Since their beginning, cryptocurrencies have experienced rapid growth and prevalent market adoption, as evidenced through the assets associated with crypto assets which have began to look within the portfolios and buying and selling methods of several asset managers. The entire process of purchasing and selling cryptocurrencies to learn is called cryptocurrency buying and selling.

Buying and selling in cryptocurrencies could be defined when it comes to its objective, mode of operation and buying and selling approach. For instance, the asset being exchanged, or cryptocurrency, is the aim of cryptocurrency buying and selling. The way cryptocurrencies are traded depends upon the kind of transaction, for example futures, options or perpetual contracts that occur available on the market.

An investor’s buying and selling technique for cryptocurrencies specifies some predetermined guidelines for exchanging on cryptocurrency exchanges. Among the fundamental buying and selling methods to purchase cryptocurrencies is place buying and selling, by which traders buy assets with the expectation of promoting them in a greater cost later on.

Related: Cryptocurrency investment: The best indicators for crypto buying and selling

This information will discuss what place buying and selling is, crypto place buying and selling signals, how you can do crypto place buying and selling and do you know the perils of crypto place buying and selling.

Exactly what is a place market in crypto?

The bottom market, where crypto assets are immediately exchanged and settled, is actually a place market, and buying and selling within this market includes buying digital currencies like Bitcoin (BTC) or any other altcoins and hodling them until their value increases.

Related: Bitcoin place versus. futures ETFs: Key variations described

It’s known as place buying and selling since the transactions are settled “on the place.” In addition, place markets include sellers, buyers and order books. Sellers place an order having a specific ask or sell cost, and buyers make an order for just about any cryptocurrency token having a particular bid or purchase cost. The bid cost may be the greatest cost that the buyer is able to pay, and also the ask cost may be the cheapest cost that the seller would like to simply accept as payment.

An order book has two sides: The ask side for buyers wanting to buy and also the bid side for sellers prepared to sell. An order book records bids and asks within the order book. For example, in place buying and selling, if Bob bakes an to purchase BTC, this transaction will instantly visit the bid side from the order book. Whenever a seller in the crypto place buying and selling platform is selling in the same specifications, this order is instantly filled.

The transaction is constantly on the the ask side from the order book when Bob enters a purchase to market BTC within the above crypto place buying and selling example. The orders in eco-friendly within the order book reflect purchasers of the specific token, as the orders in red represent sellers of this token.

What’s place buying and selling in crypto?

The aim of place buying and selling is to find low then sell high to make an income, but it is unsure this tactic will invariably try to the traders’ advantage thinking about the volatility from the crypto market.

The place cost, trade date and settlement date would be the three crucial concepts in place buying and selling. The present cost associated with a asset is known as the place cost, and also the traders sell assets into consideration immediately only at that cost. Furthermore, it’s possible to purchase or sell cryptocurrencies along with other users on various exchange platforms.

The place cost changes as new orders are put and original copies are filled. The trade date initiates and records the transaction to represent your day the marketplace really performs the trade. The assets active in the transaction are really transferred around the settlement date, also referred to as the place date.

With respect to the kind of market being traded, there might be eventually or a few days between your trade date and also the settlement date. For cryptocurrency, it always happens on the day that, although it may vary among exchanges or buying and selling platforms.

So how exactly does crypto place buying and selling work?

An industry order with an exchange enables traders to sell or buy assets in the best available place cost. A place market typically offers a number of currencies, including BTC, Ether (ETH), BNB (BNB) as well as fiat. There are many means of purchasing and selling coins on the majority of cryptocurrency exchanges, and place traders frequently use a number of fundamental and technical analysis approaches to create buying and selling decisions.

It’s possible to place trade at centralized exchanges, decentralized exchanges (DEXs) or higher-the-counter (OTC) markets. You have to first fund your bank account using the cryptocurrency you need to trade to utilize a centralized exchange. On centralized exchanges, charges are frequently levied on listings, trades along with other buying and selling activities.

