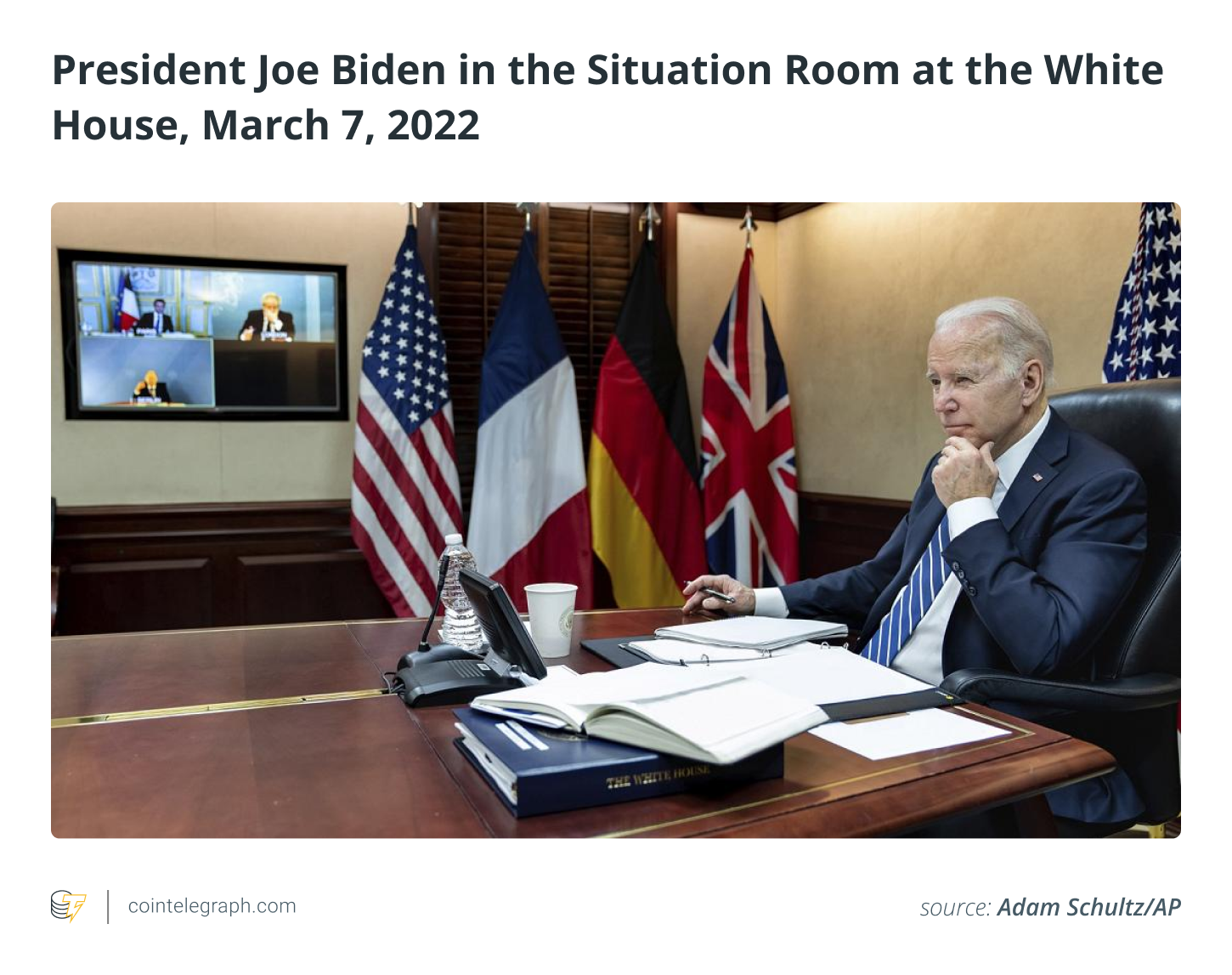

U . s . States President Joe Biden’s executive order on digital assets has kickstarted an interagency pursuit to support financial innovation while protecting Americans and interests. Even though many industry leaders welcome the constructive tone, some critics expect a attack. We don’t blame them.

