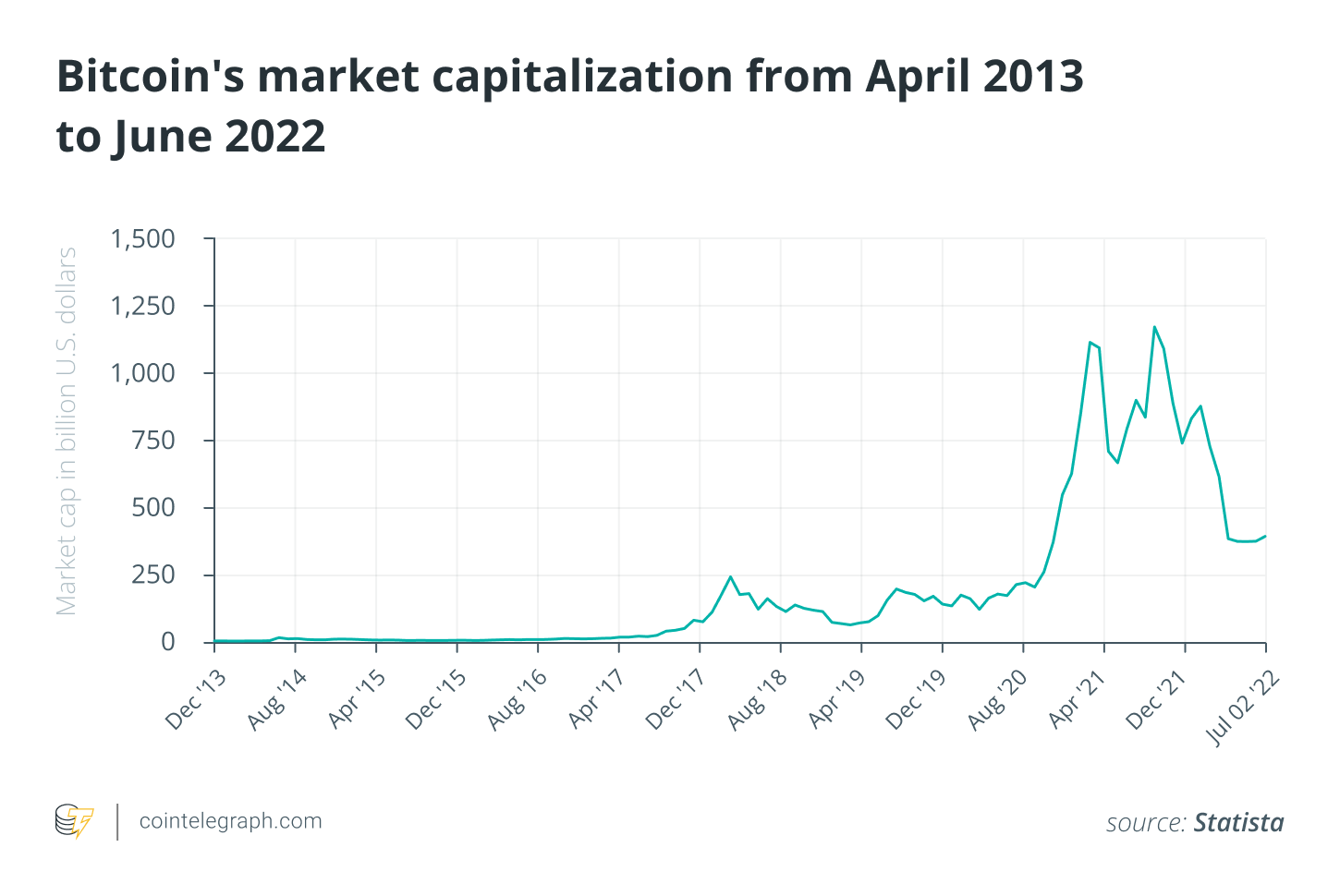

Through the finish of May, Bitcoin’s (BTC) cost had dropped 40%, Ether (ETH) had lost 50% of their value, and also the entire crypto market dipped below its $1-trillion capital the very first time since The month of january 2021. Once we enter a obvious bear market trend, it’s essential to pay attention to exactly what the blockchain industry has always recommended: build.

