If Karl Marx and Friedrich Engels were in some way transported to the current day and given a paper, the apparent insufficient class conflict would most likely result in the revolutionaries think they’d won. They’d visit a society split on various subjects — from identity politics towards the correct COVID-19 strategy — but virtually silent around the eternal struggle between labor and capital, the oppressors and also the exploited.

How different it might be if they’d came back just ten years ago once the Occupy movement was under way, with tent metropolitan areas arising in protest against crony capitalism, corporate avarice along with a reckless, out-of-control financial sector. Ten years on, exactly the same problems persist, but they’ve be a barely discernible background hum among the roiling, raging culture wars.

The FirPercent may sleep simpler nowadays, but any complacency they think is profoundly misplaced. The trend never really disappeared, so that as inequality is continuing to grow much more pronounced, capitalism’s discontents aren’t limited left. Crucially, these proto-revolutionaries now have the most effective economic weapon that ordinary citizens have ever endured.

Related: The planet doesn’t need banks, policymakers or NGOs — It requires DeFi

Welfare for that wealthy

Exactly why is revolution brewing? Because individuals aren’t stupid. They see governments spending trillions of dollars on propping in the too-big-to-fail as the poor still struggle from payday to payday. What most don’t realize, however, is the fact that governments know that welfare for that wealthy hits poor people hardest. Indeed, they’ve known it for that better a part of 300 years.

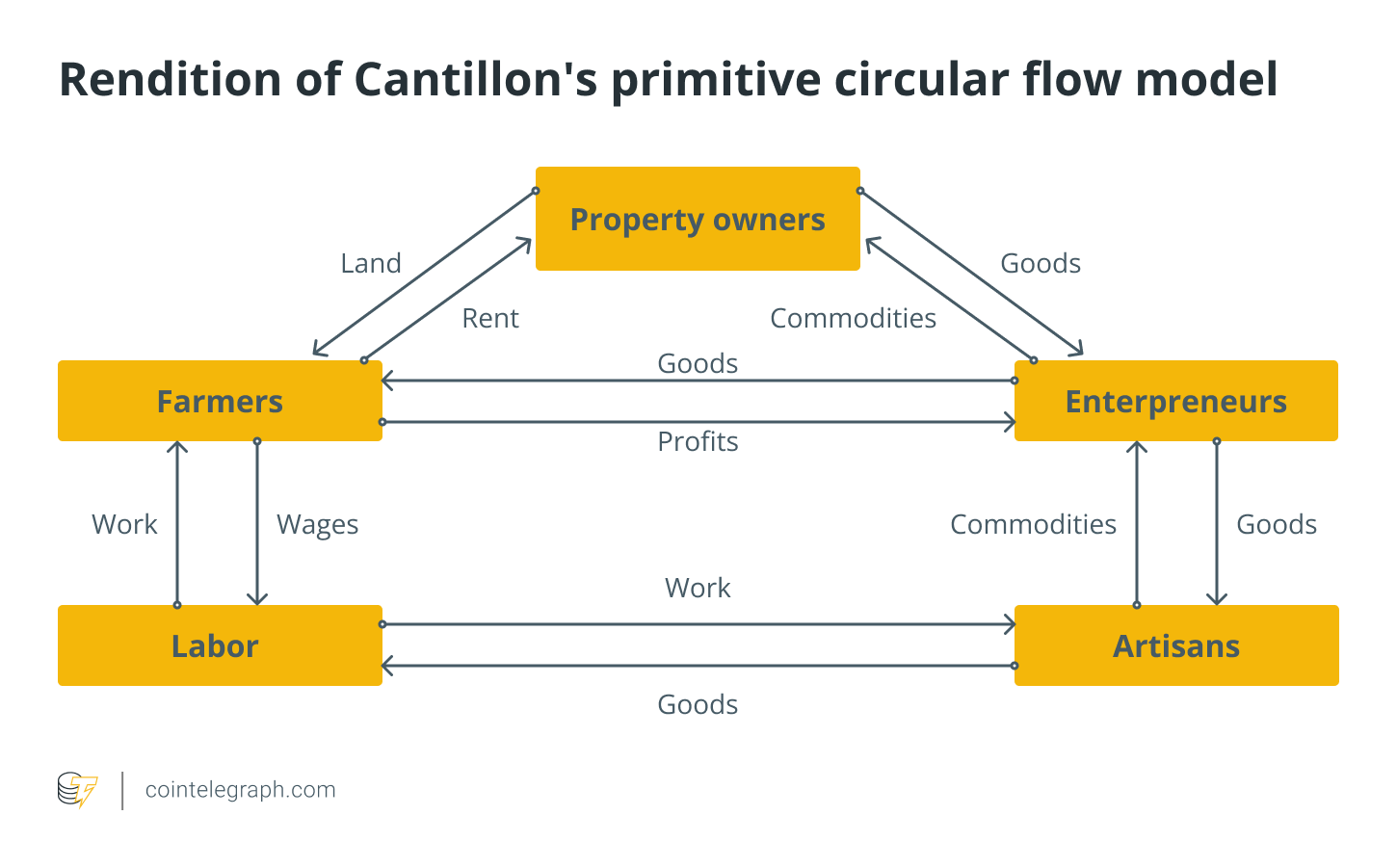

First described in early 1700s, the Cantillon Effect describes how money-printing helps make the wealthy more potent and also the poor poorer. When quite a lot of new money are pumped into an economy, the very first recipients reach spend the money before prices have elevated. If they’re prudent — because the wealthy are usually — they’ll purchase assets for example property, gold and silver, art or dark red.