Many cryptocurrency projects operate behind thin veils of decentralization. In public places, they’re offered around the premise they distribute power. Behind the curtains, leaders pull the strings. Within the recent situation of Wonderland, a serial fraudster and felon directed a $1 billion treasury.

Many projects secretly pay influencers to shill their tokens. The cost pumps. Insiders dump. Naive investors generate losses. Sometimes, the shillers are celebrities. And, sometimes, individuals celebrities leak the surprisingly inexpensive of the integrity.

Related: Year of sponsorships: Celebrities who accepted crypto in 2021

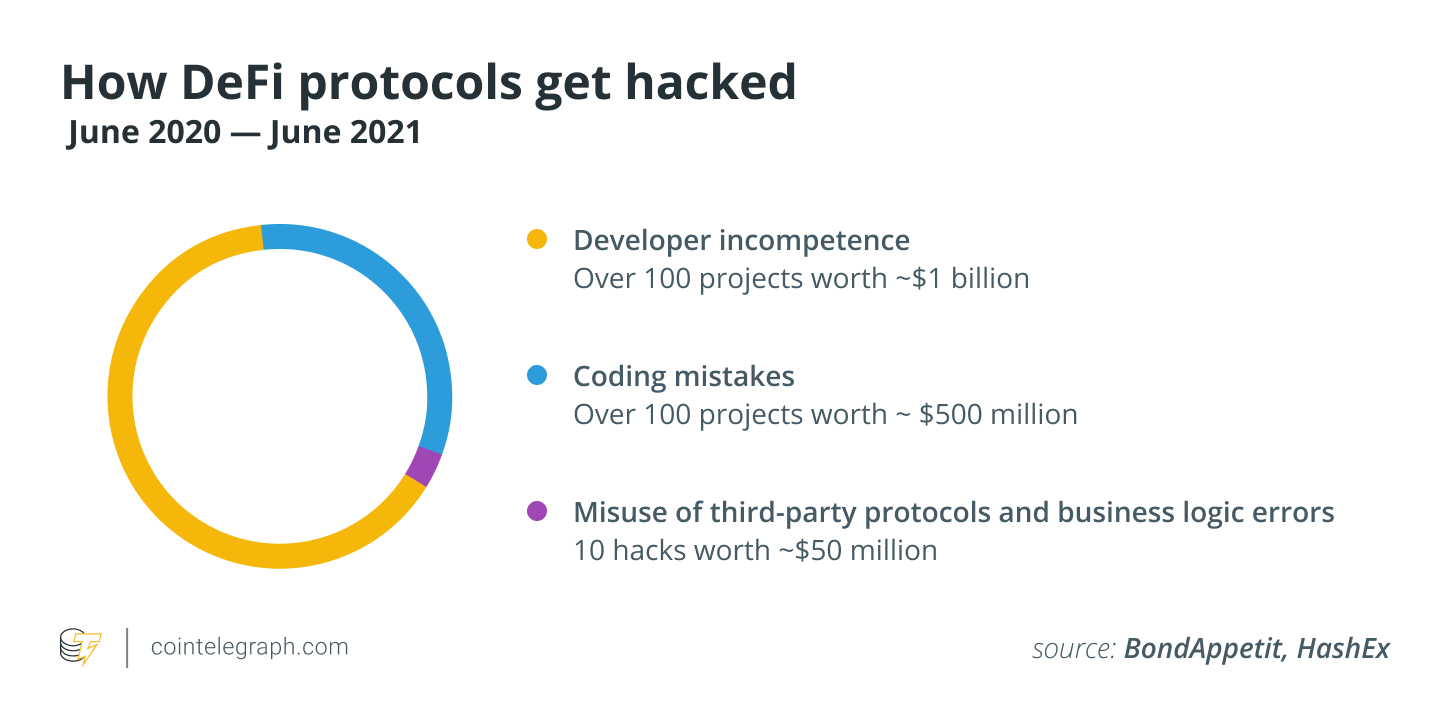

Countless projects suffer technical vulnerabilities. Apparently each week, online hackers exploit hidden software bugs. The 3rd-largest ever happened at the begining of Feb, with $326 million — gone. And also in late March, another $600 million — poof.