Bitcoin, Ether and also the broader crypto market’s downturn correlate to macroeconomic uncertainty. The uncertainty is driven by rising rates of interest along with quantitative tightening, leading to asset cost sell-offs over the stock market and also the crypto market. It’s feasible that we are able to begin to see the repeat of occasions such as the Terra ecosystem’s unwinding, crypto lending service Celsius’ fallout, and also the hedge fund Three Arrows Capital’s $400-million liquidation losses.

2022’s market crash to 2018’s crypto winter

The 2018 crypto winter was introduced about by negative market sentiment and lack of confidence however, 2022’s crypto winter is a result of macroeconomics. Decentralized finance (DeFi) is lower, equities are lower and global financial markets are lower. This bear marketplace is not isolated to crypto alone, with leverage unwind concurrently occurring across several markets.

Vc’s and investors pumped no under $30 billion into blockchain projects. Another of this amount visited gaming and virtual world projects to put the principles from the Web3 metaverse.

Once we witness an exodus of talent from Web2 projects, we anticipate elevated development of Web3 brands, with several brands for example Yuga Labs, The Sandbox and RTFKT already partnering with retail giants, including Adidas, Nike, HSBC, Warner Bros yet others. Blockchain-powered decentralized applications (DApp) and DeFi have the possibility to guide the Web3 evolution later on and assume control from a number of centralized gatekeepers.

This signifies the transition to Web3 is imminent and determined by a catalyst to proliferate. A crypto winter can unquestionably be described as a significant catalyst, because it affords Web3 projects downtime, in which they are able to concentrate on scalability and sustainability.

Related: Hiring top crypto talent can be challenging, however it doesn’t need to be