Blockchain technologies are utilized by DEXs to complement exchanging orders, and crypto place buying and selling strategies can be achieved from a trader’s wallet because of smart contracts. Buying and selling can happen on OTC platforms, through brokers that execute trades with respect to their customers, or perhaps over the telephone online age.

Benefits and drawbacks of crypto place buying and selling

When you buy a good thing in the place cost, one truly becomes the asset owner, allowing traders to market it or relocate it to offline storage because they like. Additionally, place buying and selling enables traders to make use of their cryptocurrency assets for further functions like online payments or staking.

Furthermore, place buying and selling is substantially less dangerous than margin buying and selling, i.e., it’s possible to purchase crypto assets without having to worry about taking a loss because of cost changes and with margin calls. Consequently, the trader doesn’t risk adding more that belongs to them money or losing more income than they have within their account since there are no margin calls.

However, the greatest disadvantage to place buying and selling is it doesn’t offer the benefit of any potential return amplification that leverage in margin buying and selling might provide. Furthermore, because of the lack of leverage, potential gains within the place market are less than individuals in margin buying and selling.

How you can place trade crypto on Binance?

Once you’ve produced a Binance account, place buying and selling around the platform is an easy procedure. Crypto place buying and selling charges on Binance for BTC and BUSD place buying and selling pairs is %. The steps to place trade on Binance are listed below:

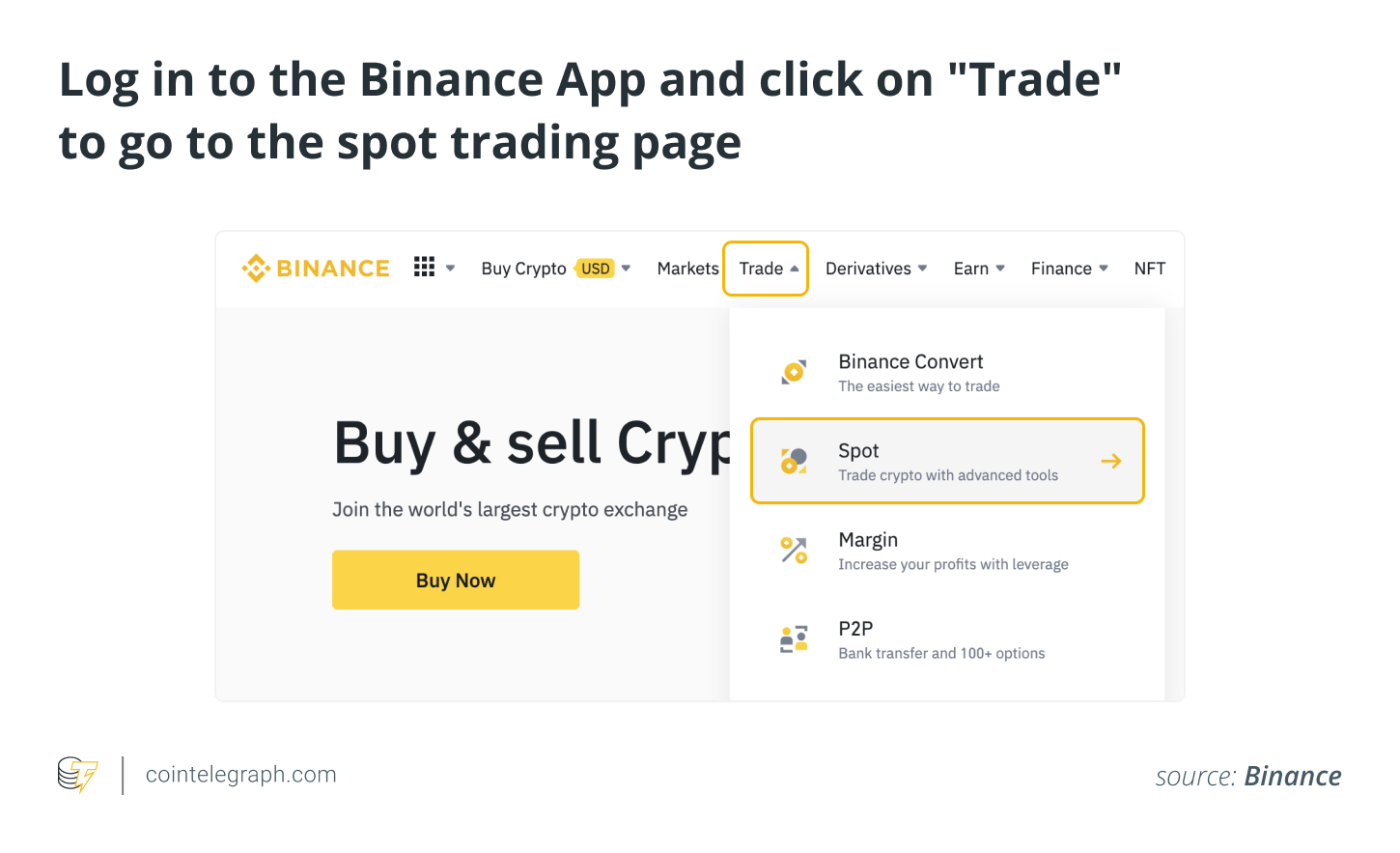

- Around the Binance site, select “Trade” after which “Spot” to gain access to the place buying and selling platform.

- The buying and selling view interface, with a couple of exciting elements, will be visible for you.

- The cryptocurrency buying and selling pair along with other market data, like the daily cost change and volume, are displayed at the very top.

- All open trade orders to have an asset are indexed by an order book, sorted by cost. It’s possible to personalize the historic cost data within this chart view. TradingView, already incorporated within the window, provides use of an extensive selection of technical analysis tools.

- It’s possible to look for different buying and selling pairs within the top right corner. By hitting the small stars, it’s possible to save your valuable favorite cryptocurrency pairs and choose the cryptocurrency pair one really wants to trade around the place market.

- A person’s sell or buy order is going to be produced within this section. They are able to pick from the different order types: limit, market and prevent-limit orders to conduct a place trade transaction.