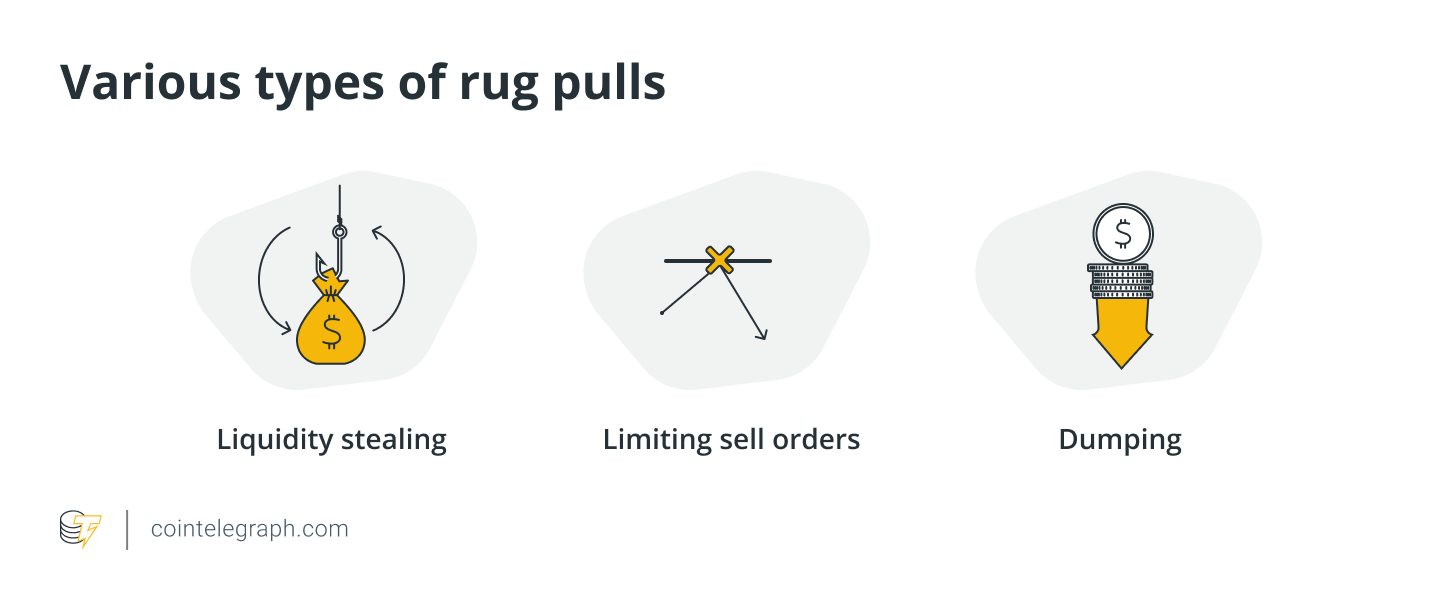

Many cryptocurrencies are blatant scams — some, proudly pyramid-formed. Market participants treat these as details of existence, with oft-used terms for exit scams (“rug pulls”) and pyramid-formed projects (“Ponzis”).

To many, cryptocurrencies look exactly the same, like tomato plants pasted in Aisle 9 — only tasteless, useless, and much more numerous. The cynical begin to see the menu of cryptocurrencies like a proxy most-wanted list. Neither group is entirely wrong.

Yet one item around the menu shines. It’s perhaps one of the most important technological advances because the internet, itself. Purchase it or otherwise, we don’t care. But we three professors do care to create one easy message: Bitcoin (BTC) is special. It deserves study and discussion.

