Bitcoin (BTC) cost initially bounced from the recent low at $29,000 however the overall market sentiment following a 25% cost stop by 5 days continues to be largely negative. Presently, the crypto “Fear and Avarice Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has stepped to the cheapest level since March 2020 and right now, there seems to become little protecting the marketplace against further downside.

Regulation is constantly on the weigh lower the markets

Regulation remains the primary threat weighing on markets and it is obvious that investors are taking a chance-off method of high volatility assets. The 2009 week, throughout a hearing from the Senate Banking Committee, United States Secretary from the Treasury Jesse Yellen called for any regulatory framework on stablecoins and particularly addressed the TerraUSD (UST) stablecoin plunging below $.70.

In addition, the Uk introduced two bills targeted at addressin crypto regulation on May 10. The Financial Services and Markets Bill and also the Economic Crime and company Transparency Bill try to strengthen the nation’s financial services industry, including supporting “the safe adoption of cryptocurrencies.”

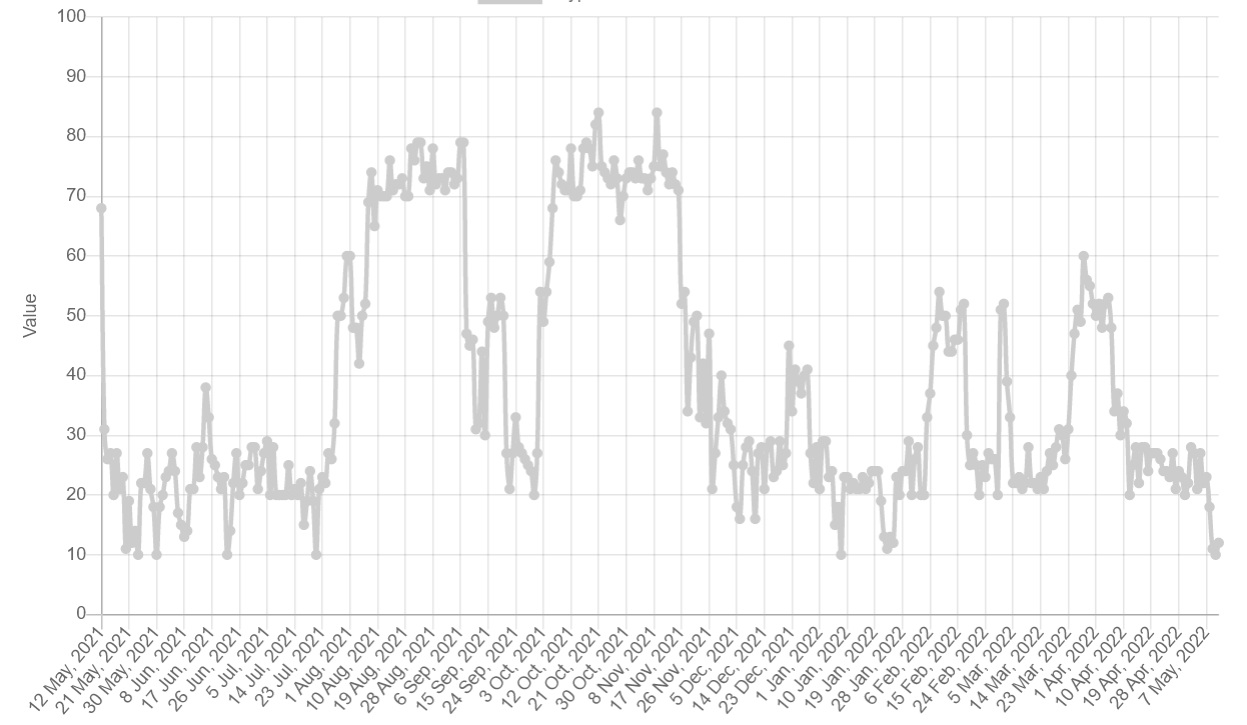

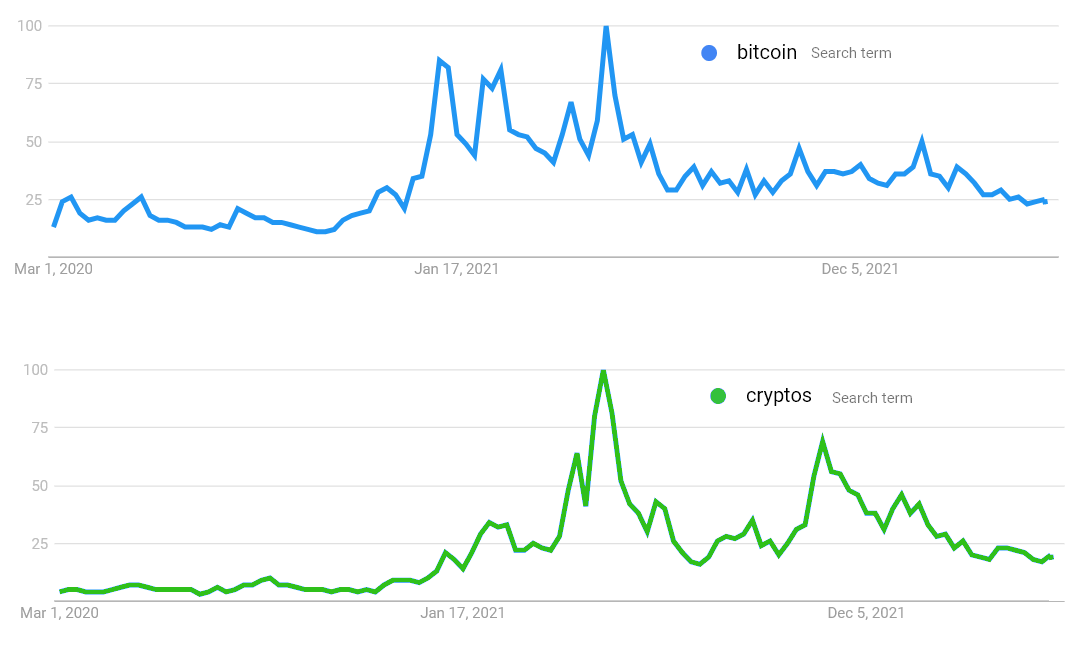

Meanwhile, looks for “Bitcoin” and “crypto” on the internet are nearing their cheapest levels in 17 several weeks.

This indicator could partly explain why Bitcoin is 56% below its $69,000 all-time high since the public interest rates are low but let us check out how professional traders are situated in derivatives markets.

Lengthy-to-short data confirms too little buyers’ demand

The very best traders’ lengthy-to-short internet ratio analyzes the positions around the place, perpetual and futures contracts. From your analysis perspective, it provides a much better understanding on whether professional traders are bullish or bearish.

You will find periodic methodological discrepancies between different exchanges, so viewers should monitor changes rather of absolute figures.

