On March. 4 and 5, Bitcoin (BTC) required another step with the $20,000 mark, getting the cost over a lengthy-term climbing down trendline that stretches completely to April 22 or November. 15, based on one’s type of technical analysis.

Some traders may be feeling a little celebratory since cost trades outdoors from the climbing down trendline, but have relevant metrics or macro factors altered enough to aid a bullish point-of-view for Bitcoin cost?

The truth is, BTC cost simply “consolidated” its way with the trendline by buying and selling inside a sideways manner where cost continues to be range bound between $18,500 and $24,500 within the last 114 days.

Direction-wise, Bitcoin and Ether (ETH) have a tendency to exchange tandem with equities and BTC’s March. 4 rally to $20,365 may come as the Dow jones, S&P 500 and Nasdaq closed your day with 2% to threePercent gains.

Like a indication that short-term cost action isn’t always reflective of the bigger trend change, Gold coin Metrics stated:

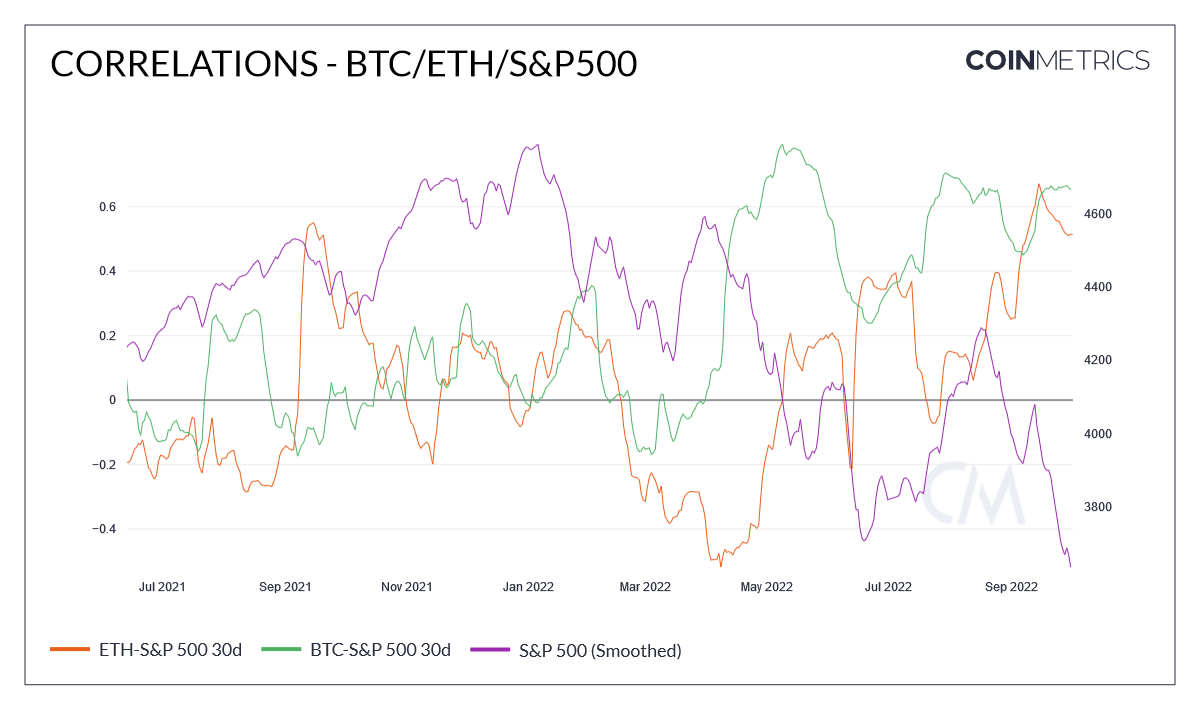

“Correlations among BTC, ETH along with the S&P 500 have elevated lately because the benchmark index fell in cost to 3600, which was not breached since December of 2020.”