Let’s discuss Bitcoin

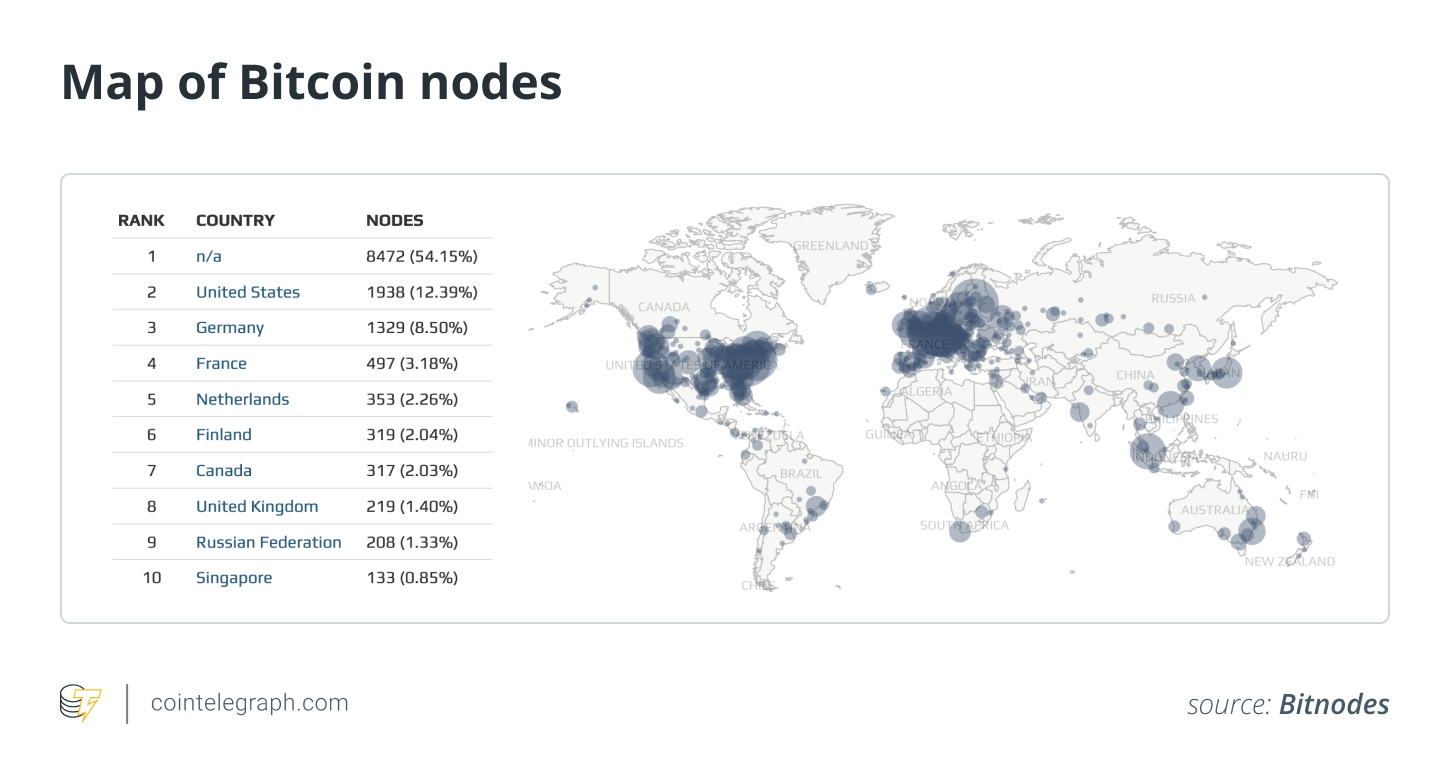

Bitcoin is genuinely decentralized. Thousands run nodes all across the globe. Operating a node is simple you could do this so inside the hour by having an internet-connected computer along with a couple of hundred gigabytes of storage. In 2017, these nodes vetoed a questionable switch to Bitcoin that will have upped the network’s centralization by looking into making it tougher for ordinary individuals to operate a node. By doing this, they trumped most Bitcoin miners, exchanges along with other effective legacy players.

Bitcoin’s decentralization causes it to be fair. No foundation enjoys a trademark or governs its financial policy. This contrasts not just with increased centralized cryptocurrencies however with the Fed, itself. Previously year, three Fed officials have resigned after a number of, your house, well-timed trades. Bitcoin hasn’t had any officials resign in disgrace — it’s no such officials. The network automates these jobs away.

