Fed Chairman Jerome Powell stated inside a question and answer session located through the Cato Institute on Sept. 8 the central bank continuously hike rates until inflation is in check. However, these comments didn’t rattle the markets around most might have anticipated, indicating that traders may have already considered a 75 basis point rate hike within the Fed’s next meeting on Sept. 20–21.

Bitcoin continues to be strongly correlated using the S&P 500 and inversely correlated using the U . s . States dollar index (DXY) within the last several days. Using the DXY cool down after hitting a 2-decade high, dangerous assets happen to be attempting a recovery.

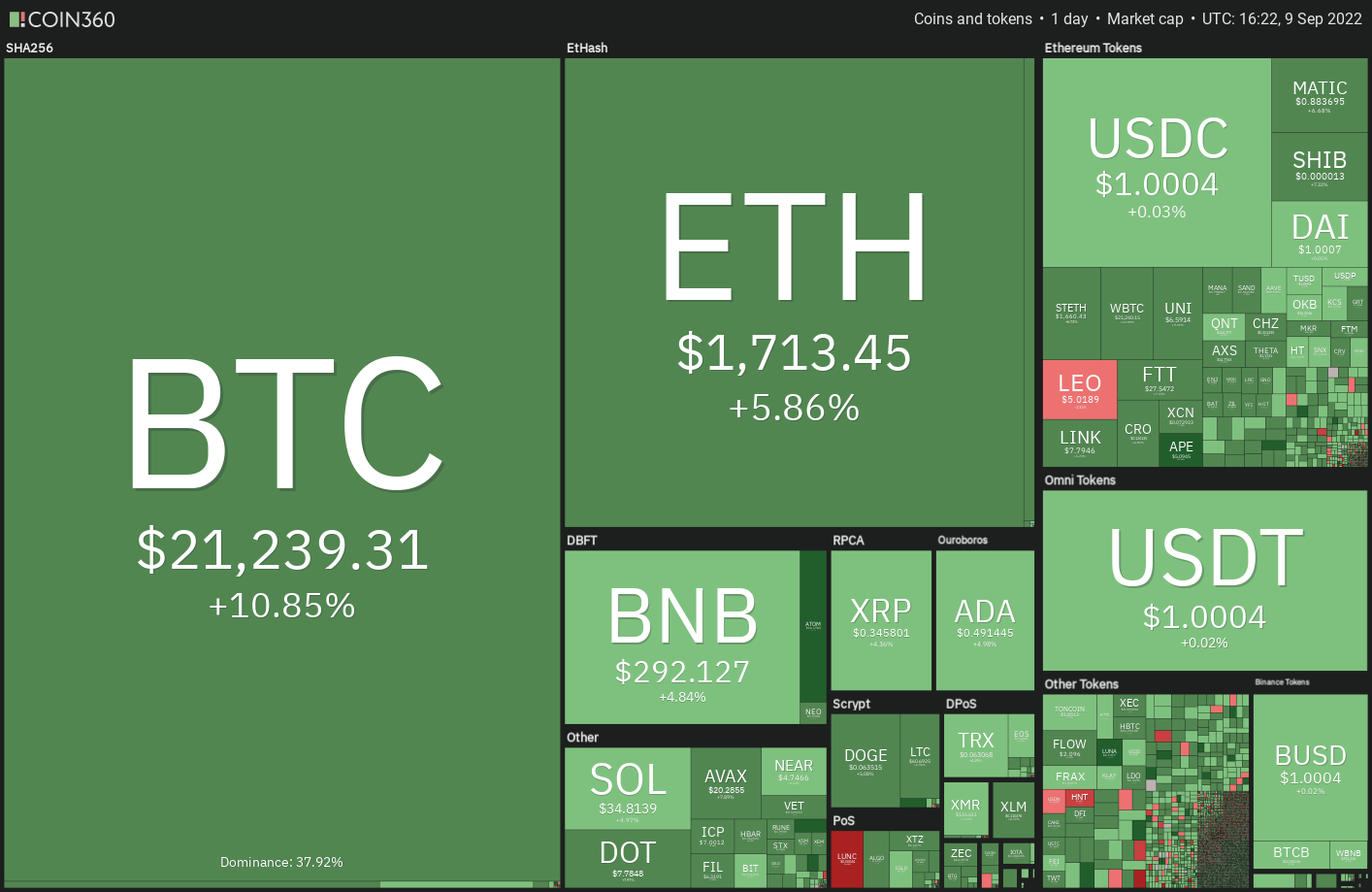

U.S. equities markets are trying to snap a 3-week losing streak while Bitcoin (BTC) has soared over the mental level at $21,000.

Will the rally within the equities and crypto markets indicate the risk-on sentiment has returned? Let’s evaluate five asset classes to examine their trends and see where they may go within the next couple of days.

BTC/USDT

Bitcoin rebounded from the strong support at $18,626 on Sept. 7 and broke back over the breakdown degree of $19,520 on Sept. 9. This might have triggered short-covering through the aggressive bears, which propelled the cost over the 20-day exponential moving average (EMA) ($20,434).

The relative strength index (RSI) has risen in to the positive territory and also the 20-day EMA is flattening out, indicating the bears might be losing their grip.

The 50-day simple moving average (SMA) ($21,981) may behave as a small hurdle, but when bulls overcome it, the BTC/USDT pair could rally towards the overhead resistance at $25,211. A rest and shut above this level could develop a double bottom pattern. This type of move may signal the beginning of a brand new up-move. The pattern target of the reversal setup is $31,796.

Unlike this assumption, when the cost turns lower in the 50-day SMA or $25,211, the happy couple could enter a consolidation for any couple of days.

Some-hour chart implies that the happy couple selected up momentum after breaking above $19,520. The moving averages have finished a bullish crossover, indicating benefit to buyers however the RSI within the overbought zone suggests a small consolidation or correction for the short term.