When these funds “trickles down” towards the poor (whether it ever does), it might be massively devalued through the inflationary results of printing it to begin with. As prices rise, the wealthy double their winnings because they see the need for their assets increase, as the poor lose two times as living costs soars.

It’s not necessary to become a socialist to rage against a fiscal machine which makes existence tougher for the poorest in society while rewarding reckless corporate behavior. What’s rarely understood, however, is this fact isn’t an insect in our supposedly capitalist economic climate — it’s an element.

Related: Just how can third-world countries counter inflation using Bitcoin?

Crony capitalism and “soft socialism”

It’s present with blame “capitalism” for that economic and societal issues the planet is facing today. Actually, were Marx alive today, he’d find a great deal to love about our economic climate — including concepts which come straight from The Communist Manifesto. For instance, Marx’s fifth tenet of communism argues for that “centralisation of credit at the disposal of the condition, using a national bank with Condition capital as well as an exclusive monopoly.” Seem familiar?

The fact is that we, in lots of ways, really reside in a “soft socialist” utopia, where rules, subsidies along with other condition interventions are geared around protecting corporate behemoths and individuals whose wealth resides in assets instead of savings accounts. It’s hard to observe how an additional lurch left will solve the structural failings of the economic climate that already sees printing money as the reply to every problem. On the other hand, lacking an effective, bloodstream-and-thunder revolution, it’s hard to see what we should can do against such effective vested interests as well as their political backers. To gain access to a popular phrase of Vladimir Lenin’s: What will be done?

Related: The way a crypto revolution might have saved the Roman Empire

Whether you’re around the Left or even the Right, the reply is to prevent fighting the wealthy by themselves terms. There’s just one method for the poorest in society to get power in the hands from the 1%, and that’s by removing remarkable ability to control fiat currency.

A bloodless revolution

Can Bitcoin (BTC) really challenge the millennia-lengthy hegemony from the asset-owning class (and without shedding any bloodstream)? You might say I’m a dreamer, but I’m only some of the one. Just ask Salvadorans.

Before Bitcoin, Salvadorans receiving remittances from abroad needed to pay a big fee to cash transfer companies like Western Union or MoneyGram — cash that might be much better allocated to food or medicine. With Bitcoin now adopted as legal tender, these companies are believed to get rid of $400 million each year. That’s money going straight into the pockets from the world’s poorest.

This is the way the revolution may happen — not via violence but through choice. Show people the way the fiat system means they are poorer, provide them with the opportunity to boost their wealth in uninflatable Bitcoin, and they’ll election using their ft. Instead of being overthrown inside a lightning coup, fiat money only will dwindle in importance as increasing numbers of people use Bitcoin to inoculate themselves from inflation. This can gather pace because the “squeezed middle” end up harder hit, with history conferring numerous proofs that revolutions only happen when the middle classes and political moderates embrace the unconventional ideas from the revolution.

Related: Blockchain is really as revolutionary as electricity: Big Ideas with Jason Potts

That very same whiff of rebellion is incorporated in the air today. People lengthy ago lost belief within their politicians, however they’re starting to question lengthy-established economic and financial narratives. What’s so compelling about Bitcoin is it does not have to preach its very own gospel or attack sleep issues: The greater people find out about Bitcoin, the greater they do know how they’re being cheated underneath the current system.

Bitcoin’s critics prefer to declare that it’s too complex for mass adoption. But that is harder to understand, an electronic currency having a hard cap of 21 million coins or even the bewildering sleights of hands utilized by central banks and finance ministers to cloak inflationary policies that reward the wealthy while hurting poor people?

While revolutionary France had the guillotine and Soviet Russia the gulag, we don’t want to use terror to battle the tyranny of unsound money. Ours is really a truly Velvet Revolution: Our sole weapon is definitely an alternative currency that can’t be inflated, censored or else manipulated, and also the only “victims” are individuals who create a killing from the system that hurts everyone else.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Nik Oraevskiy is really a co-founding father of Bitcoin Reserve. Nik has been around Bitcoin since 2012 and it has labored with wallet and exchange startups in The United States, assisting to develop and lead their proper visions. He seemed to be associated with worldwide finance and fund management in Liechtenstein before beginning lower the brokerage path with Bitcoin Reserve, with the aim of getting smart Bitcoin-buying towards the entire Europe.