After a remarkable 73% rally between This summer 13 and August. 13, Avalanche (AVAX) has faced a 16% rejection in the $30.30 level of resistance. Some analysts will attempt to pin the correction like a “technical adjustment,” however the network’s deposits and decentralized applications reflect worsening conditions.

Up to now, Avalanche remains 83% below its November 2021 all-time high at $148. More data than technical analysis could be examined to describe the 16% cost drop, so let’s check out the network’s use when it comes to deposits and users.

The decentralized application (DApp) platform continues to be a high-15 contender having a $7.2 billion market capital. Meanwhile, Solana (SOL), another proof-of-work (Bang) layer-1 platform, holds a $14.2 billion market cap, that is nearly two times the size of Avalanche’s.

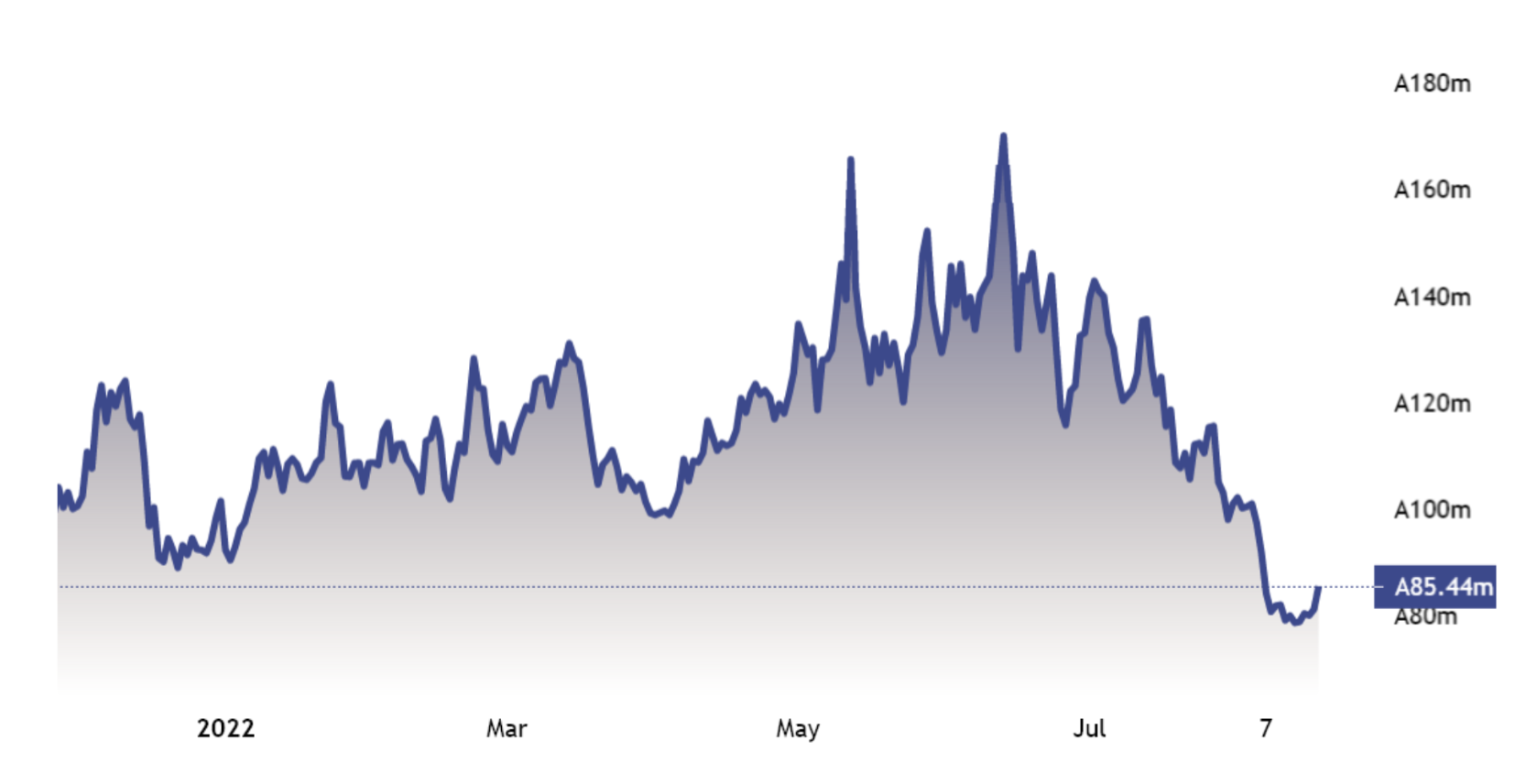

Avalanche’s TVL dropped 40% in 2 several weeks

Some analysts have a tendency to give an excessive amount of weight towards the total value locked (TVL) metic and even though this may hold relevance for that decentralized finance (DeFi) industry, it’s rarely needed for nonfungible token (NFT) minting, digital item marketplaces, crypto games, gambling and social applications.

While using layer-2 solution Polygon (MATIC) like a proxy, it presently holds a $2.2 billion TVL while MATIC’s market cap is $7.2 billion thus, a 3.3x MCap/TVL ratio. Strangely enough, exactly the same ratio pertains to Avalanche, which presently holds an identical $2.2 billion TVL and $7.2 billion capital.

