Bitcoin (BTC) enters a brand new week having a question mark within the fate from the market in front of another key U . s . States financial policy decision.

After sealing a effective weekly close — its greatest since mid-June — BTC/USD is a lot more careful because the Fed prepares to hike benchmark rates of interest to battle inflation.

Even though many wished the pair could exit its recent buying and selling range and continue greater, the load from the Given is clearly visible because the week will get going ahead, adding pressure for an already fragile risk asset scene.

That fragility can also be showing in Bitcoin’s network fundamentals as miner strain becomes real and also the true price of mining with the bear market shows.

Simultaneously, you will find encouraging signs from some on-chain metrics, with lengthy-term investors still refusing to provide in.

Cointelegraph analyzes the week’s possible market movers inside a tense week for crypto, equities and much more.

Given to select next rate hike in “another fun” week

The storyline each week, everything being equal, isn’t any doubt the Fed rate hike.

A well-recognized tale, the government Open Markets Committee (FOMC) on This summer 26-27 might find policymakers choose the level from the next rate of interest move. This really is tipped to become either 75 or 100 basis points.

U.S. inflation, as with many jurisdictions, reaches forty-year highs, and it is advance seems to possess caught the establishment unexpectedly as requires an optimum are met with even bigger gains.

“Should be another fun one,” Blockware lead insights analyst William Clemente summarized on This summer 25.

The eye rate decision arrives This summer 27 at 2:00 pm EST, a diary date that is possibly supported by elevated volatility across risk assets.

This can be exacerbated, one analyst cautioned, because of low summer time liquidity and too little conviction among buyers.

“Entering ECB/FOMC/Tech Earnings among the cheapest liquidity of the season. Marketplace is to overbought. Bulls, allow it to ride,” Twitter account Mac10 authored.

An earlier publish also flagged Q2 earnings reports as potentially adding to some downwards move consistent with previous behavior.

Tech Earnings and FOMC happen to be catalyst for 2 major crashes in 2022.

“This time around will change” pic.twitter.com/XgS1dDOLce

— Mac10 (@SuburbanDrone) This summer 22, 2022

“BTC and risk assets have pumped greater on FOMC occasions this season, simply to sell after, is that this time different?” fellow analysis account Tedtalksmacro ongoing:

“June’s FOMC meeting saw the united states fed generate a 75bps hike – the only largest since 1994. More hefty hikes are anticipated before inflation is ‘normalised.’”

A few days has already been feeling dissimilar to last, before occasions begin unfolding — Asian financial markets are flat compared to last week’s bullish tone, the one that supported an upsurge across Bitcoin and altcoins.

While one argument states the Given cannot raise rates a lot more without tanking the economy, meanwhile, Tedtalksmacro pointed towards the marketplace like a target to keep hikes coming.

“Bitcoin will find it difficult to move forward from 28k until data deteriorates,” he added.

Place cost does not nail key moving average

Bitcoin’s latest weekly close was something of the midway house for bulls, data from Cointelegraph Markets Pro and TradingView shows.

While managing its best performance in more than a month, BTC/USD overlooked reclaiming the fundamental 200-week moving average (MA) at $22,800.

Following the close, which arrived around $22,500, Bitcoin started falling to the foot of its latest buying and selling range, still lingering below $22,000 during the time of writing.

Hello legends

Range high dump throughout the overnight session on $ETH and $BTC ..

Searching for many relief when we holds $1460 on $ETH and $21,700 on $BTC

Chart updates in the future

— Crypto Tony (@CryptoTony__) This summer 25, 2022

“Observing When we find support at $21,666 horizontal. Persistence,” popular trader Anbessa told Twitter supporters in the latest update.

Fellow account Crypto Chase, meanwhile, recommended that the go back to the 200-week MA would increase the risk for further modest upside.

“Chopping round the Daily S/R (red box) by having an lack of ability to switch 22.8K (Daily resistance) to aid. Multiple attempts to do this, but failing to date,” he authored alongside explanatory charts:

“If cost pushes above again and finds acceptance, I’ll watch 22.8K to get support for potential lengthy admission to 23.2K.”

