On June 14, discussions of Celsius ongoing to populate media headlines and June 14’s news involved the platform’s CEL token accruing massive gains after what seems to possess been either an exchange glitch or perhaps a short-squeeze. CEL cost spiked from $.18 to $1.55 in a single abrupt candle before sinking to $.60 inside the same one-hour candle.

Presently, analysts are undecided about the reason behind the explosive cost breakout. Some cite Celsius repaying some of their financial obligations like a reason, while some pinpoint a potential error around the FTX exchange as the reason behind what seems to become a short squeeze.

Are debt repayments boosting investor confidence?

Celsius continues to be scrambling to pay for numerous its financial obligations which is entirely possible that some investors view this like a sign the platform can survive the present mayhem.

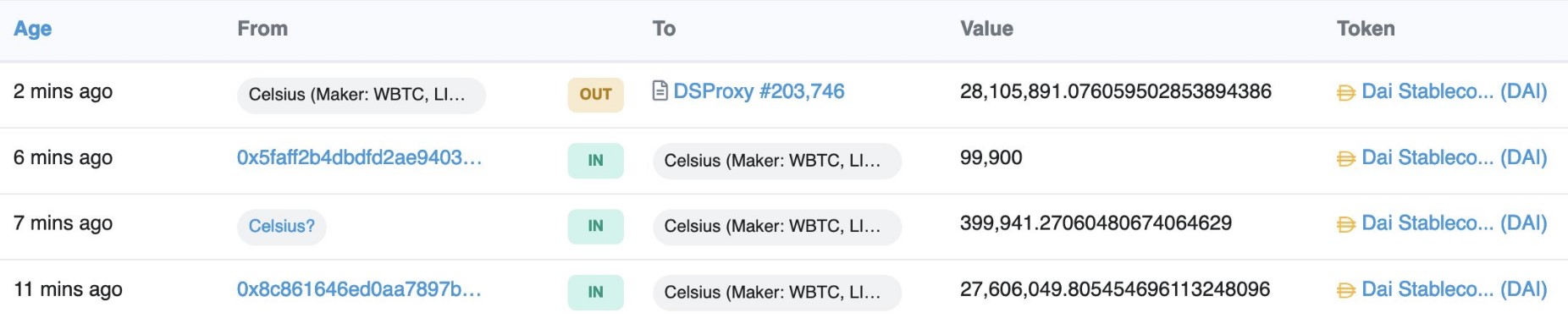

DAI coming.

Celsius finally likely to start having to pay back your debt finally, before using sufficient time by reupping collateral to reduce liq? pic.twitter.com/z6y165fzlL

— Hsaka (@HsakaTrades) June 14, 2022

Twitter analyst Hsaka stated that on-chain data implies that the $28 million in Dai (DAI) which was lately deposited right into a wallet controlled by Celsius and it has since been delivered to another address, which he identified like a debt repayment address.

Analysts think that the Celsius’s technique is to reduce its liquidation cost within the MakerDAO vaults where it holds funds and eventually avoid insolvency.

Interface problems on FTX

While the start of debt repayment may have helped inspire more confidence in Celsius, several crypto traders reported issues when trying to purchase then sell the token on FTX exchange.

Several replies towards the tweet above confirmed user difficulties when selling CEL on FTX, and Twitter user Karl Larsen stated that they “could only fill my shorts at .87–0.95.”