Based on the lengthy-to-short indicator, Bitcoin may have leaped 4% because the $29,000 have less May 11, but professional traders didn’t improve their bullish bets. For example, OKX’s top traders’ ratio decreased from 1.20 to the present 1.00 level.

Furthermore, Binance data shows individuals traders stable near 1.10, along with a similar trend happened at Huobi because the top traders’ lengthy-to-short ratio was at .97. Data shows no interest in leverage buys among professional investors regardless of the 5% cost recovery.

CME futures traders aren’t bearish

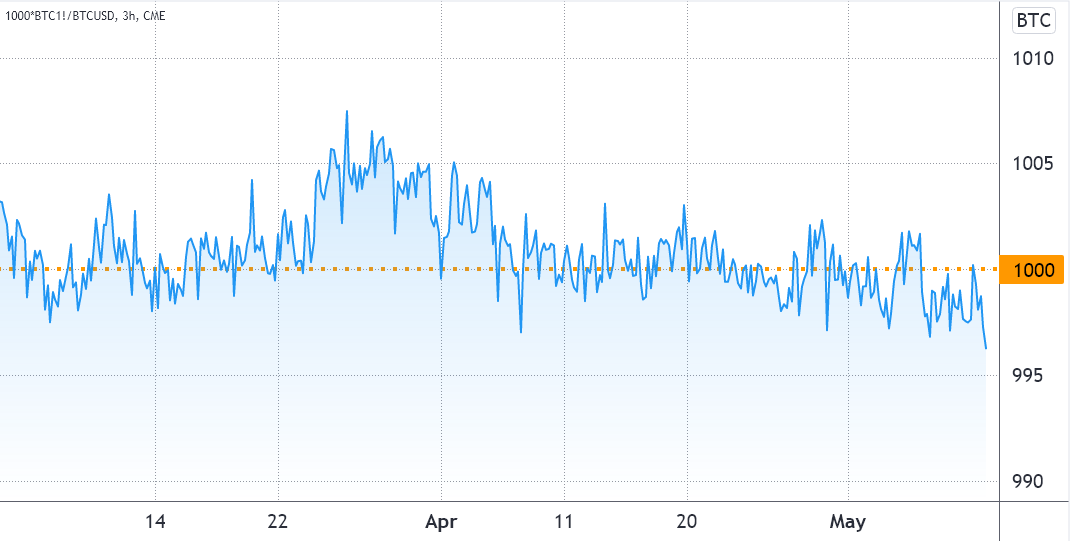

To help prove the crypto market structure has deteriorated, traders should evaluate the CME’s Bitcoin futures contracts premium. The metric compares longer-term futures contracts and also the traditional place market cost.

These fixed-calendar contracts usually trade in a slight premium, indicating that sellers request more income to withhold settlement for extended. Consequently, the main one-month futures should trade in a .5% to at least onePercent premium in healthy markets, a scenario referred to as contango.

Whenever that indicator fades or turns negative (backwardation), it’s an alarming warning sign since it signifies that bearish sentiment exists.

The chart above shows the way the indicator joined backwardation on May 10 and also the move marks the cheapest studying in 2 several weeks in a negative .4% premium.

Data implies that institutional traders are underneath the “neutral” threshold measured through the futures’ basis which suggests the development of the bearish market structure.

In addition, the very best traders’ lengthy-to-short data shows too little appetite regardless of the quick 4% cost recovery in the $29,000 level cheap BTC cost now trades close to the same level can also be concerning. Unless of course the derivatives metrics show some improvement, the chances of further cost correction remain high.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.