A later update eyed $21,200 like a potential bearish target, this developing an assistanceOropposition level around the daily chart.

At $21,900, however, Bitcoin still remains around $1,200 greater in comparison to the same point the other day.

Elsewhere, the most recent cost action wasn’t enough to alter lengthy-term views. For Venturefounder, a contributor at on-chain analytics firm CryptoQuant, a macro bottom had yet to look, this potentially arriving as little as $14,000.

“Inline using the past halving cycles, this really is still my most viable forecast for Bitcoin before next halving: BTC will capitulate within the next 6 several weeks & hit cycle bottom (between $14-21k), then chop around in $28-40k in many of 2023 and become at ~$40k again by next halving,” a retweeted forecast initially from June reiterated.

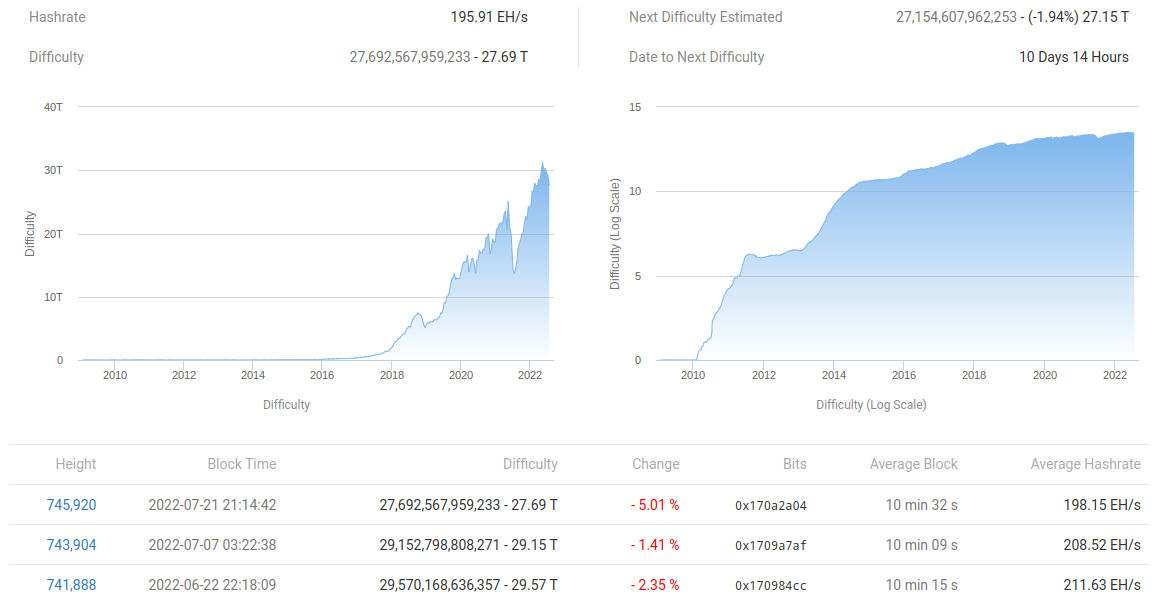

Difficulty returns to March levels

Inside a sign that miners’ troubles because of cost weakness may you need to be beginning, upheaval has become visible over the Bitcoin network.

Difficulty, the way of measuring competition among miners which adjusts itself in accordance with participation, continues to be declining since late June and it is now back at levels not seen since March.

The newest adjustment was particularly noticeable, knocking 5% from the difficulty total and heralding alternation in miner activity. Which was the biggest single drop since May 2021, and subsequently, due in ten days’ time, is presently believed to consider difficulty lower another 2%.

As perhaps the most crucial part of the Bitcoin network itself, difficulty adjustments also set the scene for recovery by leveling the arena for miners. The low the problem, the “easier” — or fewer energy-intensive — it’s to mine BTC because of there being less competition overall.