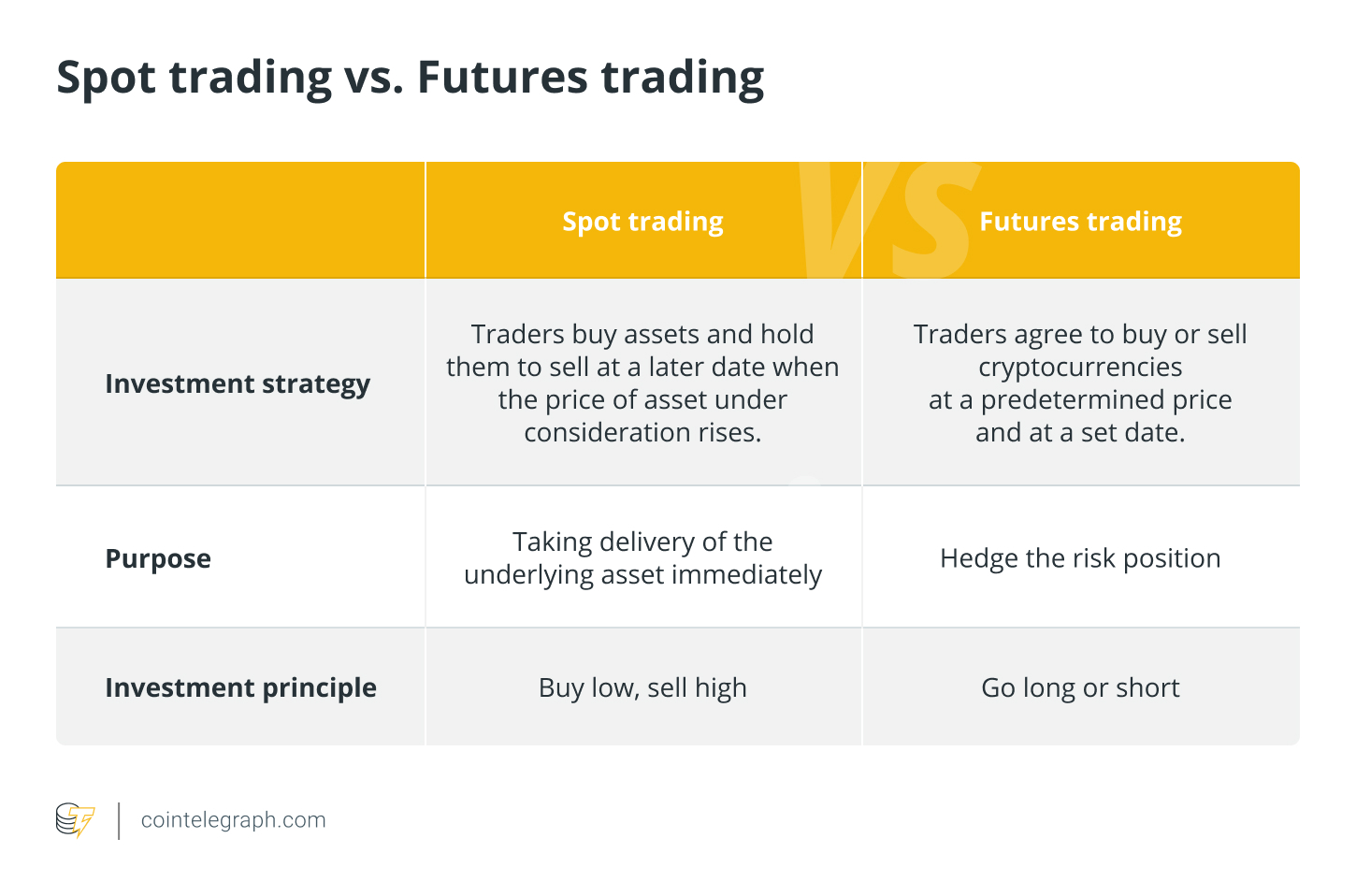

Place buying and selling versus. futures buying and selling

As pointed out, place trades are conducted instantly for fast delivery. However, contracts around the futures market are compensated for at another time whenever a seller and buyer accept exchange a particular volume of products for your cost. The seller and buyer frequently achieve an economic settlement instead of give the asset following the contract expires around the settlement date.

Variations between these two kinds of buying and selling are indexed by the table below:

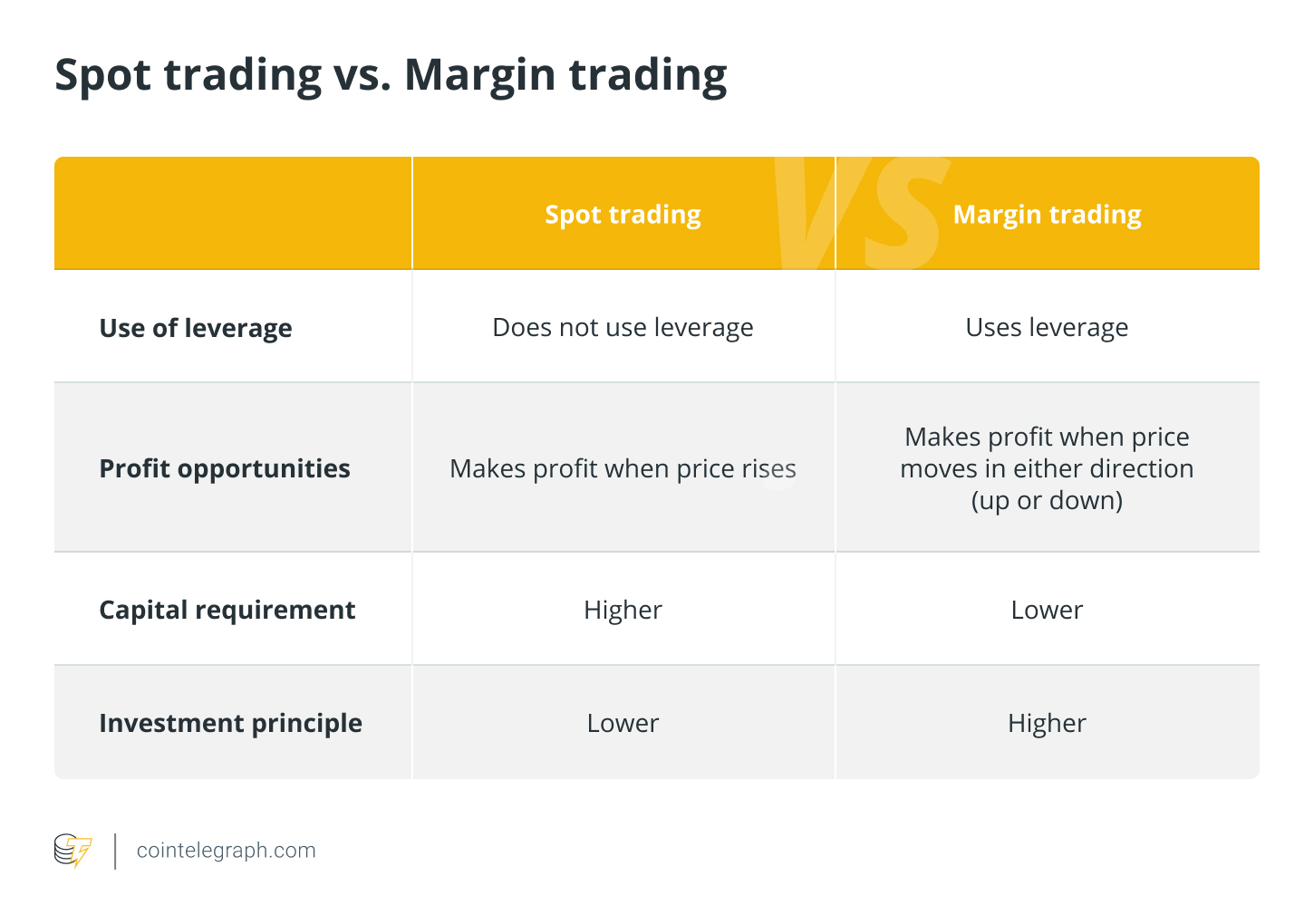

Place buying and selling versus. margin buying and selling

Day traders open short-term trades with low spreads with no expiration date in place buying and selling to consider quick receiving the underlying asset. The main difference between your offer (buy) and bid (sell) prices quoted to have an asset is actually a spread in buying and selling.

However, margin buying and selling lets traders undertake greater positions by borrowing money from a 3rd party at interest to create significant gains potentially. However, it is important to practice caution to not lose all your energy production since it also magnifies any potential losses.

Variations between place and margin buying and selling are summarized within the table below:

Is crypto place buying and selling lucrative?

Traders generally use a dollar-cost averaging strategy and wait for a next bull market to learn from place trade. However, rewards come at the expense of persistence, and absolutely nothing is instant within the volatile crypto market. Furthermore, before buying and selling in almost any crypto assets or utilizing place buying and selling strategies, it is advisable to conduct research and workout risk management to prevent suffering losses. But, is crypto place buying and selling great for beginners?

Each investor includes a different risk-return profile, and because of the highly volatile cryptocurrency market, you ought to weigh the benefits and drawbacks from the buying and selling strategy (within this situation, place buying and selling) of the choice. Which means that traders must be careful when deciding which assets to trade and should be-experienced on the market prior to beginning.