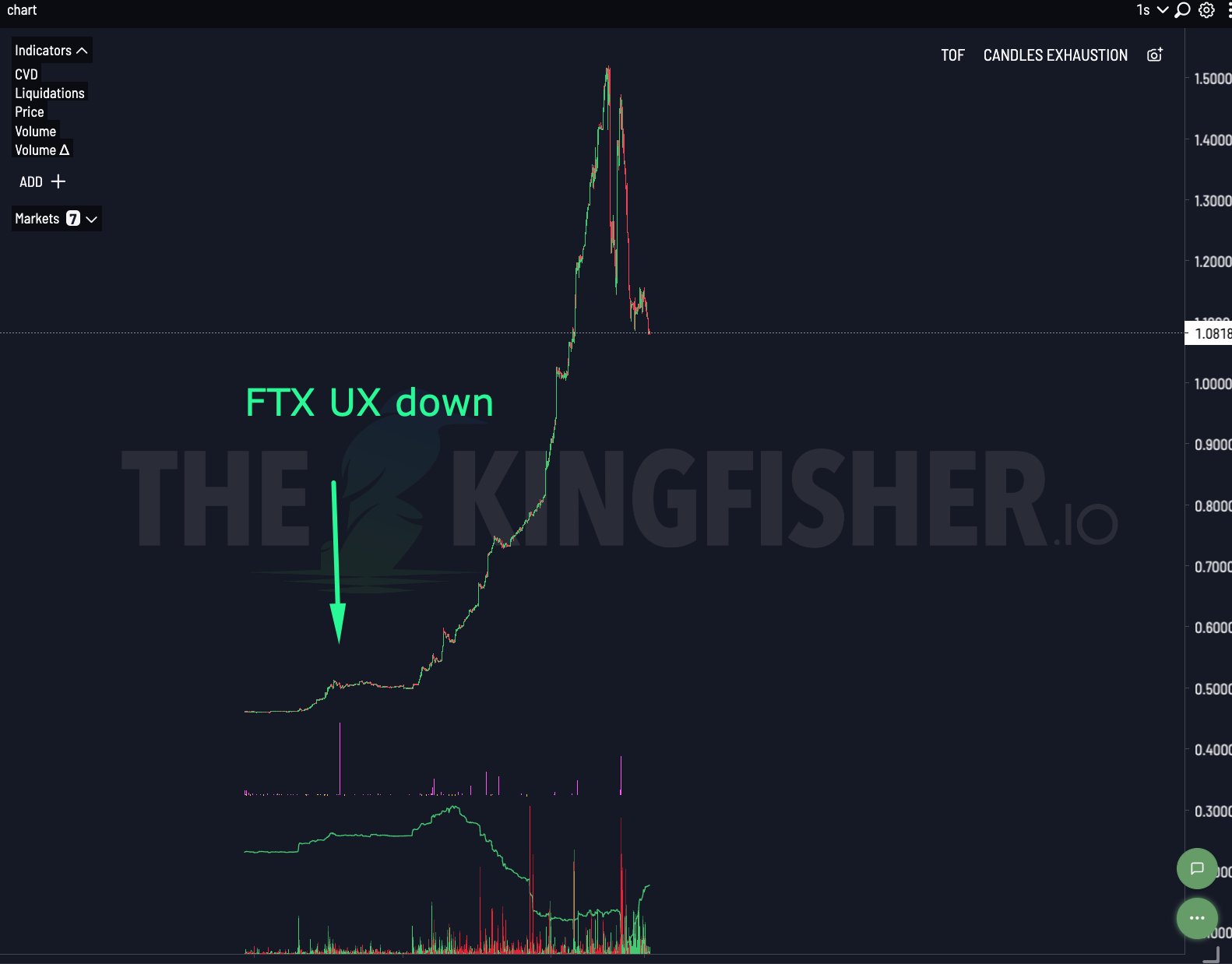

The chance that the down sides using the interface on FTX performed a component in CEL’s rapid spike seemed to be noted by analytics provider TheKingFisher, who published the next chart highlighting once the interface went lower with regards to when CEL cost pumped.

Based on TheKingfisher, once the UX went lower, “most traders [were] not able to hedge, close [or] reduce their positions.”

The firm stated,

“Spot market went above $2 to interrupt index and trigger liquidations purposely. This is a place manipulation to liquidate traders. Index being calculated on FTX itself. This isn’t outdoors of the boundary against fraud [to] keep your market organized.”

Related: Nexo purports to cash out Celsius’ loans among withdrawal suspension

It is simply another short squeeze

Some analysts repeat the cost breakout was simply a classic-fashioned short squeeze, as noted by Saleem Lala.

Bigger play ended up being to liquidate $CEL shorts on perps.

Funding was super high, over 2500% annualized, meaning large amount of everyone was short.Prices did not move much around the perps, meaning there were not natural buys, but liquidations mostly because the mark cost increased pic.twitter.com/GCeJNma6IF

— Saleem Lala (@saleemlala) June 14, 2022

It remains seen what goes on using the cost of CEL continuing to move forward, also it appears probably the most likely offender would be a cascading liquidation because these kinds of occasions are relatively frequent during strong market volatility. For instance, Chain (XCN) token went through an identical event on June 14 since it’s cost dropped 95% because of cascading liquidations.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.