Technical analysis shows that a current upward trend within the cost of Aave (AAVE) is showing indications of exhaustion according to early growth and development of a vintage bearish reversal pattern.

Is AAVE headed to $70?

Dubbed a “rising wedge,” the pattern surfaces once the cost increases in the range based on two climbing, converging trendlines. In fact, the buying and selling volume declines, pointing to too little conviction among traders when additional buying is required for ongoing upside momentum.

Therefore, falling wedges typically create a bearish breakout in which the cost breaks underneath the pattern’s lower trendline and falls up to the utmost distance between your wedge’s lower and upper trendline.

AAVE continues to be painting an identical pattern among its sharp upside change from nearly $61.50 on May 12 to in excess of $93.50 on May 17. If your sustained breakdown pans out, AAVE will fall by a minimum of $27, the wedge’s maximum height, as proven within the chart below.

This puts AAVE on the way to around $70, lower about 25% in the current cost at $89.20.

Related: Bitcoin macro bottom ‘not in yet’ warns analyst as BTC cost holds $30K

Bearish headwinds persist

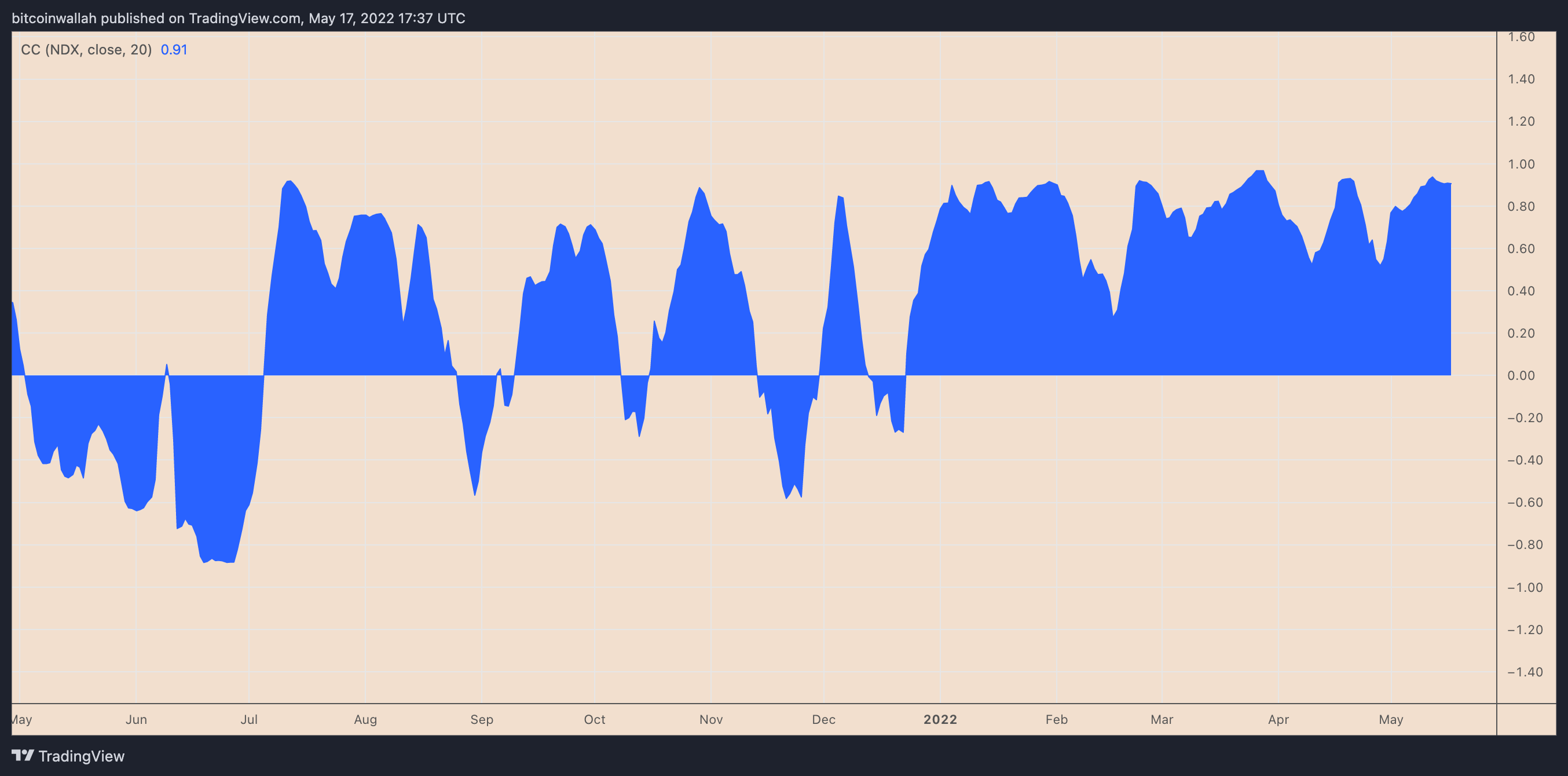

The bearish setup for AAVE seems within the wake from the crypto market’s ongoing strong correlation with U.S. equity markets.

The daily correlation coefficient between AAVE and also the tech-heavy Nasdaq 100 was at .91 by May 17, underscoring the two markets happen to be relocating an almost-perfect tandem.

Fundamentally of the synchronous trends may be the Federal Reserve’s ultra-hawkish financial policies, such as the recent .5% hike in benchmark rates of interest, against rising inflation.

Anxiety about ongoing sell-off continues to be Wall Street veterans warn in regards to a looming recession.

Based on Lloyd Blankfein, the previous Chief executive officer of Goldman Sachs, higher rates of interest, along with logistics issues, fresh lockdowns in China and also the conflict in Ukraine can keep inflation high. The persistent mixture of these 4 elements could make the Fed keep its hawkish policies and also the knock-on-effect is a decrease in U.S. economic growth.

Similarly, Michael J. Wilson, Morgan Stanley’s chief U.S. equity strategist and CIO reiterated exactly the same catalysts while predicting a 15% loss of the benchmark S&P 500 index. Because of its correlation with cryptocurrency, AAVE also risks similar downside moves heading further into 2022.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.