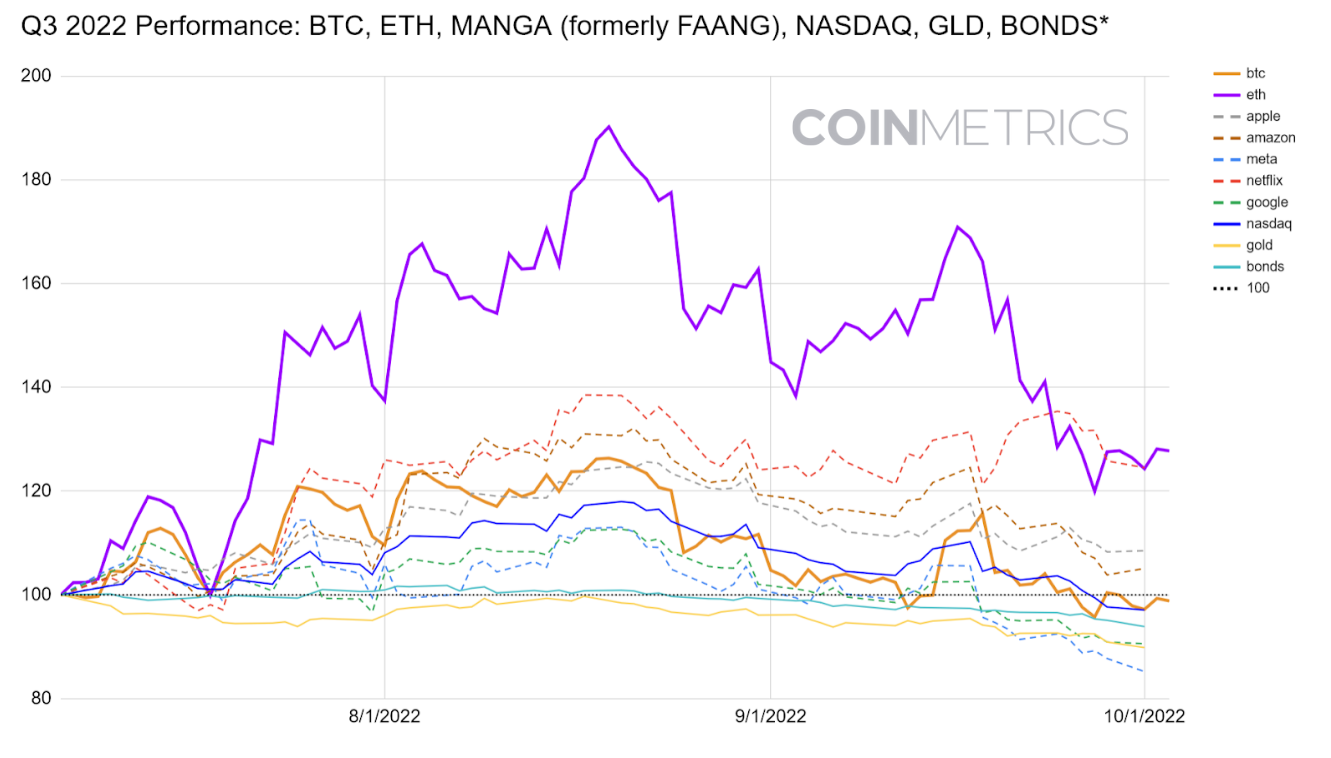

Regardless of the March. 4 “all-in rally” in stocks and crypto markets, bigger fears of worldwide runaway inflation, rising rates of interest along with other economic concerns still suppress investors’ appetite for getting together with markets, an undeniable fact that is clearly reflected in Q3 results.

On March. 5, OPEC announced intends to cut oil production by two million barrels each day, that is roughly equal to 2% of theglobal oil demand. Oil stocks rallied in the announcement, however the White-colored Home is likely concerned the reductions will complicate the government Reserve’s combat inflation and perhaps lead to greater gas prices.

Generally, institutional investors like CITI and Goldman Sachs expect volatility in equities markets to carry on, and have revised lower their finish-of-year targets for that S&P 500, while investors continue to be predicting a lower year in 2023.

All stated, inflation remains high around the world, corporate earnings expectations are now being adjusted towards the downside, and also the Given seems with confidence resolute in the current plans for reducing inflation.

None of those developments are favorable for enhancing investors’ risk sentiment, and given Bitcoin’s correlation with equities markets and sensitivity to bearish economic news flow, it appears unlikely that BTC penetrating the climbing down trendline is an indication of the trend change.

A far more convincing development will be a range-break and a number of daily closes above $25,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.