Meanwhile, however, the necessity to stay afloat remains a preoccupation, data shows. According to CryptoQuant, miners sent 909 BTC to exchanges on This summer 24 alone, probably the most per day since June 22 along with a 5% difficulty decrease.

A turnaround for miners thus remains from sight now.

As Cointelegraph furthermore reported, it’s not only the BTC cost that’s giving miners difficulty under current conditions.

Congratulations towards the MVRV-Z score

Among the hottest on-chain metrics in Bitcoin just entered what’s perhaps its most significant level — zero.

On This summer 25, Bitcoin’s MVRV-Z Score came back to negative territory following a brief week above, in that way falling in to the zone typically restricted to macro cost bottoms.

#Bitcoin $BTC MVRV Z-Score just entered .

Before: .010 -> Now: -.000

View metric:https://t.co/IBVIM3J84o pic.twitter.com/DRGqIxKW7w

— glassnode alerts (@glassnodealerts) This summer 25, 2022

MVRV-Z shows how overbought or oversold BTC is in accordance with “fair value” and it is popular because of its uncanny capability to define cost floors.

Its return could signal a brand new duration of cost pressure, as precision in catching bottoms includes a two-week margin of error.

At the outset of This summer, Cointelegraph reported on MVRV-Z, giving a worst-situation scenario of $15,600 for BTC/USD now.

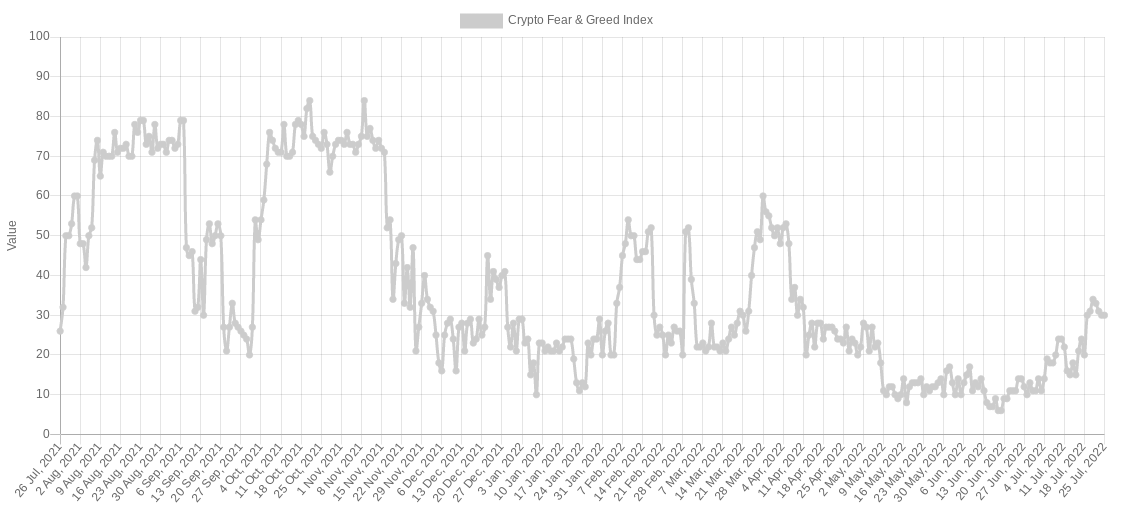

Sentiment cools from four-month highs

For that crypto market, yesteryear week might happen to be a short period of irrational exuberance if sentiment data will be believed.

Related: 5 Best cryptocurrencies to look at now: BTC, ETH, BCH, AXS, EOS

The most recent figures in the Crypto Fear & Avarice Index show a stable decline from what’s been probably the most positive market sentiment since April.

By This summer 25, the Index is 30/100 — still referred to as “fear” driving the atmosphere overall but nonetheless five points over the “extreme fear” bracket where the market formerly spent a record 73 days.

Sentiment has nevertheless made quite the comeback since mid-June when Fear & Avarice hit a number of its cheapest levels on record just 6/100.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.