Avalanche (AVAX) cost is lower greater than 30% in April, but regardless of the negative cost move, the smart contract platform remains a high contender for decentralized applications because of its scalability, low-cost transactions and it is large footprint within the decentralized finance (DeFi) landscape.

The network works with the Ethereum Virtual Machine (EVM) and different for the reason that it doesn’t face exactly the same operational bottlenecks of high transaction charges and network congestion.

Avalanche could gather over $9 billion as a whole value locked (TVL) by providing an evidence-of-stake (PoS) layer-1 scaling solution. This indicator is very relevant since it measures the deposits around the network’s smart contracts. For example, the BNB Chain, running since September 2020, holds $10.4 billion in TVL.

Positive news could produce a cost support

Although the AVAX token cost has endured and also the TVL stands behind a number of its competitors, investors remain bullish, according to essentially positive developments that happened within the month of April.

Based on an April 14 report by Bloomberg, Ava Labs, charge developer from the Avalanche blockchain, elevated $350 million from investors. This deal valued the organization at $5.25 billion and based on data from DappRadar, Avalanche holds nearly 100 active applications, varying from decentralized finance to nonfungible token (NFT) marketplaces and gaming.

Earlier in April, the organizations behind the Terra USD algorithmic stablecoin obtained a combined $200 million in AVAX for his or her proper Terra USD reserves. Terra co-founder Do Kwon reported Avalanche’s solid ecosystem growth and enormous users list.

Despite the positive news, AVAX’s cost remains 53% below its $147 all-time high, leading to an $18.4 billion market capital. Compared, the marketplace cap of Terra (LUNA) is $31. billion, and Solana (SOL) includes a $33.3 billion total value.

Total value locked drops 10.5%, but follows the marketplace-wide downtrend

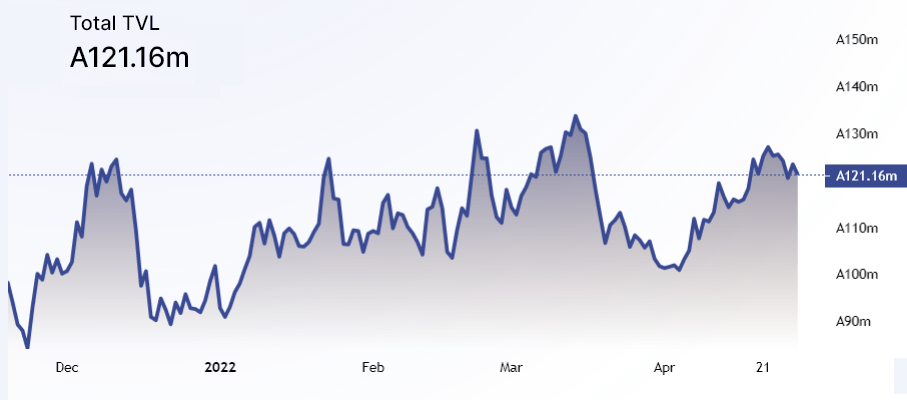

Avalanche’s primary DApp metric strengthened within the last thirty days because the network‘s TVL rebounded to 121 million AVAX.

The chart above shows how Avalanche’s DApp deposits peaked at 132.9 million AVAX on March 14, but drastically declined earlier in April towards the cheapest level since Jan. 3. Consequently, the present $8.5 billion TVL is lower 10.5% during the last thirty days.

Like a comparison, Solana’s (SOL) TVL decreased by 9.5% within the same period, reaching $4.8 billion. Similarly, Ethereum smart contract deposits decreased from $88.3 billion to $80.1 billion within the same period, that is a 9% decline.

To verify if the TVL stop by Avalanche is difficult, you ought to evaluate DApp usage metrics. Some DApps for example games and collectibles don’t require large deposits, therefore the TVL metric does not matter in individuals cases.

As proven by DappRadar, on April 28, the amount of Avalanche network addresses getting together with decentralized applications declined by 14% in comparison to the previous month. Compared, the Solana network faced a 60% user increase, while Ethereum continued to be flat.

Avalanche’s strong DeFi use-situation continues to be a bullish factor

Despite the fact that Avalanche’s TVL continues to be hit the toughest when compared with similar smart contract platforms, there’s solid network use within the DeFi segment. For example, Trader Joe’s 180,830 active addresses outnumber individuals of Ethereum’s leading DeFi application, MetaMask Swap, which holds 116,210 active users.

The above mentioned data claim that Avalanche is holding ground versus competing chains. Considering that AVAX cost stepped 29.5% in 4 weeks, investors shouldn’t panic since the decentralized application network published a good TVL and DApp usage data.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.