Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

October is in the past connected using the bulls, however in 2022, the month has additionally end up being the leader in crypto hacks as barely midway through, and also the DeFi ecosystem has seen nearly twelve hacks leading to losses of vast sums of dollars.

The biggest hack happened on Solana’s DeFi platform Mango Markets on March. 11, producing a lack of over $100 million price of crypto. The hacker has visit demand $70 million in USD Gold coin (USDC) stablecoin like a bounty to come back the stolen crypto.

In another hack, TempleDAO was exploited for $two million on the day that as Mango Market’s exploit.

Moving forward in the hacker exploits, DappRadar, a DeFi analytic firm, announced its side from the explanation on why its calculation about daily active users within the $1.6 billion metaverse ecosystem Decentraland found under 40.

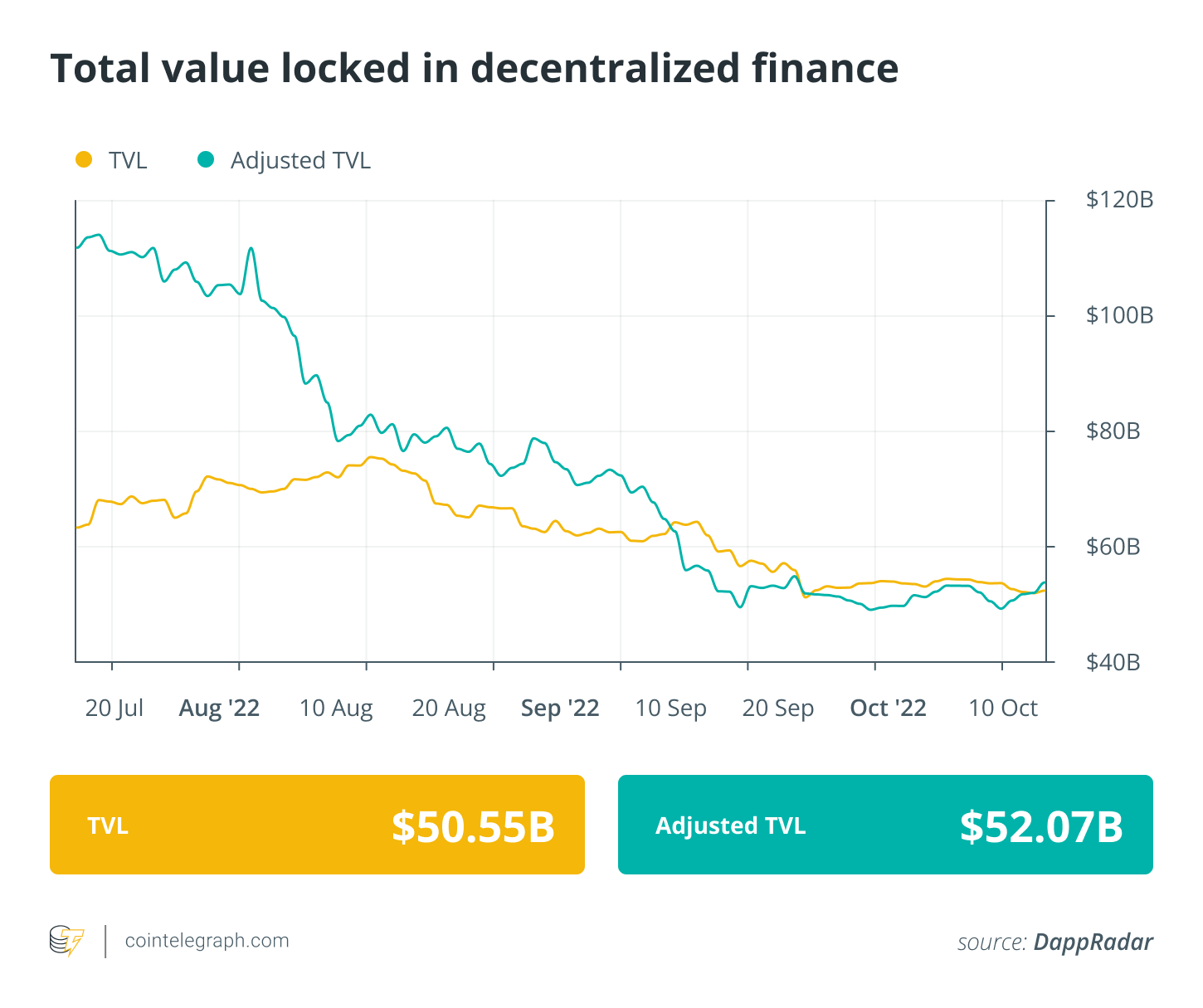

The very best 100 DeFi tokens faced bearish pressure through the week, with a few relief coming late on Thursday. A lot of the tokens traded in red around the weekly charts, barring a couple of and also the total value locked (TVL) dipped below $50 billion.

Barely midway and October may be the ‘biggest month’ in crypto hacks: Chainalysis

Blockchain analytics firm Chainalysis has labeled October 2022 as “the greatest month within the greatest year ever for hacking activity,” using the total hacked value for that month nearly reaching $718 million.

Despite not greater than midway with the month, Chainalysis stated 11 different hacks on DeFi protocols saw vast sums exploited.

Mango Markets hacker proposes steep settlement

On March. 12, eventually after $117 million was drained from Solana DeFi platform Mango Markets using a cost feed exploit, the hacker accountable for the attack required funds. The proposal was filed around the Mango Markets decentralized autonomous organization (DAO) governance forum.

If passed, the process would involve the hacker delivering stolen MNGO, SOL (SOL) and Marinade Staked SOL tokens for an address supplied by the Mango DAO team. Users without bad debt is going to be reprocessed whole. However, the hacker demands that any bad debt be observed like a bug bounty and insurance to become compensated out through the community treasury worth 70 million USDC, or $70 million.

DappRadar explains why it counted under 40 active users on Decentraland

Crypto Twitter was shocked by reports claiming Decentraland, a $1.2 billion metaverse ecosystem, has already established under 40 daily active users lately. The information, thanks to DeFi analytic firm DappRadar, produced a significant buzz one of the crypto community, with questions being elevated over the way forward for Web3.

Decentraland was quick to refute individuals metrics and claimed that to obtain a better understanding of the platform’s user activity, you ought to make reference to the dashboard online. The metaverse platform noted it taken into account 1,074 users getting together with smart contracts in September and as many as 56,697 monthly logged-in users.

MakerDAO revenue tumbles 86% on Ether and Wrapped BTC woes

MakerDAO, the governing body from the Maker Protocol, has witnessed its revenue plummet within the third quarter of 2022, the result of a fall in loan demand and couple of liquidations, while expenses have continued to be high.

Based on an March. 13 tweet by Johnny_TVL, a Messari analyst and co-author of “The Condition of Maker Q3 2022,” the decentralized autonomous organization saw its revenue plunge to simply over $4 million in Q3, lower 86% in the previous quarter.

DeFi market overview

Analytical data reveals that DeFi’s total value registered another dip, using the TVL value falling to $50 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView reveal that DeFi’s best players tokens by market capital were built with a mixed week, with a lot of the tokens buying and selling in red around the 7-day chart, barring a couple of.

Maker (MKR) ongoing its bullish momentum in to the second week of October, registering a ten. 78% gain in the last 7 days. Not one other DeFi token in top-100 was buying and selling within the eco-friendly around the weekly chart.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.