Ether (ETH) cost expires 16% since This summer 1 and it has outperformed Bitcoin (BTC) within the last seven days. The move might be partly driven by investors clinging for their hopes the Ethereum network transition to proof-of-stake (PoS) consensus is a bullish catalyst.

The following steps with this smart contract involve “the Merge,” that was formerly referred to as Eth 2.. The ultimate trial around the Goerli test network is anticipated in This summer prior to the Ethereum mainnet will get the eco-friendly light because of its upgrade.

Since Terra’s ecosystem collapsed in mid-May, Ethereum’s total value locked (TVL) has elevated and also the flight-to-quality within the decentralized finance (DeFi) industry largely benefited Ethereum because of its robust security and fight-tested applications, including MakerDAO.

Ethereum presently holds a 57% share of the market of TVL, up from 51% on April 8, based on data from Defi Llama. Regardless of this gain, the present $35 billion in deposits around the networks’ smart contracts appear less space-consuming than the $100 billion observed in December 2021.

Further supporting the reduction in decentralized application experience Ethereum is really a stop by the median transfer charges, or gas costs, which presently stand at $1.32. This figure may be the cheapest since mid-December 2020 once the network’s TVL was at $13 billion. However, one might attribute area of the movement to greater utilization of layer-2 solutions for example Polygon and Arbitrum.

Options traders flirt using the neutral range

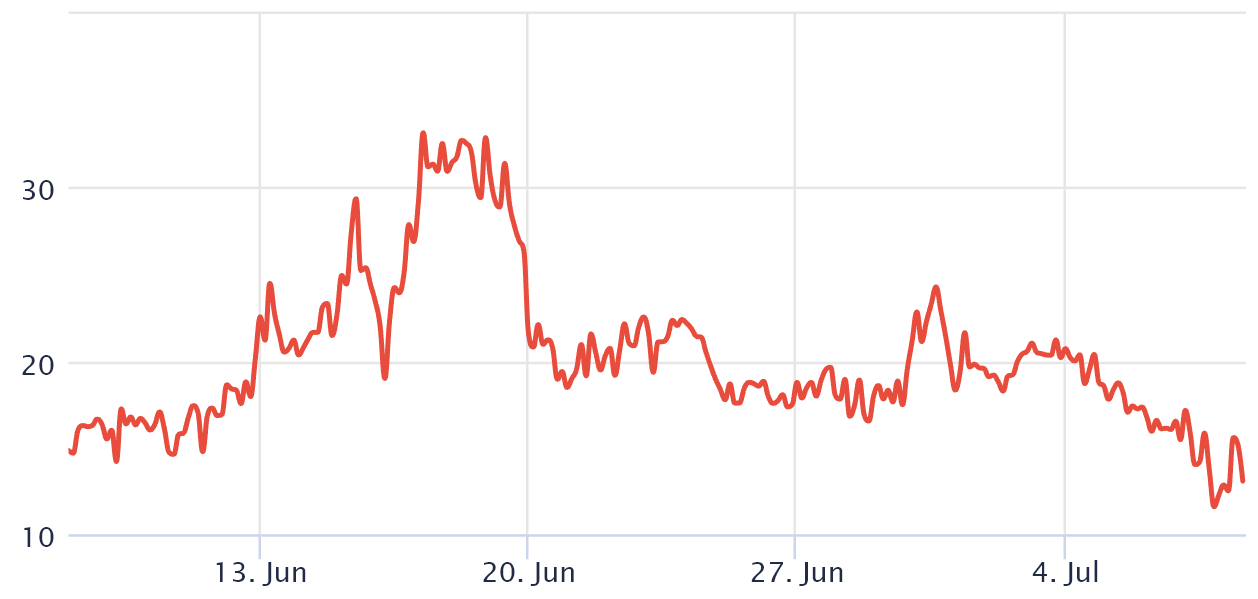

Traders need to look at Ether’s derivatives markets data to know how whales and market makers are situated. For the reason that sense, the 25% delta skew is really a telling sign whenever professional traders overcharge for upside or downside protection.

If investors expect Ether cost to rally, the skew indicator moves to -12% or lower, reflecting generalized excitement. However, a skew above 12% shows desire not to take bearish strategies, usual for bear markets.

The skew indicator briefly touched the neutral-to-bearish range on This summer 7 as Ether completed a 19% rally in four days. But individuals option traders soon shifted to some more conservative approach, giving greater likelihood of an industry downturn because the skew moved to the present 13% level. In a nutshell, the greater the index, the less inclined traders will be to cost downside risk.

Margin traders have switched very bullish

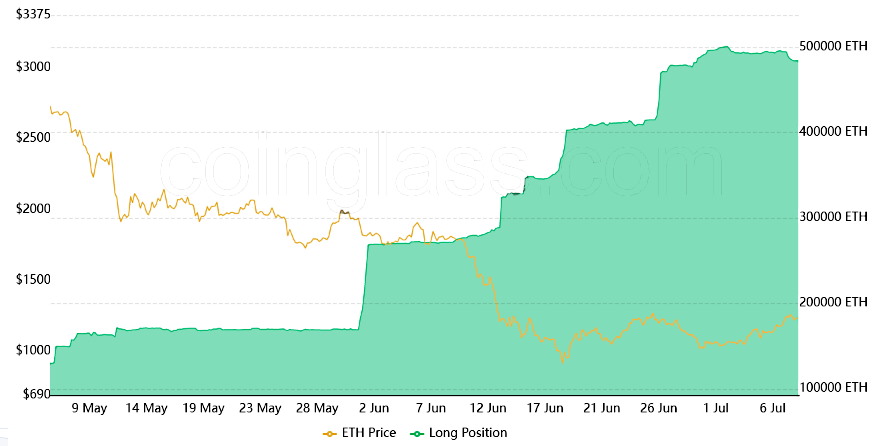

To verify whether these movements were limited towards the specific options instrument, you ought to evaluate the margin markets. Lending enables investors to leverage their positions to purchase more cryptocurrency. When individuals savvy traders open margin longs, their gains (and potential losses) rely on the Ether cost increase.

Bitfinex margin traders are recognized for creating position contracts of 100,000 ETH or greater in an exceedingly small amount of time, indicating the participation of whales and enormous arbitrage desks.

Interestingly, these margin traders greatly elevated their longs since June 13 and also the current 491,000 contracts is near its greatest level in 8 several weeks. This data implies that these traders are effectively not expecting a disastrous cost move below $900.

While there has not been a substantial transfer of pro traders’ options risk metrics, margin traders remain bullish and therefore are reluctant to lower their longs regardless of the “crypto winter.”

If these whales and market makers think that $880 on June 18 was the complete bottom, traders can start to think the worst leg from the bear marketplace is behind us.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.