When the cost turns lower in the current level or even the overhead resistance at $21,900 but doesn’t break below $20,576, it’ll claim that the sentiment has altered from selling on rallies to purchasing on dips. That may increase the probability of a rest above $21,900.

The very first manifestation of weakness is a break and shut underneath the moving averages. In the event that happens, it’ll claim that the present rise might have been a sucker’s rally.

DXY

The U.S. dollar index (DXY) is correcting inside a strong upward trend. After hitting a multi-year high at 110.78, the index has observed profit-booking that has pulled the cost towards the 20-day EMA ($108.64).

Even though the rising moving averages indicate benefit to buyers, the RSI has created an adverse divergence, indicating the bullish momentum might be weakening. When the cost sustains underneath the 20-day EMA, the following stop may be the upward trend line.

It is really an important level to keep close track of just because a break and shut below it might indicate a possible trend change. The index could then decline to $104.63. A rest below this level could claim that the index might have capped out.

On the other hand, when the cost rebounds from the moving averages with strength, it’ll indicate the sentiment remains bullish and traders are viewing the dips like a buying chance. If bulls push the cost above $110.78, the rally could include $113.95.

The 20-EMA has switched lower around the 4-hour chart and also the RSI is incorporated in the negative territory, indicating that bears possess the upper hands soon. The index could drop towards the immediate support at $108.

When the cost rebounds off $108 but does not break over the 20-EMA, it’ll claim that the sentiment has shifted from buying on dips to selling on rallies. That may increase the probability of a rest below $108. In the event that happens, the index could begin a much deeper correction.

Unlike this assumption, when the cost appears in the current level and breaks over the 20-EMA, the index could rise to $110.24 after which to $110.78. Buyers will need to overcome this barrier to point the resumption from the upward trend.

SPX

The S&P 500 is within a bottoming formation and is trying to form a greater floor near 3,900. The cost rebounded from the upward trend line, indicating that ‘abnormal’ amounts are attracting buyers.

