Aave DAO, the governance body behind decentralized finance (DeFi) giant Aave, has voted practically unanimously to produce an overcollateralized stablecoin known as GHO.

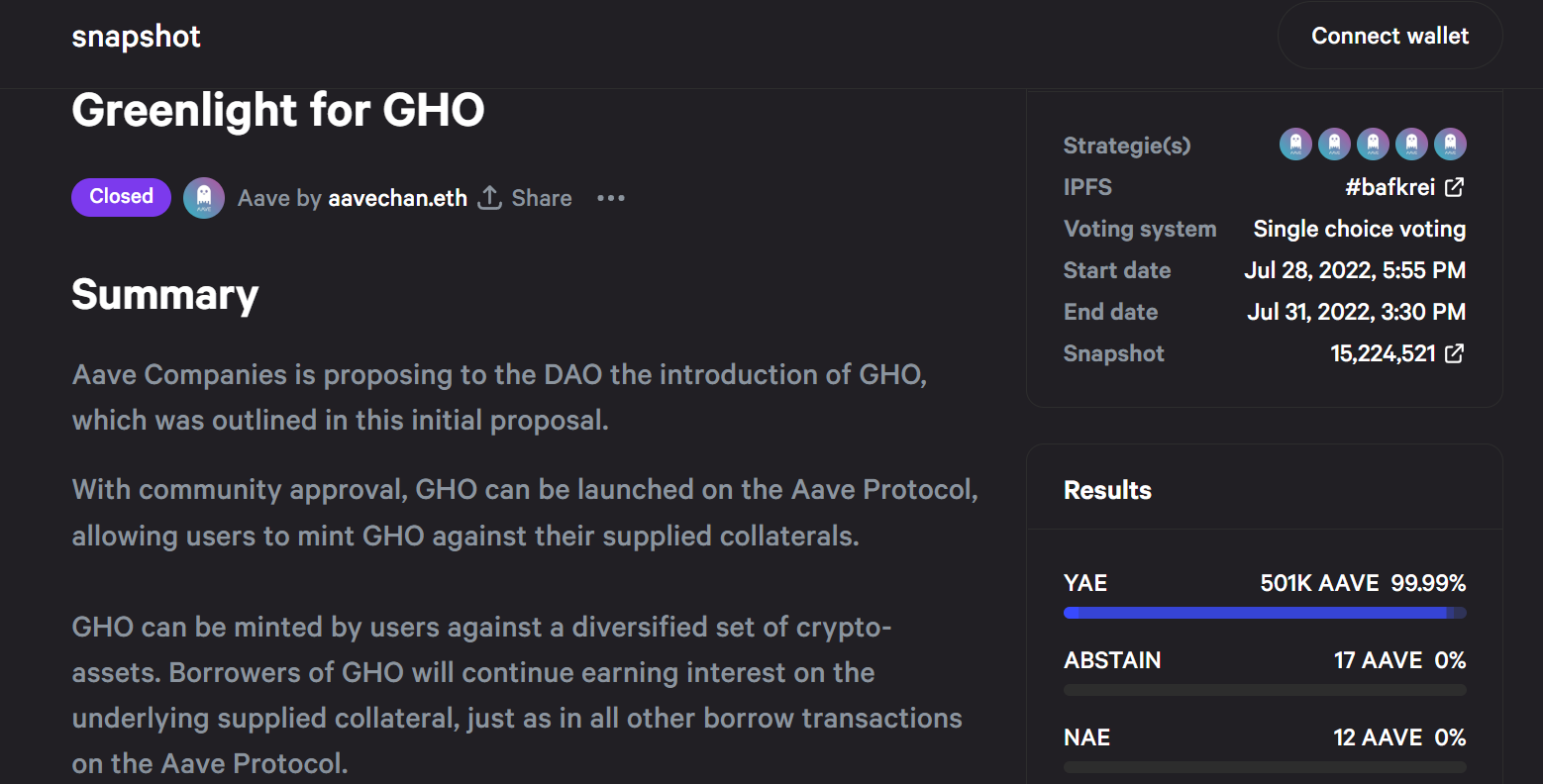

Aave Companies introduced the proposal on Thursday, also it received a massive 99.9% community election in support over 72 hours. The election ended on Sunday at 10:00 am UTC with 501,000 AAVE tokens promised in support of allowing the crypto-collateral-backed stablecoin.

GHO is a decentralized, Ethereum-based stablecoin pegged towards the U.S. dollar and collateralized with multiple crypto assets. The next phase along the way would be the development of the GHO tokens via a new Aave Improvement Proposal (AIP), and then any user searching to mint GHO can achieve this by depositing every other crypto asset recognized through the Aave protocol.

Aave is really a noncustodial decentralized crypto lending and borrowing platform and wishes to leverage its overcollateralized stablecoin to provide better liquidity and passive earnings chance.

Considering that GHO is going to be overcollateralized, users should always deposit a greater quantity of crypto compared to minting worth of the GHO. This will ensure an overcollateralized loan around the stablecoins. When the user repays the borrowed funds, their position is going to be liquidated as well as their lent GHO is going to be burned.

The lending protocol may also charge interest on loans removed in GHO, with payments returning to the Aave DAO treasury, as opposed to the standard reserve factor collected when users borrow other assets.

Related: Aave to produce overcollateralized stablecoin known as GHO

Aave’s announcement introduced back recollections from the lately depegged TerraUSD (UST) stablecoin — since rebranded to TerraUSD Classic (USTC) — whose collapse easily wiped out nearly $40 billion of investors’ money. As a result, many users were quick to dismiss GHO as the second stablecoin slated for depegging.

They always exercise. Go #AAVE

Depegging? Easy.Just deploy more capital. Steady gals. pic.twitter.com/PnNFLwX8mX

— Turbolion (@HogSomFan) This summer 31, 2022

Many Aave proponents were quick to indicate the problematic mechanism of UST, that was uncollateralized, eventually brought to the depegging while GHO is going to be overcollateralized, much like Dai, meaning the assets backing the stablecoin will be of greater value. One user authored:

“UST was uncollateralized and operated by a crook that attacked individuals who known as out he would be a crook. Aave is building an over collateralized algorithmic stablecoin much like DAI. Aave may be the greatest DeFi lending protocol on the planet and also have been only transparent.”

AAVE, the native token from the popular DeFi protocol, rose over 15% in the past week within the wake from the GHO proposal and it has seen a 4% surge in the last 24 hrs after it approval.