Crypto winter isn’t a time for you to hibernate, but to carry on building

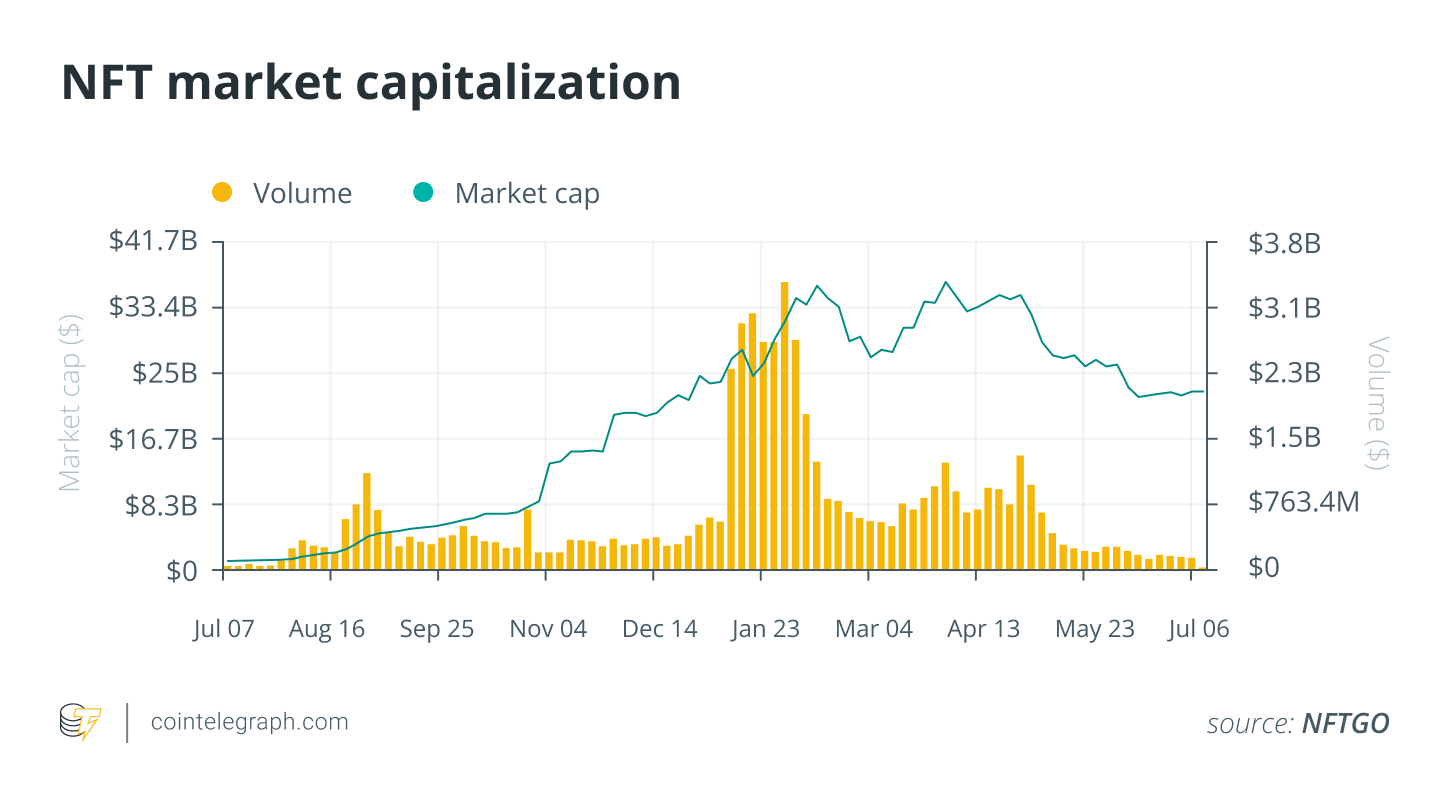

Throughout the 2018 crypto winter, we had a notable increase in several disruptive projects, for example OpenSea and Uniswap. Regardless of the downward trend, the projects leading the blockchain space were dedicated to building and enhancing their goods.

These projects required many years to be effective. In 2021, OpenSea generated $20 billion in nonfungible token (NFT) sales, while Uniswap adoption increased considerably, showcasing the potential for a decentralized economic climate. Other examples in DApps, DeFi, NFTs and Web3 games are abundant.

The important thing to expanding the Web3 community is utility

Throughout the current crypto winter, there’s apt to be more investment capital open to fund new projects, so that they might not only survive but thrive throughout the newest surge. And that’s the important thing to survival — utility. Projects that provide utility succeed, while individuals which are essentially problematic, over-hyped and non-utilitarian finish up failing. A crypto winter, therefore, separates the proverbial wheat in the chaff.

Among the best methods for crypto projects, whether DeFi, GameFi or NFT-related, to transition from Web2 to Web3 would be to think about the implication of housing processes on-chain. In addition speeding up business growth through cost-cutting is important. Payment gateways charging inflated charges ought to be the first to become scrutinized, also it certainly is sensible to think about a practical method of the intrinsic practice of turning an income.

Related: Governments, enterprise, gaming: Who’ll drive the following crypto bull run?

Crypto payment solutions that permit crypto on- and off-ramps are helping Web3 firms accelerate their business because the solution enables transactions to occur off-chain, making the charges involved dramatically less expensive than standard payment methods. Additionally, it facilitates improved conversions and revenue by enabling a project’s users to purchase and sell crypto at competitive rates inside the project’s platform. Crypto platforms searching to streamline their payment infrastructure should think about fully integrated on- and off-ramps.

The interest in API solutions like on-and-off-ramp platforms is continuously growing simply because they help companies to stay different currency and cryptocurrency transactions, lowering the counterparty risk and charges, therefore empowering companies as well as their users. Such platforms offer cost transparency with leading forex rates with low conversion spreads, so users understand what they’re likely to pay and just what they’re having to pay for.

Within this ensuing winter, this is actually the kind of chance that people should seek: projects which are ground-breaking and scalable infrastructure which will drive the following evolution from the digital asset ecosystem. Of course, the important thing to knowing when you should be greedy when other medication is fearful, and fearful when other medication is greedy isn’t as easy as it might seem, but business platforms built upon solid foundations stay reliable over time and also have a built-in resilience which will discover their whereabouts through good occasions and bad, like the crypto winter we’re dealing with.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Raymond Hsu is really a co-founder and also the Chief executive officer of Cabital, a cryptocurrency wealth management platform. Just before co-founding Cabital in 2020, Raymond labored for fintech and traditional financial institutions, including Citibank, Standard Chartered, eBay and Airwallex.