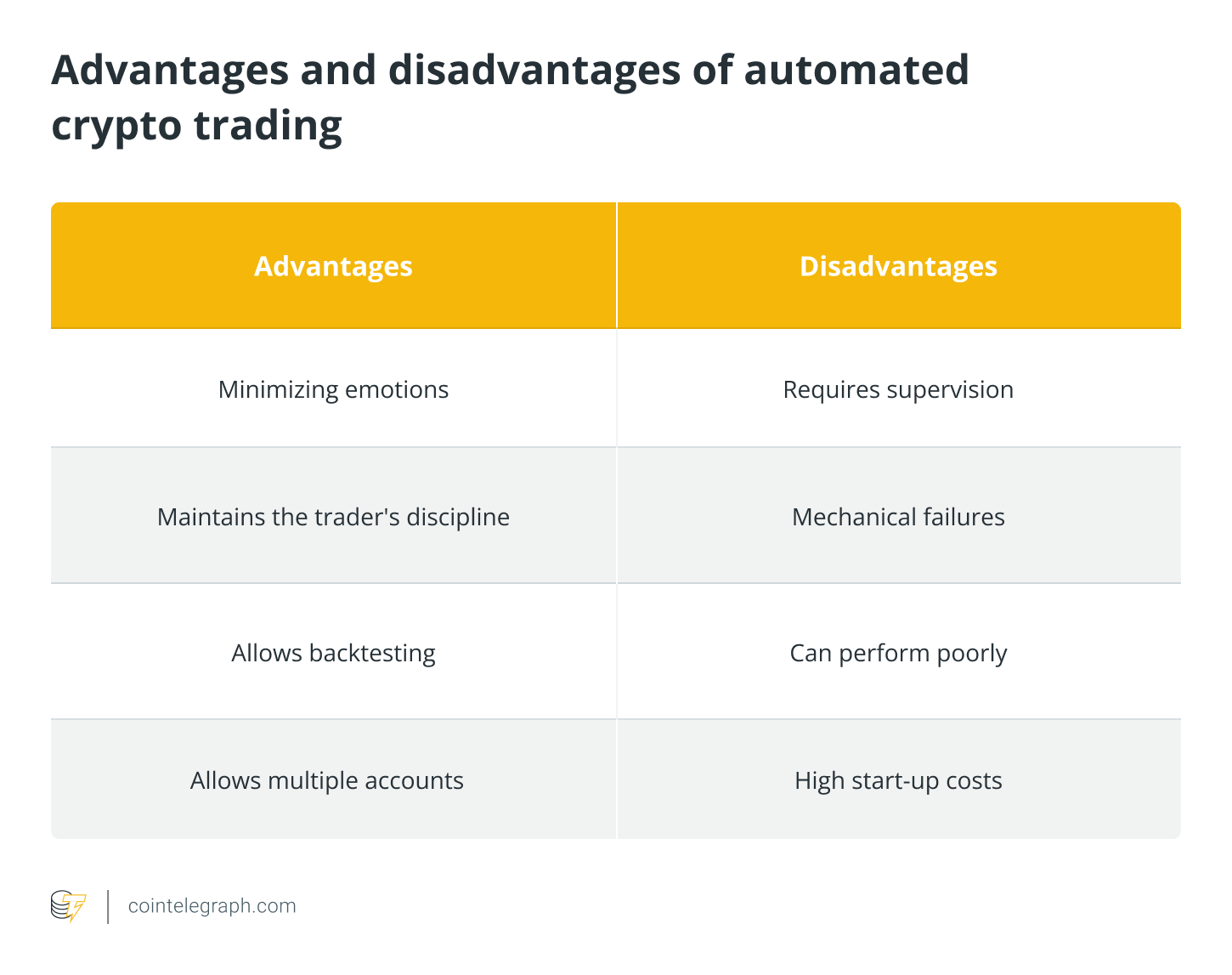

Pros and cons for automated crypto buying and selling

There are a variety of benefits that individuals who adopt automated crypto buying and selling enjoy. Here are the noticably advantages of automated buying and selling

Advantages

Minimizing Emotions

Automated crypto buying and selling systems assistance to control feelings by instantly executing trades when the set trade parameters happen to be met. By doing this, traders won’t hesitate or second-guess their decisions. Crypto buying and selling bots aren’t just for timorous traders they may also help individuals who will probably overtrade by exchanging at each chance.

Backtesting

Automated buying and selling systems could be backtested using historic data to create simulated results. This method enables for that refinement and improvement of the buying and selling strategy before it’s put in live use. When building an automatic buying and selling system, all rules should be concrete without any space for biases.

The pc cannot assume things and needs to be given explicit instructions on how to proceed. Before risking money, traders can test these parameters against past data. Backtesting is a technique of tinkering with buying and selling ideas and figuring out the system’s expectancy, the average amount an investor can get to achieve (or lose) for every unit of risk.

Preserving discipline

It’s tempting to obtain taken in an industry rally making impulsive decisions. Traders may take a systematic method of their buying and selling, even just in volatile market conditions, by using the buying and selling rules set by their strategy. By sticking to those rules, traders can avoid pricey mistakes for example chasing losses or getting into trades with no concrete plan.

Improving order entry speed

Crypto buying and selling bots can monitor the marketplace and execute trades quicker than humans. They may also respond to changes on the market a lot more rapidly than the usual person. Inside a market as volatile as Bitcoin (BTC), getting into or from a trade only a couple of seconds sooner might considerably modify the trade’s result.

Diversifying buying and selling

Crypto bots allow users to trade numerous accounts or different strategies simultaneously. By investing in a number of assets, traders can help to eliminate the probability of loss by diversifying their portfolios. What can be incredibly challenging for any human to complete is efficiently performed with a computer in milliseconds. Automated crypto buying and selling systems are made to benefit from all lucrative buying and selling possibilities that could arise.

Disadvantages

Although automated crypto traders enjoy a number of benefits, there are a variety of drawbacks connected using the practice, including.

High start-up costs

When designing an automatic buying and selling system in the ground-up requires both skills and time. As well as, these initial expenses might combat any gains the machine makes. In addition, operational costs for example hosting and vps (VPS) services should be compensated for regularly to help keep the machine running easily.

Ongoing maintenance costs

Automated buying and selling systems should be monitored regularly for problems for example network outages, software upgrades and unanticipated market occasions that may disrupt trade execution. These expenses might accumulate with time and lower profits.

Insufficient versatility

Crypto buying and selling bots are made to follow along with some rules and can’t adjust to altering market conditions. This rigidity may lead to missed options or poor trades.

Mechanical failure

An automatic crypto buying and selling system, like every other system, can are afflicted by technical problems for example network outages, power outages, and knowledge feed errors. These failures could trigger a purchase being placed in the incorrect cost or quantity, producing a loss.

Is automated crypto buying and selling safe?

The security of automated crypto buying and selling depends upon the machine design and whether trades are regularly monitored. However, they can’t just be set and forgotten, expecting these to tackle market volatility and spare traders from losses perfectly. They might, however, be considered a reliable tool that may ease cryptocurrency buying and selling journeys by optimizing processes and allowing 24/7 hassle-free buying and selling. Being instantly emotionless, they assist prevent unfortunate decisions associated with taking a loss because of human error or vice-versa.

Before you decide to purchase anything or put anything lower for any buying and selling account, conduct proper research around the projects and platforms and try to inquire to obvious your doubts. Otherwise, you may find yourself taking a loss should you not.