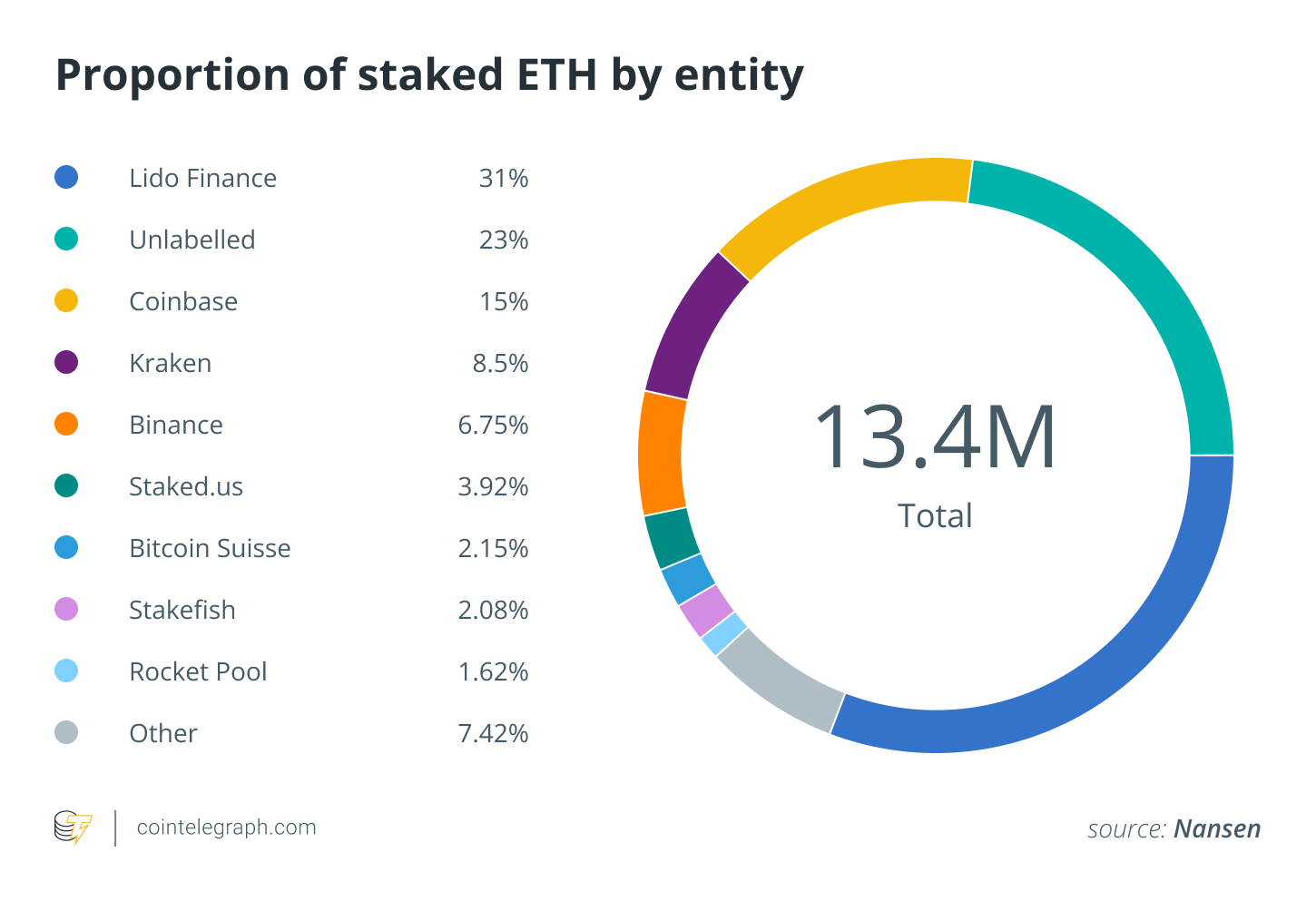

A study from blockchain analytics platform Nansen highlights 5 entities that hold 64% of staked Ether (ETH) in front of Ethereum’s long awaited Merge using the Beacon Chain.

Ethereum’s shift from proof-of-try to proof-of-stake is placed to occur within the future after final updates and shadow forks have bee completed in early September. The important thing element of The Merge sees miners no more utilized as validators, substituted with stakers that commit ETH to keep the network.

Nansen’s report highlights that simply over 11% from the total circulating ETH is staked, with 65% liquid and 35% illiquid. There’s a total of 426,000 validators and a few 80,000 depositors, as the report also highlights a little number of entities that command a substantial part of staked ETH.

Three major cryptocurrency exchanges take into account nearly 30% of staked ETH, namely Coinbase, Kraken and Binance. Lido DAO, the greatest Merge staking provider, makes up about the biggest quantity of staked ETH having a 31% share, while a fifth unlabelled number of validators holds 23% of staked ETH.

Lido along with other decentralized on-chain liquid staking protocols were initially setup like a counter-risk to centralized exchanges accumulating nearly all staked ETH, considering that these lenders are needed to conform with jurisdictional rules.

Related: Experts weigh in around the Ethereum vulnerabilities after Merge: Finance Redefined

Nansen’s report stresses the requirement for Lido to become sufficiently decentralized to stay resistant against censorship. Onchain data implies that possession of Lido’s governance token (LDO) is targeted, with categories of large tokenholders potentially transporting censorship risk.

“For example, the very best 9 addresses (excl. treasury) hold ~46% of governance power, and a small amount of addresses typically dominate proposals. The stakes for correct decentralization are extremely high to have an entity having a potential majority share of staked ETH.”

Nansen also concedes the LIDO community is positively seeking methods to the danger of over-centralization, with initiatives including dual governance in addition to a legally and physically distributed validator set suggested.

Because of the ongoing slump in cryptocurrency markets, nearly all staked ETH is presently from profit – lower by ~71%. Meanwhile 18% of staked ETH takes place by illiquid stakers which are in-profit.

Nansen shows that this group of stakers is easily the most prone to sell their ETH once withdrawals are enabled in the Shanghai upgrade. Fears of the major sell-off in the Merge are unwarranted, though, as ETH withdrawals are only possible six to twelve several weeks following the Merge.

“Even then, not everybody can withdraw their stake at the same time as there’s an exit queue in position for validators like the activation queue close to six validators (usually 32 ETH each) per epoch (~6.4 min).”

Nansen notes when all validators withdrew their staked ETH and stopped being validators, this could take around 300 days with more than 13 million ETH staked.

The blockchain and analytics platform announced the launch of the new information and education arm alongside its Merge report, targeted at marrying its on-chain data analytics with masterclasses and research papers. Nansen Research Portal may also publish industry-expert research reports from various partners within the blockchain and cryptocurrency industry.