The 20-day EMA ($4,050) is a vital level to take into consideration soon. If bulls drive the cost above this resistance, it’ll claim that the most recent leg from the correction might have ended.

The index could after that chance a rally to $4,200. This level may behave as a small hurdle but when bulls overcome it, the recovery could achieve the critical overhead resistance at $4,325.

This positive view could invalidate for the short term when the cost turns lower in the 20-day EMA. In the event that happens, the bears will endeavour to sink the cost underneath the upward trend line. When they succeed, the decline could achieve major support at 3,700.

Some-hour chart implies that the current correction pulled the RSI in to the oversold territory. That began a bounce, which arrived at the downtrend line. Buyers will need to push the cost above this potential to deal with indicate a possible trend change. The index could then rise towards the 50-SMA and then to $4,200.

On the other hand, when the cost turns lower in the downtrend line and slips underneath the 20-EMA, it’ll claim that bears still sell on rallies. The bears will make an effort to sink the cost below $3,886 and resume the downward move.

Related: Bitcoin cost cracks $21K as trader states BTC buy now ‘very compelling’

GC

Gold futures (GC) is within a downtrend but it’s attempting to create a greater low at $1,700. The cost has arrived at the moving averages, that is serving as a powerful resistance as seen in the lengthy wick around the Sept. 9 candlepower unit.

When the cost turns lower in the current level, it’ll claim that the sentiment remains negative and traders can sell on rallies. The bears will make yet another make an effort to sink the cost below $1,700 and challenge the important support at $1,675.

On the other hand, when the cost appears and breaks over the moving averages, it’ll claim that the bears might be losing their grip. That may push the cost towards the downtrend line. A rest and shut above this resistance could indicate the downtrend might be over. That may begin a rally to $1,825.

Some-hour chart shows bears are strongly protecting the overhead resistance at $1,737.40. When the cost slips underneath the moving averages, the decline could include $1,700. Which will advise a range-bound action between $1,700 and $1,737.40 for many additional time.

Alternatively, when the cost appears in the moving averages, it’ll claim that bulls are purchasing on minor dips. The bulls will attempt to propel the cost above $1,741. When they succeed, a rally to $1,774.80 can be done.

CL

Oil futures (CL) has been around a downtrend within the last several days. Buyers tried to begin a sustained recovery in August however the bears effectively defended the 50-day SMA ($94) on August. 30.

The bulls attempted to arrest the decline near $85.73 however the level cracked on Sept. 7 and oil started again its downtrend. A small positive would be that the bulls haven’t permitted the bearish momentum to get. This signifies buying at ‘abnormal’ amounts. The bulls are trying to push the cost back over the breakdown degree of $85.73.

It is really an important level to keep close track of if the cost sustains above $85.73, it might catch several aggressive bears unawares. That could cause a brief squeeze and also the cost could rise towards the 50-day SMA.

On the other hand, when the cost turns lower from $85.73, it’ll indicate that bears have flipped the amount into resistance. The sellers will attempt to resume the downtrend by pulling the cost below $81.20. When they succeed, the decline could include $70.

Crude Oil’s 4-hour chart shows an optimistic divergence around the RSI. This means the negative momentum might be weakening. Buyers have pressed the cost over the 20-EMA and also the breakdown degree of $85.73, the first indication the selling pressure might be reducing. The rally could next include $88.

Alternatively, when the cost does not sustain above $85.73, the bears will attempt to sink the cost back underneath the 20-EMA. When they succeed, the cost could dip to $82.71 and then to $81.20.

The rally may not break the popularity

Bitcoin’s recovery is basically driven through the pullback within the DXY and also the rally within the SPX as observed in case study above. These two assets are largely determined by the Fed’s action within the next meeting which could dictate Bitcoin’s direction soon. The Bitcoin bulls should always keep an eye on the DXY and also the SPX for confirmation of the bottom in Bitcoin.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.