Bitcoin’s decentralization also causes it to be secure. Most cash is digital and sits underneath the thumb of organizations like banks and payment processors. But innocent Russian and Canadian citizens help remind us that organizations can freeze and seize individuals balances, particularly when susceptible to condition pressure. Reliance upon organizations jeopardizes funds. Bitcoin participants holds their very own private keys and therefore save and send value without organizations. Bitcoin is within another league than other cryptocurrencies. Within the digital age, Bitcoin’s unparalleled degree of decentralization causes it to be the safe place from condition and company overreach.

Related: The significant shift from Bitcoin maximalism to Bitcoin realism

And in contrast to other cryptocurrencies, Bitcoin didn’t have a personal token purchase to vc’s or perhaps an initial gold coin offering to enhance insiders. Bitcoin is easily the most broadly distributed digital asset. Within an important sense, it’s no insiders — only early adopters.

The primary early adopter, Satoshi Nakamoto, found in regards to a million Bitcoin (5% from the maximum supply). Satoshi’s holdings are fully visible, and Satoshi never spent just one cent. With many other cryptocurrencies, the wealthy get more potent, sometimes in hidden ways, and also have more say within the network. Not too with Bitcoin.

Whereas some projects move fast and break things, Bitcoin moves gradually but surely. Bugs are rare. Granted, this conservative approach has tradeoffs. Upgrades are as rare as bugs. And Bitcoin lacks the versatility of other platforms. However in exchange, countries and corporations feel secure with Bitcoin on their own balance sheets.

You might have heard about hacks and stolen Bitcoin. These cases don’t involve weaknesses in Bitcoin, itself. They illustrate rather the pitfalls of insecure key storage or counting on third-party custodians.

Related: Satoshi might have needed an alias, but could we are saying exactly the same?

Finally, Bitcoin isn’t any scam. It can typically be used for scams — similar to the U.S. dollar, or any other digital assets. However the Bitcoin network offers final settlement of their native asset, similar to the Fed System offers final settlement from the U.S. dollar. People do speculate extremely around the Bitcoin cost. Such may be the method for initial phases of innovation. And people worldwide require it even while fortunate Westerners speculate.

Bitcoin’s design involves tradeoffs, to be certain. Its public ledger makes privacy difficult, though not possible. It takes energy because of its security. And it is fixed supply engenders cost volatility. However for everything, Bitcoin is becoming something outstanding: an unbiased financial system past the charge of autocrats. Ideologues will balk because they seek that perfect — but perfectly elusive — financial system. Wise and practical policymakers, by comparison, will rather aim to use Bitcoin to enhance the planet.

Here’s what which means for public policy

First, we have to not think that cryptocurrencies share more in keeping compared to what they, actually, do. Bitcoin leads all of them precisely because nobody leads it. The insurance policy must begin here from the host to understanding — not of cryptocurrency, generally, but of Bitcoin, particularly. As President Biden’s executive order conveys, digital assets are not going anywhere soon. The overall category isn’t going anywhere precisely because Bitcoin, itself, isn’t going anywhere. We owe it special attention. Not Bitcoin only, but Bitcoin first.

Second, Bitcoin is credibly neutral because the network remains leaderless. Consequently, the U.S. may use and support Bitcoin without “picking winners and losers.” Bitcoin has, actually, already won like a globally neutral financial network. Nurturing the Bitcoin network, using Bitcoin like a reserve asset, or paying over Bitcoin could be similar to deploying gold inside the financial system — only digital, more portable, more divisible, and simpler to audit and verify.

We commend President Biden for recognizing that digital assets deserve attention. We’ll need all on the job deck — from computer scientists, economists, philosophers, lawyers, political scientists, and much more — to spur innovation and nurture what’s already here.

This short article was co-created by Andrew M. Bailey, Bradley Rettler and Craig Warmke.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Andrew M. Bailey, Bradley Rettler and Craig Warmke are guys using the Bitcoin Policy Institute and also the Resistance Money Bitcoin research collective and educate, correspondingly, at Yale-NUS College, the College of Wyoming and Northern Illinois College. Warmke is another author for Atomic.Finance.