Bitcoin (BTC) bulls shouldn’t get looking forward to the recovery in the June lows of $17,500 at this time as BTC heads into its riskiest month within the future.

The psychology behind the “September effect”

Historic data shows September being Bitcoin’s most worst month between 2013 and 2021, with the exception of 2015 and 2016. Simultaneously, the typical Bitcoin cost loss of the month is really a modest -6%.

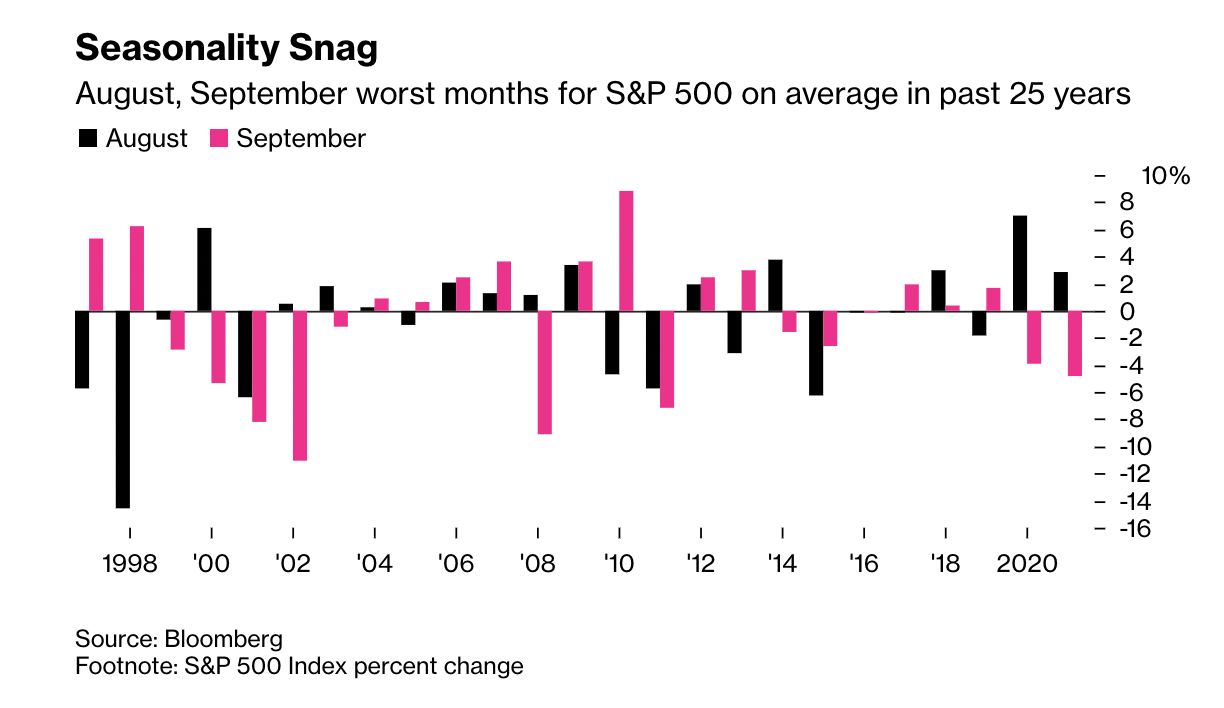

Interestingly, Bitcoin’s poor history over the previous September several weeks coincides concentrating on the same downturns in the stock exchange. For example, the typical decline from the U.S. benchmark S&P 500 in September is .7% within the last twenty five years.

Traditional chart analysts have dubbed this annual drop-off because the “September effect.”

Analysts argue that investors exit their market positions after coming back using their summer time vacations in September to lock gains, or perhaps tax losses, in front of the year’s close.

Meanwhile, additionally they observe that individual investors liquidate their assets in September to cover their children’s annual school costs.

Bitcoin’s correlation with the stock exchange continues to be largely positive after and during the coronavirus pandemic. Therefore, additionally towards the September effect, these mirroring cost trends may also increase BTC’s probability of shedding full of the ominous month.

So expect low volume, chop & random violent moves either in direction. The purpose of this publish is not to fearmonger anybody. Always a eco-friendly markets somewhere. I am discussing insight on what to anticipate in order to save newer retail traders from excruciating discomfort. Have patience and embrace the suck

— Seven V. Matos (@Sevenvmx) August 22, 2022

Given eyes 75bps rate hike

Bitcoin’s losses in 2022 were attracted from fears from the Federal Reserve’s rate hikes so the unwinding of their $120 billion monthly bond-buying plan to tackle rising inflation.

However the market’s narrative now use hopes that inflation had peaked. The idea strengthened following the This summer U.S. consumer cost index (CPI) came at 8.5% versus 9.1% within the month prior, resulting in speculations the Given would tone lower its tightening plans.

It coincided with Bitcoin and S&P 500 recouping small servings of their yearly losses, as highlighted below.

But several analysts think that Bitcoin’s recovery might be a bull trap, a “relief rally” which will trap investors who think the marketplace has bottomed.

The psychology of the relief rally

Cost will get just bullish enough to fool you this rally is the real thing.

There might be an finish towards the discomfort.

Then BLAMO, the marketplace rugs you shattering your hopes.

Expect mtss is a couple of more occasions throughout the bear!#bitcoin #crypto

— Lark Davis (@TheCryptoLark) August 22, 2022

Furthermore, most Given officials still favor raising by 75 basis points in their next meeting in September, given their pledge to create inflation lower to twoPercent.

Related: Wen moon? Most likely not soon: Why Bitcoin traders should make buddies using the trend

Consequently, Bitcoin and S&P 500 risk ongoing their prevailing correction trend in September, eyeing more yearly lows.

Bitcoin technicals hint at drop to $17.6K

Theoretically speaking, Bitcoin will decline toward $19,250 by September whether it breaks from its current “bear flag” pattern. The bearish continuation setup is highlighted within the four-hour chart below.

Meanwhile, around the daily chart, BTC continues to be breaking lower from the rising wedge pattern since August. 19. The bearish reversal setup’s profit target involves be near $17,600, as highlighted within the chart below.

Overall, September appears like it might once more be considered a red month for Bitcoin according to technical, fundamental and macro factors.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.