Avalanche’s primary DApp metric started to show weakness at the end of This summer following the TVL dropped below 110 million AVAX. In 2 several weeks, the present 85.4 million is really a sharp 40% cut and signals that investors happen to be withdrawing coins in the network’s smart contract applications.

The chart above shows how Avalanche’s smart contracts deposits peaked at 175 million AVAX on June 13, adopted with a constant decline. In dollar terms, the present $2.2 billion TVL may be the cheapest number since September 2021. The dpi represents 8.2% from the aggregate TVL (excluding Ethereum), according to data from DefiLlama.

Initially, the information appears disappointing, especially thinking about Solana’s network TVL reduced by 27% within the same period in SOL terms, and Ethereum’s TVL declined by 33% in ETH deposits.

DApp use has additionally underperformed competing chains

To verify if the TVL stop by Avalanche is difficult, you ought to evaluate a couple of DApp usage metrics.

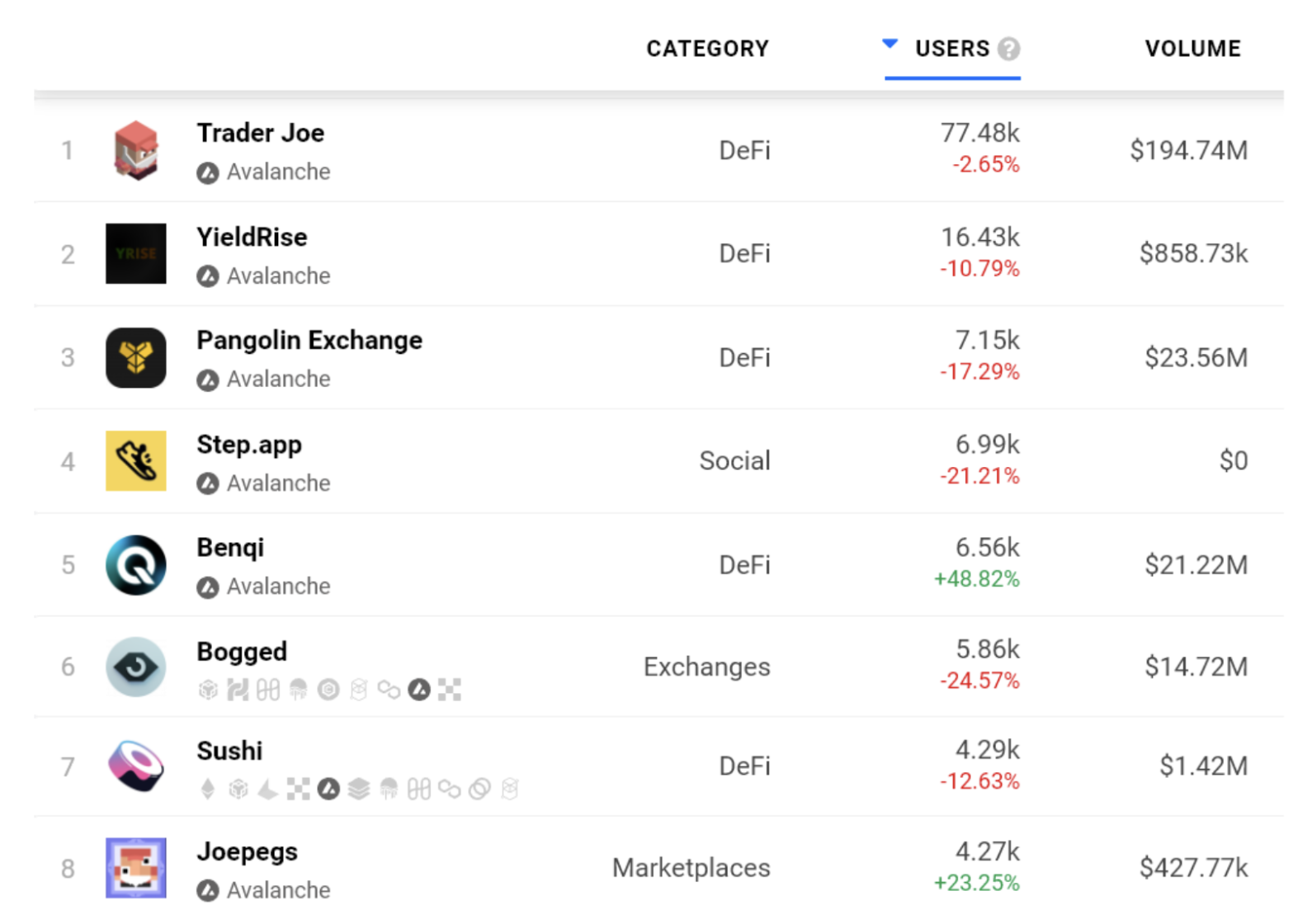

As proven by DappRadar, on August. 18, the amount of Avalanche network addresses getting together with decentralized applications declined by 5% in comparison to the previous month. Compared, Ethereum published a 4% increase and Polygon users acquired 10%.

Avalanche’s TVL continues to be hit the toughest when compared with similar smart contract platforms and the amount of active addresses getting together with most DApps only surpassed 20,000 in a single situation. This data ought to be an alert signal for investors betting about this automated blockchain execution solution.

Polygon, however, tallied up 12 decentralized applications with 20,000 or mo active addresses in the same time frame period. The findings above claim that Avalanche is losing ground versus competing chains which adds further reason behind the current 16% sell-off.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.